Google Stock: Why There Is More Pain Ahead (NASDAQ:GOOG)

Alena Kravchenko

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) and other technology companies are laying off tens of thousands of employees in a bid to protect their profits as the economy appears to head for a major recession in FY 2023. Because of slowing growth and weak forecasts for Q4 2022, I believe the recent rebound in valuations after Q3 2022 results is only temporary and many tech players, including Google, are set to retest their lows in the coming months.

The U.S. economy is fundamentally weakening while inflation remains a top concern for consumers. Investors that can mentally prepare for a prolonged shakeout in the technology sector and endure negative returns in the short term, however, are very likely going to make fortunes in the long term!

New round of layoffs

Technology companies are laying off more employees as profit pressures are building and investors are getting increasingly nervous about the tech sector. Most recently, two major technology companies, Meta Platforms (META) and Amazon (AMZN), have announced massive layoffs that have resemblance to the layoffs during the dot-com crash in the early 2000s.

Mark Zuckerberg announced that Meta Platforms was going to lay off 11 thousand employees, or roughly 13% of its global headcount, in an attempt to deal with deteriorating profitability and slowing top-line growth. Yesterday, the New York Times reported that Amazon is letting 10 thousand employees go, which calculates to about 3% of the retailer’s global workforce. Google already instituted a hiring freeze earlier this year, and the company’s CEO, Sundar Pichai, has said Google is pushing for 20% productivity gains, as the advertiser market is seeing a slowdown in ad spending.

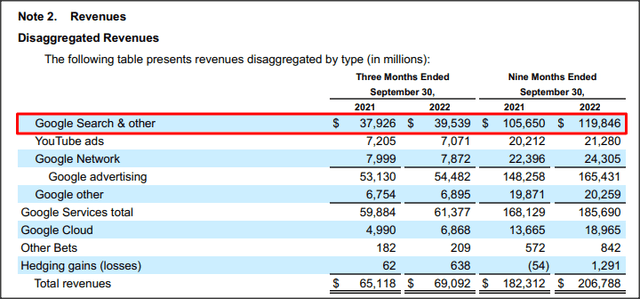

This advertising slowdown is a problem for Google, obviously. Google’s Search revenue growth slowed from 44% in Q3’21 to just 4% in Q3’22. Search revenues in the first nine months of FY 2022 were $119.8B, showing an increase of only 13% while most of this growth occurred mostly in the first half of FY 2022. Google is clearly seeing a serious slowdown in the advertising business, and the slowdown in ad-spending in FY 2022 was also the key reason behind Meta Platforms having to reduce its headcount.

Source: Google Search Revenues

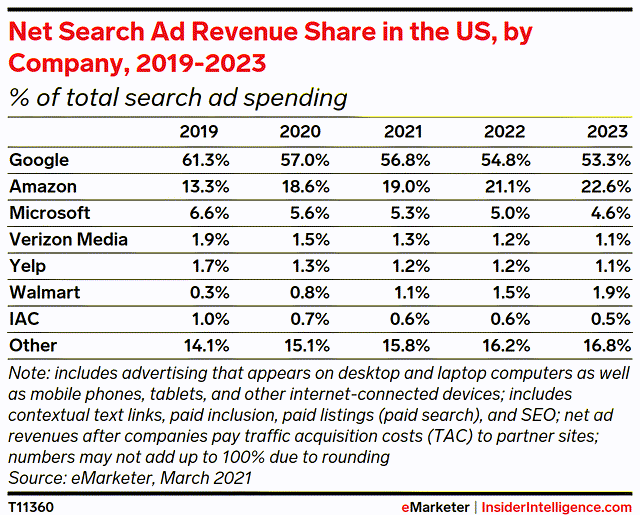

Although Google’s revenue growth in Search is slowing down, Google is set to remain the dominant player in the search-based digital advertising market. According to eMarketer, Google is set to get more than half (53%) of all search-based digital advertising spending in the U.S. market in FY 2023… which puts Google into a strong competitive position, even if the U.S. economy slips into a recession in FY 2023.

Google’s valuation might get a whole lot cheaper

Google’s valuation, I believe, is already attractive since the company: (1) has an increasingly diversified (recession-resilient) business that generates a ton of free cash flow (“FCF”) every quarter; and (2) Google’s board of directors approved a $70B stock buyback earlier this year, which means a lot of this free cash flow is going to flow into the pockets of shareholders this year and next year. To compensate investors for a declining stock valuation for Google, I believe the board of directors would want to dramatically up-size Google’s stock buyback plan in FY 2023.

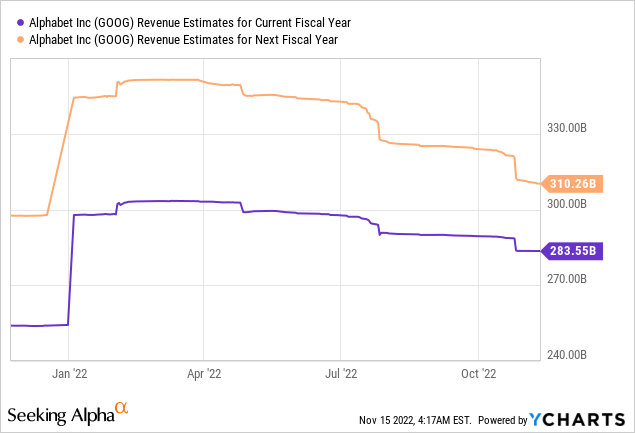

Given the immediate challenges in the advertising business, however, Google’s revenue estimates have trended down hard in the last 90 days. This is an indication that investors are expecting, at least in the short term, more pain. In the last three months, there were 39 down-ward revisions for Google’s forward revenue estimates, which compares against 0 upward revisions.

This Is My Back-Up-The-Truck Price Range

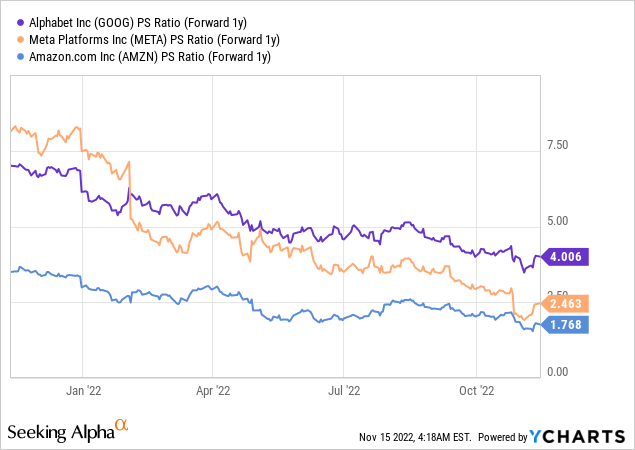

The expectation is for Google to generate revenues of $310.3B in FY 2023, implying a year-over-year revenue growth rate of just 9%. Compared to Meta Platforms and Amazon, which are search giants in their own right, Google has the highest P/S ratio of 4.0x.

Google is also expected to generate EPS of $5.43 in FY 2023, which calculates to a P/E ratio of 17.7 X. There is growing earnings risk for Google depending on how severe the next recession is going to be. For those considerations, I believe Google’s stock will remain under pressure in the short term and retest its recent low at $83.45. I am willing to pay a 13-14x P/E ratio for GOOG, which translates to a price range of $70-76.

Risks with Google

Compared to other FAANG stocks, I believe risks with Google are fairly under control. This is chiefly because the technology company is increasingly diversified and generating free cash flow in businesses that don’t all have exposure to the cyclical digital advertising market. Google’s top line growth, however, is likely going to slow down further in the short term, and the company could even see a top line slowdown to the very low single digits in FY 2023.

Final thoughts

Layoffs in the tech sector are mounting and investors should have no illusions: layoffs are an ominous warning that the tech sector and the U.S. economy are headed for more trouble in the near term. I believe Google, due to the presence of Cloud and its strong market position in Search, is uniquely positioned to withstand an economic downturn, even if conditions in the advertising market were to get worse.

Google already represents deep value at the current valuation, I believe, but I am really going to double down on GOOG once the stock retests its lows. My back-up-the-truck price for Google is in the price range of $70-76, which represents a P/E ratio of 13-14x.