Hertz Global Grows But Contends With Economic Headwinds (HTZ)

Cindy Ord

A Quick Take On Hertz Global

Hertz Global (NASDAQ:HTZ) went public in November 2021, raising approximately $1.29 billion in gross proceeds from an IPO that was priced at $29.00 per share.

The firm provides car rental and related fleet operations services to consumers and companies worldwide.

Optimistic investors may believe that Hertz still has strong performance in the coming quarters, but a recession looming or already underway in many regions has me more cautious.

I’m on Hold for HTZ in the near term.

Hertz Global Overview

Estero, Florida-based Hertz was founded to develop various brands for vehicle rentals, car sharing, and car sale services globally.

Management is headed by Chief Executive Officer, Stephen Scherr, who has been with the firm since February 2022 and was previously a Chief Financial Officer at Goldman Sachs, among other roles.

The company’s primary offerings by brand include:

-

Hertz

-

Dollar

-

Thrifty

-

Hertz Car Sales

-

Firefly

The firm utilizes a variety of marketing efforts including online, social media, television, print and other media to reach consumers and businesses.

Hertz Global’s Market & Competition

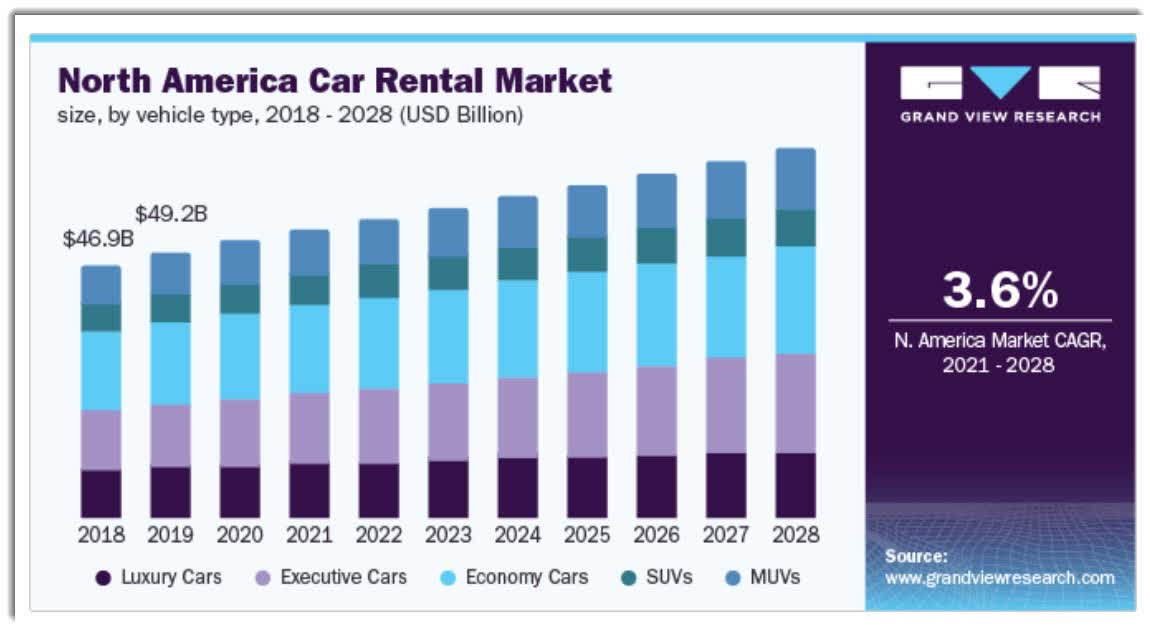

According to a 2021 market research report by Grand View Research, the global car rental market was an estimated $98 billion in 2020 and is forecast to reach $140 billion by 2028.

This represents a forecast CAGR of 4.6% from 2021 to 2028.

The main drivers for this expected growth are an expected increase in the number of people taking leisure and business trips as well as a growing penetration of internet service, making it more convenient to utilize car rental services.

In terms of geography, North America was the largest market for car rentals in 2020, accounting for more than 40% of the global market.

The region is also expected to grow at the fastest CAGR of 5.6% from 2021 to 2028 due to the increased demand for car rentals from business and leisure travelers.

Also, below is a chart showing the historical and projected future growth trajectory for the North American car rent market, by car type:

N. America Car Rental Market (Grand View Research)

Major competitive or other industry participants include:

-

Enterprise Rent-A-Car

-

Sixt

-

Europcar

-

Avis Budget Group

Hertz’s Recent Financial Performance

-

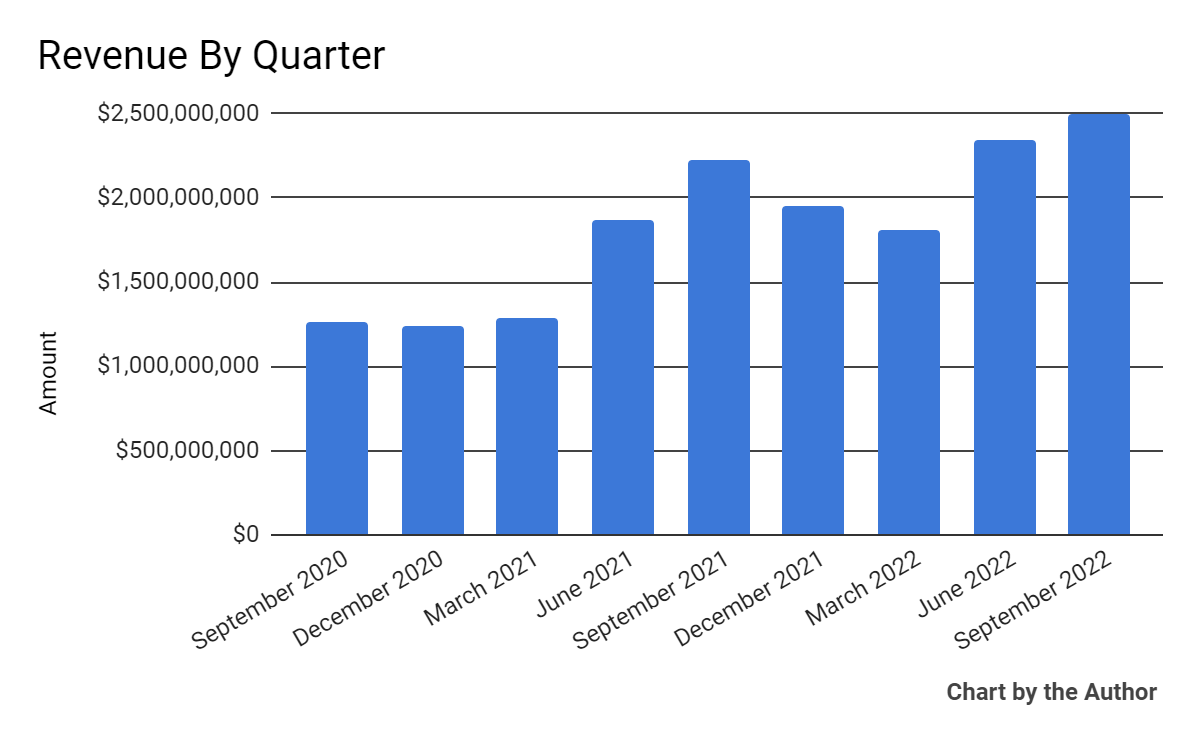

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

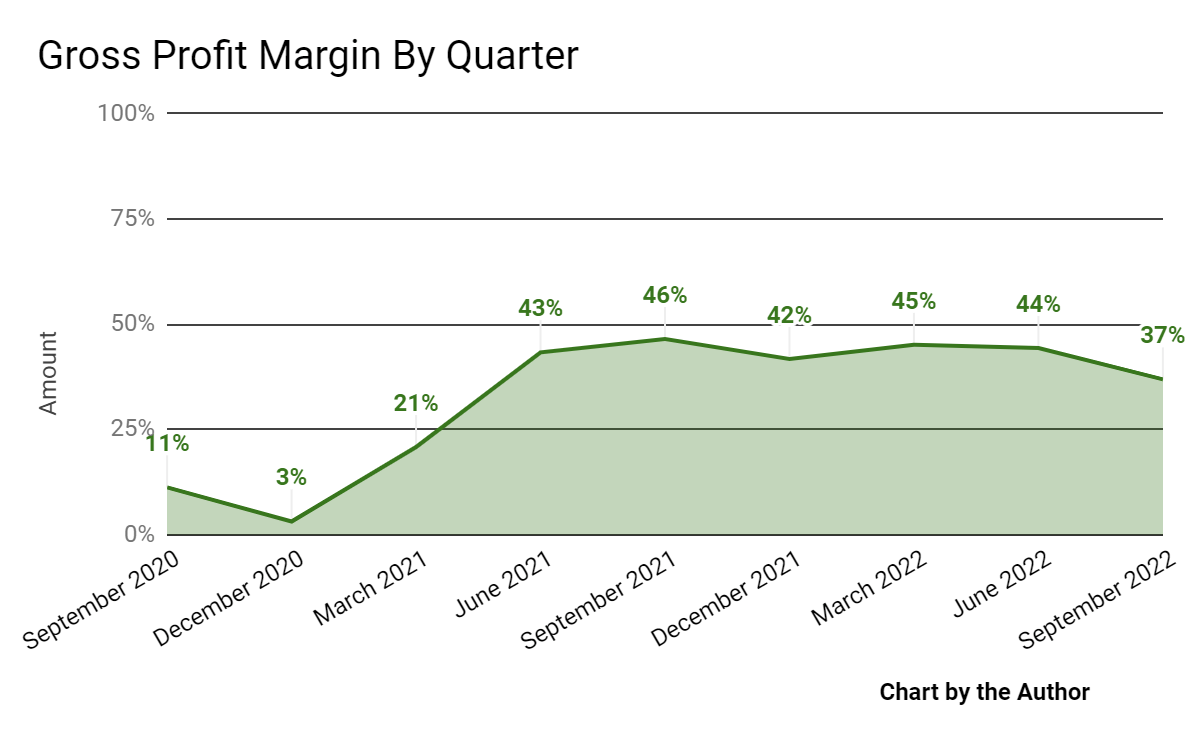

Gross profit margin by quarter has fallen in the most recent quarter (Q3 2022):

9 Quarter Gross Profit Margin (Seeking Alpha)

-

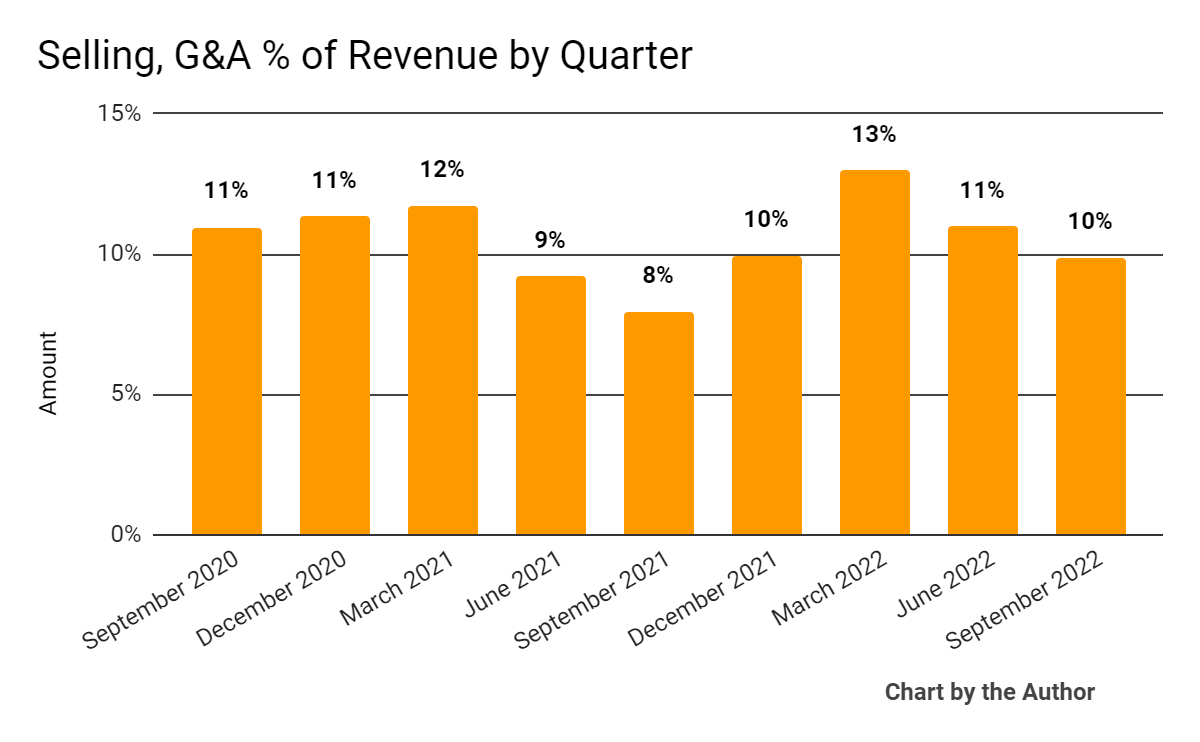

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a relatively narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

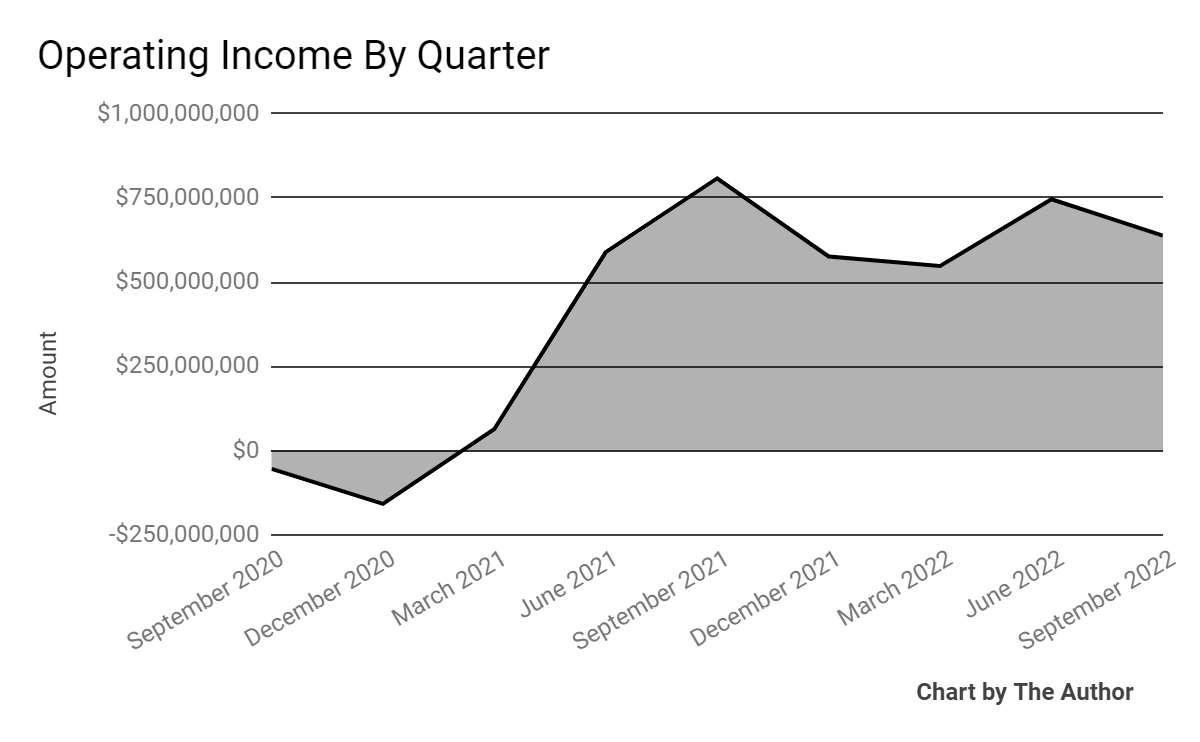

Operating income by quarter has grown substantially in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

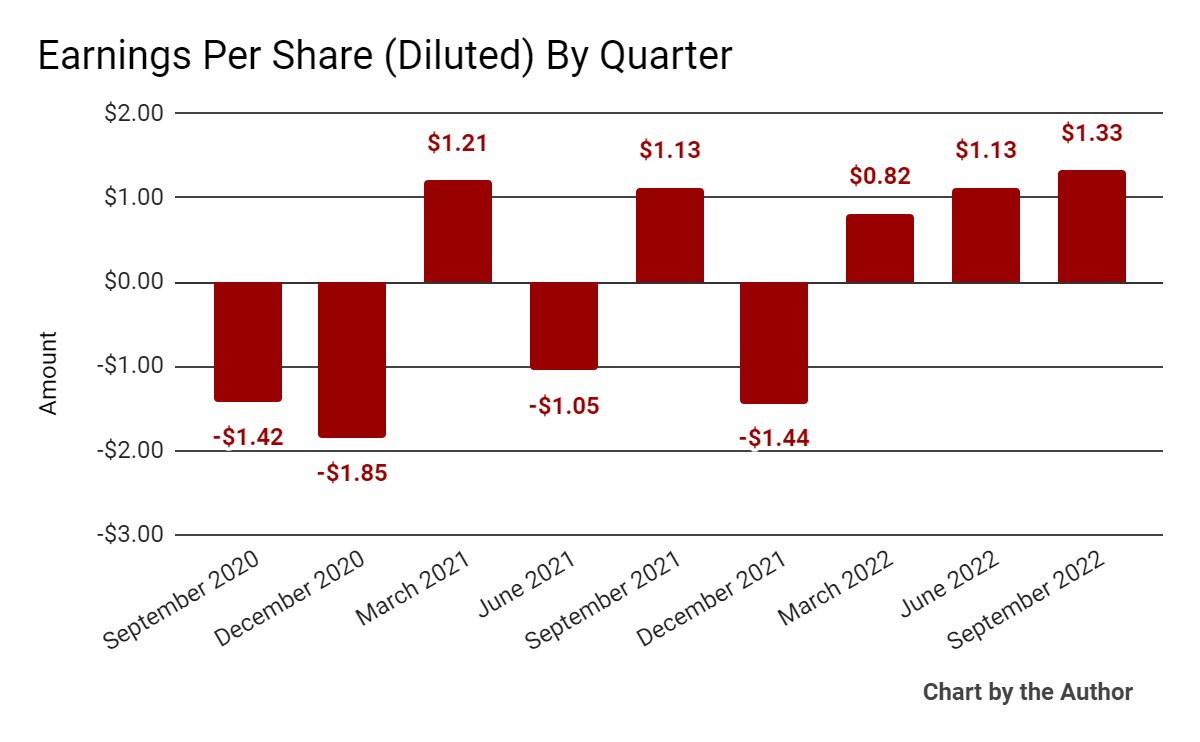

Earnings per share (Diluted) have reached a 9-quarter high in the most recent quarter:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

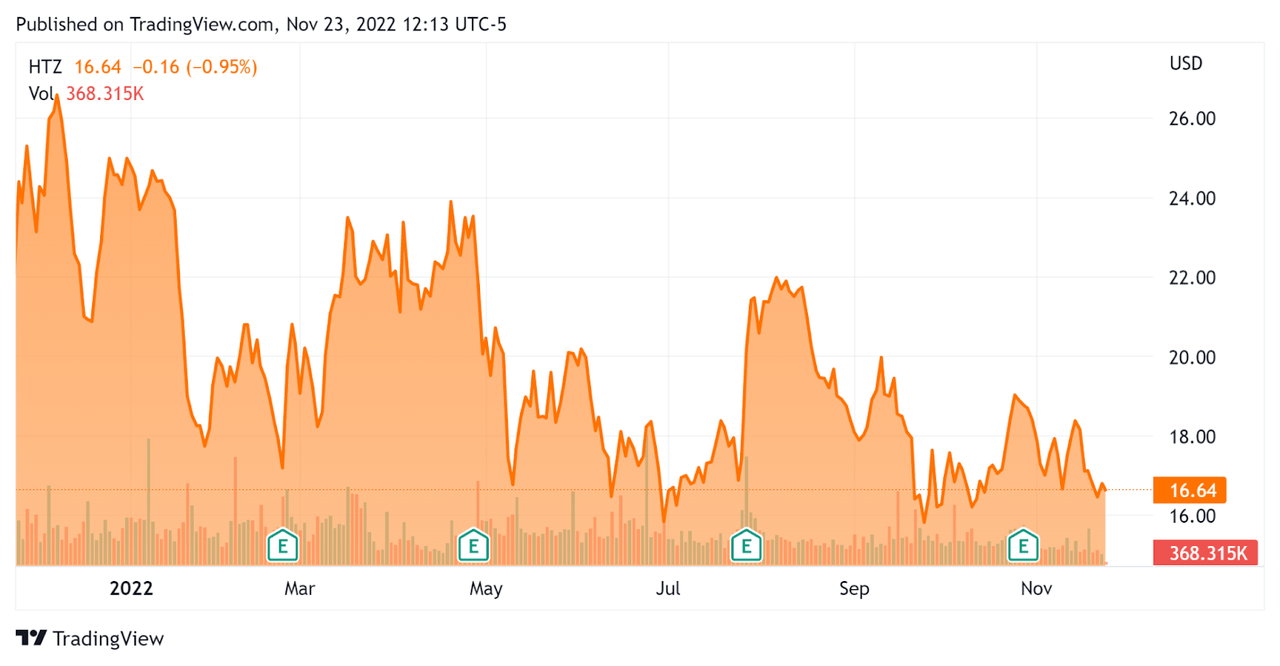

Since its IPO, HTZ’s stock price has dropped 24.3% vs. the U.S. S&P 500 Index’s drop of around 14.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Hertz

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

2.2 |

|

Enterprise Value/EBITDA |

7.1 |

|

Revenue Growth Rate |

29.9% |

|

Net Income Margin |

19.6% |

|

GAAP EBITDA % |

31.2% |

|

Market Capitalization |

$5,500,000,000 |

|

Enterprise Value |

$18,980,000,000 |

|

Operating Cash Flow |

$2,860,000,000 |

|

Earnings Per Share (Fully Diluted) |

$1.84 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Avis Budget Group (CAR); shown below is a comparison of their primary valuation metrics:

|

Metric (TTM) |

Avis Budget Group |

Hertz Global |

Variance |

|

Enterprise Value/Sales |

2.4 |

2.2 |

-9.4% |

|

Enterprise Value/EBITDA |

6.5 |

7.1 |

8.3% |

|

Revenue Growth Rate |

45.6% |

29.9% |

-34.5% |

|

Net Income Margin |

23.1% |

19.6% |

-15.2% |

|

Operating Cash Flow |

$4,810,000,000 |

$2,860,000,000 |

-40.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Hertz

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted ‘strong demand’ across a variety of segments amid high utilization rates.

Corporate demand saw particular strength, likely due to continued growth in in-person events as the pandemic wanes in many regions.

Revenue per day (RPD) was $68.57, stronger than typical seasonal expectations.

However, management is seeing a significant drop in used car valuations amid supply increases and consumer demand drops due to higher interest rates and a slowing macroeconomic environment.

As to its financial results, Q3 revenue rose 12% year-over-year and adjusted EBITDA margin was 25%.

But, gross margin appears to have peaked as has operating income, as the industry may have seen its peak rebound period in recent quarters.

The firm faces labor cost increases like any labor-intensive company, especially as it seeks to bring more contractors in-house to improve quality of service.

For the balance sheet, the company ended the quarter with cash, equivalents and trading asset securities of $1.15 billion and debt of $3 billion.

Also, the company reduced its share base a whopping 7% during the quarter through share repurchases.

Over the trailing twelve months, free cash used was $1.74 billion, with $4.6 billion in capital expenditures.

Looking ahead, management has seen ‘no evidence of softness based on current bookings. In fact, revenue metrics for the month of October, including RPD and transaction days, are up year-over-year.’

Regarding valuation, compared to Avis Budget, the market is valuing Hertz at an EV/EBITDA premium of around 8%, despite a lower growth rate and reduced net income margin.

The primary risk to the company’s outlook is the slowing macroeconomic environment and rising cost of capital, putting a damper on its growth prospects while increasing.

A potential upside catalyst to the stock could include a ‘short and shallow’ downturn as the global economy moves past supply chain bottlenecks and high energy prices, but I judge it will take some time for this to occur.

While HTZ’s performance has been enviable in recent quarters, it appears the ‘bloom is off the rose’ and the sharp growth rates associated with the pandemic reopening and constrained automobile inventory may not be repeated in the quarters ahead.

Optimistic investors may believe that Hertz still has strong performance in the coming quarters, but a recession looming or already underway in many regions has me more cautious.

I’m on Hold for HTZ in the near term.