MillerKnoll: Cheap Enough To Make Up For Uncertainty (NASDAQ:MLKN)

alvarez

Although furniture may not seem like a very exciting category for investors to buy into, there is a market for it and there are companies in this space that are fundamentally healthy that are trading at low prices. One great example of this is MillerKnoll (NASDAQ:MLKN), which formed as a result of the merger between Herman Miller and Knoll in a transaction that was completed in July of 2021. Given how well this company has performed and considering how cheap shares are right now, I do believe that it makes for an interesting ‘buy’ prospect moving forward.

Understanding MillerKnoll

The company that is, today, MillerKnoll was once two separate firms. In July of last year, Herman Miller, which owns a family of brands that includes Colebrook Bosson Saunders, Design Within Reach, Geiger, HAY, and others, acquired Knoll, an enterprise known for its extensive portfolio of furniture, textiles, leathers, accessories, and architectural and acoustical elements. The transaction cost shareholders of Herman Miller $11 per share in cash plus 22% of the combined company in what ultimately had a transaction value of $1.8 billion. Since then, the combined firm has been focused on increasing shareholder value and, so far, the results have been impressive. But before we get to that, we should first discuss exactly what kind of enterprise we are dealing with.

Today, MillerKnoll is a rather large player with over 60 global retail studios and with over 1,000 contract dealers that it works with throughout 110 countries. 32% of its revenue is associated with all of the activities that were included under the Knoll entity. The rest is associated with the traditional Herman Miller brand of high-end furniture and other related products dedicated in large part to furnishing offices and other related properties. Although the company recently reported financial results for the final quarter of its 2022 fiscal year, the business has not yet filed its annual report. So because of that, some of the data regarding the firm is from the third quarter of its 2022 fiscal year.

During the latest quarter, 37.8% of the company’s revenue came from the workforce category of products that it sells. This category includes products centered around creating highly functional and productive settings for groups and individuals alike. A further 23.5% of revenue came from the performance seating category, which includes products centered on seating ergonomics, productivity, and function for its customers. Another emphasis for the company was on the lifestyle category, which ultimately focuses on products that support a more relaxed environment. According to management, this category made up 32.7% of the company’s revenue in the latest quarter.

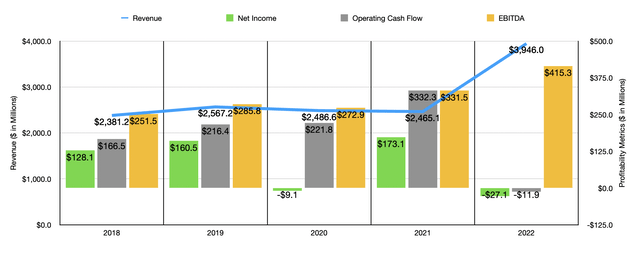

When it comes to a situation like what we have here, where one company acquired another large player, it’s not the greatest idea to rely on historical financial performance. To see what I mean, we need only compare how the company performed in 2021 compared to the 2022 fiscal year. Revenue in 2021 came in at $2.47 billion. In 2022, that number surged to $3.95 billion. While the business undoubtedly benefited from a reopening of the economy following the worst days of the COVID-19 pandemic, there is no denying that the merger of the two entities was the driving force behind this sales increase. This effectively renders profitability comparisons useless as well. And to further complicate things, it’s worth keeping in mind that the 2021 results don’t even accurately reflect an entire year of the two firms combined.

This is not to say that we have nothing to work with. One option is to look into the future. But the difficulty here is that management has only provided guidance for the first quarter of the company’s 2023 fiscal year. Overall revenue should come in at between $1.08 billion and $1.12 billion. At the midpoint, this would translate to a year-over-year increase of 39%. But again, the acquisition is a factor at play here. On the plus side, we do know that organic revenue should come in about 11% higher than it was previously. That demonstrates that the legacy company that required Knoll continues to perform well in the current environment.

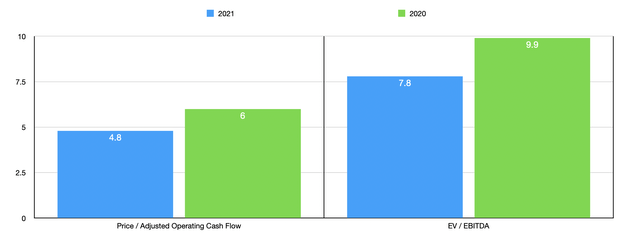

When faced with situations like this, I like to see if the company is cheap even without factoring in the full impact of the transaction in question. If it is, then we know the picture would look even better with all the numbers incorporated. Taking 2022 results, for instance, we can see that shares of the company are quite cheap. The firm is currently trading at an EV to EBITDA multiple of 7.9. Even if we look at the results prior to the merger, and use the data from the 2021 fiscal year, we end up with a multiple of 9.9. Although management reported results covering the final quarter of 2022, they have not provided details about working capital adjustments for operating cash flow. As such, we are stuck dealing with the cash outflow of $11.9 million for the 2022 fiscal year. But if we assume that the relationship between EBITDA and operating cash flow of Herman Miller will remain consistent with the combined entity, we can get a rough approximation of $415.3 million for that metric on an adjusted basis today. That would translate to a price to adjusted operating cash flow multiple of 4.8. That’s down from the 6 reading that we would get if we used the data from 2020.

As part of this analysis, I decided to compare the company to five similar firms. On a price to operating cash flow basis, these firms ranged from a low of 2.7 to a high of 17.4. In this case, one of the five companies only was cheaper than MillerKnoll. Using the EV to EBITDA approach, the range was from 6.4 to 11.8. In this scenario, three of the five were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| MillerKnoll | 4.8 | 7.9 |

| HNI Corporation (HNI) | 16.7 | 10.1 |

| Steelcase (SCS) | 17.4 | 11.8 |

| Interface (TILE) | 17.1 | 7.3 |

| Pitney Bowes (PBI) | 2.7 | 7.0 |

| ACCO Brands (ACCO) | 6.5 | 6.4 |

Takeaway

At this point in time, some difficulties and uncertainty exists for investors in MillerKnoll. Although this is unfortunate and it does muddy the waters, it is also true that the company, even ignoring multiple months of results from Knoll, looks to be trading on the cheap on an absolute basis and, from an operating cash flow perspective, relative to similar players. Because of this, I do still think the firm has some nice upside potential moving forward. And as a result, I have decided to rate it a ‘buy’ for now.