I Am Scooping 2 Oversold Fat Dividend Stocks

anouchka

Co-produced with Treading Softly

Investors love to try to bet on a “sure thing”. To help themselves do so, they come up with clever titles or terms to denote safety or stable company.

We see them on Seeking Alpha all the time don’t we? SWAN – sleep well at night – is one classic one, for example. Or perhaps you’ve heard the term “too big to fail” when it comes to very large, stable, and old companies. That term is frequently used in regard to some of America’s largest banking institutions.

We also love the dark and ominous sounding “too big to succeed” as the opposite of being too big to fail.

When it comes to dividend or income investing, we throw around titles like dividend aristocrats, kings, champions, or contenders. Strong-sounding titles that project strength, safety, and heroic abilities to overcome hard times.

Those give investors comfort or a sense of calm amid a stormy market – like we’re living in right now.

I like the term blue chip. I come from a long line of honest, hardworking individuals. Tilling the land, feeding cattle, or working in a factory. They did their work to the fullest of their ability, and companies rewarded them accordingly, or they saw the fruits of their labor as their crops and livestock grow.

Today, I want to offer you two blue-chip income generators. Long-standing, steady-paying companies that have a history of growing their dividends even in the face of adversity.

Let’s dive in.

Pick #1: ARCC – Yield 9.8%

When the market gets volatile, it is often good to have a bias for high quality that rarely goes on sale. There are two reasons for this:

- Higher quality doesn’t go on sale as frequently.

- If the market’s fears turn out to be based in reality, it is much more comfortable holding high quality through turbulence.

Ares Capital (ARCC) is a time-tested BDC that has been through the worst and come out the other side strong.

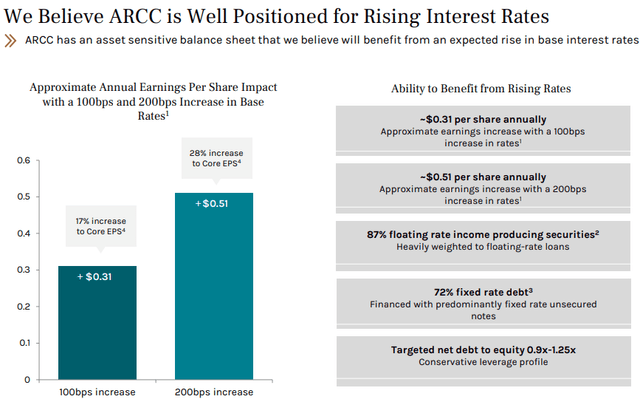

The Federal Reserve is hiking rates, which is a substantial positive for ARCC. ARCC’s business model is to borrow fixed-rate debt and lend floating-rate. All else being equal, rising interest rates sends more cash directly to the bottom line. (Source: ARCC Q2 Equity Presentation)

Note that this calculation was starting at rates as of June 30th. Since then, rates are up nearly 200 bps and are widely expected to go even higher. ARCC’s core earnings are going up 28% over the course of a single quarter, which is an astounding growth rate. We could see even more gains with the Fed doubling down on its hawkishness.

Naturally, every positive comes with a counterbalance. If ARCC’s earnings are skyrocketing, why is ARCC down in price? The main concern is a recession, which historically is tied to increased defaults. It doesn’t really matter that a borrower owes you more money if they cannot pay.

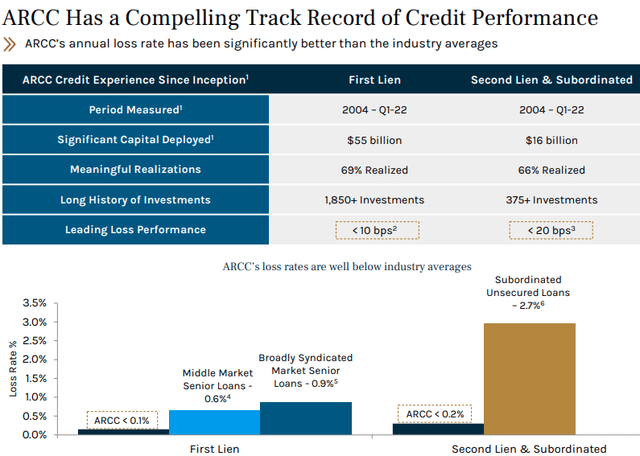

This is where the “quality” comes in. Since 2004, ARCC has had an incredible track record compared to the industry averages. Despite going through the Great Financial Crisis and Covid, ARCC has experienced a loss rate of less than 0.1% on first-lien loans and less than 0.2% on second-lien loans.

While past performance is no guarantee of future success, it is very reassuring that ARCC has navigated some very tough markets and had results that were well above average. We aren’t talking about a small difference that might be “luck”, we are talking about substantial outperformance over 18 years!

This is a BDC that will benefit immediately from the Fed hiking rates, and if the market’s worst fears come to pass, it is a blue chip you can comfortably hold through anything.

Pick #2: MPW – Yield 10.8%

Medical Properties Trust (MPW) is now trading below March 2020 lows. That’s right, it is cheaper today than it was at the height of the pandemic when its tenants were shutting down all of their profitable elective surgeries and all the unknowns of the pandemic.

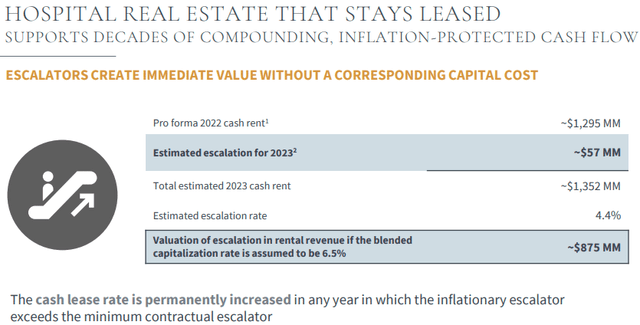

The fundamentals certainly don’t justify it. MPW’s AFFO/share is 16.6% higher than it was in March 2020. MPW’s pro forma leverage is only modestly higher at 6.3x debt/EBITDA compared to 5.9x debt/EBITDA in March 2020. Tenant EBITDARM rent coverage was 2.7x in March 2020, it was 2.4x through Q1 and is expected to rise. MPW’s dividend was $0.27/quarter, it is now $0.29/quarter. In 2020, MPW’s leases were only going up by the minimum escalators. In 2023, MPW will see rents increasing over 4% from escalators alone.

Hands down, the fundamentals today say that MPW is in a much better condition, with less uncertainty than it had in March 2020. Yet the price is lower.

The focus of the obsession on the bear side of the argument seems to be about tenant Steward Health Care. With absolutely no evidence, a number of investors seem to be convinced that Steward is on the brink of bankruptcy. We believe that the facts don’t support such an assertion. It seems at odds with Macquarie being willing to acquire a JV interest in several Steward properties at a healthy premium just last year.

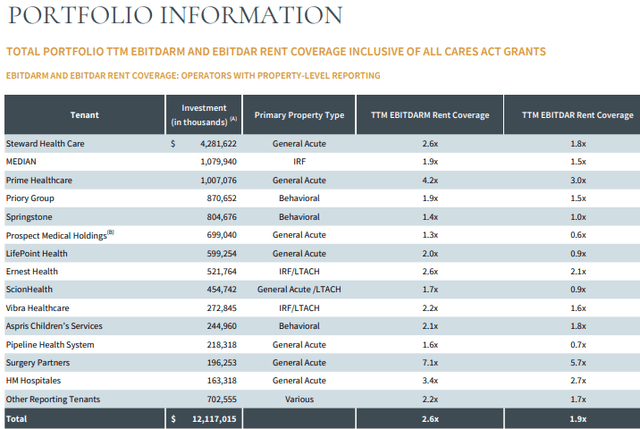

Meanwhile, Steward’s EBITDARM rent coverage is at 2.6x, a healthy level.

Note that Steward isn’t even close to MPW’s weakest tenant using EBITDAR coverage. That would fall to Prospect, at only 0.6x EBITDAR. MPW just sold three of Prospect’s properties for $457 million, approximately the price they paid 3 years ago, plus MPW received 100% of the rent due over the years. The bottom line, MPW is closing the investment with a healthy total return. A great result for a tenant that is struggling.

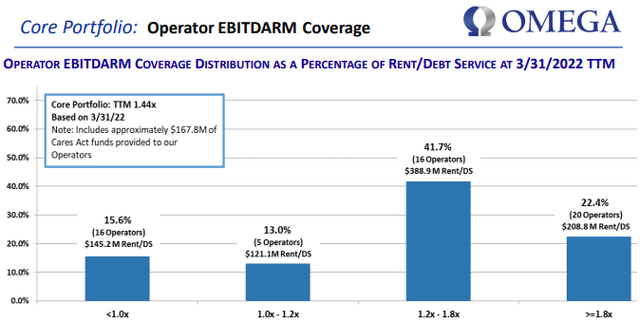

If Steward were one of Omega Healthcare’s (OHI) tenants, it would be known as one of the best tenants.

It is true Steward is certainly struggling with all the realities that are pressuring the hospital sector right now. Labor costs have soared, revenue has been slower to recover, already thin profit margins are being squeezed, and they have had to pay back Medicare for the advance payments – those were finished by the end of September.

Even if Steward were to file bankruptcy, it does not mean that Steward simply stops paying rent. The worst-case scenario would be a renegotiation of the master lease to a lower rate. A 25% reduction in Steward’s rent would reduce approximately $100 million from MPW’s bottom line. How much does that impact AFFO? About $0.04/quarter. MPW’s AFFO Q2 2022 $0.35. MPW’s AFFO in Q1 2020: $0.30. Note that even at $0.31/share AFFO, the $0.29 dividend would still be covered.

No doubt about it, such a situation would be a significant blow to MPW, destroying a couple of years of growth. But with the share price trading below COVID-era lows, even that worst-case scenario appears to be fully priced in.

We have been highlighting MPW in our “how to” series, and we will continue to do so in upcoming articles. We have received a lot of questions about Steward, so it is an issue worth addressing head-on. We don’t think a Steward bankruptcy is at all likely, but even if Steward declared bankruptcy tomorrow, we’d still be happy to buy MPW at current prices.

Shutterstock

Conclusion

With MPW and ARCC, we can invest in companies that have withstood challenging environments and continued to raise their dividends, not just pay them. While there will always be those who are skeptical of any investment, especially in a down-trending or volatile market, I aim to buy income at excellent prices and enjoy it for decades to come. I take advantage of the market’s knee-jerk overreactions to buy income when it is on sale.

A fireman does not run into a burning house and simply sits in it for fun. No, they go in, get their job done, and get out. As investors in this type of market, we must invest in the opportunities we find which are best for meeting our long-term goals and then get away from the market to preserve our well-being. Those who are most upset and worried about the market at those who are glued to it 24/7. Unless you plan to act, there is no need to sit in the burning building.

That’s why I view the market as a tool to achieve my goals, not as my life itself. I have hobbies and interests that do not relate to the market at all, I’m assuming you do too. Get your work done, then go enjoy them! No need to stress about what you cannot control when your income continues to pour in unabated.

That’s how you have a stress-free retirement. That’s the beauty of income investing.