Google: Search And Margins May Have Peaked, Bearish Outlook (NASDAQ:GOOG)

EricVega/iStock Unreleased via Getty Images

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Google’s parent company, has been one of the biggest success stories in the tech and internet industry. They’ve been able to do that by leveraging the ridiculous margins in search to the even more ridiculous margins in the cloud platform and have leveraged all of those to venture into future industries like autonomous driving, IoT (the internet of things) and many more.

But at its core, they are still a search company, with over 57% of their overall revenues last year coming from the “Google Search” and more than 71% of their total ad revenue, with the rest coming from platforms like YouTube and other ads on various services.

So there’s this problem – young people. While millennials are Google Search experts, younger generations aren’t using Google as much as previous generations have, even when they get older. This can potentially mean that the company will begin seeing some tough comparative growth rates in their search business and rely more and more on the recently-turned-volatile cloud business and “other bets”, which have historically been a slight hinderance on their bottom line.

So What’s The Problem?

The broader problem here is that Generation Z, the latest generation which now makes up a significant portion of the population around the world, is using other platforms like TikTok, a ByteDance (BDNCE) company, and Instagram, A Meta Platforms (META) company, to do most of their searching.

This is due to the more infinite scrolling and other features that are easier to use on TikTok and Instagram. While Google is trying to lure these folks back into searching using their platforms, it has yet to produce meaningful turnover.

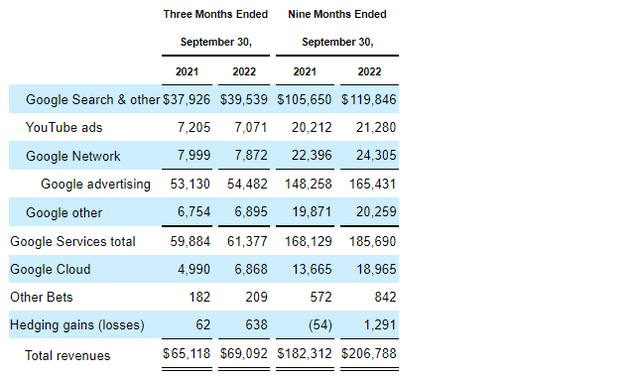

The problem with this is that although the company is growing their cloud business and others at a fast pace, they still make a significant portion of their revenues from their search business. In the most recent reporting quarter, the company generated a total of $69.1 billion, with $54.5 billion made up from Search, YouTube ads and the Google Network, or almost 79% of total sales.

Revenues Breakdown GOOG/L (Company 10Q)

In the most recent quarter, the company already experienced a lower ad revenue environment in their YouTube ads and other Google Network ads, with revenue from search growing just 4.2%, compared to over 13% if you look at the past 9 months compared to the same period last year. While there certainly are several factors contributing to this, I believe this is one of them.

What’s Countering This Factor?

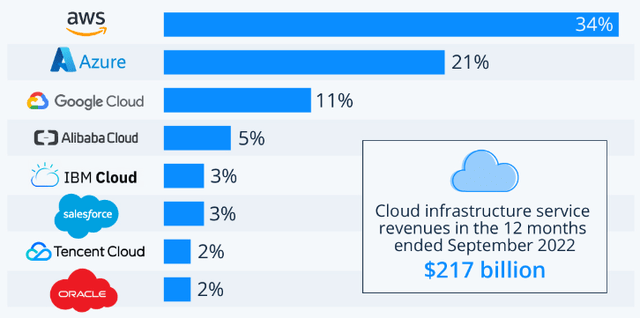

The reason most can still be bullish long term on Alphabet is due to their high growth rate in the cloud business, which grew by almost 38% in the latest reporting quarter over the same period last year.

Global Cloud Market Share (Statista)

But even here, as with other cloud giants like Microsoft (MSFT) and Amazon (AMZN), the growth in the cloud business is slowing somewhat, as evident by the company’s 9-month performance being slightly higher than the most recent quarter, which came in at almost 39% compared to the same period last year.

Is this growth still mighty impressive? Absolutely. But with fierce competition from the likes of Amazon and Microsoft, as well as other international companies like Alibaba (BABA) emerging as a prime international threat, not just in the People’s Republic of China and the Asia-Pacific region, I believe that the company will see growth in this segment continue to decline slightly over the next few quarter until business investment picks back up.

Even So: Margins May Improve, Kinda

As many other technology companies have been doing recently, Alphabet has been laying off high-salaried tech workers in an effort to lower expenses in the longer run in the name of increasing efficiency within their various segments.

While this may create some temporary margin headwinds due to severance and other headcount reduction expenses, in the long, these layoffs should save the company more than $1 billion each year based on an average salary savings of over $100,000. These savings should aid the company’s long-term profit margins, but there are still other factors need considering.

While the company’s search income may decline, or grow a lot slower than projected, the company’s cloud revenues can still face some tough times when it comes to margins due to the fact that the company is in fierce competition with the likes of Amazon and Microsoft, as well as countless other small players, for a slowing piece of the cloud services pie.

This, I believe can cause the company to use their search income to subsidize pricing in their cloud platform and therefore further reduce margins.

Conclusion: Expect Contractions

I still don’t believe Alphabet is going to report any significant declines in the quarters or years to come given that they operate in an environment where people and companies are still keen on spending their advertising dollars in.

On top of that, the company is working on increasing their operating efficiency by laying off ‘underperforming’ employees, which can save them as much as $1 billion a year moving forward. Even so, there are several factors which have turned me slightly bearish on the company moving forward:

1 – The company’s search platform, where it generates most of its business revenue from, is likely to see more people, primarily young folks, migrate over to other platforms like TikTok and Instagram for their search needs and although the company is trying hard to mimic those scrolling features, it doesn’t seem to be working just yet.

2 – The company’s cloud platform, while currently thriving, is slowing somewhat and can force Alphabet into lowering their pricing in order to remain competitive with companies like Amazon, Microsoft and others, which in turn is likely to lower their cloud profit margins.

3 – The company’s ‘other bets’ and various ventures like Waymo are still a while away from generating any meaningful sales, let alone profitability, which means that the company’s research and development expenses will continue to be high without much effort by the company to lower them.

Given these factors, I believe that Alphabet is highly likely to either miss expectations over the coming 2-3 years or see downwards earnings revisions.

This means, I believe, that it’s warranted that they trade at a lower multiple, leading to the company being a bad short to medium term investment relative to other tech platforms.

As a result, I have turned slightly bearish on Alphabet and will be avoiding the stock for the time being.