Namibia Critical: Microcap Mining Narrative I Don’t Believe (NMI:CA)

Isaac74

Rare earths

Rare earths are quite the thing these days, we all need many more of those magnets to power the EV revolution. I’ve no problem with that base idea. I do suspect that more of these projects are going to come to fruition than many other think and that therefore rare earth prices are going to – long term – fall back considerably. But that’s an opinion, not something I can actually point to as being a truth.

We should also note that we don’t normally talk about microcaps here at Seeking Alpha. Simply because thin markets in tiny companies aren’t quite the thing for investment advice. This is a microcap in the rare earths space, but writing about it here isn’t to try to boost or recommend it. Quite the opposite, there’re some numbers in their most recent estimates that make me go hmmm.

And hmmm isn’t what you want to hear in the analysis of the assumptions underlying a mining adventure. You’d all much rather hear “Yep, those numbers look just great!”.

It’s also true that this analysis is pretty short. This is because when looking at a small company that line of Tolstoy’s comes into effect. Each family is unhappy in its own way – there are so many mining opportunities out there, so many microcaps, that we only need to find one thing that we’re not happy about, and we can drop consideration and move onto the next. Which is what I’m doing here.

We could even say that’s all most unfair of me, and we might even be right. But then part of the purpose of this site in itself is that we put our opinions out there and then reality shows us, in the end, who is right.

Namibia Critical Metals (OTCPK: NMREF), (NMI: CA)

So, Namibia Critical Metals is telling us of its heavy rare earths project at Lofdal. The numbers, in the sense of the contents of the concentrate to be produced, look very good indeed. Quite out of line with most other mines, in fact, but that’s easily enough explained. They’re after xenotime, not bastnaesite (the “normal” rare earth ore like at MP Materials, Lynas, or even the monazite that Energy Materials has been working upon) and different ores do have different contents. So, that’s fine.

However, reading through their plans for this project we come acorss this and this doesn’t make me happy, not at all:

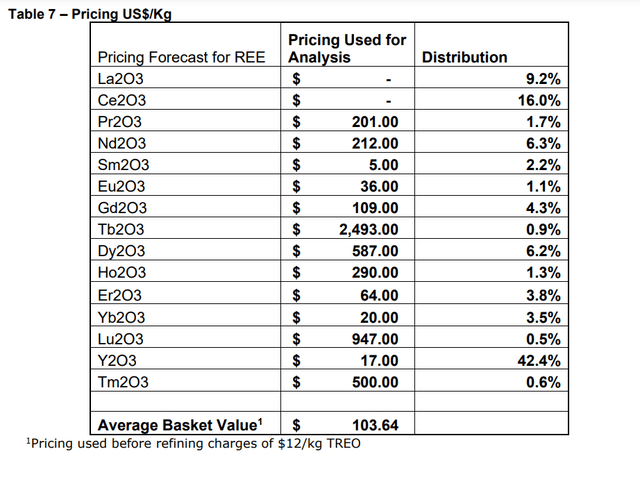

Rare earth price assumptions (Namibia Critical Metals)

One little thing to note there, that refining charge. I’ve talked about this with Energy Fuels, also with ionic clays. The separation of rare earths from the concentrate into the individual elements costs money. A lot of it. That’s what their $12 is there. That’s per kg of material processed. Now, I’d say that number looks a little low. I’d assume more in the $15 to $20 range. $15 if you built your own processing plant (this is what Pensana seems to assume for its new plant at Saltend) and $20 is a useful rule of thumb for selling to someone else who runs their own separation plant. My numbers aren’t accurate either, but the Namibian ones do look on the low side to me.

One thing also to note – they’re assuming that the La and Ce have no value. As I’ve said, again, several times here – that’s about right. $500 a tonne seems to be a useful idea of price at present. This is because to get to those desired magnet metals, the Nd, Pr and so on, you simply do have to end up with a pile of La and Ce. Since everyone is doing this, we’ve much more La and Ce around and the price has cratered.

It is the other prices that look off to me. $200 a kg for Nd and Pr? $580 for Dy? Those look more like metal prices than oxide prices – and they are telling us they’re measuring oxide prices.

Metals and oxides

A slight diversion. Metals prices are always going to be above oxide prices. The standard formulation is Nd2O3, Dy2O3 and so on (can be Tb4O7, but that’s not so, so, different). Making the metal from the oxide is, by definition, driving off that oxide.

The atomic weight of Nd is 144 or so, of oxygen 16. So, when we drive off the O3 there to get to the Nd we start with 144 plus 144 plus 48 in atomic weight and end up with 144 plus 144 – we’ve lost 48/336 or our original starting material, or 14%. So, even if we assume that there’s no cost at all to metal production (there is), no bottlenecks that folk will profit from (there are) then the oxide price must always be 14% below the metal’s price.

Rare earth prices

So, that they’re listing the oxide prices as being close to the metals prices looks a little wrong to me. But then to go further. On the major pay metals, their prices look distinctly too high to me.

Pr and Nd oxides at $200 and change each. Hmm, no, I’m seeing them at more like $100 each. Or if we take these Chinese prices, again around $100 per kg each.

That Dysprosium price looks pretty chunky, too. They’ve got it at $587 and somewhere around $330 looks more reasonable. Tb seems overweight too.

Now, true, it’s not necessarily true that Chinese prices and global prices will be the same. It’s also possible that there’s been some surge in just the past few weeks. But if we look at a 6-month average price, then we see, again, that those prices look really very rich indeed as assumptions. Even, about twice that trailing 6-month average.

That looks like a very high set of prices to be putting into an assumption about revenues for the future decades. Very high indeed, to me at least.

I wouldn’t say I was convinced of anyone’s ability to sell that thulium, holmium, erbium and ytterbium either. Yes, there are market prices, and yet they’re really, really, not liquid markets. But maybe that’s just me, and I’ve not included it in the following calculation.

Real prices

OK, so perhaps Namibia Critical does have the real prices in their assumptions. If they do, then of course I am wrong. But I’ve adjusted for what I think are closer to real market prices for those, umm, extremely aggressive price points they’ve used. Dropping the Nd and Pr by $100 a kg, shaving $200 and change off the Dy and so on. Just the major pay metals there, including the Yttrium.

This drops the value of that basket by some $18 to $19 a kg material. At which point I’d emphasise again that I’m not saying that I am absolutely right here. Rather, I think these would be more realistic prices to use.

Then there’s that estimation of processing costs, which – again, to me – looks a little low. Say, by $3 or $4.

Which means that we want to reduce the value of the basket by, say, $22 a kg.

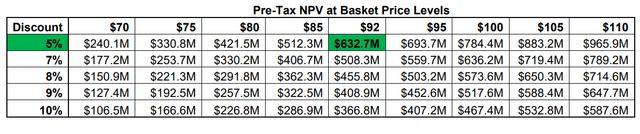

Again, not saying this is entirely accurate, but it is what I think. So, now we need to have a look at the other calculations using this new revenue idea. Fortunately, there’s a sensitivity analysis in this paper:

Sensitivity analysis (Namibia Critical)

So, I’ve dropped that value basket down to perhaps $70. Note that I’ve not done that by building in some margin for future price changes. Instead, I’ve done it simply be using what – I think at least – are closer to current market prices. This still leaves no room at all for risks of market changes.

No, doesn’t work

Well, at least for me, no, this doesn’t work. Leaving no margin for market changes, cost overruns, the usual sorts of disasters that can afflict anyone, we’ve a $240 million return on the $200 million they’re asking for over the life of the mine.

No, that doesn’t work. Sorry, but it doesn’t.

As I say, that Tolstoy. We’ve only got to find, at this end of the market, just the one reason why we don’t want to invest. Further analysis about why it might work – nope, not something we need to do. Quite apart from anything else, if people are being aggressively optimistic about revenues then what else is being skated over?

Why am I wrong?

Now, it could be that my numbers and prices are wrong. I don’t think they are, I’ve done the best I can – including knowing what some other miners assume about prices of the same materials. But there’s no one single price for any of these materials. No one exchange where we can – like with copper say – read off the price and that’s what it is.

So, sure, my prices could be wrong. But that’s what has to be done to disprove my idea here. Show that my price assumptions are too low. That’s what has to be done to make Namibia Critical interesting.

The investor view

Trust my numbers just as you would – or wouldn’t – anyone else’s, of course. Namibia Critical has given us both their price assumptions and their sensitivity analysis. Make your own price assumptions, feed that into the analysis and see what you come up with.

For me, I’ve done enough. Namibia Critical Metals is making much too aggressive revenue assumptions. Correcting those to current market prices means that the project doesn’t seem, to me at least, to be making a real return. So, no investing from me.

Of course, the other issue here. If my analysis is correct, then who else is going to put the capital in? Will the project even break ground?