MillerKnoll: Work-From-Home Headwinds Are Impacting Results, Shares Remain Undervalued

alvarez

While it has been known for a while that work-from-home is affecting office occupancy, and therefore office equipment suppliers, we were still surprised that it was specifically referenced during MillerKnoll’s (NASDAQ:MLKN) Q1 earnings call as one of the reasons orders remain weak. The company said that in the US in particular they are seeing a lot of indecision from CEOs as to what they want their return to the office to look like, which is creating lots of uncertainty for the company. A great way to gauge the work-from-home effect on physical office occupancy is to look at the Kastle Back to Work Barometer. On average, physical office occupancy in the main cities in the US is at less than half of pre-Pandemic levels. Luckily the company still has some verticals that are performing relatively well, such as healthcare, higher education, and the public sector. Now that the office business is softer they are leaning into those verticals that are more resilient.

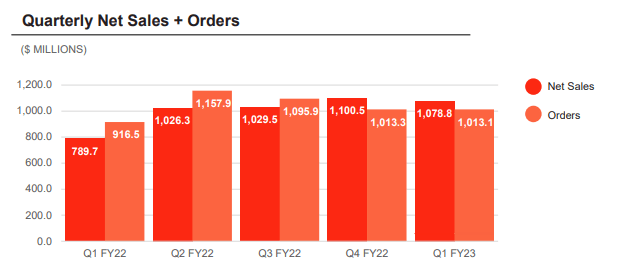

First quarter results were not too bad, it was mostly guidance that disappointed. Consolidated net sales in the first quarter were $1.1 billion, an increase of 12% organically compared to the same quarter last year. Diluted earnings per share came in at $0.34, and adjusted diluted earnings per share were slightly higher at $0.44, still this was lower than the $0.50 the company delivered a year ago.

Inflationary pressures continue to depress profitability. MillerKnoll is making efforts to counter this with price increases and cost reductions. It expects to realize annualized expense reductions of between $30 million and $35 million, which should start having a meaningful effect by the third quarter. Importantly, MillerKnoll believes that if the inflationary environment stabilizes it should see gross margin expansion in the periods ahead.

Orders Disappoint

Order volumes disappointed, despite the company reporting that its customer visits were up ~10% compared to last year. Apparently the problem is that they are seeing a lot of hesitation on the part of customers in terms of what they really need for a more hybrid-focused work environment.

On an organic basis orders were down 11% compared to the same period last year, primarily driven by the Americas Contract and Retail segments.

MillerKnoll Investor Presentation

Inventory

Another disappointment in the quarter came from inventory levels. The company reported a build in inventory levels which caused cash flow from operating activities to turn negative. From management’s commentary it seems that they were surprised by weaker than expected demand in the quarter, particularly in the Contract business. To make things worse, they had to incur some warehousing and storage costs that weighted on margins. This is what CFO Jeffrey Stutz had to say about it during the Q&A session of the earnings call:

Well, so clearly, we did have a build in inventory and you see that in the cash flow. I think our cash flow from operating activities was a negative, I want to say, [$67 million]. It’s in that hut, Budd. And a big chunk of that is working capital tied up related to inventory, a couple of areas where we’re seeing it. We do see some inventory buildup in the Contract business related to the continued relative strength in International, so I would make that point. That one will certainly take. I think that if you ring-fence the area that was a bit of a surprise, we did have an inventory build in the Retail business. And Debbie can unpack this a bit in a little more color. But I would just simply say that the lead times that, that business was contending with back in the spring and even the early part of summer were such — and demand levels were such that we were ordering in front of it, right? We were trying to get in front of it.

And with the falloff in demand that we saw in the quarter, as I mentioned in my prepared remarks, orders organically were down 8% for that business. We did see a buildup in demand or in inventory levels, they piled up. And in fact, we had to incur some costs related — that we weren’t expecting related to warehousing and storage and transportation of that inventory that weighed on margins in the period.

Financials

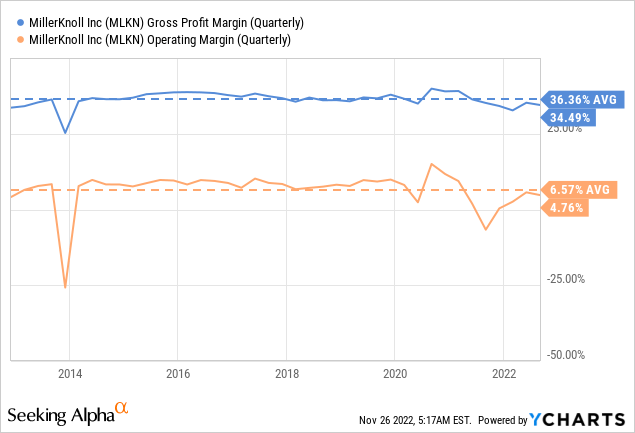

Consolidated gross margin for the first quarter was 34.5%, which is down 70 basis points compared to the same period a year ago. The company’s profitability continues to be impacted by higher commodity costs and other inflationary pressures, partially offset by recently implemented price increases. MillerKnoll reported that it is on track to deliver $120 million in run-rate EBITDA synergies from the Knoll acquisition, with $80 million of run-rate savings already captured through Q1 FY23. Despite these synergies gross profit and operating margins remain below their historical averages.

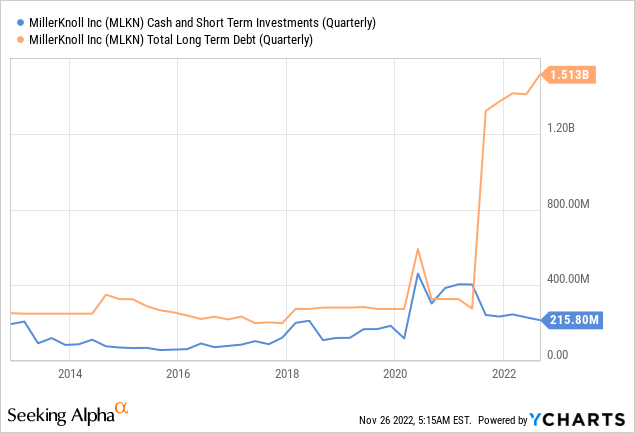

Balance Sheet

MillerKnoll ended the quarter at 2.9x net debt to adjusted EBITDA. We are worried that the company has yet to start reducing its long term-debt, which has continued increasing. The balance sheet remains one of MillerKnoll’s biggest weaknesses.

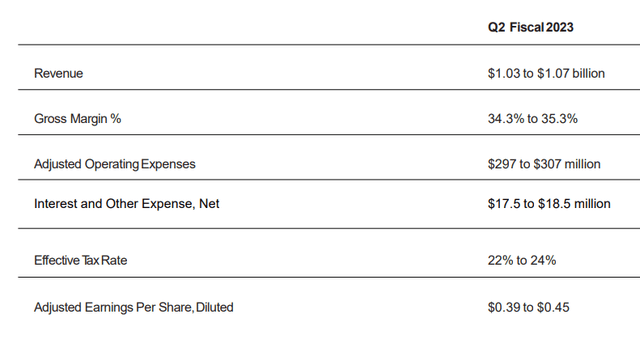

Guidance

The table below shows the guidance given by the company for the second quarter. It expects net sales to range between $1.03 billion and $1.07 billion, and adjusted earnings per share to be between $0.39 and $0.45. In addition to these numbers, we’ll be paying a lot of attention to orders and inventories when the company reports Q2 results.

MillerKnoll Investor Presentation

Valuation

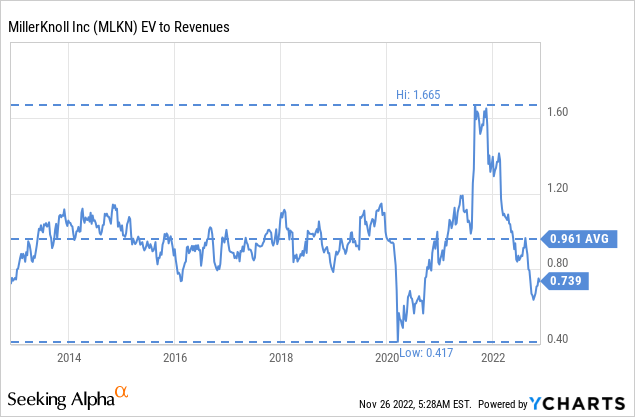

The low valuation is already discounting to a large degree the uncertainty and the significant headwinds. The company has historically traded with an EV/Revenues multiple of close to 1x, but lately shares have been trading close to a 0.73x multiple.

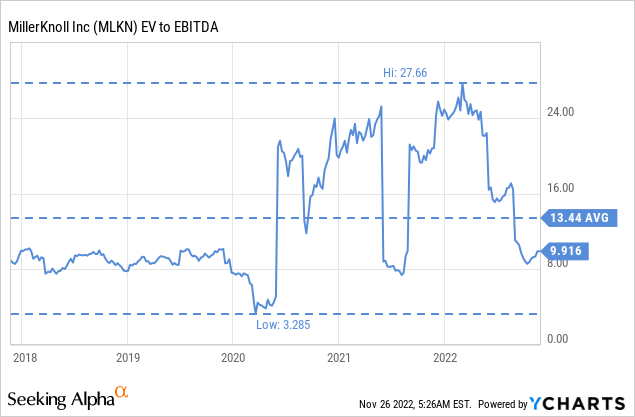

EV/EBITDA does not look that cheap at ~9.9x, but that is in large part due to the lower margins the company is experiencing due to the inflationary pressures. As the company delivers on price increases, cost reductions, and synergies from the Knoll acquisition, there is an expectation that margins should rebound, driving EBITDA much higher.

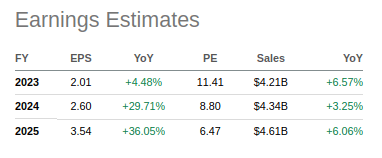

Analysts seem to be optimistic about future earnings, with average EPS estimates for fiscal year 2025 at roughly $3.54. This results in an extremely low FY25 forward p/e of only ~6.4x. Of course, for the company to be able to deliver anything close to these results it will have to see profit margins expand and some level of sales growth.

Seeking Alpha

We estimate the fair value for the shares by calculating the net present value of its future earnings. We use analyst EPS estimates for the next three years, then assume earnings will grow at ~5% annually until FY2033. We assume 2% terminal growth, and use a 15% discount rate given the high levels of risk and uncertainty. Despite these conservative assumptions we still get a share price above where shares are currently trading.

| EPS | Discounted @ 15% | |

| FY 23E | 2.01 | 1.75 |

| FY 24E | 2.60 | 1.97 |

| FY 25E | 3.54 | 2.33 |

| FY 26E | 3.72 | 2.13 |

| FY 27E | 3.90 | 1.94 |

| FY 28E | 4.10 | 1.77 |

| FY 29E | 4.30 | 1.62 |

| FY 30E | 4.52 | 1.48 |

| FY 31E | 4.74 | 1.35 |

| FY 32E | 4.98 | 1.23 |

| FY 33E | 5.23 | 1.12 |

| Terminal Value @ 2% terminal growth | 40.23 | 7.52 |

| NPV | $26.20 |

Risks

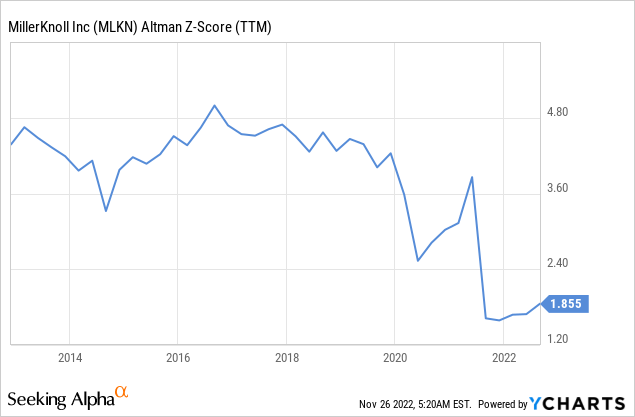

We believe the biggest risk with MillerKnoll is its highly leveraged balance sheet. Before the Knoll acquisition the company had an Altman Z-score comfortably above the critical 3.0 threshold, now it is at a worrying level of ~1.8x.

Conclusion

We were mostly disappointed with Q1 results, but continue to believe that headwinds will eventually dissipate and profit margins will rebound. That said, we are getting more worried about the balance sheet, and believe the company is getting more risky as an investment. We still consider shares to be undervalued, but given the headwinds the company is facing we are updating our rating to ‘Buy’ from ‘Strong Buy’.