Hercules Capital: I Am Happily Buying This Covered 12.41% Yield (NYSE:HTGC)

metamorworks

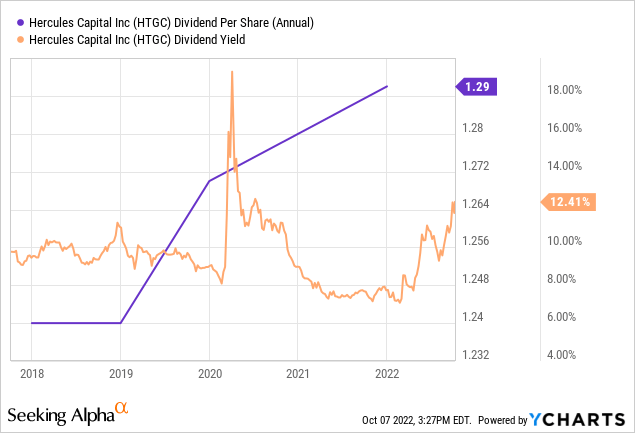

With market volatility and uncertainty about the economic trajectory on the rise, I am increasing my holdings of business development company Hercules Capital Inc. (NYSE:HTGC), which provides investors with not only a 12.41% dividend yield that is covered by net investment income but also a strong investment track record, a focus on the technology sector, earnings consistency, and a much lower valuation than a few months ago.

I believe HTGC’s high dividend yield makes it worthwhile to buy on the drop.

More Than Just A Fat Yield

Obviously, Hercules Capital’s dividend yield of 12.41% is very appealing. However, the business development firm has a lot more to offer, such as a diverse portfolio and consistent earnings results during the last recession.

Hercules Capital has also been able to increase its dividend payout due to strong new debt origination and portfolio performance. The BDC currently pays a quarterly dividend of $0.35 per share, which is supplemented by special dividends of $0.15 per share.

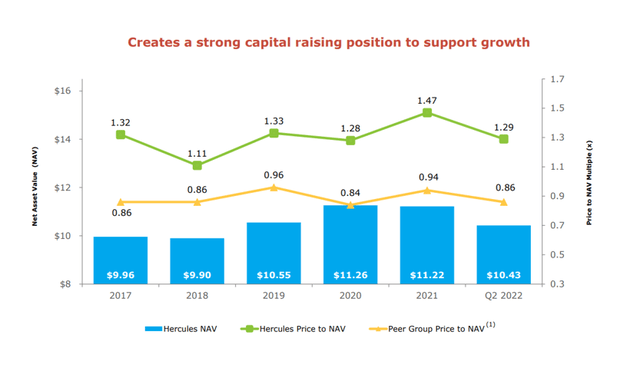

Having said that, HTGC is currently trading at one of its most compelling valuations since the Covid-19 pandemic.

HTGC is currently trading at an 18% premium to net asset value, which was $10.43 at the end of the second quarter. A premium to net asset value of 18% is a low valuation for a business development company that has historically traded at a much higher premium to net asset value.

Net Asset Value (Hercules Capital)

Diversification And Return Consistency May Be Hercules Capital’s Biggest Assets

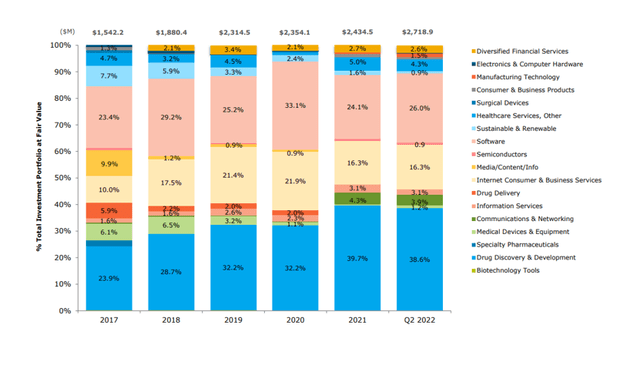

Hercules Capital focuses on companies in technology and life sciences that have cash flows that differ from those in manufacturing or retail.

Hercules Capital’s portfolio companies are frequently well-funded by venture capital firms and primarily operate in the drug discovery and software industries, which have cash flows that are less affected by cyclical economic swings.

Hercules Capital adjusts its investment allocation based on macroeconomic factors such as growth expectations but has long remained committed to its core investment strategy.

Hercules Capital’s largest sector, with a 39% investment allocation, is Drug Discovery and Development, followed by Software, with a 26% investment allocation.

Investment Overview (Hercules Capital)

Hercules Capital’s technology-focused investment strategy has proven successful, as evidenced by the company’s results.

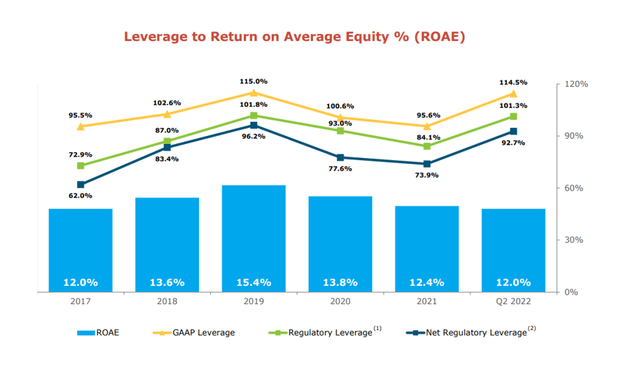

Hercules Capital has achieved high consistency of results over time, even during the Covid-19 pandemic, and has reported annual returns on (average) equity of at least 12% since 2017. During the pandemic, Hercules Capital generated average returns on equity of 13.8% (2020) and 12.4% (2021), effectively shielding the company from the market turmoil.

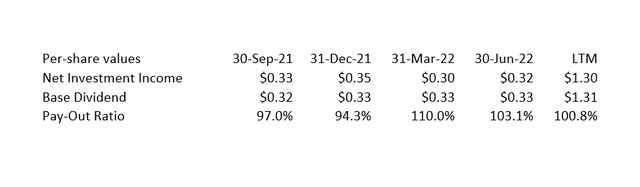

Base Dividend Is Covered

Hercules Capital paid out its base dividend last year, and investors should note that the BDC increased its regular dividend from $0.32 per share per quarter in 3Q-22 to $0.35 per share per quarter now. In my opinion, the dividend is safe as long as the BDC’s portfolio performs well.

Furthermore, Hercules Capital has the potential to earn higher net interest income as interest rates rise, as I discussed in my previous Hercules Capital article, which you can read here.

Dividend (Author Created Table Using BDC Information)

Why HTGC Might See A Lower Valuation

We have seen significant pressure on company valuations in recent months as risks to the U.S. economy have increased, with inflation playing an outsized role in the creation of investor concerns.

Moving forward, I see macroeconomic risks, but I am very comfortable with HTGC in my portfolio because the business development company has weathered the Covid-19 pandemic admirably and has been able to maintain high earnings consistency even during the BDC’s most stressful periods.

Given that HTGC has increased its base dividend payout by 9% in the last year, Hercules Capital is a high-quality BDC that investors should consider, despite the current bearish sentiment toward stock investments.

My Conclusion

Hercules Capital provides more than just a 12.41% dividend yield that is covered by net investment income. The business development firm is diverse, has a strong track record of consistent ROE results, even during difficult economic times, and has historically traded at a higher book value multiple.

I believe the HTGC selloff, which followed the broader market, represents an excellent opportunity to add a high-quality business development company to an income-focused investment portfolio. I’m doubling down on HTGC.