Global X MSCI Argentina ETF: Momentum Beyond The Economic Headlines (NYSEARCA:ARGT)

Authentic Images/E+ via Getty Images

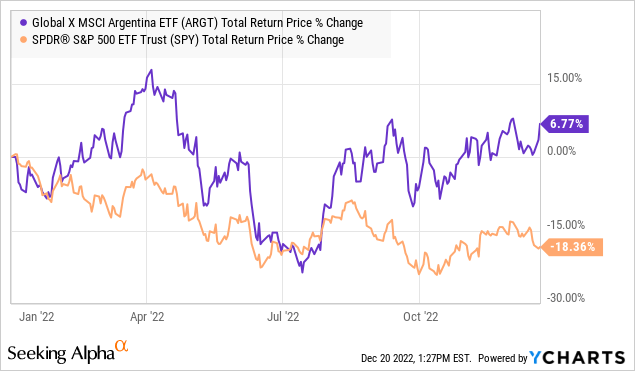

The Global X MSCI Argentina ETF (NYSEARCA:ARGT) has been a surprising winner in 2022 with a 7% gain year to date which is in contrast to most global equity markets facing extreme volatility. Indeed, the exchange-traded fund which invests across some of the most important stocks in Argentina is something of an outlier considering both its performance and unique portfolio strategy.

A key point here is that ARGT is largely hedged against the underlying economic conditions in South America’s second-largest country which faces hyperinflation and an ongoing recession. Simply put, ARGT’s portfolio is tilted toward more regionally diversified companies and commodity exporters that are less exposed to direct FX risks. The result is a fund that is well-positioned to continue delivering positive returns beyond what is recognized as a highly speculative economy. The fund can work for investors in the context of a broader portfolio to represent a bullish view of LATAM and emerging markets.

What is the ARGT ETF?

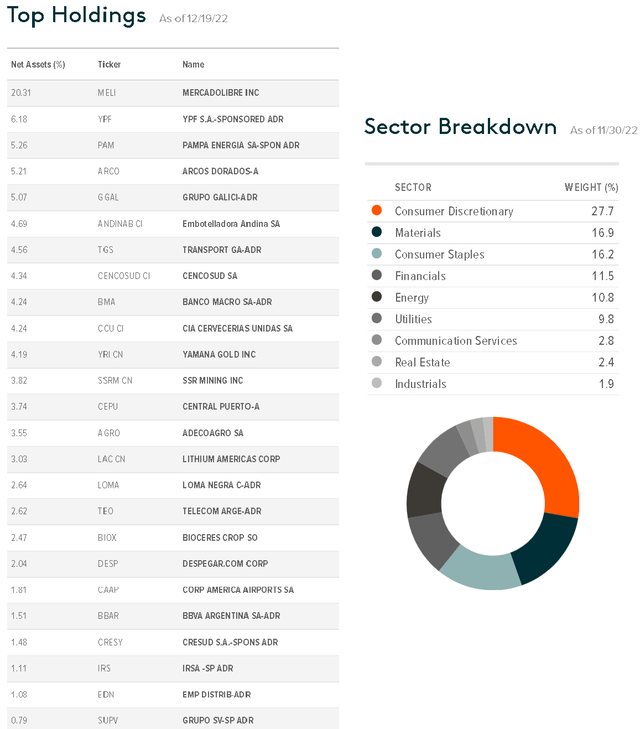

ARGT technically tracks the “MSCI All Argentina 25/50 Index”. Those figures refer to a 25% weighting cap on the largest holding while the sum of all stocks with a greater than 5% allocation may not exceed 50%. One of the investing criteria is that all companies are headquartered or listed in Argentina and carry out the majority of their operations in Argentina.

This is important as some of the high-profile holdings are more “international” where the connection to the country is more of a formality. That’s the case with the largest holding in MercadoLibre SA (MELI) which represents a particularly large position at 20% of the fund.

MELI is often referred to as the “Amazon” of Latin America although its operation in Argentina represents less than 25% of its total revenue and an even smaller amount of operating income. By this measure, MELI highlights the more regional exposure of the ARGT fund that includes trends in neighboring countries like Brazil, Chile, and Uruguay.

That same theme is evident down the list of current holdings including Arcos Dorados SA (ARCO) with a 5% weighting which is the largest McDonald’s franchisee in Latin America. This is a stock we have previously covered with a positive outlook supported by high-level trends of an emerging middle class in the region driving demand for packaged and fast-food options. “Coca-Cola” bottler Embotelladora Andina SA (AKO.A) also falls in this category. Similarly, Despegar.com Corp (DESP) is a regional online travel agency with a leading market share position in Brazil beyond its Argentine roots.

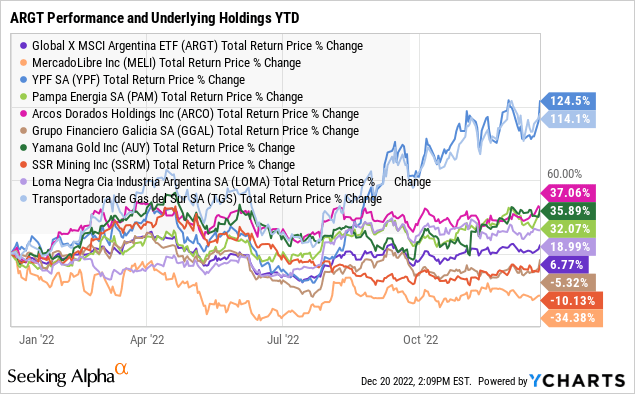

We mentioned commodities and this sector also plays an important role in the fund with materials and energy combined representing 28% of the total fund breakdown. Names like YPF SA (YPF), the state oil company of Argentina, have benefited from elevated market pricing and rising exports.

Curiously, ARGT also includes several mining stocks like Yamana Gold Inc (AUY), SSR Mining Inc (SSRM), and Lithium Americas Corp (LAC) that have operations in Argentina. Again, the idea here is that the company’s financial results and stock market performance is more based on global macro factors than the current underlying conditions in the Argentinian economy.

To be clear, there are stocks in the portfolio that can be described as a direct pure-play on the country, including several financial institutions. Grupo Financeiro Galicia SA (GGAL), Banco Macro SA (BMA), and BBVA Argentina SA (BBAR) more closely follow local financial trends, but are generally well-positioned to respond to inflationary conditions by taking advantage of interest rate dynamics. Argentine utility stocks also play a role in the fund.

Putting it all together, this eclectic mix of stocks has been a winning combination in 2022. The positive momentum in ARGT has accelerated in recent months with the return particularly impressive considering MELI, the largest holding, has underperformed, down 33% in 2022 considering its segment of global tech and consumer discretionary has been under pressure. An exceptional return from YPF, up more than 120% this year, along with Transporadora de Gas del Sul (TGS) has led the fund higher.

Argentina Macro Update

When looking at the ARGT fund, the disconnect with the economic conditions in Argentina stands out. While the country received a growth boost emerging out of the pandemic since last year, structural issues are a major problem with the environment still described as a financial crisis.

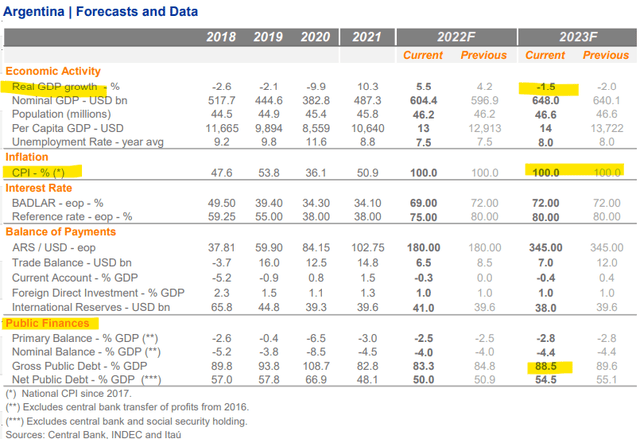

The inflation rate was last reported at 92.4%, among the highest in the world, with the only silver lining being that the trend has at least slowed to the monthly rate of 4.9% from 6.3% in October. The benchmark monetary policy rate set by the Central Bank is at a staggering 75% which, in combination with government-ordered price controls, has been a futile attempt to stabilize consumer prices.

The country also uses multiple exchange rate regimes depending on the channel. There is an official exchange rate against the Dollar for financial transactions that are controlled by the Central Bank, while the population follows a parallel market to buy dollars at a premium that has approached 100%. The government also uses a so-called “soy dollar program” to purchase Dollars from agricultural exporters at a favorable rate, to encourage exports as a means to build FX reserves.

The data we’re looking at from Itau Economics Research suggests real GDP will contract by -1.5% in 2023 while the unemployment rate ticks up to 8% from 7.5% this year. Inflation is also expected to remain around 100% with the main challenge being a widening fiscal deficit and growing public debt. A downtick in the current account deficit as a percentage of GDP will likely continue to pressure the parallel exchange rate.

source: Itau Economics Research

ARGT Price Forecast

The takeaway here is that the ARGT ETF is structured in such a way that it is relatively immune to the political and macro headlines of the Argentine economy. It’s an ugly economic forecast but the reality is that there are some companies finding ways to successfully navigate this environment.

The remaining layer of productive activity in the country is being captured by a consolidated group of market leaders which is part of the story in ARGT. Even MercadoLibre in Q3 noted an increase in user levels and gross merchandise volumes out of Argentina reflecting company-specific factors that are separate from the broader economic indicators.

Overall, we’re bullish on the fund and view the overweight position in MELI as a strong point in the outlook, which captures themes in high-growth as a beaten-down technology name that can outperform going forward. We’d also point to the weaker U.S. Dollar globally as supporting a rebound in commodity prices as a tailwind to the materials and energy sector names in the fund. That diversification across various sectors and more regional names keep the fund interesting with the backdrop of positive momentum into 2023.

If there is a bullish case for Argentina, inflation needs to surprise sharply lower while economic activity outperforms. There has been some thought that the historic World Cup victory could be a catalyst to boost sentiment in the region. The ARGT could also benefit from that upside if the cards fall right into a sustained economic turnaround eventually. On the upside, an improvement in global macro conditions including trends toward emerging markets could be a tailwind for the next leg higher in the fund.

In terms of risks, the worst-case scenario for ARGT would be some shift towards greater direct government interference or complete nationalization of entire industries, although there is no indication these steps are being considered. Even with the recent strength as ARGT is trading near a seven-month high, the fund remains exposed to global financial market volatility. In our view, as long as ARGT remains above the $28.00 level of technical support, the bulls are in control.