Netflix Stock: Streaming Wars Enter New Phase (NASDAQ:NFLX)

peepo/E+ via Getty Images

Investment Thesis

There’s no shortage of cases where investors naively extrapolate recent results, yet Netflix (NASDAQ:NFLX) provides a particularly high-profile example. A pandemic favourite, and one of the revered FAANG stocks, its bullish thesis relied on operating leverage combined with relentless growth. With Netflix’s growth now in question, the streaming wars are set to enter a new phase.

But Netflix is still the clear streaming leader for the foreseeable future, and they have barely even placed much emphasis on profitability, up until now. Given what management has accomplished so far, subscriber-wise, it seems odd to think that they won’t figure out things like an ad-supported tier, monetizing non-paying users, and a more disciplined content spend. After the massive surge in demand during the pandemic, a price hike, and easing lockdowns, a small pullback in subscribers does not foretell doom. and the valuation is now reasonable, even if future growth were to be at a low single-digit level.

Still, I don’t yet have Netflix in a high-conviction bucket — a lot can change in 1-5 years, and competitors have pulled much of their premium content to support their own services. Netflix might no longer be the uncontested top streaming choice for many consumers. But then, with more than a -70% price collapse, one would expect to see some risks and uncertainties. NFLX could fall further, but I rate it as “buyable” at <$200.

The Streaming Wars Enter the Middle Game — Profits Will Be in Focus

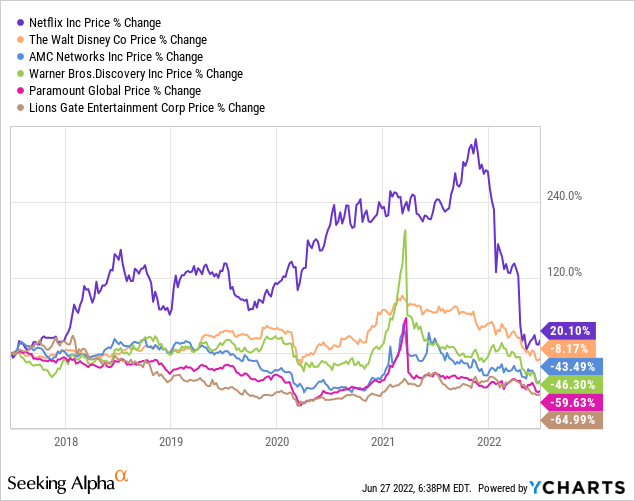

In the initial phase of the streaming wars, Netflix emerged as an underdog to up-end the traditional media players and become the dominant force in a new way of delivering content –– streaming. So far, the biggest winner has been the consumer, who has been deluged with more cheaply-available content than ever before — meanwhile, the stock prices of incumbents have been crushed, long before Netflix’s recent stock price collapse.

A key concern for the industry as a whole has been the fear that a winner-takes-all race for streaming dominance will lead to the long-term casualty of profits. But this oversimplifies the picture, and neglects how the competitive dynamics are likely to evolve as the industry matures. The first phase of the streaming wars involved a land-grab for subscribers, in an effort to drive future operating leverage. Netflix’s stalled growth is set to usher in a new phase for the industry:

- A smaller total addressable market, on its own, would justifiably lead to some drop in valuation potential for streamers.

- But Netflix will no longer be able to sacrifice margins for growth, as much as before. Netflix has long been the industry front-runner and standard-setter, so this could enable greater industry-wide pursuit of profitability.

- There is room for multiple top players — a 2022 survey placed the average number of streaming services per U.S. household at 4.7, although this could have plateaued.

- Other players are still earlier in their streaming growth trajectory, but there’s an expectation for further industry consolidation.

- Netflix’s recent layoffs suggest more discipline on costs.

- The consumer surplus is certainly there — streaming offers one of the best entertainment bang-for-its-buck out there. It will be a question of whether the industry can capture more of that surplus.

A range of levers could lead the industry to become more profitable, over time, by eroding some of that consumer surplus. Some of this is already happening, to varying degrees:

- More differentiation by tiers — examples could include (1) ad-supported tiers, (2) tiers that support password sharing, (3) more tiers that vary by content depth, (4) other possibilities.

- Gradual but steady increases in prices.

- A crack-down on password-sharing.

- Content spend that grows more slowly than revenues.

- Churn has always been key, but it’s still early days for the industry. Experimentation will continue. Month-to-month prices, for example, could eventually increase sharply relative to annual plans, and some expect ad-tiers to reduce churn.

- Either way, more rebundling may be in store. By December 2021, 19% of all broadband households had a vMVPD service, which aggregates content into a unified experience. Rebundling will also happen with HBO Max and Discovery+, and Disney+ and Hulu.

The eventual endgame will probably be a new oligopoly of major streaming services that are on a substantially more profitable footing, versus what is apparent today. This could be a few years away, though, which is more like eons for the time-horizon of modern investors. In the meantime, valuations are pricing-in a bleak industry future.

Netflix’s Valuation is Now Arguably Reasonable, Even if Cash Flows Are Mostly In-Absentia

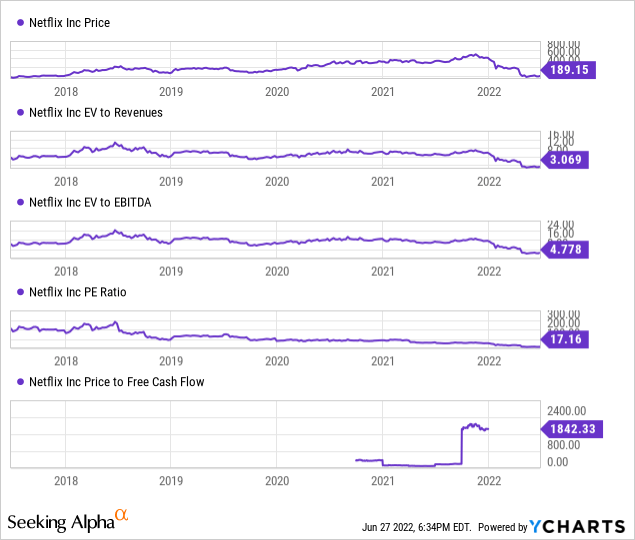

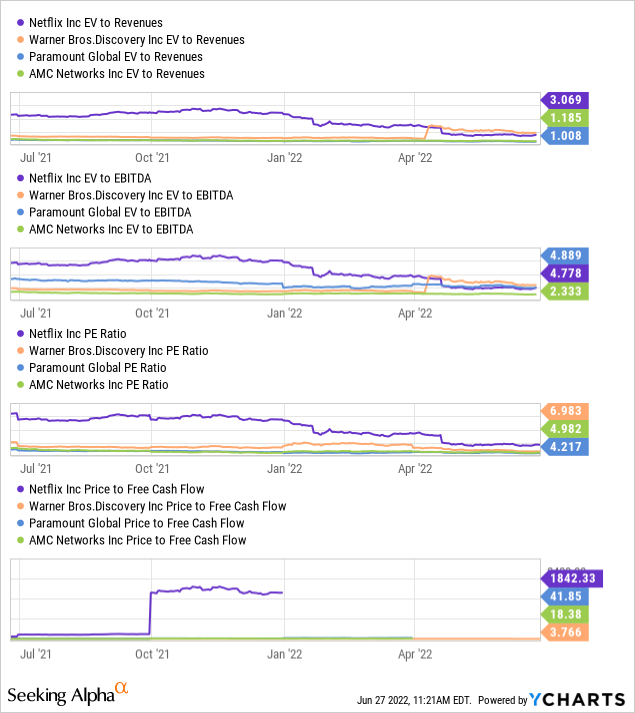

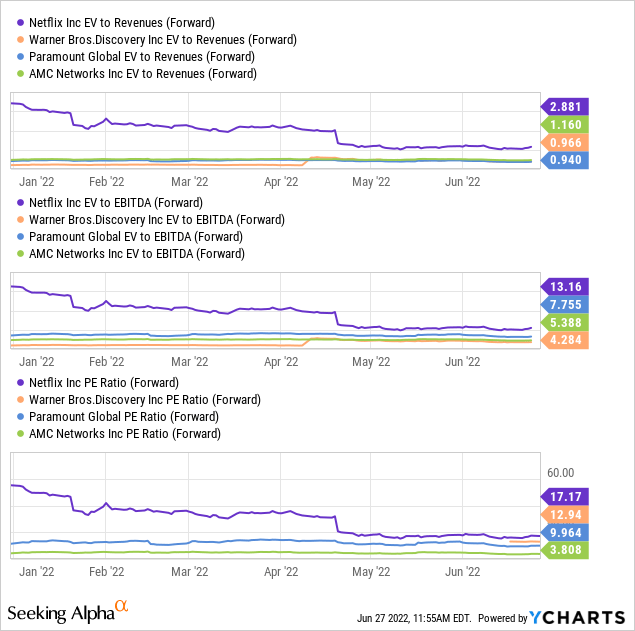

Netflix now trades at an enterprise value (~$96B) that is similar to that of Warner Bros. Discovery* (WBD), although the latter’s capital structure includes much more debt. Paramount Global (PARA) weighs-in at an enterprise value of ~$30B. Multiples like EV/revenues, EV/EBITDA, and the P/E ratio, look reasonable relative to Netflix’s history and on an absolute basis, particularly for a market leader.

*Since the WarnerMedia-Discovery merger closed after the last quarter’s end on March 31st, the ~$43B of debt from AT&T doesn’t show up in WBD’s numbers, yet.

Free cash flow has been more elusive, but this wasn’t the priority when the business was in a high growth phase. Over the past several years, the market has looked for strong subscriber growth — Netflix delivered, and the market rewarded it. Now that this subscriber growth has waned, Netflix management will reorient, although the adjustment will take time.

Reasons for Optimism — Multiple Avenues for Improved Profitability

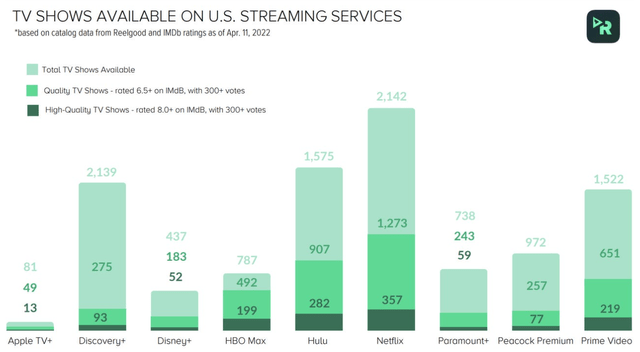

Netflix is still the clear leader in streaming, with over 220M global subscribers, and despite the current dip, I doubt that the large majority of subscribers will be going anywhere. Netflix has a proven ability to drive the cultural zeitgeist — what it lacks in franchises it has made up for in diverse shows like Squid Game, Stranger Things, Bridgerton, the Tiger King, Ozark, etc. Many consumers don’t want to watch superheroes, all the time — Netflix dominates streaming ratings for both original and acquired shows.

Netflix has also not had to focus on profitability, until now. With profitability coming into sharper focus as a goal, this might not be as elusive as some fear. Apart from overblown industry fears, reasons for optimism could include the following:

- Content slate weighted towards the back half of the year.

- Regardless of one’s subjective opinion of Netflix content quality, it has been enough to turn the streamer into the market leader — streaming charts and award nominations should do some of the talking.

- Russia drove a one-off loss of 700k subscribers in 2022Q1. The effects of the recent price hike and other factors could also obscure the underlying trend in demand.

- There is likely potential for more discipline on content spend, to drive subscriber revenue at the margin. For example, I don’t really see how Netflix’s foray into gaming would generate good returns.

- Monetization of non-paying viewers.

- Ad monetization. Cowen analysts estimate ARPU of $17/month for an ad-tier, and ultimately a 6% revenue boost for the UCAN region.

- With Netflix doing an about-face on its sacred cow of ad-free content, management has shown a willingness to adapt quickly to changing circumstances. One might also ask how much longer the “no pesky contracts, no commitment” mantra will last.

Reelgood, and Business Insider.

Note that this chart does not differentiate by original shows — however, it also doesn’t differentiate by age of programming, either, where Netflix could have an advantage.

Reasons for the 2022Q1 subscriber miss warrant a closer look. For what it’s worth, management offered the following commentary on the earnings call:

It’s a combination of factors there. We talked about interrelated factors in the letter, but one very directly, that Russia’s invasion of Ukraine had some spillover effect in other parts of EMEA. We saw that in the Central and Eastern European countries. There were some elevated churn. We also saw probably some — a little bit more macro strain in some countries, some parts of the world, like Latin America, we mentioned that on the last call, but that was elevated, and just a little bit more seasonality in the business.

We suspect some of that is those macro factors we mentioned and maybe a little bit of competition on the margin as well. So that’s really what we saw in Q2 — I’m sorry, in Q1. And that’s really what’s reflected in Q2, which is sort of the continued trends we’re seeing in acquisition and […] slightly elevated churn to probably continue through the quarter. It’s just a softer seasonal quarter for us typically, and that’s what’s reflected in the guide, is a little bit of softer seasonality and the same — essentially the same acquisition and retention trends.

-CFO Spencer Neumann, 2022Q1 Earnings Call.

Reasons for Caution — Not Yet a Value Stock, and Growth Still Depends on International Markets

Netflix’s forward P/E of around ~17x is arguably fairly priced, for a market leader. But despite the large pull-back in stock price, Netflix is not yet a deep value stock, or even necessarily in value territory, particularly in the midst of a broad market correction — there could still be another ~50% downside, depending on results for subsequent quarters. Although Netflix is still the clear market leader in streaming, competitors have been pulling back content to fuel their own streaming offerings — consumers now have multiple good options. Nor does NFLX have the same spigot of cash flow in a core cable business, like its competitors.

The development of an ad-supported offering will likely take time — management cited a gradual phase-in over the next couple of years. So without a corresponding boost to fundamental results in the near-term, it doesn’t look like the market will be in any rush to drive Netflix’s stock price much higher, as it adjusts to the new reality of Netflix’s situation. And even movie studios are now being hit by supply chain woes.

With the North American market at saturation, product optimization will only drive so much future growth. For example, one analyst assessment is that cracking down on password sharing will only drive 4% of revenue upside. Unsurprisingly, the large majority of growth will probably still have to come from internationally. A show like Squid Game, which helped drive 8.28M net subscriber adds in 2021Q4, exemplifies the extent that specific content can help to make lumpy inroads in new geographies.

Recent M&A Rumours

Co-CEO Ted Sarandos denied recent rumours relating to a possible M&A deal with Roku — instead, discussions are ongoing with multiple solutions providers in the ad space. M&A has not been a part of Netflix’s DNA, though it is very familiar with striking partnerships, an obvious example being its content licensing arrangements. The earnings call added some colour on Netflix’s thinking:

…the online ad market has advanced. And now, you don’t have to incorporate all the information about people that you used to. So we can be a straight publisher and have other people do all of the fancy ad-matching and integrate all the data about people. So we can stay out of that and really be focused on our members creating that great experience and then again, getting monetized in a first-class way by a range of different companies who offer that service.

-Co-CEO Reed Hastings, 2022Q1 Earnings Call.

Other Options Could Offer More Reward versus Risk

Despite NFLX now being more attractive as an investment, other players in the space could be an even better option. Having already been beaten down as streaming laggards, then by sectoral concerns related to Netflix’s woes, and then by the broad market crash, valuations for Warner Bros. Discovery, Paramount Global, and AMC Networks (AMCX), appear to be pricing in extremely low expectations. Their trailing and forward EV/EBITDA and P/E ratios are generally in the mid-single digits.

These players have suffered from the perception that they are bogged down by a core legacy cable business, but this also provides strong cash flow to support their streaming efforts, and to return to shareholders. Overall, subscription streaming video is still expected to see robust growth into 2022, at 13% y/y, following a strong pandemic period. And if they do suffer the same slow-down in growth as Netflix, I’d expect that this would go hand-in-hand with a slower decline of the cable business. In that case, these players would win either way.

Final Words

It has been with a mix of schadenfreude and self-pity that I’ve observed the implosion of Netflix’s stock price over the past few months. Schadenfreude, because many market gurus were rather self-satisfied to declare Netflix the hands-down winner of the streaming wars and are now facing a dose of reality — self-pity, because I had already started to nibble on Netflix stock as it lurched downwards! The pullback from pandemic highs isn’t all that surprising, but perhaps its dramatic extent is.

But at this stock price level, NFLX looks like it’s worth the risk to hold a position. Netflix offers tremendous value to subscribers, and because of its torrid growth, it had not focused much on profitability, yet. With the slowdown in growth, this is starting to change — Netflix has a number of avenues with the potential to drive improved profitability, such as an ad-supported tier and monetization of password sharing, although this could take a couple of years to fully roll-out.

Let me know your thoughts and feedback on NFLX, and how you expect the streaming industry to evolve.