Intuitive Surgical: Risky Ahead Of Third Quarter Report (NASDAQ:ISRG)

ClaudioVentrella

Intuitive Surgical (NASDAQ:NASDAQ:ISRG) remains strong in the robotic surgery industry and it is well known for its leading da Vinci robotic surgical system.

ISRG posted a slowing total revenue YoY growth of 3.97% this quarter compared to its 31.01% in FY21. Grandview research estimates that the global surgical robot market is growing at 19.3% CAGR, from 2022 to 2030. This implies that the market is far from maturing, however, looking at the company’s slowing top line growth posts some concern, making this stock unattractive at its valuation today.

On the brighter side, according to the management, they have an impressive growth figure in their installed base to 7,135 systems, up 13% from 6,335 in Q2 ‘21 and up 6% from its 6,730 recorded in Q4 ‘2. However, considering today’s high inflationary environment, this comes with bloated input costs affecting its operating margin and its customers’ budget which translated to its slowing deferred revenue. ISRG remains relatively expensive than its peers, making it still risky despite the significant drop.

In Q2 ‘22, ISRG remained strong in growing da Vinci procedures volume to 465,000, up from 408,000 from the same period last year. In addition, $1.24 billion, or 81% of total revenue, remains recurring in nature, up from 75% in the previous fiscal year.

Additionally, the company is now seeing positive results in its investment in urology and gynecology procedures and increased its procedure growth as quoted below.

On our last call, we forecast full year 2022 procedure growth within a range of 12% to 16%. We are now increasing our forecast and expect full year 2022 procedure growth of 14% to 16.5%. Source: Q2 2022 Earnings Call Transcript

This indicates a continuous increase in market share and growth, potentially reaching 1.72 billion procedures in 2022, up from 1.5 billion procedures in 2021.

However, Growth Top Line Hurt Its Margin

I do not think the current high inflationary climate would force individuals to abandon digitization, particularly in the healthcare sector. Nevertheless, it might slow, especially considering the fact that the number of procedures often drops during recession.

This may disrupt ISRG’s overall demand which is now showing in its total deferred revenue of $413.70 million down from its $414.00 million recorded in FY21 but remains elevated compared to its $382.40 million recorded in FY20.

This quarter, its operating income went down to $397.60 million from $511.20 million recorded in Q2 ’21. Looking at its operating margin, it slowed to 26.12% compared to 34.92% recorded in the same period last year. However, headwinds from its bloated input cost seem to snowball this FY22.

On our last call, we forecast our 2022 full year pro forma gross profit margin to be within 69% and 70.5%. We are now refining our estimate of pro forma gross profit margin to be within 69% and 70% of net revenue. Given the ongoing impact of higher input costs related to supply chain and the impact from a stronger U.S. dollar, we would expect to be towards the lower end of that range. Source: Q2 2022 Earnings Call Transcript

As a result, the company’s diluted earnings per share fell to $3.91 in FY22, from $4.66 in FY21. Furthermore, analysts are forecasting a disconcerting -6% YoY growth figure for FY22, adding to the gloomy outlook.

Weaker Outlook Continues

In addition, ISRG has reduced its CAPEX budget for FY22 to a range of $700 million to $800 million. However, the management has maintained its growing projection for stock-based compensation expense to increase to a range of $520 million to $540 million, up from its $449.20 million recorded in FY21 and up from its $395.40 million recorded in FY20. This will continue to affect its deteriorating net margin of 24.05%, down from 29.85% last fiscal year and dilute its earnings per share.

Still Relatively Overvalued

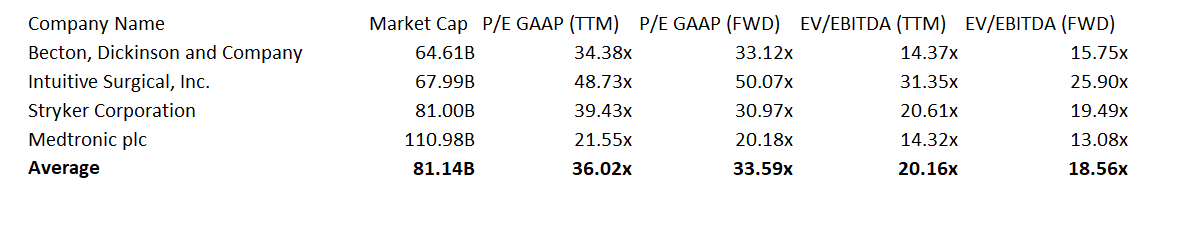

ISRG: Relative Valuation (Source: Data from SeekingAlpha. Prepared by InvestOhTrader)

Becton, Dickinson and Company (NYSE:BDX), Stryker Corporation (NYSE:SYK), Medtronic plc (NYSE:MDT)

Comparing ISRG’s trailing P/E multiple of 48.73x to its average peer group’s 36.02x suggests a premium. Looking at its trailing EV/EBITDA multiple of 31.35x it reveals some premium as well compared to its peer group’s average, 20.16x. Considering its slowing operating margin and slowing ROE, I believe ISRG remains risky as of this writing.

ISRG’s forward P/E multiple of 50.07x trades relatively expensive compared to its peer’s average of 33.59x, while its forward EV/EBITDA multiple of 25.9x reveals a premium as well, compared to its peer group’s average of 18.56x.

In contrast, Medtronic has a more stable valuation than ISRG, with a trailing P/E multiple of 21.55x and an EV/EBITDA multiple of 14.32x, and bears an attractive 3.26% dividend yield.

Set to Invalidate Double Bottom Pattern

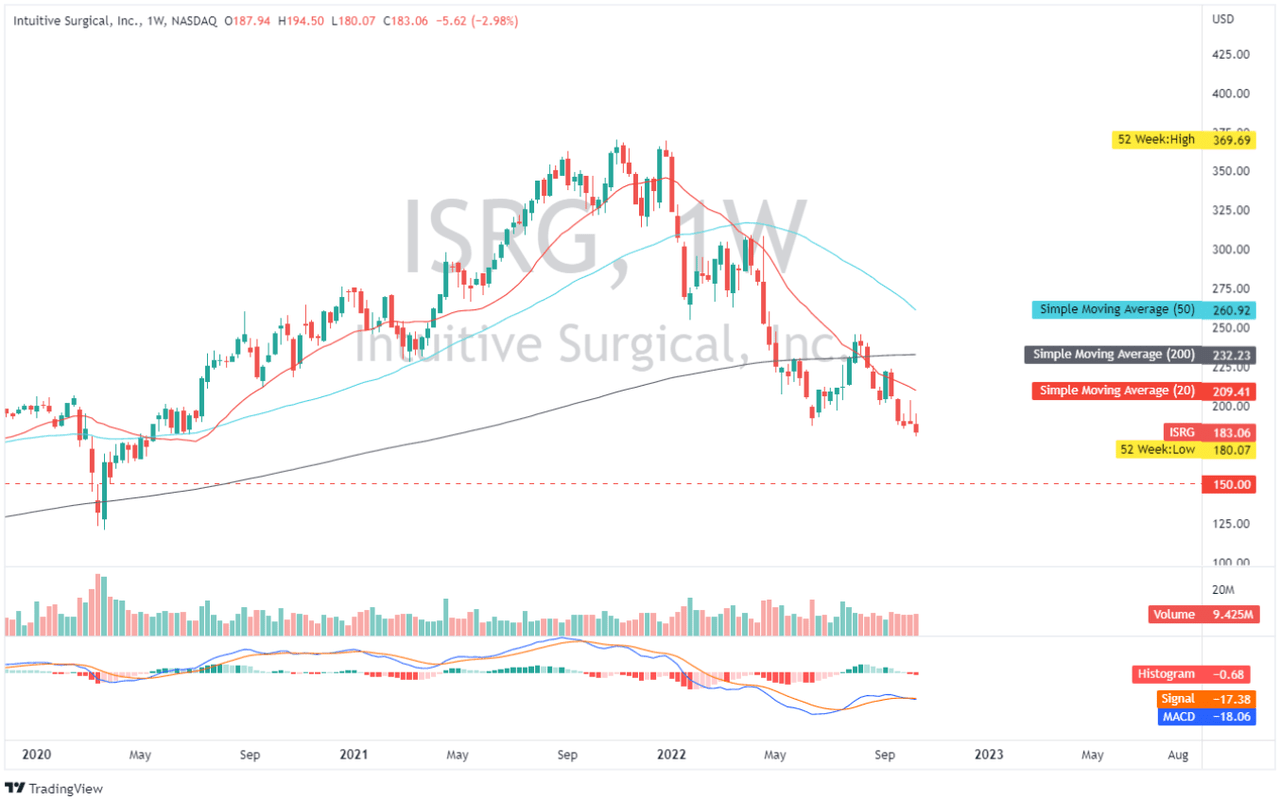

ISRG: Weekly Chart (Source: TradingView.com)

Looking at the chart above, ISRG is currently retesting its $187 zone, however, price seems to ignore this level and is heading to create new lows. Consistent with this selling pressure, ISRG’s price is currently trading below its simple moving averages.

If price breaks and consolidates above $191 on a daily chart, it might signal to investors and traders that we may have seen the second swing low in the double bottom.

Conclusion

ISRG generated a declining FCF of $1,294.00 million compared to its $1,735.90 million recorded last fiscal year. This snowballed to its declining FCF margin of 21.70%, down from 30.40% recorded last fiscal year.

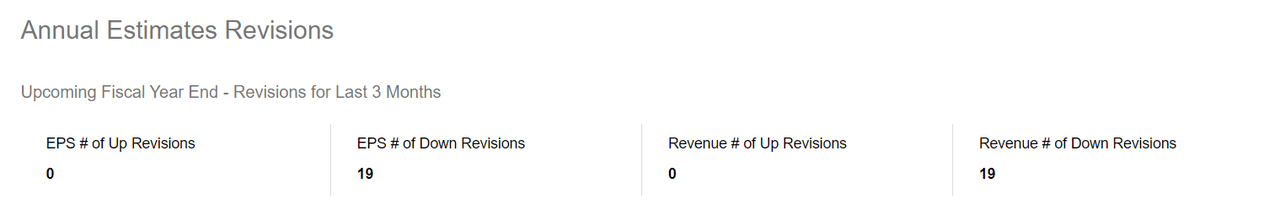

ISRG: Negative Annual Estimates Revisions (Source: SeekingAlpha.com)

Today’s sentiment shows that 19 analysts have revised their forecasts lower, as seen in the image above. With no total debt and the slowing CAPEX outlook, I believe ISRG will have enough liquidity to utilize a significant portion of its share repurchase authorization amounting to $3.5 billion.

Despite the substantial decline, ISRG remains fundamentally expensive, and has unfavorable sentiment from analysts’ expectation, making this company risky ahead of its third quarterly release.

Thank you for reading!