I’m Living The Retirement Dream, Paid For By Dividends

vernonwiley

Co-produced with Treading Softly

When I would go into the office, I frequently was asked how I was doing. It’s the standard and polite greeting many would give each other:

Hey, how are you doing?

Hi Curtis, I’m living the dream.

At times it was simply my default reply to a default greeting. How often are you guilty of asking someone how they are doing when you honestly couldn’t care less about how they were actually doing? You asked out of a feeling of societal requirement, not personal interest.

I’m here to tell you I am living the dream. Really living it every day.

The “dream” varies from person to person. For decades, Americans strove to achieve “the American dream”. That perfect lawn and white picket fence enclosing a piece of property with your home on it, a spouse, a handful of kids, and a dog. Your little slice of America. The land of the free.

Now for many, that stereotypical American dream doesn’t apply to them. They don’t want to be a land owner, and white picket fences are no longer in style. But “the American Dream” stands for the idea that through hard work, anyone can achieve their dream lifestyle.

For me, the dream of retirement is enshrined with a foundation of financial freedom. So many of us enjoy freedom but do not truly have it. We’re quietly enslaved to debt, be it credit cards, student loans, or home loans. Too many don’t work doing a job that they enjoy. Why? Because the reality is we need the money to pay our bills and debt. Satisfying immediate necessities all too often means setting aside our dreams.

How often have you considered quitting your job but know you couldn’t do so because you cannot afford to do it? If that’s you, raise your hand. That’s almost all of you reading this today.

How can we achieve financial freedom in retirement? From my perspective, financial freedom is a state in which, if I do not punch the pay clock ever again, I have the means to afford my desired lifestyle indefinitely. I only have to work if I want to work. It is this financial freedom that has allowed me to pursue my passion and take the leap from a guaranteed salary at a job I didn’t really love to do what I truly love every single day.

To achieve this freedom, I built a large portfolio of income-producing investments that pay me regularly. They reward me with cash for the simple choice of being a part-owner of the company.

Today, I want to take the cover off my income-producing powerhouse of a portfolio and highlight two investments that can help you live that dream retirement and have it all paid for you. Instead of doing all the work yourself, demand that your capital work for you. Nothing makes money like money does.

Let’s dive in.

Pick #1: DMLP – Yield 13.9%

Dorchester Minerals, L.P. (DMLP) has announced that they have entered into an agreement to acquire mineral, royalty, and overriding royalty interests of approximately 2,100 net royalty acres located in 12 counties across New Mexico and Texas. This acquisition is being made in exchange for 851,423 common limited partnership units of Dorchester Minerals, L.P., and was completed on September 30, 2022. A related lease bonus payment of approximately $7.3 million received by DMLP will be included in the Partnership’s third-quarter distribution to unitholders.

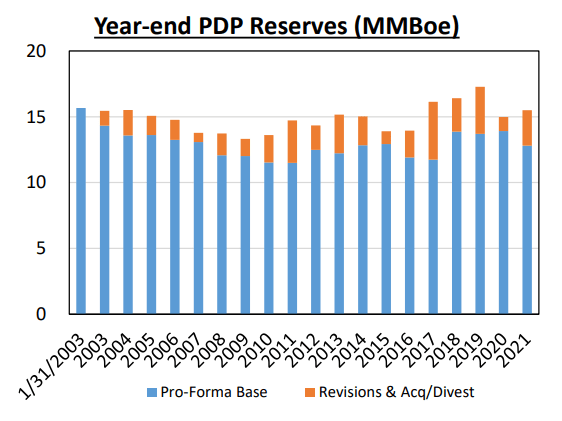

Such transactions are routine for DMLP, and they pursued a similar one in March 2022 and in December 2021. DMLP is designed to be a perpetual mineral royalty firm, and they aim to maintain their mineral reserves through acquisitions from time to time. The chart below shows consistent acquisitions yearly to maintain reserve levels.

DMLP Annual Report

Source: DMLP Annual Report

Unlike entities like Sabine Royalty Trust (SBR) that are designed to eventually exhaust their resources and liquidate as a firm, DMLP has maintained its mineral levels for over 20 years. This transaction is good news as it ensures the long-term sustainability of mineral royalties (and our distributions).

Meanwhile, the market has been selling off DMLP because the price of oil has come down. Yet “down” is a bit misleading as oil remains well above the average prices seen since 2014.

DMLP pays a variable distribution based on the royalties they collect, which is a combination of volume and price. The distribution might peak if oil fails to have another rally back to $100, but even in the $70s or $80s, DMLP will remain a great source of high yield.

Invest in DMLP and collect the variable distribution. The higher oil prices go, the more income you’ll collect. If they hang out in the $70s and $80s, DMLP’s yield will still be in the double-digits.

Note: DMLP issues a K-1 at tax time.

Pick #2: ATAX – Yield 8.6%

America First Multifamily (ATAX) announced its distribution for October. As we anticipated, another $0.20 supplemental distribution is added to the regular $0.37 distribution. This supplemental distribution will be paid in shares, or in cash if the amount owed to the shareholder is less than 0.5 shares. (Ex-dividend date was Sept. 29th. The current 8.6% yield does not include suplemental distributions).

Historically, ATAX has aimed to distribute 100% of CAD (cash available for distribution). CAD came in at $0.76/unit and $1.74 in the first half – this is huge. For comparison, ATAX’s CAD was $1.92 for the entire year in 2021.

While the Board has not yet declared any distributions for subsequent quarters, the Partnership currently expects to continue to be in a position to make a supplemental distribution, in addition to the regular quarterly distribution, for the fourth quarter of 2022. – ATAX press release Sept. 14

Even including the supplemental distributions, ATAX’s CAD is likely to be much higher than its distributions unless it also issues a special distribution like it did last year.

This resounding success in 2022 is thanks to ATAX’s “Vantage” joint venture. This JV builds apartments, leases them up, and then sells them to investors. While some real estate sectors have been struggling, multi-family remains very strong.

We don’t think it takes a wild leap in logic to figure out why: apartments are leased with short terms, typically one year. This means that rent can be increased relatively quickly to reflect inflation, making it a very attractive sector for investors who are looking to shield themselves from inflation.

On top of that, have you seen mortgage rates? Many consumers are being priced out of the residential housing market. A $3,000 mortgage payment could buy a $621,000 home when mortgages were 3%. With mortgages at 6%+, a $3,000 payment won’t be enough to buy a $480,000 home. Meanwhile, home sellers have been reluctant to lower prices specially when you are talking about six-figure declines in buying power.

If you can’t afford to buy a home because mortgage rates are high and housing prices are still high, what do you do? You rent. Remember, apartment rents are always competing with the costs of home ownership. People need to live somewhere, and most consumers decide between renting or owning. With the cost of owning soaring, demand for rent is high.

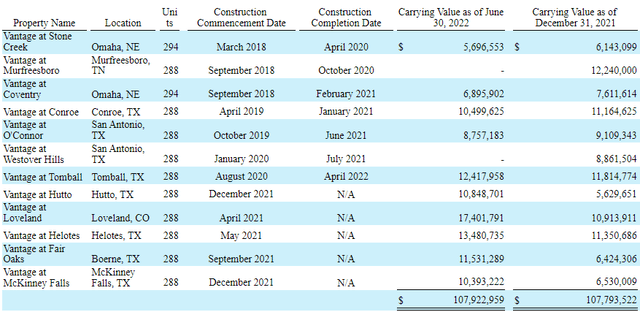

Vantage has sold five properties year to date and has another four properties where construction has been completed. We could see a couple more sales this year, boosting ATAX’s CAD even higher.

MPW Q2 10-Q

The Vantage JV also has five additional properties that have been under construction and will be completed next year. This strategy will continue to provide excess earnings for ATAX, as the multifamily sector remains strong.

A strong rental market is also very positive for ATAX’s core business, which is holding “mortgage revenue bonds” or MRBs. These are bonds secured by apartments with affordable living units. They are issued by state housing agencies to encourage the new construction of affordable living units. ATAX provides the capital, receives a first-lien mortgage, and benefits from tax-exempt interest. This benefit is passed along to shareholders through the partnership structure. Any distributions tied to earnings from MRBs will be Federal Tax exempt.

Landlords having an easier time leasing at higher rents have an easier time paying their mortgage. We can expect ATAX’s core business to keep humming along providing enough cash flow to cover the regular distribution, while the Vantage JV will provide us supplemental and the occasional special distribution.

ATAX is firing on all cylinders, I’m happy to buy the dip!

Note: ATAX issues a K-1 at tax time.

Dreamstime

Conclusion

With ATAX and DMLP, I enjoy big distributions which pay my retirement bills, expenses, and extras. I get cash regularly, and no work is required.

Buy shares, sleep, get paid, repeat.

It’s just that easy. Sounds too simple right? Well, it is simple. Unless you try to complicate it with trading, hedging, and options. They jump in and out, making bold predictions about the future and gambling their entire portfolio on being right.

Many will overcomplicate it. They’ll try to add in extra requirements and steps, claiming they have a faster route to achieve the same thing. I can’t tell you if they do. Why? Because they might! But I don’t need to gamify the most important process in my life. Games can be lost, even when your team is a huge favorite going into it. When you’re dealing with your retirement, losing isn’t an option. The goal is to achieve financial freedom and have a retirement paid for by those investments you hold. – Not to get a “high score” this week.

I don’t need to risk predicting what the market will do next week, next month, or next year. I have a process, a simple one, that keeps paying me solid income time and time again. It’s not fast, it’s slow and steady.

It is simple, it is common sense, but I don’t mean to say it is easy. I’m not here to tell you that you can put $1,000 into the stock market and expect to quit your job next year. I’m not here to tell you that you’ll realize bazillion percent returns overnight. It took years of investing and reinvesting. Making small sacrifices to set aside extra cash here and there for investing. Passing up on some immediate wants to improve my future.

My income stream started out very modest. But then something magical happened. The power of compounding, as I took the dividends that my portfolio earned and reinvested them in new dividend-paying investments. Suddenly my income was growing, even before I invested new cash. My trickle of income grew, then that larger stream was reinvested, growing at an even faster rate. Eventually, the income generated from my portfolio was exceeding the income I received from my employer. I was in a position where I no longer needed to work to pay my bills. I was in a position to make that leap and leave a guaranteed salary to plunge into the unknown. To do what I wanted rather than being forced to do what was necessary. That is the greatest feeling of freedom I believe a person can ever experience. That is the dream.

I’m living mine. You are welcome to join me.