Google Vs. Microsoft: Which Stock Is The Better Choice?

Ingus Kruklitis

Investment Thesis

- Although Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) missed revenue estimates in 3Q22 (its revenue was $69.1B in 3Q22: an increase of 6% as compared to the same quarter of the previous year and an increase of 11% on a constant currency basis), I continue my strong buy rating for the company.

- Microsoft (NASDAQ:MSFT) reported a revenue of $51.9B in its latest quarterly report, which was an increase of 12% as compared to the same quarter of the previous year. Its operating income was $20.5B, implying an increase of 8% compared to the same quarter of the previous year.

- Both companies receive my strong buy rating. My ratings are based on the fact that I continue to consider them as excellent choices when it comes to risk and reward. Therefore, I see both as excellent buy and hold investments.

- Both companies have strong competitive advantages such as a high brand value, strong financials, a proven ability of integrating new businesses, and fast-growing cloud business units as growth drivers.

- If I could only choose one of the two at this moment in time, I would select Alphabet over Microsoft. This is due to Alphabet’s lower valuation and higher expected annual rate of return.

- The HQC Scorecard rates Alphabet (91/100) slightly higher than Microsoft (90/100), strengthening my investment thesis to select the company over Microsoft.

- My investment thesis is also supported by Alphabet’s higher Free Cash Flow Yield [TTM] of 4.78% (while Microsoft’s is 3.51%) and its higher Free Cash Flow Per Share Growth Rate [FWD] of 24.03% (compared to Microsoft’s, which is 13.31%).

- However, I consider the risk of investing in Microsoft to be lower than investing in Alphabet; particularly due to Microsoft’s broader and more diversified product portfolio.

The Competitive Advantages and Growth Drivers of Alphabet and Microsoft

Both Alphabet and Microsoft have strong competitive advantages and I expect this will continue to contribute to the growth of the companies in the years to come:

Brand Value

Both companies are among the most valuable brands in the world: while Google is ranked 3rd in the ranking of the most valuable brands according to Brand Finance, Microsoft is ranked 4th. Google’s brand value is currently estimated to be $263,425M, while the one of Microsoft is estimated to be $184,245M. Compared to 2021, Google’s brand value increased by 37.76% in 2022 and Microsoft saw an increase of 31.19%.

Financial Strength

Both Alphabet and Microsoft have enormous financial strength: while Alphabet currently disposes of Total Cash & ST Investments of $116,259M, Microsoft’s Total Cash & ST Investments is $107,244M.

Further proof of this enormous financial strength is provided by the companies’ credit ratings: while Alphabet has an Aa2 credit rating from Moody’s, Microsoft shows an Aaa rating from the same agency. According to Moody’s, obligations rated Aaa have minimal risks and obligations rated Aa are subject to very low credit risk. These excellent credit ratings are indicators that the risk of investing in both Alphabet and Microsoft are relatively low. However, due to Microsoft’s higher credit rating from Moody’s, it can be deduced that the risk of investing in the company is lower than investing in Alphabet. In the risk section of this analysis, I will provide further evidence of this.

Proven Ability of Integrating New Businesses into their existing businesses

Both companies have a proven ability of integrating new businesses into their existing ones. While Alphabet, for example, acquired YouTube in 2006, for which it paid $1.65B, Microsoft paid $26.2B for the acquisition of LinkedIn back in 2016.

Due to this proven ability of integrating new businesses, I expect that the acquisition and integration of new companies will continue to be growth drivers for both in the future.

Cloud Business

In my previous analysis on Microsoft, I gave an overview of the growing Cloud Computing Market:

“According to Fortune Business Insights, the global Cloud Computing Market Size will reach $791.48B in 2028, growing with a CAGR of 17.9% from 2022 till 2028. According to data from Statista, Amazon’s AWS is currently the leading cloud infrastructure service provider with a worldwide market share of 34%. Microsoft’s Azur is second with a market share of 21%, ahead of Alphabet’s Google Cloud (market share of 10%), Alibaba Cloud (5%) and IBM Cloud (4%).”

This is evidence that there is plenty of room to grow for both companies, although they were unable to expand their market share. For this reason, I expect the Cloud Business to be one of the growth driver’s for both Alphabet and Microsoft in the coming years.

Diversified Product Portfolio

When it comes to diversification, I see Microsoft as being ahead of Alphabet. I have already shown Microsoft’s broad and diversified product portfolio in my analysis on the company:

“In 2021, 32% ($53,915M) of Microsoft’s total revenue was generated by its business unit Productivity and Business Processes, 35.74% ($60,080M) by its business unit Intelligent Cloud and 32.18% ($54,093M) came from the unit of More Personal Computing. The fact that each of the three different business segments account for about 1/3 of the company’s total revenue is an indicator of its broad and diversified product portfolio and shows that it does not depend on a specific business unit.”

Alphabet however, still depends highly on the revenue of its Advertising business unit, since more than 80% of its revenue is generated by its business unit Google Advertising. Those numbers show that Microsoft has a much broader and more diversified product portfolio and acts as a further indicator that the risk of investing in the company is less than an investment in Alphabet.

The Valuation of Alphabet and Microsoft

Discounted Cash Flow [DCF]-Model

I have used the DCF Model to determine the intrinsic value of Alphabet and Microsoft. The method calculates a fair value of $123.38 for Alphabet and $283.16 for Microsoft. At the current stock prices, this gives Alphabet an upside of 25.90% and Microsoft an upside of 19.50%.

My calculations are based on the following assumptions as presented below (in $ millions except per share items):

|

Alphabet |

Microsoft |

|

|

Company Ticker |

GOOGL |

MSFT |

|

Revenue Growth Rate for the next 5 years |

8% |

10% |

|

EBIT Growth Rate for the next 5 years |

8% |

10% |

|

Tax Rate |

15.7% |

13.1% |

|

Discount Rate [WACC] |

8.75% |

8.25% |

|

Perpetual Growth Rate |

4% |

3% |

|

EV/EBITDA Multiple |

12.5x |

20.7x |

|

Current Price/Share |

$98.00 |

$ 237.00 |

|

Shares Outstanding |

13,044 |

7,458 |

|

Debt |

$28,810 |

$ 78,400 |

|

Cash |

$17,936 |

$13,931 |

|

Capex |

$29,816 |

$23,886 |

Source: The Author

Based on the above, I have calculated the following results:

Market Value vs. Intrinsic Value

|

Alphabet |

Microsoft |

|

|

Market Value |

$98.00 |

$237.00 |

|

Upside |

25.90% |

19.50% |

|

Intrinsic Value |

$123.38 |

$283.16 |

Source: The Author

Internal Rate of Return for Alphabet

The Internal Rate of Return [IRR] is defined as the expected compound annual rate of return earned on an investment. Below you can find the Internal Rate of Return as according to my DCF Model (when assuming different purchase prices for the Alphabet stock).

At Alphabet’s current stock price of $98.00, my DCF Model indicates an Internal Rate of Return of approximately 15% for the company. I have assumed a Revenue and EBIT Growth Rate of 8% for Alphabet for the next 5 years and a Perpetual Growth Rate of 4% afterwards. (In bold you can see the Internal Rate of Return for Alphabet’s current stock price of $98.00.) Please note that the Internal Rates of Return below are a result of the calculations of my DCF Model and changing its assumptions could result in different rates.

|

Purchase Price of the Alphabet Stock |

Internal Rate of Return as according to my DCF Model |

|

$75.00 |

24% |

|

$80.00 |

22% |

|

$85.00 |

20% |

|

$90.00 |

18% |

|

$95.00 |

16% |

|

$98.00 |

15% |

|

$100.00 |

15% |

|

$105.00 |

13% |

|

$110.00 |

12% |

|

$115.00 |

11% |

|

$120.00 |

10% |

Source: The Author

Internal Rate of Return for Microsoft

At Microsoft’s current stock price of $237.00, my DCF Model indicates an Internal Rate of Return of approximately 13% for the company (while assuming a Revenue and EBIT Growth Rate of 10% for the next 5 years and a Perpetual Growth Rate of 3% afterwards). (In bold you can see the Internal Rate of Return for Microsoft’s current stock price of $237.00.)

|

Purchase Price of the Microsoft Stock |

Internal Rate of Return as according to my DCF Model |

|

$190.00 |

19% |

|

$200.00 |

18% |

|

$210.00 |

17% |

|

$220.00 |

15% |

|

$230.00 |

14% |

|

$237.00 |

13% |

|

$240.00 |

13% |

|

$250.00 |

12% |

|

$260.00 |

11% |

|

$270.00 |

10% |

|

$280.00 |

9% |

|

$290.00 |

8% |

Source: The Author

Relative Valuation Models

The P/E [FWD] Ratio for Alphabet and Microsoft

Alphabet’s current P/E [FWD] Ratio of 20.03 is 27.39% below its Average P/E [FWD] Ratio over the last 5 years (27.59). This suggests that the company is currently undervalued.

When comparing Microsoft’s current P/E [FWD] Ratio of 24.57 with its Average P/E [FWD] Ratio of the last five years (30.77), we can see that it’s 20.15% below its average, showing that Microsoft is currently undervalued.

Fundamental Data: Alphabet vs. Microsoft

When taking a closer look into the Fundamental Data of Alphabet and Microsoft, the following can be highlighted:

Microsoft currently has a higher market capitalization ($1.81T) than Alphabet (with a market capitalization of $1.32T). At the same time, Microsoft has a higher EBIT Margin (42.06%) (Alphabet’s is 29.65%) as well as a higher Return on Equity: while Alphabet shows a Return on Equity of 29.22%, Microsoft’s is 47.15%, indicating that it is even more efficient than Alphabet in using the equity of shareholders to generate income.

However, the analysis of the following Fundamental Data strengthens my investment thesis to select Alphabet over Microsoft, if I had to select one out of the two companies:

Alphabet has a higher Average Revenue Growth Rate over the last 5 Years [CAGR] (22.88%) when compared to Microsoft (which has one of 15.47%). In addition to that, Alphabet has a higher EBIT Growth Rate over the last 3 Years [CAGR] (33.92%) than Microsoft (24.74%). Both demonstrate that Alphabet is ahead of Microsoft when it comes to growth. Further evidence of this is that Alphabet’s EPS Growth Diluted [FWD] of 26.44% is significantly higher than that of Microsoft’s (which is 14.05%), demonstrating that Alphabet is growing its profits with a higher growth rate.

Alphabet’s higher Free Cash Flow Yield [TTM] of 4.78% as compared to Microsoft’s 3.51% and its higher Free Cash Flow Per Share Growth Rate [FWD] of 24.03% (Microsoft’s is 13.31%) once again underlines my investment thesis to select the company first.

Furthermore, Alphabet shows a lower Total Debt to Equity Ratio (11.28%) when compared to Microsoft (47.08%), further strengthening my opinion that Alphabet is the more attractive choice.

|

Alphabet |

Microsoft |

||

|

General Information |

Ticker |

GOOGL |

MSFT |

|

Sector |

Communication Services |

Information Technology |

|

|

Industry |

Interactive Media and Services |

Systems Software |

|

|

Market Cap |

1.32T |

1.81T |

|

|

Profitability |

EBIT Margin |

29.65% |

42.06% |

|

ROE |

29.22% |

47.15% |

|

|

Valuation |

P/E GAAP [FWD] |

20.03 |

24.57 |

|

P/E GAAP [TTM] |

18.81 |

25.09 |

|

|

Growth |

Revenue Growth 3 Year [CAGR] |

23.32% |

16.36% |

|

Revenue Growth 5 Year [CAGR] |

22.88% |

15.47% |

|

|

EBIT Growth 3 Year [CAGR] |

33.92% |

24.74% |

|

|

EPS Growth Diluted [FWD] |

26.44% |

14.05% |

|

|

Free Cash Flow |

Free Cash Flow Yield [TTM] |

4.78% |

3.51% |

|

Free Cash Flow Per Share Growth Rate [FWD] |

24.03% |

13.31% |

|

|

Dividends |

Dividend Yield [FWD] |

– |

1.12% |

|

Dividend Growth 3 Yr [CAGR] |

– |

10.46% |

|

|

Dividend Growth 5 Yr [CAGR] |

– |

9.71% |

|

|

Consecutive Years of Dividend Growth |

– |

17 Years |

|

|

Dividend Frequency |

– |

Quarterly |

|

|

Income Statement |

Revenue |

278.14B |

198.27B |

|

EBITDA |

96.89B |

97.98B |

|

|

Balance Sheet |

Total Debt to Equity Ratio |

11.28% |

47.08% |

Source: Seeking Alpha

The High-Quality Company [HQC] Scorecard

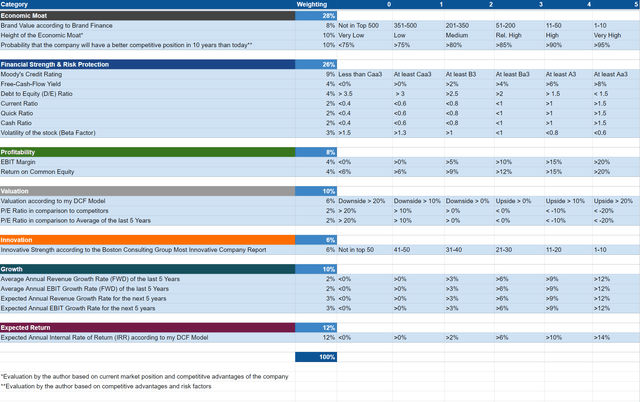

“The aim of the HQC Scorecard that I have developed is to help investors identify companies which are attractive long-term investments in terms of risk and reward.” Here you can find a detailed description of how the HQC Scorecard works.

Overview of the Items on the HQC Scorecard

“In the graphic below, you can find the individual items and weighting for each category of the HQC Scorecard. A score between 0 and 5 is given (with 0 being the lowest rating and 5 the highest) for each item on the Scorecard. Furthermore, you can see the conditions that must be met for each point of every rated item.”

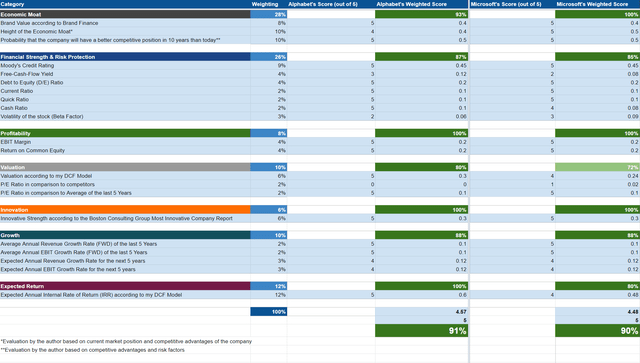

Alphabet and Microsoft According to the HQC Scorecard

Alphabet achieves 91/100 points and Microsoft 90/100 according to the HQC Scorecard. The rating shows that both companies are very attractive when it comes to risk and reward, but that Alphabet is the slightly more appealing option.

Both Alphabet and Microsoft are rated as very attractive in terms of Economic Moat (93/100 for Alphabet and 100/100 for Microsoft), Financial Strength (87/100 for Alphabet and 86/100 for Microsoft) and Profitability (100/100 for both companies).

In terms of Valuation, Alphabet (80/100) is rated higher than Microsoft (72/100).

For Innovation (both score 100/100), Growth (88/100 for both) and Expected Return (100/100 for Alphabet and 80/100 for Microsoft), both companies achieve a very attractive rating.

Alphabet’s higher rating in terms of Valuation and the company’s slightly higher overall rating when compared to Microsoft, reinforces my investment thesis to select the company over Microsoft at this moment in time.

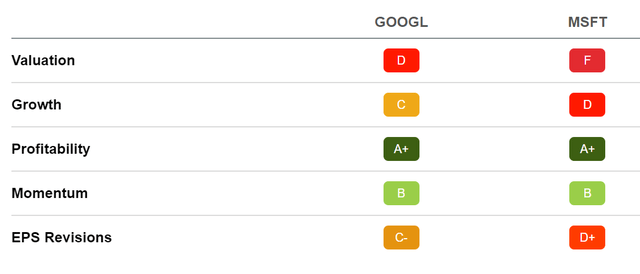

Alphabet and Microsoft According to the Seeking Alpha Quant Factor Grades

The Seeking Alpha Quant Factor Grades provide confirmation that Alphabet is currently more attractive than Microsoft. For Valuation, Alphabet receives a D rating while Microsoft receives an F rating. For Growth, Alphabet receives a C while Microsoft is only rated with a D. For EPS Revisions, Alphabet receives a C- rating while Microsoft is rated with a D+. Only in the categories of Profitability (both rated with an A+) and Momentum (both rated with a B), are Alphabet and Microsoft rated equally.

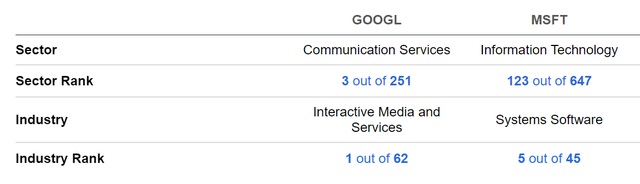

Alphabet and Microsoft According to the Seeking Alpha Quant Ranking

When taking a look at the Seeking Alpha Quant Ranking, we get further evidence that Alphabet is currently more attractive than Microsoft. Alphabet is ranked 1st (out of 62) in the Interactive Media and Services Industry and 3rd (out of 251) in the Communications Services Sector. Microsoft is 5th (out of 45) in the Systems Software Industry and 123rd (out of 647) in the Information Technology Sector.

In the overall ranking, Alphabet is ranked 149th (out of 4722) while Microsoft is only ranked in 1045th place.

Alphabet and Microsoft According to the Seeking Alpha Authors Rating and Wall Street Analysts Rating

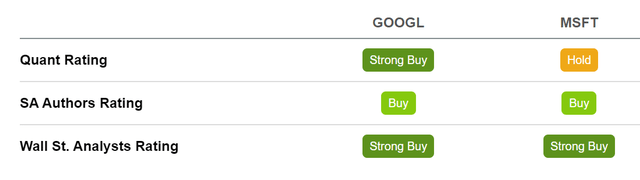

According to the Seeking Alpha Quant Rating, Alphabet is currently a strong buy while Microsoft is only a hold. This again supports my opinion to rate Alphabet ahead of Microsoft.

Risks

When considering risk, I see Microsoft as being a slightly less risky investment than Alphabet. My opinion is based on the following factors:

As shown in the section The Competitive Advantages and Growth Drivers of Alphabet and Microsoft, the latter has a broader and more diversified product portfolio. Therefore, I consider the risk of investing in Microsoft to be lower than the risk of investing in Alphabet. A broader and more diversified product portfolio contributes to a company being more resistant in economically difficult times.

Microsoft’s business units Productivity and Business Processes, Intelligent Cloud and More Personal Computing each account for about 1/3 of the company’s total revenue. In contrast to Microsoft, Alphabet still strongly depends on its Advertising business unit, which I have discussed in more detail in my analysis on the company:

“One potential risk factor I see for Alphabet is the fact that the largest part of the company’s revenue (more than 80%) is generated by its business unit Google Advertising. Reduced spending in advertising by Alphabet’s clients could adversely affect its business and therefore result in decreasing profit margins. However, as shown in this analysis, Alphabet’s other business units are becoming more and more important: proof of this, for example, is the fact that Google Cloud already accounted for 9% of the company’s total revenue in 2Q22 while it accounted for only 7.5% in the same quarter of the previous year.”

In my previous analysis on Microsoft, I showed that its intense competition in the different industries in which it operates, to be one of the company’s main risk factors:

“Microsoft’s cloud computing service Azure faces competition from other similar providers such as Amazon, Google, IBM and Oracle (NYSE:ORCL). Microsoft’s Xbox and its cloud gaming services face competition with other online streaming services, operated by, for example, Amazon, Apple and Tencent (OTCPK:TCEHY). Additionally, the company’s gaming platform competes with console platforms from Nintendo (OTCPK:NTDOY) and Sony (NYSE:SONY). In addition to that, Microsoft faces competition from computer, tablet, and hardware manufacturers that offer high-quality industrial design and innovative technologies.”

However, I have also shown that I consider the overall risk of investing in Microsoft as being relatively low:

“Although Microsoft faces strong competition in various areas in which it operates, I consider the risk of investing in the company as being relatively low. This is due to the fact that the company has a wide economic moat, which helps it to maintain its competitive advantages. Particularly, Microsoft’s own ecosystem, its strong brand image and strong financials contribute to the fact that I consider the investment risk to be relatively low.”

Although I consider Alphabet to currently be the more attractive choice, I have come to the conclusion that the risk of investing in the company is slightly higher than investing in Microsoft. This is particularly based on Microsoft’s broader and more diversified product portfolio when compared to Alphabet.

The Bottom Line

In my opinion, both Alphabet and Microsoft are high quality companies. I would overweight both in an investment portfolio built with a long investment horizon: I consider the companies to be excellent choices in terms of risk and reward and therefore, I rate them both as a strong buy.

My strong buy rating for both is underlined by the excellent ratings as according to the HQC Scorecard. Both are rated as very attractive in terms of risk and reward: while Alphabet receives 91/100 points, Microsoft scores 90/100.

However, if I could only choose one of the two, I would select Alphabet over Microsoft: Alphabet’s higher Free Cash Flow Yield [TTM] of 4.78% (Microsoft’s is 3.51%) and its higher Free Cash Flow Per Share Growth Rate [FWD] of 24.03% (when compared to Microsoft’s 13.31%), support my investment thesis to rate the company over Microsoft. My opinion is also underlined by Alphabet’s lower valuation: while Alphabet has a P/E [FWD] Ratio of 20.03, Microsoft’s is 24.57. In addition to that, Alphabet shows a higher upside (25.90%) than Microsoft (19.50%) according to my DCF Model.

However, I see the risk of investing in Alphabet as being slightly higher than the risk of investing in Microsoft. My opinion is based on the fact that Microsoft has a broader and more diversified product portfolio while Alphabet is still highly dependent on the revenue generated by its business unit of Google Advertising (which generates more than 80% of the company’s revenue).

For this reason, for risk-averse investors, Microsoft might be the slightly better choice. This could also be the case if your main investment focus is dividend growth: Microsoft’s Dividend Growth Rate [CAGR] of 9.71% over the last five years indicates that the company is an excellent pick for dividend income investors.

I have both companies in my own personal investment portfolio and they belong to my largest positions, since I consider both to be excellent picks in regards to risk and reward. Which one do you prefer?