ManpowerGroup At Fair Value Now, But A Recession Is Not Priced In (NYSE:MAN)

Hinterhaus Productions/DigitalVision via Getty Images

Introduction

This is the second article of a miniseries through which I intend to cover the main player of the HR and Employment Service sector. In fact, given the fears of an upcoming recession, this sector can be both a helpful forecaster, as it is right in the midst of the labor market, and something to avoid, as a recession would slow down the need for workers. After Adecco, I would like to focus on ManpowerGroup (NYSE:MAN).

Two Notes On The Industry

The industry ManpowerGroup is in is clearly sensitive to changes in the level of economic activity, which has an impact on recruitment and staffing needs. When the economic activity slows down, companies prefer at first to reduce their use of temporary and contract workers before undertaking layoffs of their regular employees, resulting in decreased demand for temporary and contract workers. Thus, ManpowerGroup and its peers may suffer greatly from a recession.

Furthermore, the employment services market is very fragmented and highly competitive with limited barriers to entry. In fact, there is actually no real moat that prevents new players from founding new staffing companies with a local and regional focus that eats part of the pie of the major leaders. The real drivers of competition and speed in finding the workers needed and pricing. In this industry, price competition is fierce and this is why we see net margins in the low single digits.

An Overview On ManpowerGroup

ManpowerGroup Inc. offers HR and workforce solutions and services. It works in 75 countries and territories, and it offers a range of workforce solutions and services like recruitment and assessment. In simple words, ManpowerGroup tries to match demand and supply of workforce talents. It is also active in training and development to prepare candidates and associates to succeed in the marketplace. The company has a wide portfolio of training courses and leadership development solutions that help clients maximize talent and optimize performance. Moreover, ManpowerGroup helps workers manage their career through its career management services. One of the most important activities is outsourcing.

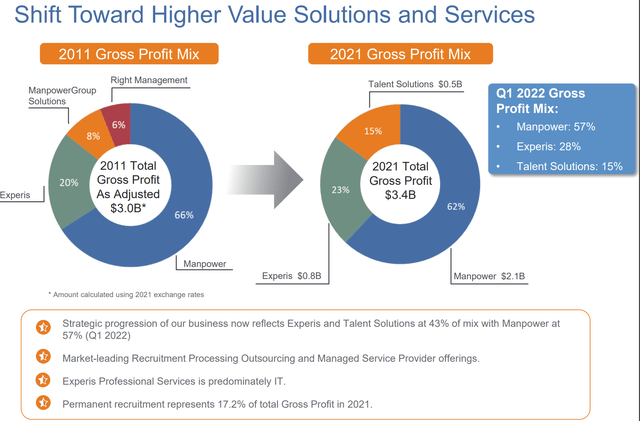

ManpowerGroup has three main brands. Manpower focuses on contingent staffing and permanent recruitment. Experis offers professional resourcing and project-based solutions, in particular in Information Technology, Engineering and Finance. Talent Solutions help organizations effectively source, manage and develop talent at scale. Talent Solutions is the third brand and aims at addressing client demand for expert offerings, integrated and data driven workforce solutions.

ManpowerGroup is trying to transition towards a more profitable company, enhancing Experis and Talent Solutions, as shown in this slide below:

ManpowerGroup 2022 Investor Presentation

Financials

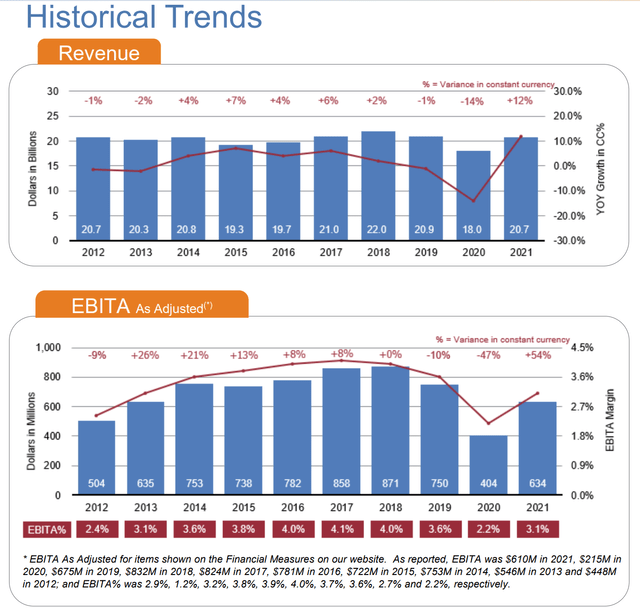

Manpower closed last year with a revenue of $21 billion, 45% of which comes from Southern Europe ($9.3 billion). As shown in the Investor Presentation 2022, gross margin came at 17.4%, while EBITA margin at 3.1%. Its debt/EBITDA ratio is quite good, coming in at 1.4.

If we look at its historical trends, we see a company that over the past decade has been stagnant, with revenue dancing around $20 billion per year. However, the EBITA up until 2018 seemed to trace a better path, with a constant increase that brought it from 2.4% of revenue in 2012 to 4% in 2018. However, already before the pandemic hit, this trend was broken as EBITA shrunk back to 3.6% of revenue. The strong rebound of the worldwide economy in 2021 didn’t really impact on ManpowerGroup top and bottom line as we see that revenue went back to its usual size, while EBITA remained low at 3.1%.

ManpowerGroup 2022 Investor Presentation

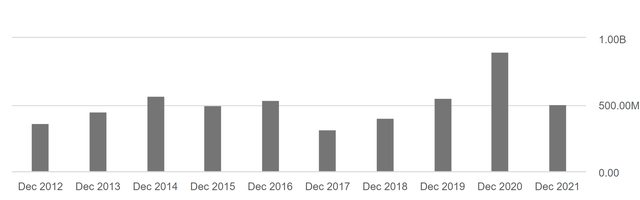

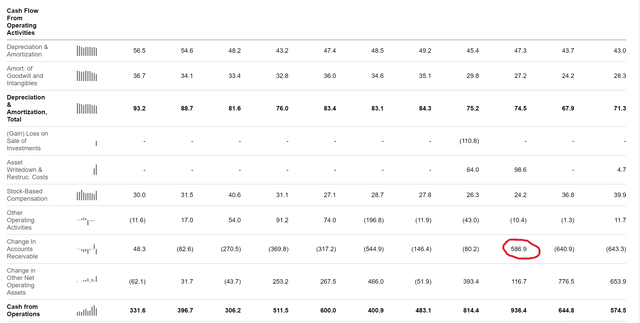

One of the most important metrics investors are using more and more is free cash flow and, in particular, free cash flow per share. On Seeking Alpha, we can look at the chart of free cash flow over the last decade.

Surprisingly, we see that FCF actually spiked up in 2020, making ManpowerGroup seem like a counter-trend business. In a certain sense, it may be true, but we have to understand why and if the reason behind this is really indicating a thriving business.

The real reason is easy to see. If we look at the cash flow statement, we see the number I circled in red for 2020: a positive change in accounts receivable for $586 million.

What does this mean? Account receivable shows the cash customers still owe the company.

Let’s recall what the relationship between accounts receivable and FCF is.

If accounts receivable increases, then the company sees a reduction on the cash flow statement because its sales are increasingly paid with credit instead of cash. On Seeking Alpha, we see this with a negative number because it is a “use” of cash that is seen as an outflow.

If accounts receivable decreases, then the company sees more cash on its cash flow statement, as the company has been paid in cash. Seeking Alpha shows this with a positive number because it is a cash inflow.

Now, in 2020, as many companies didn’t need staffing or other services ManpowerGroup offered, many contracts came to an end and had to be paid by the end of the year. Thus, the spike generated more FCF.

However, it is clear that this is also a negative signal for a business like ManpowerGroup’s because it shows that many staffing deals are coming to an end due to an economic downturn.

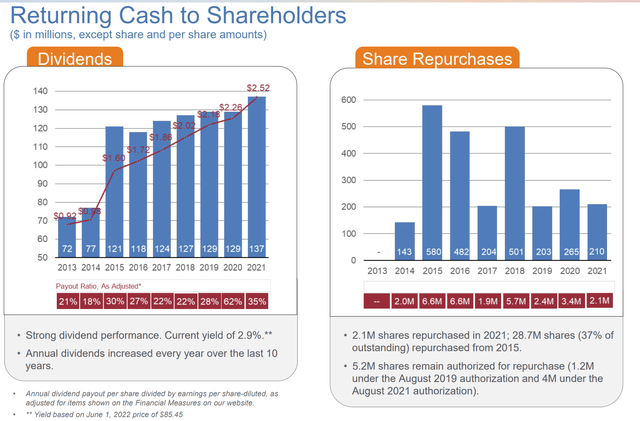

The company is also returning more and more cash to its shareholders, both in the form of semi-annual dividends and share buybacks.

Manpower 2022 Investor Presentation

The payout ratio is very conservative at 32% and the current yield is interesting as it is 3.37%. The past five-year growth rate is 7.92%, quite satisfactory in times of normal inflation, but now this growth doesn’t keep up with the price increases we are seeing. Seeking Alpha’s Quant Ratings give an A to ManpowerGroup’s dividend’s safety, along with a B- regarding its growth, an A- to its yield and an A for its consistency.

However, the dividend will be sustainable over the long run not only by increasing the EBITA, but also by finding a way to start growing once again.

The Last Recession

Let’s see what happened in 2009, during the last recession. ManpowerGroup experienced one of the most rapid drops in revenue in the history of the company, as stated in the 2009 Annual Report.

A difficult labor market caused ManpowerGroup’s revenue to fall by 26% from the $21 billion of 2008 to $16 billion in 2009. The company ended up with a net loss of $9 million, down from the net income of $206 million in 2008. Even the cash flow was down from $699 million to $379 million, a 45% decrease.

Clearly, the company struggled during this period. Furthermore, it didn’t come out of it with the strength to keep on growing, but it just returned to its 2008 results and consolidated till today, with almost no growth.

This is why I would be wary in investing right now in ManpowerGroup, as the risk of a recession may hit the stock very hard.

Valuation

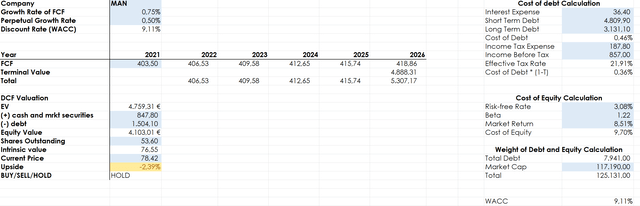

The stock has already traded down 31% YTD, but it is still above its support level that ranged from $54 to $70. In my discounted cash flow model, I projected the future five years of the company assuming no recession and a growth rate of 0.75% which represents a base scenario. With these results, the stock seems fairly valued.

Author with data from Seeking Alpha

However, it is clear that in case a recession takes place by the end of this year, today’s valuation doesn’t offer enough margin of safety for investors. This is why I rate the stock as a hold and suggest keeping it on a watchlist for a possible recovery play after a recession has indeed occurred.