Limoneira Company Stock: Approach With Caution (NASDAQ:LMNR)

Rouzes/E+ via Getty Images

With any investment, there are bound to be positive and negative attributes to weigh. For instance, when talking about the agricultural industry, one benefit is the fact that the goods ultimately produced not only perform an important public service, they also are integral to the perseverance of the human race to endure. Because of that, there will always be some demand for what is grown and harvested. On the other end of the spectrum, you also have the negative attribute that the agricultural space is highly commoditized and, as a result, often suffers from low margins caused by tremendous amounts of competition. From time to time, investors can find attractive opportunities in this space. Unfortunately, Limoneira Company (NASDAQ:LMNR) is not one of those. Despite having a long operating history, the enterprise is not in the greatest financial condition. In addition to that, current fundamental performance suggests that shares might be rather significantly overpriced. Because of that, I’ve decided to rate the business a ‘sell’ at this time.

A niche agribusiness play

The management team at Limoneira describes the company as an agribusiness firm dedicated to the California market. According to management, the company operates as one of California’s oldest citrus growers, with operations dating back to 1893. More specifically, the company operates as one of the largest growers of lemons in the US. On top of this, it also produces a significant amount of avocados, making it one of the largest domestic producers of that product as well. The company also sells other products like oranges, specialty citrus, and other crops.

In all, the company has control over 15,400 acres of land. Based on the data provided, 6,100 acres, representing about 40% of all the company’s land holdings, is dedicated to the production of lemons. It has a further 800 acres dedicated to avocados. Overall acreage for oranges is 1,000, while the company has 900 acres attributed to specialty crops. Most of its land, as I stated already, is attributed to California. However, the company also has exposure to other places like Arizona, Chile, and Argentina. The company also has a 47% ownership interest in Rosales S.A., a citrus packing, marketing, and sales business. It owns a 90% interest in Fruticola Pan de Azucar S.A., and lemon and orange orchard. And on top of this, it also has a 100% interest in another lemon and orange orchard called Agricola San Pablo SpA. Finally, the company has a 51% interest in a joint venture for a lemon orchard in Argentina.

Operationally speaking, the company has three main units that warrant attention. The first of these is what management calls its agribusiness. Through this, the company engages in the farming of the aforementioned products. It also plants products on these properties in order to prepare for future harvests. Finally, this unit focuses on the lemon packing and sales process where it packs and sells lemons grown by it, as well as lemons grown by other businesses, to various customers.

The second unit is referred to as rental operations. This includes the company’s residential and commercial rentals, leased land operations, and organic recycling activities. To be more specific, the company owns and maintains 256 residential housing units in parts of California that it leases to employees, former employees, and even people not otherwise affiliated with the business. As part of this, it also owns several commercial office buildings that are capable of generating cash flow for the enterprise. And lastly, the company also leases 500 acres of land out to third-party agricultural tenants who grow a variety of row crops on its land. The final unit is referred to as its real estate development operation. The company basically invests in real estate development projects like developable land parcels, multifamily housing and single-family homes, and other related opportunities. At present, it currently has an ownership interest in roughly 900 units in various stages of planning and development.

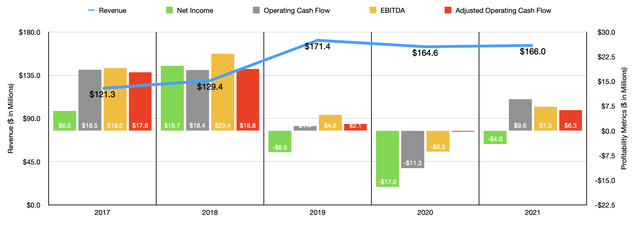

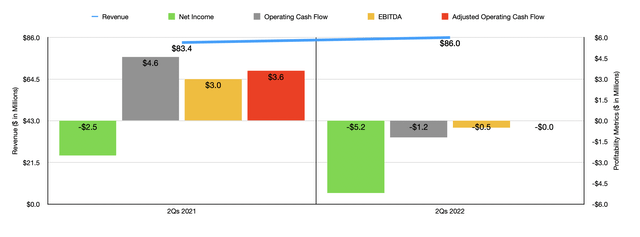

From an operational perspective, you might view Limoneira as an attractive opportunity. Here you have a company that has been around for a very long time and that provides a product that will always have demand. However, the fundamental picture for the company is not so great. Admittedly, the revenue trajectory for the firm has generally been positive. For instance, between 2017 and 2019, sales increased consistently, rising from $121.3 million to $171.4 million. Sales then dipped to $164.6 million in 2020 before ticking up slightly to $166 million last year. Financial performance has continued to improve into the current fiscal year. Revenue in the first half of 2022 totaled $86 million. That represents a modest improvement over the $83.4 million generated the same time one year earlier.

Unfortunately, the bottom line for the company is where things start to look ugly. Over the past five years, the company has seen no real trend in profitability. The best year was in 2018 when it generated net income of $19.7 million. But in each of the past three years, the business generated a loss. Other profitability metrics have been only marginally better. Operating cash flow declined from $18.5 million in 2017 to negative $11.3 million in 2020. 2021 proved to be a bit better, with operating cash flow coming in positive to the tune of $9.6 million. Even if we adjust for changes in working capital, there was no clear trend for the enterprise. And in fact, using this approach, profitability in the 2021 fiscal year was even lower, with cash flow totaling $6.3 million. Even when we look at EBITDA, we see the absence of any real trend.

Unfortunately, this issue with profitability has persisted into the 2022 fiscal year. In the first half of the year, the company generated a net loss of $5.2 million. That’s more than double the $2.5 million loss achieved in the first half of 2021. Operating cash flow went from $4.6 million to negative $1.2 million. Even if we adjust for changes in working capital, the metric would have worsened, turning from $3.6 million to basically nothing. Meanwhile, EBITDA has gone from $3 million to negative $0.5 million.

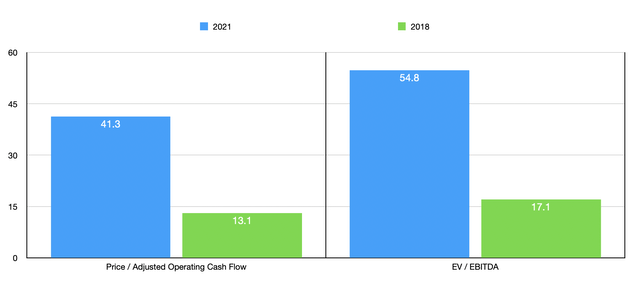

Management has not provided any real guidance for the current fiscal year. But if we use data from 2021, we can see that shares look very expensive. The firm is currently trading at a price to adjusted operating cash flow multiple of 41.3. The EV to EBITDA multiple is even higher at 54.8. Shares only look reasonably priced if we were to revert back to the kind of performance achieved in 2018. In this case, these multiples would be 13.1 and 17.1, respectively. To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 8.8 to a high of 22.6. And using the EV to EBITDA approach, the range was from 4.5 to 11.1. In both cases, Limoneira was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Limoneira Company | 41.3 | 54.8 |

| Alico (ALCO) | 22.6 | 4.5 |

| Darling Ingredients (DAR) | 16.1 | 10.3 |

| Ingredion (INGR) | 18.4 | 8.3 |

| Archer-Daniels-Midland Company (ADM) | 8.8 | 11.1 |

| Fresh Del Monte Produce (FDP) | 13.9 | 9.6 |

Takeaway

Based on the data provided, I will say that I view Limoneira as an interesting company. But beyond that, there isn’t much to say that’s positive. Yes, the company has been around forever. But at the same time, the fundamentals don’t come close to justifying its current pricing. If the company was growing at a rapid pace and cash flows were demonstrating a consistent upswing, then we might have something positive here. But at present, shares are so pricey that I cannot help but to rate the business a ‘sell’ at this time.