LSB Industries: Grow Your Portfolio With This Diversified Chemical Maker (LXU)

Galeanu Mihai

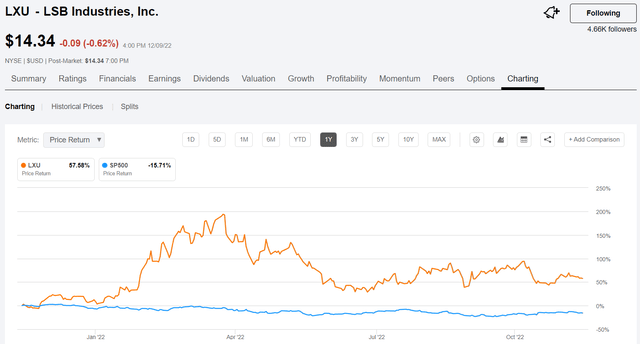

Looking back on 2022 as we approach the holiday season, the stock market has been a challenge for many asset classes and industry sectors. There have been very few opportunities to realize growth in individual stocks this year as nearly every sector has taken a beating in the bear market that started just about a year ago. One smallcap stock that has performed better than most in the past year is LSB Industries (NYSE:LXU), a diversified chemical producer that specializes in ammonia, ammonium nitrate, sulfuric acid, nitric acid, and nitrogen-based fertilizers for the farming, mining, and industrial markets.

In the past year, the stock price of LXU is up over 57% compared to the S&P 500, which is down nearly -16%.

When I last wrote about LXU, I focused on the agricultural fertilizer business, which was expected to get a boost from a combination of factors including the Russian invasion of Ukraine. That was in March shortly after the start of the conflict and sanctions against Russia were just being discussed and were expected to affect the global fertilizer market, in which LXU is a key player. In that article, which also reviewed CVR Partners (UAN) and their role in the global fertilizer market providing urea ammonium nitrate for farming, I stated that the growth prospects looked very good for both stocks. This is what I said at the time about LXU:

LXU does not pay a dividend but has shown excellent growth over the past year, and especially in the past 30 days. The company is well positioned to continue the growth going forward. The forward P/E for LXU is 10.57 according to SA. So even though the share price has seen a significant increase over the past several weeks, there appears to be plenty of additional growth not yet priced in.

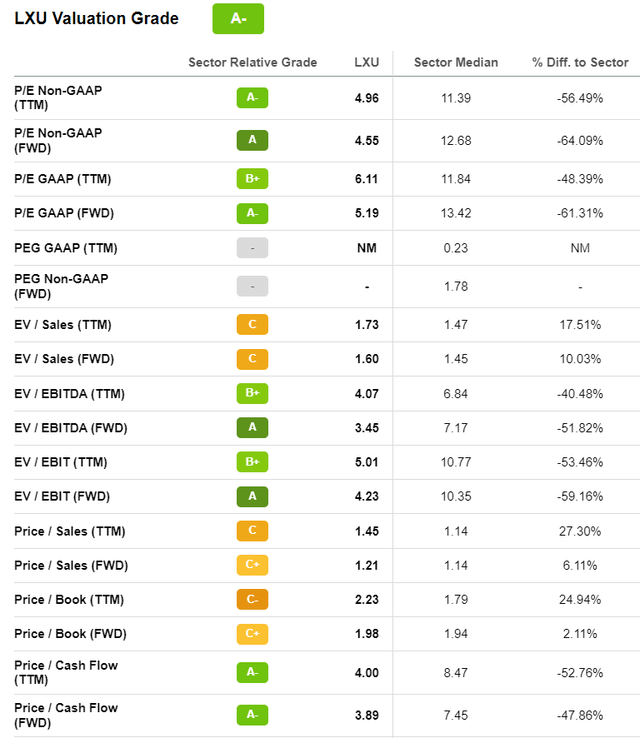

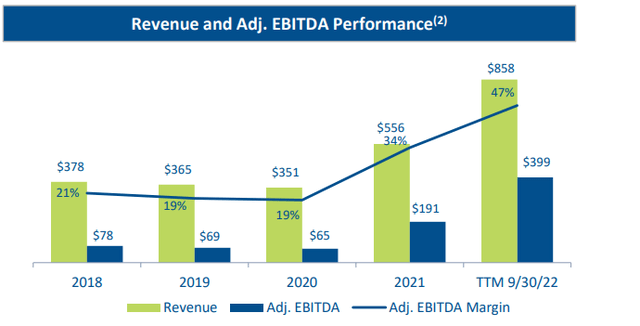

And although I was correct in the short term, the stock price peaked just a few weeks later at a price of $26.74 on April 19 and has come back down to a closing price of $14.34 as of 12/9/22. Now at a forward P/E of 5.19 according to SA, the growth prospects for 2023 and beyond look even better as revenues and gross margins continue to grow. The company was transformed when the current CEO and CFO assumed their roles in 2019 and since then the growth in revenues, EBITDA, and margins have continued a positive upward trajectory (with a slight downturn in 2020 due to the Covid pandemic) as shown in this slide from the company’s November investor presentation.

November investor presentation

Reasons for the sustained growth and operational excellence include several key factors such as:

- Diversified nitrogen chemicals business with differentiated end markets (not just agriculture).

- Over $1 billion invested in operational improvements and ongoing continuous improvement initiatives.

- Increased production capacity and favorable demand and pricing environment.

- Opportunities for further bottom line improvement from several in-process projects.

- Reduced cost of capital and improved balance sheet.

- Growth through organic expansion along with accretive acquisitions and opportunities for low carbon ammonia applications.

Experienced Management Team

The current CEO is Mark Behrman who became CEO in 2018. He joined the company in 2014 and was in roles including Executive VP and CFO from 2015 to 2018. He has more than 35 years’ experience in financial and investment banking.

The CFO is Cheryl Maguire, who joined in 2015 as VP Finance and was promoted to CFO in 2018. She has 20 years of experience in finance and banking in the energy and manufacturing sectors.

Two, more recent additions include John Burns, EVP Manufacturing and Damien Renwick, EVP and Chief Commercial Officer. Burns joined in 2020 and Renwick came on board in 2021.

LSB Industries at a Glance

LSB Industries is based in Oklahoma City, OK and owns and operates 3 production facilities –in El Dorado, AR, in Cherokee, AL, and in Pryor, OK. The company also operates a facility in Baytown, TX that is owned by Covestro (OTCPK:CVVTF) and operated by LSB under a long-term agreement. They produce nitrogen-based fertilizers, nitric acid, and various other chemical products for mining and industrial applications. The company was founded in 1968 and acquired the El Dorado facility from Monsanto in 1983. The Cherokee facility was acquired in 1999 from La Roche Industries and in 2000 they acquired the Pryor facility but did not begin operations there until 2010 to take advantage of low natural gas prices and high fertilizer prices at the time.

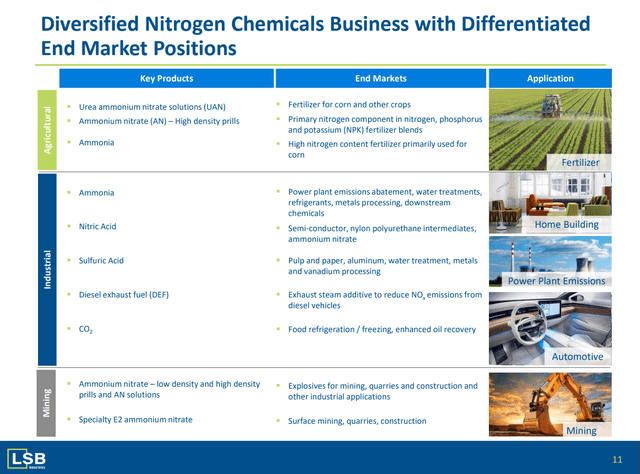

This slide from the November presentation illustrates the diversity of products and end markets served by LSB.

November investor presentation

In 2022 the market conditions for high fertilizer prices have driven the revenue growth for LXU and looks likely to continue into 2023. In fact, after reporting Q3 earnings on November 1 with revenues of $184.27M representing 44.9% YOY growth, CEO Mark Behrman had this to say:

“We continued to benefit from higher selling prices compared to last year, and our strategic commercial initiatives that enabled us to optimize our sales mix in the face of a rapidly changing market environment. Pricing remains well above year-ago levels and there are multiple supply and demand factors currently at play that we expect will continue to support strong pricing for the final two months of 2022 and for 2023, if not longer.”

Operational Improvements

The company completed 2 plant turnaround operations in 2022, back-to-back. The El Dorado turnaround began mid-July and was completed in August. The Pryor plant turnaround began Labor Day and was completed in October. Despite those 2 turnarounds (versus one completed in 2021) the earnings results delivered in the third quarter were very good. Furthermore, there is no turnaround scheduled for 2023, so sales should not be negatively impacted next year from plant downtime, barring some unexpected event.

Also mentioned on the earnings call transcript are planned debottlenecking initiatives that are in the works, according to CEO Behrman, which should help to further improve production and increase future sales.

On top of that, we believe we can increase the production capacity of our plants through various debottlenecking initiatives. We are currently evaluating multiple potential projects that could significantly increase our production and sales volumes and our profitability while meeting our investment return profile. The increase in nitrogen production capacity would also assist with the USDA’s stated goal of increasing domestic fertilizer production to ensure that farmers have an appropriate supply of fertilizer to meet their increasing demands.

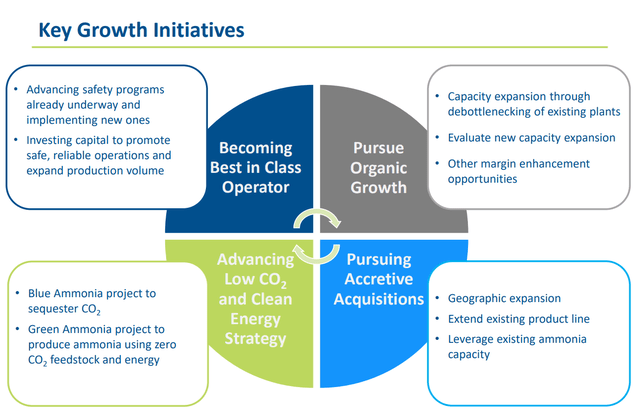

There are also 2 clean energy projects in the works, referred to as green and blue ammonia. Those two projects offer compelling opportunities to emerge as a leader in decarbonization in the industry. This slide from the November presentation illustrates the key growth initiatives that the company is currently undertaking.

November investor presentation

Ratings and Outlook

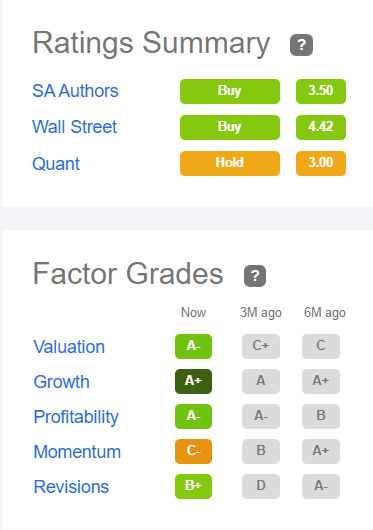

The LXU stock continues to receive Buy and Strong Buy ratings and has good quant factor grades. On November 17, LXU was given an Outperform rating by RBC based on the farming outlook and strong demand for nitrogen fertilizer.

LSB should benefit as a US-based pure-play nitrogen producer using low-cost domestic natural gas as the main feedstock. High crop prices and pent-up demand going into spring are positive for the price of agricultural chemicals including fertilizer, according to RBC.

Seeking Alpha

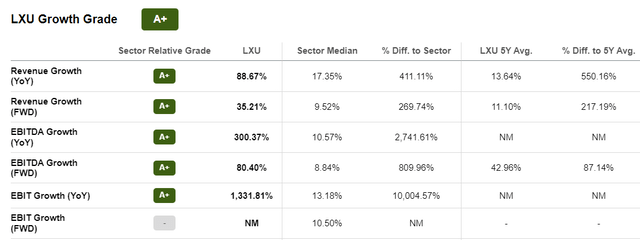

For Growth, the stock receives an A+ quant grade based on strong revenue, EBITDA, and cash flow growth.

The Valuation grade is an A- based on a low forward P/E, low Price/Cash Flow, and moderate Price/Sales ratios.

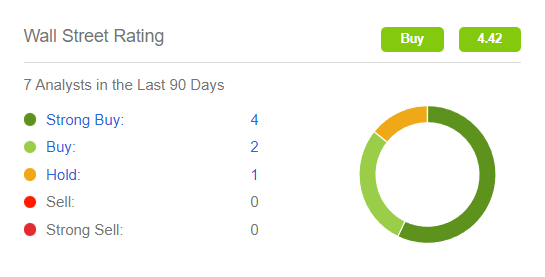

Wall Street analysts include 4 Strong Buy, 2 Buy and 1 Hold rating.

Seeking Alpha

The CEO was very optimistic on the Q3 earnings call regarding the outlook for the remainder of 2022 and full year 2023 earnings growth. In support of that optimism was the announcement that the share repurchase program was expanded and extended. From the earnings call transcript, CEO Behrman stated:

“As we head into the final months of 2022, we are highly enthusiastic about our near and longer term prospects for profitable growth, free cash flow generation and increased shareholder value given the favorable outlook for our markets coupled with the company-specific initiatives we have underway. Supporting that belief, on Monday we announced an increase of $75 million to our share repurchase program bringing the total repurchase program to $175 million.”

Conclusion

The stock has performed well in 2022 but in the past six months, the market has not rewarded LXU with share price growth and has instead further discounted the stock to a price that trades near 5X forward earnings, which are expected to increase next year. I believe that LXU currently offers growth investors an excellent buy price below $15 and should be trading above $20 by mid-2023 as the revenue and earnings growth accelerates based on company initiatives and continued strong demand for nitrogen fertilizer.

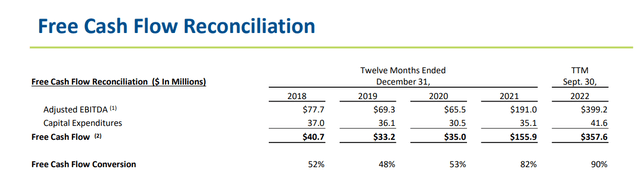

The company has ample cash on the balance sheet, with growing free cash flow that stands at over $357 million in Q322 at a 90% conversion rate.

November investor presentation

This is outstanding performance for a company with a market cap of just over $1B that is trading for a forward P/E of 5.2. For investors looking for growth at a reasonable price and are willing to accept some risk I would recommend taking a closer look at LXU to determine if the reward is worth the potential risk from external market factors that could prevent the stock from taking off. If all goes according to plan, the share price of LXU could easily increase by 50% or more in 2023.