Monster Accumulation: i-80 Gold (NYSE:IAUX)

RamonCarretero/iStock via Getty Images

Many regular readers know I have been growing quite bullish on precious metal investments since late summer, especially gold and silver. An article last week here outlines all the positive lining up for a constructive run higher in prices next year, possibly with most of the gains concentrated between November and March 2023. The summary is seasonal winter strength, a tight physical market indicated by spiking lease rates for gold, a reversal in U.S. dollar exchange rate gains, gold’s function as a terrific money printing hedge going into a recessionary environment, and a collapsing cryptocurrency market all represent powerful reasons to accumulate hard-money gold now.

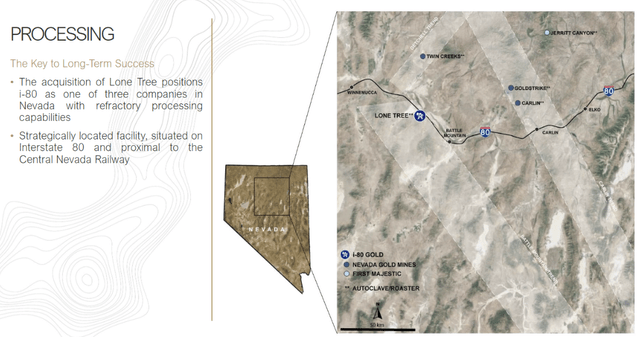

In this vein, a small-cap miner in Nevada, i-80 Gold Corp. (NYSE:IAUX, TSX:IAU:CA) seems to have as much upside potential as any other miner I am researching, with recent success at discovering high-grade gold ore around and beneath previous open pit operations. Management has put together a number of valuable properties in proximity to each other along Interstate-80. Existing mining/processing equipment and facilities are owned, permits are largely in place, water rights exist, and surrounding large-cap mining personnel are being hired to vastly increase gold production over coming years.

Management has a goal of becoming a mid-tier size producer rather quickly. For a better discussion of drill results and how mining operations will ramp soon, I resolutely suggest you read Taylor Dart‘s articles on IAUX, with his latest missive posted a few weeks ago here. He is the leading expert on Seeking Alpha covering the nuts and bolts of gold/silver miner exploration, production, and share valuations.

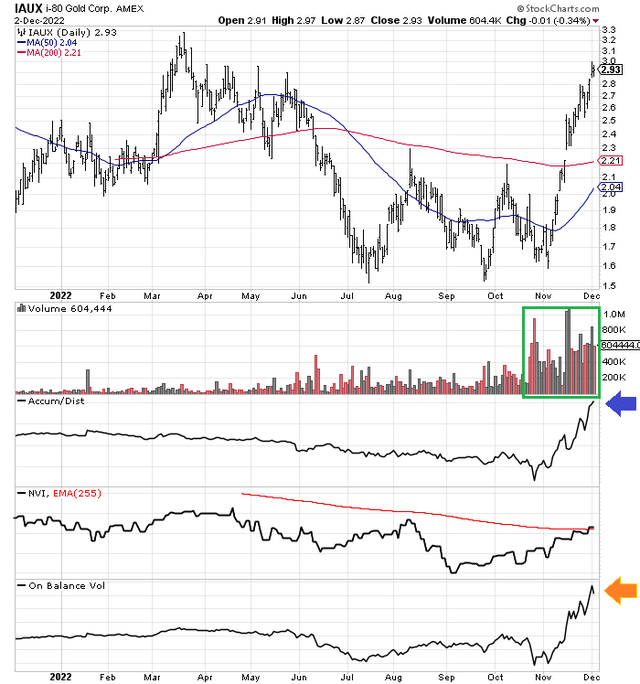

My quick effort focuses on the technical chart pattern, with an amazing amount of buying interest appearing in November-December. While such does not guarantee price will continue to zigzag higher, I place the statistical odds of a double or triple in price to $6 to $9 a share into April as a reasonable prospect worthy of investor attention.

The Chart Picture

Below is a 1-year chart of daily price and volume changes, alongside some of my favorite momentum indicators. I have boxed in green the incredible buy volumes, day after day running for weeks. The Accumulation/Distribution Line (marked with blue arrow) and On Balance Volume (marked with orange arrow) have recorded straight up moves, while the Negative Volume Index has been able to recover above an important long-term moving average (red line).

StockCharts.com – i-80 Gold, Daily Price and Volume Changes with Author Reference Points, 1 Year

Will this superb relative-strength up-move end over coming days or weeks? You never know. But stay tuned, because bigger fireworks could be approaching. Another chart from January 2022 reminds me of the strong IAUX move of late.

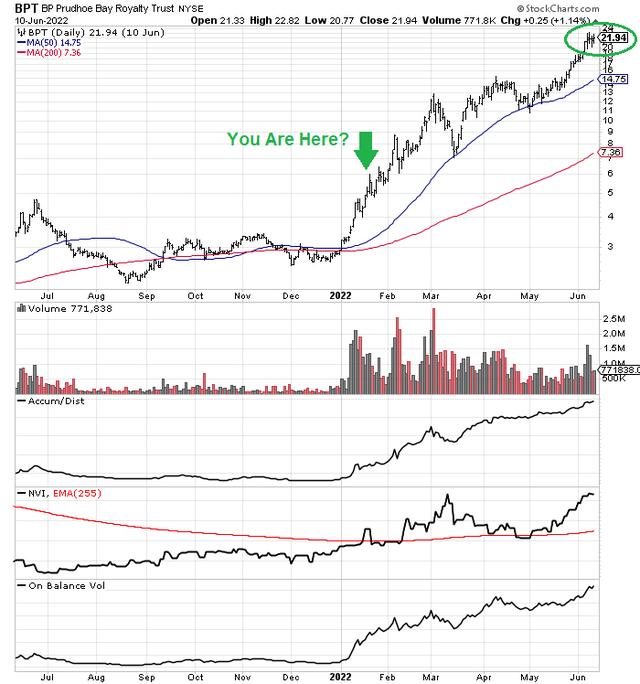

The IAUX patterns for volume, price change, and momentum are remarkably similar to the early 2022 setup for BP Prudhoe Bay Royalty Trust (BPT). I have drawn a similar time-frame picture for BPT below, a leading crude oil royalty interest. When global oil/gas prices erupted higher as a shortage-fear response to the Russian invasion of Ukraine, the royalty math for dividend payments from BPT exploded higher. From the same spot on the chart roughly lining up with IAUX today (marked with a green arrow), price had almost doubled over six weeks into the middle of January. The good news is enormous upside was waiting for investors. Overwhelming buying pressure would still create another +300% price advance between January and June 2022 (circled in green).

StockCharts.com – BP Prudhoe Bay Royalty Trust, Daily Price and Volume Changes with Author Reference Points, June 2021 to June 2022

Final Thoughts

Basically, i-80 Gold owns one of the sturdiest accumulation chart patterns in the whole U.S. equity market today, not just the gold mining sector. A bull rush of high-volume interest dramatically tilts the chances for big price gains in your favor, from my research. If I was not optimistic on gold/silver specifically, I would honestly still be happy to own this super-positive technical chart.

However, gold and silver are also rising and may run quickly to the upside in early 2023 as everyone on Wall Street realizes a recession will directly cause another round of money printing by the Federal Reserve. How do you hedge dollar devaluations? Gold. How do you leverage gold upside? By owning some of the best-positioned and strongest performing gold miners. Following this line of reasoning, one the smartest gold mining choices in early December is i-80 Gold.

What’s the downside risk? That’s a great question. Taylor Dart estimates the company is already in possession of mining plant and equipment worth more than the current stock quote (US$700 million market cap). So, if large-scale gold mining at a cash profit can be achieved into 2024-25, I don’t know how much downside really exists at $3 a share for long-term investors. A move back to 2022’s low price would generate a -45% loss, which looks quite unlikely to me given rising gold/silver prices and all the new ore discoveries.

Reward potential for investors could be extraordinary. If gold is headed to US$2500+ an ounce next year, at the same time as additional high-grade resources are discovered, the company could be worth several billion dollars and quickly become takeover bait for mining neighbors and major producers Newmont (NEM) and/or Barrick Gold (GOLD). Through the Nevada Gold Mines partnership, the two mining giants are the largest inground gold owners in the state of Nevada. Interestingly, the second-biggest defined resource owner is i-80 Gold.

i-80 Gold, November 2022 Investor Presentation

If i-80 Gold is on the verge of a “mother lode” discovery on its properties in 2023, who knows, gains of +200% or +300% might be just the beginning. All told, the risk/reward setup seems to favor bulls by a wide margin currently. I own a normal-sized position in my portfolio, which is larger than I usually hold for a small-cap company, but not for my bullish gold outlook in 2023.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.