Is Walgreens Stock A Buy Before Upcoming Earnings? (NASDAQ:WBA)

Justin Sullivan/Getty Images News

Elevator Pitch

I have a Buy investment rating for Walgreens Boots Alliance, Inc.’s (NASDAQ:NASDAQ:WBA) shares. Previously, I highlighted that WBA is “the largest pharmacy chain operator in the US” based on market share data sourced from Euromonitor in my earlier article published on April 7, 2021.

In this article, I assess the investment case for Walgreens in view of WBA’s upcoming Q3 FY 2022 (YE August 31) earnings release. It isn’t an issue buying Walgreens’ shares prior to the upcoming results announcement, as I expect WBA to report in-line EPS. As such, it is more important to look beyond the third-quarter earnings and focus on key re-rating catalysts for the stock. In my view, potential non-core business or asset sales and the above-expectations growth of the health segment are likely to drive WBA’s share price higher, which makes Walgreens a Buy.

WBA Stock Key Metrics

The key metrics for WBA’s stock are its share price and financial metrics.

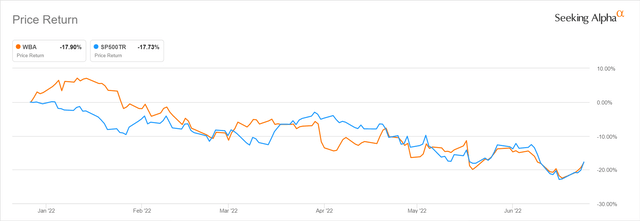

Walgreens’ stock price performance in the past couple of months has been decent on a relative basis. While WBA’s shares pulled back by -17.9% in the last six months, this is on par with the S&P 500’s -17.7% correction over this same period.

WBA’s Historical Six-Month Share Price Performance

Seeking Alpha

In my opinion, WBA’s shares haven’t lagged behind the broader market in recent months, because of the company’s good second-quarter financial performance and its long history of positive earnings. I will touch on Walgreens’ Q2 FY 2022 results in this section, and discuss WBA’s profitability track record in the next section.

Walgreens released the company’s financial results press release for the second quarter of fiscal 2022 on March 31, 2022, and WBA’s non-GAAP adjusted earnings per share or EPS expanded by +26% YoY from $1.26 from Q2 FY 2021 to $1.59 in Q2 FY 2022. Walgreens’ most recent quarterly EPS also exceeded Wall Street’s consensus EPS estimate of $1.40 by +14%.

In its earnings media release, WBA highlighted that “strong execution across business segments, led by COVID-19 vaccinations and testing” was a key factor that drove the company’s bottom line growth in the recent quarter. Although it is expected that there will be a slowdown in testing and vaccinations relating to the pandemic for the second half of fiscal 2022, WBA has kept its full-year FY 2022 guidance of low-single digit EPS growth unchanged.

In this current environment of weak consumer demand and inflationary cost pressures, many companies will find it tough to achieve earnings growth or even just remain profitable. In contrast, a pharmacy chain operator like Walgreens is seen as a defensive stock boasting resilient revenues and the pricing power to pass on cost increases. This explains why Walgreens’ shares have been able to keep pace with the market in the last few months. WBA’s track record of profitability also provides support for the stock being a defensive play, as discussed in the next section.

Does Walgreens Make A Profit?

Walgreens was profitable for both the recent Q2 FY 2022 and full-year FY 2021. In fact, WBA has been profitable for decades. Based on historical financial data sourced from S&P Capital IQ, the company has been delivering positive earnings for the past 40 years.

Looking forward, Wall Street analysts also see Walgreens staying in the black for the foreseeable future, or at least till FY 2026 for which sell-side analysts’ financial projections are available.

In a nutshell, WBA’s long history of positive net income and expectations of sustained profitability in the future are a key reason why the company’s shares haven’t underperformed the S&P 500 in recent months.

For the rest of the article, I focus on Walgreens’ upcoming Q3 FY 2022 earnings, and potential re-rating catalysts.

When Does Walgreens Report Earnings?

WBA will report the company’s Q3 FY 2022 earnings on Thursday, June 30, 2022, as indicated in its recent June 2, 2022 press release.

In the next section, I touch on the expectations for Walgreens’ upcoming third-quarter financial results.

What To Expect From Earnings

Q3 FY 2022 is expected to be a challenging quarter for Walgreens, but I expect WBA’s third-quarters to be in line with market expectations.

WBA’s non-GAAP adjusted EPS jumped by +95% YoY to $1.38 in the third quarter of fiscal 2021, this sets up a high base for the company’s Q3 FY 2022 earnings. Walgreens also stressed at the company’s Q2 FY 2022 earnings call on March 31, 2022 that Q3 FY 2021 “was the peak of vaccinations.” WBA also cautioned about increased investments for the health segment and higher labor expenses for 2H FY 2022 at its most recent quarterly investor briefing.

However, I am of the view that these headwinds have been factored into the market’s consensus financial forecasts already. Walgreens’ consensus Q3 FY 2022 EPS projection has been reduced by -9% and -20% in the past three months and six months, respectively. The current Wall Street consensus EPS estimate of $0.92 for the third quarter of fiscal 2022 translates into a substantial -33% YoY decline.

Taking into account the significant cut in consensus bottom line estimates in the past couple of months and the fact that the company maintained its full-year FY 2022 guidance, I don’t expect a big earnings beat or miss for Walgreens in the upcoming quarter. Instead, I think that WBA’s Q3 FY 2022 earnings should meet investors’ expectations.

What Is Walgreens’ Forecast?

Given that the probability of a negative surprise relating to WBA’s upcoming Q3 FY 2022 earnings announcement is low, investors should watch out for catalysts that offer upside to Walgreens’ financial forecasts in subsequent quarters and years.

I see two catalysts worth paying attention to.

The first catalyst is the potential sale of Boots, which is referred to as WBA’s “U.K. drugstore/beauty chain” business in an earlier April 1, 2022 Seeking Alpha News article.

At its Q2 FY 2022 earnings briefing in March 2022, Walgreens emphasized that “we continue to apply a rigorous strategic lens to our equity investments and explore all options to unlock value.” Specifically, WBA highlighted “the strategic review of our Boots business” at its second-quarter investor call.

In early-June, there were media reports suggesting there could be a joint bid for Boots made by Apollo Global (NYSE:APO) and Reliance Industries. Previously, there were potential buyers who valued Boots at £5 billion or $6.1 billion, which is equivalent to a significant 17% of Walgreens’ current market capitalization.

There are also other parts of WBA that could potentially be put up for sale in the future, specifically the company’s non-US operations such as its interests in businesses in China and Germany.

Walgreens could rely on the one-off gains and cash flow from these potential divestments not included in the company’s consensus forecasts to either fund its future growth or return excess capital to shareholders.

The second catalyst is the expansion of its health segment.

Walgreens revealed at its Q2 FY 2022 results call that “Walgreens Health” is on “a clear path to a run rate of more than $4 billion exiting fiscal year 2022”, and it guided that the company could double that in a few years’ time with its “$9 billion to $10 billion in sales by fiscal 2025.” At the JPMorgan (JPM) Virtual Healthcare Conference in January 2022, WBA noted that it expects the health segment to generate a reasonably good “high-teens sales growth” in the steady state after 2025.

For the company as a whole, Walgreens’ top line is forecasted to increase from $132.1 billion (estimated) in FY 2022 to $144.3 billion in FY 2025. This implies that the revenue contribution from WBA’s health segment is expected to increase from an estimated 3% by the end of fiscal 2022 to as high as 7% by fiscal 2025.

Last week, WBA announced that it will set five Walgreens Health Corners in Ohio by partnering with “Buckeye Health Plan, an Ohio managed care company.” According to the company’s website, Walgreens Health Corners offer “clinical and non-clinical services from Health Advisors, who are licensed pharmacists or nurses.” This is consistent with Walgreens’ plans to increase the number of Walgreens Health Corners from the current 55 to 100 by the end of calendar year 2022. Walgreens’ long-term target is to grow to 3,000 Walgreens Health Corners.

In summary, Walgreens’ intermediate-to-long term outlook and forecasts are good. As discussed earlier, WBA is expected to remain profitable in the next few years (up to FY 2026 as far as analysts’ forecasts go), as it did in the past decades. With respect to the company’s overall top line growth, the expansion of the health segment will be a key driver. There is also potential upside to WBA’s future financial performance with the sale of non-core businesses or assets like Boots.

Is WBA Stock A Buy, Sell, or Hold?

WBA stock is a Buy. I am not worried about an earnings miss for Q3 FY 2022, as consensus numbers have already been revised downwards to a large extent. Positive surprises like the successful divestment of Boots and the faster-than-expected growth of the health segment could be catalysts for WBA stock, justifying a Buy rating for the company’s shares.