iShares MSCI World ETF (URTH) Is Risky – 7 Aspects Worth Considering

Marcus Millo/iStock via Getty Images

Introduction

Mr. Market is offering us increasingly better opportunities against a backdrop of rising interest rates, high inflation, a conflict in Eastern Europe and an energy crisis, as well as expectations of an economic downturn. Individual stocks, especially those of cyclical companies or formerly significantly overvalued tech high-flyers, are being beaten down and trading at increasingly palatable valuations. Investing in individual stocks can be an extremely interesting venture that can lead to market-beating results, provided a proper strategy is followed and the investor’s nerve costume is strong enough to act in a contrarian manner.

However, investing in individual stocks carries a number of risks, such as those listed below – it seems only reasonable that an investor would want to minimize risk as much as possible.

- Management must have a clear view of impending changes and adapt accordingly. Failure to adapt and evolve can make a business model obsolete.

- Today’s innovators may prove to be tomorrow’s laggards. Areas that promise above-average returns on investment (ROI) naturally attract competition, with the result that ROIs tend to contract over time and valuations adjust accordingly.

- Overly generous shareholder returns in times of easy money can lead to an over-leveraged balance sheet, making a company particularly vulnerable in a high interest rate environment.

- A company could face an external shock – think of the mandated store closures during the pandemic, which primarily affected brick-and-mortar retailers.

- Companies that are overly dependent on a single jurisdiction, customer or supplier suffer from concentration risks.

This is far from an exhaustive list of the risks that investors face with individual stocks. Personally, I am aware of the risks I take and believe that the benefits of investing in personally selected dividend-paying stocks outweigh the risks taken. Of course, my portfolio is broadly diversified to minimize concentration risks.

Personally, I am not a fan of a fund-based strategy in the traditional sense as I have outlined in this well-received article, but can very well understand if someone chooses such a strategy. Those who have realized that the nerve costume is simply not strong enough to invest in individual stocks, especially as it pertains to value stocks that must be bought in a contrarian manner (i.e., when a company is facing a headwind), have reached a very important conclusion that itself protects against significant losses. Ultimately, the psyche can be the worst enemy in investing.

In this article, I will discuss seven important aspects that investors pursuing a fund-based strategy should consider when seeking to maximize risk-adjusted returns. The article uses the iShares MSCI World ETF (NYSEARCA:URTH) as an example to illustrate various risks and focuses exclusively on equity-based ETFs that, in their entirety, aim to track the global economy. I strongly believe that only equities can deliver real returns (i.e., after inflation) over the long term – as opposed to fixed income investments such as bonds.

1. Pay Close Attention To Fees

In recent years, exchange-traded funds (ETFs) have become increasingly popular, in part because of their lean cost structure. Actively managed funds can cost as much as 1% or 2% per year (measured by position size), while the major providers of ETFs, such as Vanguard or BlackRock (BLK) through iShares, typically charge only fractions of a percent per year because ETFs simply track a broad index such as the S&P 500 (e.g., VOO, IVV, or SPY) and do not require compensation of active fund managers. Of course, there are active fund managers who have consistently beaten the market over the long term, but the majority are on par with the broader market or, worse, lagging it. Therefore, the performance of the actively managed fund in which an investor wishes to participate should be critically examined – after fees have been deducted.

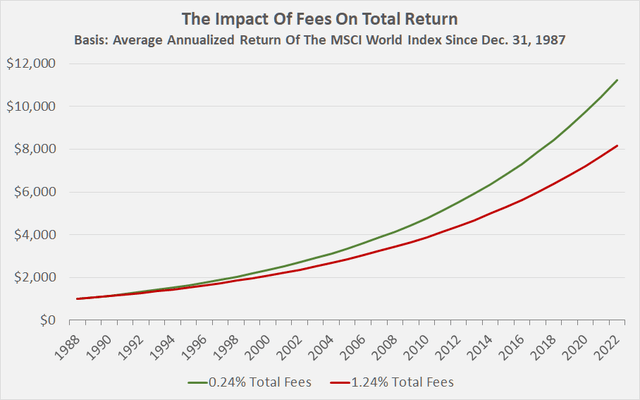

For illustration purposes, assume an investment of $1,000 on January 1, 1987, in an actively managed fund that charges 1.24% per year. The fund manager earns a return on par with the MSCI World Index, i.e., 7.61% per year on average, and it is assumed that URTH (total expense ratio, TER, of 0.24%) would have existed at that time.

The visualization in Figure 1 should be viewed as an illustration of the impact of the seemingly small difference of just 1% in management fees. At the end of 2022 and net of fees, the passive investor is sitting on more than $11,000, the literal “ten-bagger,” while the holder of the actively managed fund has earned only $8,100. In addition, actively-managed funds often come with additional fees charged upon initial investment and sometimes when the fund is sold.

It should also be noted that URTH is not a particularly low-cost ETF, as there are several alternatives with expense ratios of 0.05% or less. For this reason, and several others (see below), an investment in URTH alone should be critically questioned.

Figure 1: Theoretical comparison of two identically performing funds, with a spread in total expense ratio of 100 basis points.

As an aside, investors who already invest in low-cost ETFs should not try to overstate the issue of fees. Brokers and fund managers occasionally offer ETFs at a discount, especially as part of fund savings plans. Such offers are for marketing purposes and are usually limited to a specific time period. Care should be taken not to fall into the trap of selling an ETF at the end of a promotional period. Such transactions are taxable (unless the funds are held in a tax-deferred or tax-exempt account), and the regular payment of capital gains taxes can significantly impact long-term performance.

Of course, buying and selling fees (either directly or indirectly through the bid/ask spread) should also be considered. In this context, especially offers from funds with low assets under management (see section 3) and/or low trading volume should be closely examined, as their bid/ask spreads can be very large. In extreme cases, the bid price may even be unrealistic, as it may only apply to very small volumes. The aspect of possibly unrealistic bid prices only concerns large institutional investors in normal times, but is also relevant for small investors in times of market distress.

2. Geographical And Sector Diversification

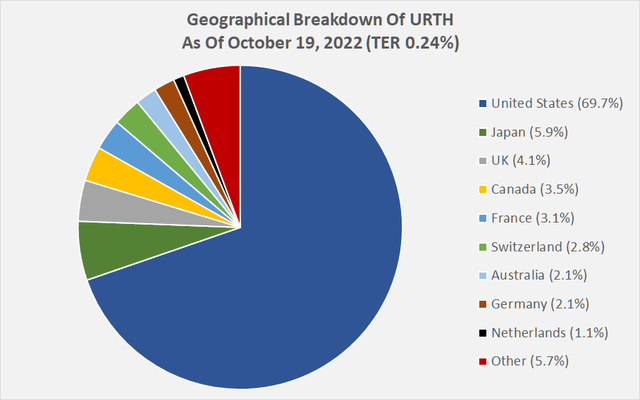

ETF investors often turn to a single MSCI World ETF such as URTH and expect appropriate geographic diversification. The degree of geographic diversification deemed appropriate must be determined on a case-by-case basis, but is certainly not trivial.

URTH is heavily U.S.-weighted at nearly 70% of market value (as of October 19, 2022) and contains only companies based in developed markets:

Figure 2: Geographical breakdown of the iShares MSCI World ETF (URTH) (own work, based on the fund’s holdings report as of October 19, 2022)

Of course, the notion of geographic exposure usually refers to the domicile of the companies held in the fund and is therefore a very approximate metric per se. Take, for example, Philip Morris International (PM), which currently generates its sales in international regions but is nevertheless categorized as a U.S.-based company (p. 23, semi-annual report of URTH). This, of course, does not take into account the likely acquisition of Swedish Match (OTCPK:SWMAY, OTCPK:SWMAF), which is heavily involved in the United States and for which Philip Morris has just increased its takeover bid (see my recent article on PM). Clearly, accurately distinguishing geographic exposure in the context of exchange-traded funds that hold shares of hundreds or thousands of companies is a pointless and, in my view, unnecessary exercise. Rather than examining individual ETF holdings, it is better to be vaguely right than exactly wrong.

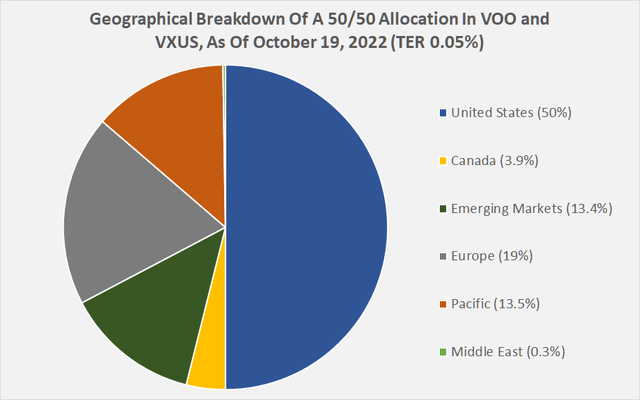

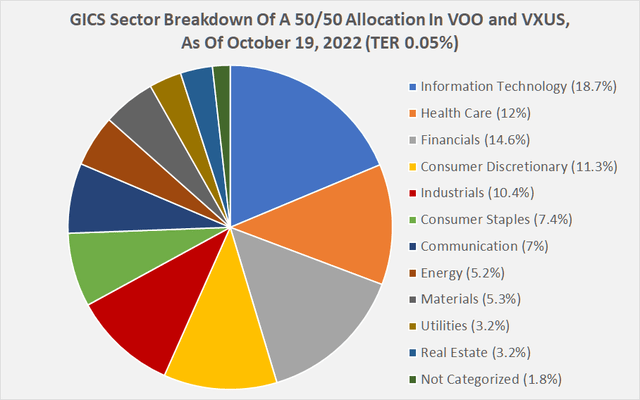

A simple solution that provides geographic diversification at one’s personal comfort level is to simply select ETFs with more granular geographic exposure, such as the Vanguard S&P 500 ETF (VOO) and the Vanguard Total International Stock ETF (VXUS). Such a simple-to-implement allocation would also have the added benefit of even lower costs – the expense ratios of VOO and VXUS are currently 0.03% and 0.07%, respectively, and a weighted-average ratio of 0.05% in the example shown in Figure 3. Compared to the hypothetical investment return after fees on an investment in URTH, the investor would have generated nearly $12,000, all else being equal.

Of course, the past performance of a fund portfolio with a smaller exposure to the U.S. equity market (which has experienced significant multiple expansion in recent decades) cannot be compared to this example. Conversely, however, investors should obviously never use past performance as an expectation for future performance – who knows, maybe emerging markets will be the return drivers of the years to come? Of course, this is not to say that I would “bet” on any particular geography as an ETF investor – I think it is important to remain as passive as possible when investing in ETFs.

Figure 3: Geographical breakdown of a 50/50 allocation in the Vanguard S&P 500 ETF (VOO) and the Vanguard Total International Stock ETF (VXUS) (own work, based on the funds’ holdings reports as of October 19, 2022)

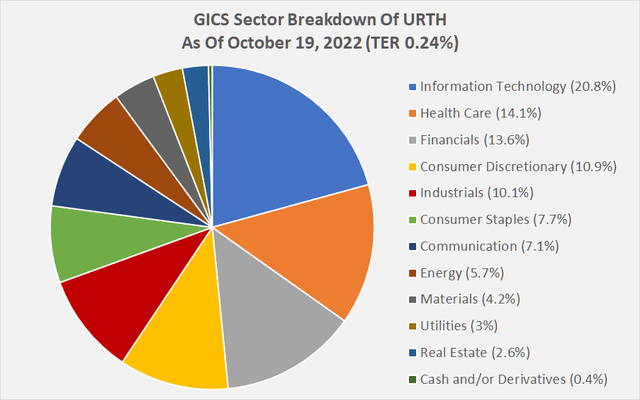

As with geographic regions, several ETFs are overly concentrated in certain sectors. ETFs typically categorize their holdings according to the Global Industry Classification Standard (GICS) system. Large inflows, particularly in 2020 and 2021, into information technology (IT) stocks were partly responsible for the high segment weighting in URTH. However, even after most technology stocks have taken a significant breather and valuations have moved much closer to their long-term averages, 20.8% of URTH volume is still tied up in IT stocks. One could argue that this percentage is perfectly acceptable given the dominance of information technology these days. While this argument is valid in principle, a closer look is warranted.

Figure 4: GICS sector breakdown of the iShares MSCI World ETF (URTH) (own work, based on the fund’s holdings report as of October 19, 2022)

Apple (AAPL) and Microsoft (MSFT), the two largest positions in URTH, are IT companies according to the GICS classification system and together account for 8.5% of the current fund volume. Amazon (AMZN, 2.24%), on the other hand, is categorized as a consumer discretionary company, which is somewhat misleading given the importance of its cloud business. Even more interesting is that Alphabet (GOOG, GOOGL) and Meta Platforms (META) are categorized as communications companies, as is AT&T (T). Conversely, it is open to debate why Visa (V) and Mastercard (MA) fall into the IT category. If GOOG, GOOGL, META and AMZN were added to the IT segment while removing MA and V, the sector allocation would increase to 24.9%.

I want to emphasize that it is not my intention to question the GICS classification system – it is inherently impossible to assign every single company in the world to a particular sector, and this is especially true for large multinationals with complex business models. My point is that investors should not be lulled into a sense of security by the assumption that a single MSCI World ETF like URTH provides adequate diversification among sectors. Personally, I would take a step back and consider the cyclicality of each sector. In this way, Amazon’s somewhat questionable categorization still leads to the conclusion – valid in my opinion – that the company is sensitive to business cycles because of its indirect and direct dependence on advertising revenue and IT-related capital spending by other companies.

Evidently, both geographic and sector diversification are difficult to measure accurately. If I were constructing an ETF portfolio for myself, knowing these limitations, I would take a relatively simple approach (e.g., as shown in Figure 5, resulting in somewhat lower exposure to U.S.-based technology and communications companies). Finally, ETF investors are typically passive investors and do not want to spend much, if any, time researching individual companies. However, with a little more effort, an enterprising ETF investor could add a focus on emerging companies by also choosing small-cap ETFs such as the iShares Russell 2000 ETF (IWM) for U.S. companies and the iShares MSCI Europe Small-Cap ETF (IEUS).

It is important not to over-analyze the issue and instead diversify to a comfortable level, taking into account the other aspects discussed in this article.

Figure 5: GICS sector breakdown of a 50/50 allocation in the Vanguard S&P 500 ETF (VOO) and the Vanguard Total International Stock ETF (VXUS) (own work, based on the fund’s holdings report as of October 19, 2022)

3. Fund Age, Size, And Manager

URTH is managed by BlackRock, the world’s largest asset manager with approximately $8.5 trillion in assets under management as of the end of June 2022. Founded in 1988, the company has revolutionized fund investing through its low-cost offerings and generally has a very strong track record. As a result, it is hard to think of BlackRock as a high-risk custodian, and I personally would sleep well owning funds from BlackRock. However, since it has been shown that cost and diversification benefits can very easily be achieved by buying more than a single fund, multiple asset managers should also be considered. BlackRock may be too big to fail, but diversification appears to be prudent in this regard as well.

Other aspects that should be considered are the age and size of the fund. URTH was launched in 2012 and its net asset value (NAV) is currently $1.96 billion. Personally, I consider an ETF that has been in existence for at least ten years and has a NAV of more than $1 billion to be a suitable long-term investment, provided the fund manager also has a good reputation. Very small funds run the risk of being abandoned abruptly (and most likely in tumultuous times), and because of the lower trading volume, there may also be unfavorable bid-ask spreads as already mentioned.

If I were putting together an ETF portfolio, I would definitely consider BlackRock, as well as competitors Vanguard, State Street (STT), Invesco and Charles Schwab (SCHW), all of which offer similarly low-cost and regionally diversified ETFs. Owning ten funds while focusing on different fund managers, appropriate geographic and industry diversification, and keeping track of the weighted-average expense ratio is certainly neither a complex nor a time-consuming endeavor.

4. Currency Risks – Does It Pay To Own A Currency-Hedged Fund?

By investing in broadly diversified ETFs, one participates in the economic development of the entire world. Therefore, investors are indirectly exposed to currency risks. Just because an ETF like URTH trades in U.S. dollars, one should not be blinded to the fact that the fund’s holdings can and do have currency risk.

This aspect is relevant not only to an MSCI World ETF like URTH, but also to some degree to seemingly purely U.S. funds like VOO, SPY or IVV. For example, a company that is headquartered in the U.S. and pays its dividends in U.S. dollars may nevertheless generate its cash flows abroad (e.g., Philip Morris, see above). Continued appreciation of the U.S. dollar would put pressure on the company’s overseas earnings, which could ultimately put its dividend at risk, but also its valuation (which is directly relevant to the fund). Other examples include companies based in countries with different currencies or those that are highly exposed to foreign debt.

In summary, currency risk cannot really be controlled in a diversified fund, but should be considered in fund selection. For example, an investor who transacts in euros probably should not invest too heavily in funds that contain primarily U.S.-based companies. This is pure theory, of course, considering that the U.S. dollar is the world’s reserve currency and generally has safe haven status, but it still deserves to be mentioned.

Once it is understood that a single MSCI World ETF such as URTH carries multiple concentration risks (sector, country, fund manager, currency, large-cap companies), it is easy to pick a set of five to ten ETFs that allow for proper diversification in all desired degrees of freedom.

For those too concerned about exchange rate fluctuations, fund managers such as BlackRock offer currency-hedged funds. These use derivatives such as currency forwards that lock in the exchange rate of a currency pair (buy or sell side) at a future date. Such derivatives are a form of insurance and come at a price. Personally, I view exchange rate fluctuations as a cost of doing business and therefore would not be willing to pay for a currency hedge. Instead, I would diversify appropriately through several ETFs.

5. Fund Replication Methods, Replication Quality, Securities Lending

ETFs are extremely cost-efficient investment instruments. However, it goes without saying that an MSCI World ETF such as URTH involves a significant management effort, considering that the fund has to track the price performance of currently 1,514 constituents . The iShares MSCI ACWI ETF (ACWI), which also includes emerging market companies, currently covers 2,334 holdings, while the MSCI World ACWI Index it tracks has more than 2,900 constituents. Both contain the world’s largest listed companies by market capitalization, but still represent only a small fraction of the world’s listed companies (more than 43,000, according to the World Bank). But how is it that the ACWI contains fewer positions than the index it tracks?

Fund managers have developed three approaches to replicating the indexes their ETFs track:

- Fully replicating funds contain each position in a 1:1 manner. It is easy to understand why only very large ETFs can afford full replication. An MSCI ACWI ETF just launched is unlikely to be able to buy at least one share of every company in the index. This is where the “sampling” strategy comes into play.

- ETF providers typically try to match the performance of the entire index with a smaller number of holdings, as is the case with the ACWI example. In this way, management fees can be kept very low and the performance of the ETF still matches that of the index for the most part. The difference between expected and actual performance is called tracking error. Fund managers usually show the tracking error in a chart (e.g., for URTH and ACWI) and alert investors to the associated “tracking error risk” (e.g., on p. S-7 of URTH’s summary prospectus).

- The third form of replication is synthetic replication, which means that the ETF does not hold the individual stocks or bonds, but swaps instead. Such derivatives are entered into with other financial institutions and provide a straightforward and inexpensive way to replicate an index. They also offer very creative ETF construction options, such as for inverse, leveraged, or commodity-based funds, but these are not discussed in this article. Personally, I would not want to invest in synthetic replicating ETFs as they come with counterparty risks. This is especially crucial in these times of a highly leveraged financial system and significant interdependencies – just think of how credit default swap spreads for Deutsche Bank (DB) and Credit Suisse (CS) have widened as a result of recent events in the UK bond market). It goes without saying that an investor in a synthetic replicating ETF does not even indirectly hold shares in companies – they only have a claim on a financial derivative.

In connection with the fact that one does not really “own” the shares held in a fund, the aspect of securities lending should also be mentioned. Several ETF providers reduce their costs by lending the shares they hold in custody. On page S-7 of URTH’s summary prospectus, BlackRock mentions “securities lending risk.” Simply put, the fund may not get the loaned shares back, a risk that might materialize in a severe stock market crash that goes in hand with margin calls and waves of insolvencies. Equally important, the collateral pledged by the borrower may turn out to be worth less than originally thought, and this too can become relevant in times of market turmoil when assets are quickly and relentlessly revalued. Needless to say, the savvy ETF investor would be better off opting for a slightly higher expense ratio if securities lending can be avoided altogether.

6. Bonds As Volatility Dampers Or Liquidity Reserve?

Investors often want to dampen the volatility (i.e., the definition of risk according to the Capital Asset Pricing Model, see my discussion) of their portfolio and therefore mix bonds or bond funds into their portfolio. The classic 60/40 portfolio invests 60% of its funds in equities (e.g., via ETFs) and 40% in bonds. Since the equity portion is naturally exposed to the cyclicality of the economy, the bond portion is usually invested in government bonds.

Even though the U.S. Federal Reserve and other central banks around the world have started raising interest rates in 2022, we are still in a low interest rate environment. Given the current level of government debt, it seems highly unlikely that interest rates in the 5% range or higher will prove sustainable – the interest burden would simply become unmanageable at some point. Investors in government bonds will therefore have to make do with yields in the low to mid-single digits, while real bond yields will remain negative for the foreseeable future.

Compared with a savings account with interest rates close to zero, owning bonds could make sense, as it allows investors to recover at least part of the purchasing power lost due to inflation. However, it should be borne in mind that bonds only entitle the holder to a fixed coupon. It is not correct to compare the rate of inflation with the yield of a bond or a stock, a common fallacy I have discussed in detail in another article.

This misconception is the main reason why I personally don’t invest in bonds and have chosen a dividend growth strategy. As long as I rely on the right companies, my dividend income should grow at or above the rate of inflation, thus maintaining or increasing my purchasing power.

Instead of a volatility dampening effect, some investors may want to hold a liquidity reserve. However, it is extremely important not to confuse this type of liquidity reserve with an emergency fund, as discussed in section 7. If one looks at the portfolios of certain actively managed equity funds, such liquidity reserves are often apparent. In this way, fund managers try to time the market and be able to act opportunistically when the stock market takes a dive.

However, the funds associated with such a liquidity reserve are not held in bank accounts. This is because institutional investors typically manage very large amounts of money that cannot be insured by the FDIC. If the funds were deposited with other banks, institutional managers would be exposed to significant counterparty risks. Instead, fund managers invest in short-term bonds (bonds with a maturity date far in the future entail a higher interest rate risk), which they plan to sell when the opportunity to buy stocks arises.

Personally, I would think twice about holding a liquidity reserve, as its effectiveness is highly correlated with the emotional strength of the investor. Holding bonds as a liquidity reserve can backfire, especially because interest rates can make wild moves during stock market gyrations, which of course directly affect bond prices. It is important to always remember that for every seller, there must be a buyer – and in times of distress, buyers can be rare or non-existent. Recent events in the United Kingdom confirm this old adage. Even worse, investors who want to spread their risk further and invest in government bonds around the world are also exposed to currency risks. Holding a liquidity reserve through a government bond ETF is also pointless, as such funds can naturally become illiquid, especially if they are relatively small.

Therefore, if one chooses to hold a liquidity reserve, it proves advantageous to hold the funds directly with the broker or bank. Of course, this only applies to the case of the typical retail investor with a cash reserve that is FDIC-insured.

7. The Dangerous Misconception Of Treating An ETF As A “Modern Savings Account”

On several occasions, I have noticed an ETF portfolio being touted as the “modern savings account” due to the low interest rate environment and the resulting zero or near-zero interest rates on savings accounts. As central banks began raising interest rates in 2022, interest rates on savings accounts have improved somewhat, but it is important to understand the critical difference between a savings account and an ETF portfolio. The former allows the holder to withdraw money on a daily basis or at a pre-agreed maturity date, while the latter is, in effect, an investment with a maturity date far in the future (those interested in the duration aspect of bonds and stocks should take a look at my educational article).

The old adage that only those funds that will not be needed for at least five to ten years should be invested in equities – or equity-like investments such as ETFs – still holds true today, even if real returns on a savings account are currently negative. Emergencies (job loss, car breakdown, needed repairs to a house or apartment, health problems) can happen at any time, and investors without a cash-like liquidity reserve suffer especially during an economic downturn and the depressed stock valuations that come with it, as they become forced sellers. Those who invest on margin and/or without an emergency fund are part of the regularly observed phenomenon of accelerated selling pressure during a stock market crash. Of course, this aspect is also relevant for those who invest in individual stocks.

Key Takeaways:

- At first glance, an investment in URTH appears to be a low-risk and low-cost way to participate in the global economy.

- However, the fund suffers from significant concentration risks, both in terms of geography and industry sectors – both partly responsible for the fund’s poor performance of -24% year-to-date.

- A selection of ten ETFs, each focused on a different geography (e.g., U.S., Canada, Europe, developed countries in Asia, emerging markets) and market capitalization (small and medium/large cap funds), is sufficient to construct a well-diversified portfolio.

- URTH not only suffers from concentration risks, but is also a relatively expensive ETF. A simple model portfolio with a 50/50 allocation to VOO and VXUS provides better diversification and saves 80% of the cost.

- Opting for an ETF portfolio consisting of ten funds has the added benefit of removing the investor’s dependence on a single asset manager, thus avoiding another form of concentration risk.

- Currency risk is extremely difficult to manage, and currency-hedged ETFs are generally not worth the money. Currency risk in a well-diversified portfolio should be considered a cost of doing business.

- Synthetic replicating ETFs may be cheaper than fully replicating funds, but they should be avoided because of the significant counterparty risk. Similarly, funds that opt for securities lending to reduce costs should be critically scrutinized.

- A liquidity reserve can serve well in the event of a market crash, provided the investor is equipped with the appropriate nerve. However, care should be taken not to hold government bonds denominated in foreign currency or long-term bonds.

- A liquidity reserve should not be confused with an emergency fund – in such a case, the investor could find himself a forced seller in unfavorable times.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.