Meta Platforms: Invest In The Future (NASDAQ:META)

Lemon_tm

Introduction

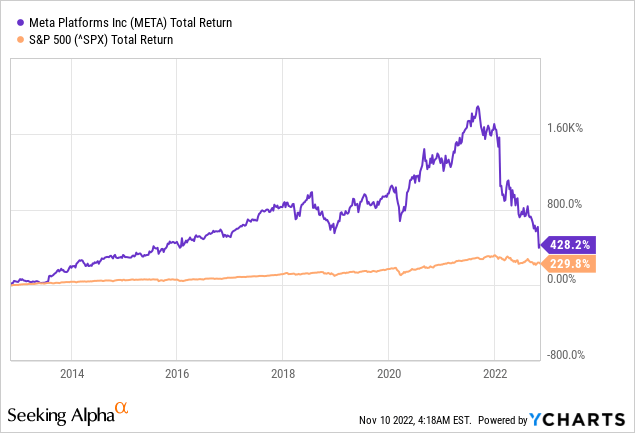

Those who bought Meta Platforms, Inc. (NASDAQ:META) during the IPO and held it until 2022 have made huge returns. Meta is a growth stock that also shows strong profit margins. The stock’s valuation was expensive for years, but Meta has proven itself and has delivered on expectations. I bought Meta after the sharp decline in late 2018, after which the stock rose sharply.

As of 2022, the stock is in a bear trend as the Fed raises interest rates sharply to address high inflation. With higher interest rates, companies’ advertising budgets could shrink, to Meta’s detriment. Competitor Alphabet (GOOG, GOOGL) is also in a bear trend since early 2022.

Strong cost cutting should push profit margin back up. Cooling inflation will accelerate dovish Fed policy that will cause the Fed to stabilize or cut interest rates. The lowering of interest rates favors Meta because the company’s advertising budgets could recover. Furthermore, the massive share repurchase program may boost share price. These events are strong catalysts for Meta.

Revenues Fell, But Strong Cost Cuts Could Boost Earnings

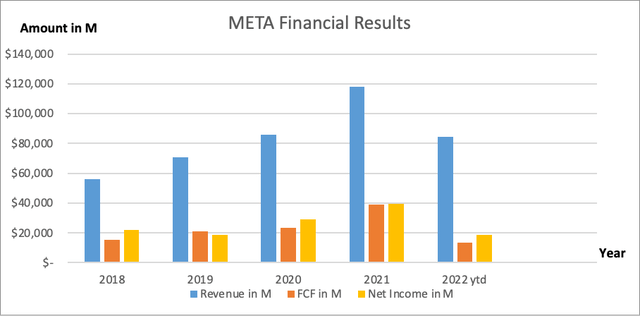

Meta experienced strong revenue growth in recent years. From 2018 to 2022, revenues grew an average of 28% per year. Net income grew an average of 21% per year during the same period.

In the third quarter, Meta saw revenue decline by 4% YoY. The decline in revenue was mainly due to the 18% decrease in the average price per ad. High inflation has caused companies to slash their advertising budgets, which has resulted in a decline in ad sales. Continued high inflation and interest rates pose a risk to the continued growth of Meta Platforms. A dovish Fed policy may indirectly lead to higher ad sales.

Costs and expenses increased 19% year-over-year due to a $413M impairment charge on certain operating leases, reducing operating income by 46%. Meta continues to see growth in the number of daily active people on Family, which increased 4% year-over-year. The number of daily active users on Facebook increased 3% year-over-year.

Meta Financial Results (SEC and Author’s Own Graphical Representation)

Analysts on Meta’s Seeking Alpha ticker page expects a 1% decline in revenue for fiscal 2022. For the same year, analysts expected EPS of $9.09. Analysts are pessimistic about Meta’s future due to high investments in Metaverse and lower revenue growth figures.

Massive Cost Savings From Reduction Of Workforce

Meta has announced to reduce workforce by more than 13%. The reduction in workforce will result in strong cost savings that could lead to higher earnings for the coming years. Revenue outlook for the fourth quarter remains unchanged at $30B to $32.5B, representing a 6% year-over-year decline.

Meta is a strongly profitable company; its operating margin was 20% last quarter. With Meta cutting costs, the operating margin could rise sharply. Over 2021, the operating margin was still a strong 40%. The high operating margin provides a margin of safety to absorb potential revenue declines. Meta remains quite profitable as a result, and users continue to stick with Meta’s social apps.

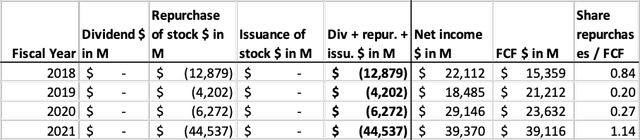

6% Share Buyback Yield Could Boost Share Price

In the past quarter, Meta bought back as much as $6.55B of shares, with $17.78B of shares still outstanding. The management is very shareholder-friendly: in 2021, it bought back $46B of shares. That represented a buyback yield of more than 6%.

Meta is authorized to repurchase more than $18B in shares. At the current share price, this represents a buyback return of more than 6%.

The share repurchase program reduces the number of shares outstanding. When shares are repurchased in the open market, demand increases and supply decreases. This should boost the share price.

The high free cash flow margin of more than 22% (trailing twelve months) provides sufficient cash to return to shareholders. Meta’s net cash position currently stands at $4.4 billion.

Meta’s cash flow highlights (SEC and author’s own calculations)

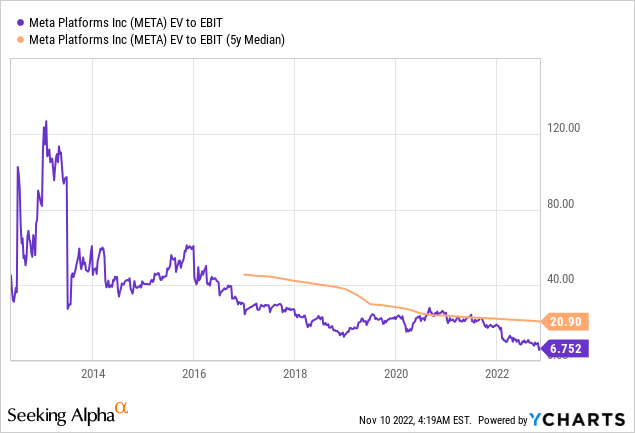

EV/EBIT Ratio Extremely Low For A Tech Company

The EV/EBIT ratio is a good choice to chart its valuation because it takes Meta’s cash and debt into account. In previous years, the EV/EBIT ratio was very high, Meta grew strongly and delivered on its growth expectations. Meanwhile, Meta is favorably valued with an EV/EBIT ratio of 6.8.

The cost savings to lay off 11,000 employees will contribute to a stronger EBIT for the next few years. Quoted from Charlie Munger:

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing.”

Meta is a good bet because they are innovating in social media and the Metaverse. Instagram is still a widely used platform for posting photos, reels and amassing high social status. The Metaverse is still in its infancy, but it can certainly provide long-term rewards. Users of the Metaverse can make purchases in the Metaverse. Companies like Nike (NKE) can use the Metaverse to offer their sneakers to users. These users try on their new sneakers in the Metaverse and can order them. Meta would get a premium for this. This sounds unreal, but so was the Internet in the 1990s. Who buys clothes on the Internet? Back then, it was a common joke. Now it is reality. When you buy Meta Platforms, you are investing in the future.

Risks

As Meta Platforms gets bigger, growth will stagnate. There is a limited number of people on earth, and Facebook/Instagram already serves a large portion of them. As a result, monthly active user (“MAU”) growth will slow to the growth of the world’s population. There are nearly 3 billion monthly users active on Facebook while the world population is nearly 8 billion. So, the growth potential is limited. Meta revenues increase when the price per ad increases, growth in the number of users who see the ad and growth in the number of ads.

TikTok is an emerging growing app coming over to the West from China. More and more youthful users are using the app, making TikTok a major competitor to other social media platforms such as Facebook, Instagram, and Snapchat. Instagram reacts by introducing Instagram Reels. Instagram Reels, like TikTok, offers short videos in which users creatively showcase their ideas to others.

Another risk is rising interest rates. The Federal Reserve is raising interest rates sharply to slow inflation. Higher interest rates hit companies, profits fall, which may cause companies to cut their advertising budgets.

Conclusion

Meta’s revenues grew steadily in recent years, up 28% over the past 4 years. Net income grew an average of 21% annually over the same period. However, during the third quarter, revenue fell 4% year over year. The decline in revenue was mainly due to the drop in the average price per ad. High inflation caused companies to cut their advertising budgets, causing ad sales to decline. Continued high inflation poses a risk to Meta’s continued growth.

Meta announced to lay off 13% of its total workforce to cut costs. The cost savings will lead to higher profit margins and improved revenues. Thanks to the high operating profit margin, Meta remains highly profitable. The high free cash flow will be distributed to shareholders by repurchasing shares. The share buyback yield is 6%. Furthermore, the share valuation is very favorable because the EV/EBIT ratio is historically low at 6.7.

As Meta has grown significantly over the years, growth in MAU should stagnate. Revenue may continue to grow through growth in ad volume and increase in price per ad. TikTok’s strong growth poses a risk to Meta, but Meta responded by releasing Instagram Reels. Meta Platforms, Inc.’s huge cost savings, favorable inflation numbers, stock buyback program and favorable stock valuation make the stock a strong buy.