GameStop: What About This Time? (GME)

Anne Czichos/iStock Editorial via Getty Images

Before GameStop (NYSE:GME) reported its previous quarter (FQ2 2023), I wrote an article saying that Microsoft’s (MSFT) gaming revenues were ominous, and that GameStop was thus set to easily miss revenue estimates.

Such was the case. When GameStop reported FQ2 2023, it did indeed miss revenue estimates by a full 10.2%, turning an expected growth quarter into a quarter where revenues actually shrank. GameStop stock, though, had already fallen precipitously into that earnings report, so at the actual earnings report it temporarily rebounded.

Now, months later, we’re again at the same crossroads. Microsoft has already reported its Q1 FY2023 earnings, and again we can look into what it reported regarding gaming, and perhaps again reach conclusions on how GameStop’s FQ3 2023 quarter might be going.

Furthermore, we have other sources which also already reported how gaming did into September 2022, thus leaving just 1 further month in GameStop’s quarter which we don’t know about. Let’s do this exercise, then.

Microsoft’s Implications

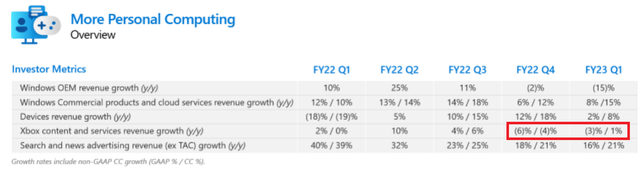

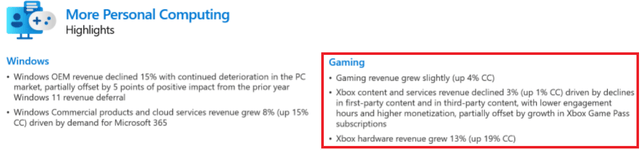

There is indeed news when it comes to Microsoft’s latest earnings report, and how gaming did. Here’s what we can glean from Microsoft’s earnings presentation (red highlights are mine):

Microsoft Earnings Presentation

Microsoft Earnings Presentation

Already, there are several observations to make:

- Xbox content and services, which will tend to map to GameStop’s software sales, still showed year-on-year contraction. However, the contraction slowed.

- Microsoft’s gaming revenue in general was actually up year-on-year (4%, in constant currency).

- And importantly, Xbox hardware revenue was up strongly (13% on reported currency, 19% on constant currency). Later, we’ll see why this might be more relevant for GameStop.

Another Source

This time, we’ll also complement the Microsoft observations with observations from another source. That would be NPD videogame statistics (for September 2022). Here’s what we learn from it:

- Overall gaming sales continued falling yoy (year-on-year). However, the drop has been slowing down, much like Microsoft reported. July was -9% yoy. August was -5% yoy. September was -4% yoy.

- Interestingly, although overall gaming sales continued to show yoy declines, hardware already had a strong September. Hardware sales were +19% yoy, which is a strong number and, again, consistent with Microsoft’s report.

How Is It All Relevant To What GameStop Might Report, Then?

First, let’s take a look at GameStop’s revenue expectations for FQ3 2023:

Seeking Alpha

We can see that the market consensus is, again, for GameStop to post revenue growth in FQ3 2023. However, the expectation (+4.2% yoy) is now lower than in the previous quarter at this point (+6.9% yoy).

We then need to combine this lower expectation, with the fact that gaming sales at Microsoft and in general aren’t doing as bad as they were doing, again at the same time in the previous quarter (when I published my previous article). Already we see that things aren’t so clear now.

It doesn’t stop there, though. You see, gaming sales, as per NPD’s reporting, are heavily slanted towards software. For instance, in the September report I linked to above, out of $4.073 billion in considered gaming sales, only $490 million (12%) referred to hardware.

However, when it comes to GameStop’s own revenues, things are slanted much, much harder towards hardware! In GameStop’s latest quarter, hardware represented a full 52.5% of revenues.

We can already see the problem here. In the previous quarter (and thus in my previous article), both software and hardware sales were doing poorly, yet expectations were for GameStop to post revenue growth. That was very unlikely to happen.

However, in this quarter while software and services are still weak (but less weak), hardware sales actually look strong! And what’s more, for GameStop, when it comes to revenues, hardware sales are much more relevant than for the overall gaming market.

Thus, to sum it up, we have these facts:

- GameStop faces lower expected revenue growth

- The gaming software market is bad, but not as bad as before

- The gaming hardware market has turned very strong

- And GameStop relies (for revenues) to a much higher extent on gaming hardware sales than on software sales

All of these facts point to the same thing: GameStop’s potential revenue miss is a lot less predictable this time around.

It might even be that GameStop will report such hardware revenue growth that it will be enough to compensate for software revenue declines, even though software revenue declines are likely to continue at a pace higher than the market’s. If anything, this happening (hardware sales growth fully compensating for software sales decline) is more likely than not.

Conclusion

In short, last quarter, taking into consideration what Microsoft had reported, it was easy to see that GameStop was going to miss revenue expectations, and miss them big.

This quarter, that’s not the case. Hardware sales improved enough (market-wide, not just at Microsoft), and are so much more relevant for GameStop, that this factor might be enough for GameStop to actually show revenue growth during the quarter, possibly even matching or surpassing revenue expectations.

Now, does this change anything regarding GameStop’s prospects?

Not really. GameStop is still stuck in an obsolescence death trap. Software sales, where the margins are, will still be contracting. And the (low-margin) hardware cycle won’t be favorable for much longer, either.

In the end, I expect that GameStop will struggle to survive in its current (physical store-based) form, if it survives at all. And the stock price will end up being much lower than it stands today. Struggling physical retailers don’t carry 1.4x Price/Sales multiples. They can easily trade for Price/Sales 70-90% lower than that.

But the main gist of the article is still that this time, a large revenue miss is far from predictable, unlike the last time.