Is Enphase Energy Stock Overvalued Or Undervalued? (NASDAQ:ENPH)

Sundry Photography

Elevator Pitch

I assign a Hold investment rating to Enphase Energy, Inc.’s (NASDAQ:ENPH) stock. ENPH refers to itself as “the world’s leading supplier of microinverter-based solar and battery systems” in the company’s media releases.

A comparison of Enphase Energy’s valuation multiples and forward-looking financial metrics with its peers leads me to the conclusion that ENPH is fairly valued. As such, a Hold rating for Enphase Energy is justified.

ENPH Stock Key Metrics

The key metrics for ENPH’s stock that would have caught investors’ attention relate to its stock price performance.

Enphase Energy’s shares have done exceptionally well this year thus far. In 2022 year-to-date, ENPH’s stock price surged by +34.8% and this beats the S&P 500’s -23.5% decline over the same period by a very wide margin.

But the story for ENPH has changed in the past month. Enphase Energy’s shares dropped by -18.6% in the last one month, which doesn’t compare favorably with the much more modest -6.7% pullback for the S&P 500 in the same time frame.

The share prices of listed companies typically drop due to expectations of weaker revenue or earnings, and valuation multiple de-rating. It seems to be more of the latter, rather than the former, which has contributed to Enphase Energy’s recent share price weakness.

Based on the sell-side’s consensus financial estimates obtained from S&P Capital IQ, analysts are of the view that Enphase Energy’s Q3 2022 revenue and normalized earnings per share or EPS should expand by +74.9% YoY and +81.5% YoY, respectively. Wall Street also expects ENPH’s top line and bottom line for full-year FY 2022 to grow by +62.2% and +68.8%, respectively. These are very strong numbers by any measure.

Also, there hasn’t been significant changes made to Enphase Energy’s forward-looking financial forecasts recently. In the past one month, the change in the market’s Q3 2022 and FY 2022 consensus revenue and bottom line estimates was less than 0.2% in either direction.

As per the metrics highlighted above, it is reasonable to assume that ENPH’s poor stock price performance in the last one month wasn’t related to worries or concerns about a slowdown in the company’s top line and bottom line growth. In the subsequent two sections of the article, I discuss about Enphase Energy’s consensus price target and valuation multiples, respectively.

What Is Enphase Energy Stock’s Price Target?

The Wall Street analysts’ consensus target price for Enphase Energy provides relevant insights about why ENPH’s shares haven’t performed well in the recent one month.

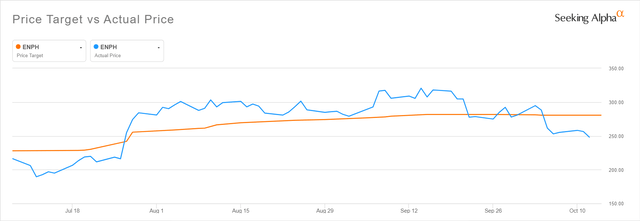

A Comparison Of Enphase Energy’s Consensus Price Target And Actual Share Price For The Past Three Months

Seeking Alpha

The chart presented above shows that the mean target price for Enphase Energy has been increasing gradually in the last three months. In the past one month, the average price target for ENPH didn’t change much as seen in the chart. In other words, Enphase Energy’s weak share price performance in the recent month had nothing to do with a change in the sell-side analysts’ assessment of what the company’s shares are worth.

Instead, the potential upside implied by the consensus analyst target price is more telling.

Enphase Energy last traded at $248.70 as of the end of the October 13, 2022 trading day. In comparison, the current analysts’ consensus price target for ENPH is $280.61. This is equivalent to an expected capital appreciation of +12.8% for the company’s shares which is below the typical required rate of return for investors in the +15%-20% range justifying a Buy. This means that Enphase Energy’s stock doesn’t seem attractive even after its underperformance in the recent one month.

Is ENPH Stock Overvalued Or Undervalued?

There is a good reason why ENPH’s shares don’t offer significant upside (as implied by the consensus target price) now, even though it has experienced a substantial price correction recently. Enphase Energy’s valuations are still rich. As an example, ENPH’s consensus forward next twelve months’ Enterprise Value-to-Revenue multiple has compressed from 15.9 times a month ago to 12.8 times now, which is still expensive in absolute terms.

ENPH’s Peer Valuation Comparison

| Stock | Consensus Forward Next Twelve Months’ Enterprise Value-to-Revenue | Consensus Forward Next Twelve Months’ EV/EBITDA | Consensus Forward Next Twelve Months’ Normalized P/E | Consensus Current Fiscal Year Revenue Growth | Consensus Forward One Fiscal Year Revenue Growth | Consensus Current Fiscal Year EBITDA Margin | Consensus Forward One Fiscal Year EBITDA Margin |

| Enphase Energy | 12.8 | 43.0 | 55.9 | +62.2% | +33.7% | 29.6% | 29.6% |

| Sunnova Energy International (NOVA) | 12.0 | 39.9 | N.A. | +98.5% | +37.0% | 27.3% | 32.0% |

| Sunrun (RUN) | 6.1 | N.A. | N.A. | +34.2% | +7.9% | N.A. | N.A. |

| SolarEdge Technologies (SEDG) | 3.0 | 18.6 | 26.7 | +56.6% | +27.7% | 14.5% | 18.1% |

| SunPower Corporation (SPWR) | 1.8 | 22.1 | 37.7 | +25.1% | +18.1% | 5.8% | 8.8% |

Source: S&P Capital IQ

Enphase Energy is the most expensive stock in the peer group as indicated in the table presented above. The stock’s forward Enterprise Value-to-Revenue, EV/EBITDA and normalized P/E multiples are significantly higher than that of its peers.

On the flip side, ENPH does deserve a valuation premium. With the exception of NOVA whose valuations are comparable to that of ENPH, Enphase Energy’s expected revenue growth rates and EBITDA margins are the best among its peers.

As such, I deem Enphase Energy’s stock to be fairly valued, rather than undervalued or overvalued.

What Is The Long-Term Prediction For Enphase Energy Stock?

The prediction for Enphase Energy in the long run is that the company will continue to deliver strong revenue and earnings growth in the long run.

According to the Wall Street’s consensus financial projections sourced from S&P Capital IQ, ENPH should achieve top line and bottom line CAGRs of +33.3% and +30.3%, respectively, for the FY 2022-2025 period. In my view, these assumptions are reasonable.

Enphase Energy’s long-term top line and profit growth will be driven by rising demand for its core inverter products brought about by the increase in the penetration rate of electric vehicles over time. Other drivers include higher revenue contribution from battery sales and geographical expansion to capitalize on opportunities in Europe in the future.

Is ENPH Stock A Buy, Sell, or Hold?

ENPH stock is rated as a Hold. Enphase Energy’s valuation multiples are much higher than its peers, but this is justified considering expectations of faster top line growth and higher margins for ENPH.