Fujimi, Siltronic: Two Of Intel’s Suppliers On Your Watchlist

kynny/iStock via Getty Images

In these times of acute stock market turmoil, it becomes important to step back and think about strategy and how to take advantage of secular trends. One of them is the deglobalization of the supply chain as the U.S aims to bring production back home for the most important electronics items like semiconductors.

For this purpose, this thesis considers two of Intel’s (NASDAQ:INTC) suppliers who won awards for the quality of their products and services back in March 2021. That was more than a year back, but there has been no such award by Intel since. These are Germany’s Siltronic (OTC:OTCPK:SSLLF) and Japan’s Fujimi (OTC:OTC:FUJXF) whose price performances have also been on a downward trend just like the chip giant as shown in the charts below.

Price performance comparison (www.seekingalpha.com)

In addition to providing insights as to their finances, and the way they could be impacted by demand concerns faced by the semiconductor sector, the aim of this thesis is to explore whether these two companies have operations on U.S. soil, which could prove useful as Intel’s expands its footprint in the U.S.

Fujimi with its U.S. operations

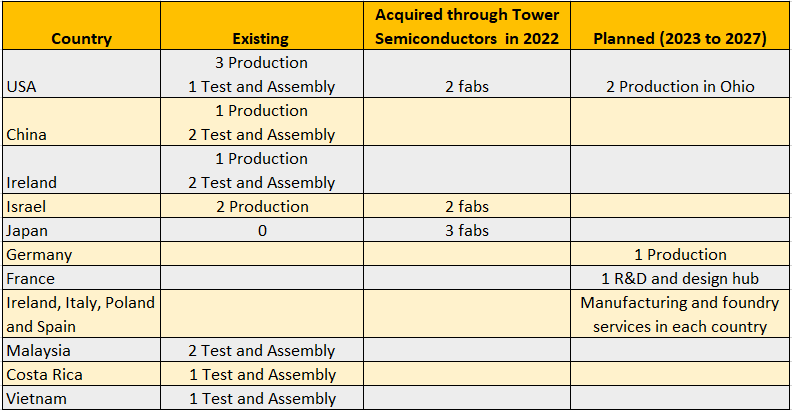

Onshoring of the supply chains, especially for Intel will imply that more foundry capacity will be added on American soil. In addition to its existing facilities as shown in the table below, it is building two big fabs in Ohio with an investment of $20 billion and in order to be operational, these will require more than just the chip equipment machines made by the likes of ASML (ASML) and Lam Research (LRCX).

Table built by the author using data from (intel.com)

In this respect, the products and services of Fujimi, a materials company specializing in CMP (Chemical Mechanical Polishing). This is about polishing a wafer or a thin slice of semiconductor surface through a combination of chemical and mechanical actions so that it can be later transformed into a chip with electronic circuitry.

The company’s U.S subsidiary happens to be located in Oregon where Intel already has fabs. Moreover, in 2020, the Japanese company announced the establishment of a High Volume Manufacturing site for silicon carbide wafer polishing slurries.

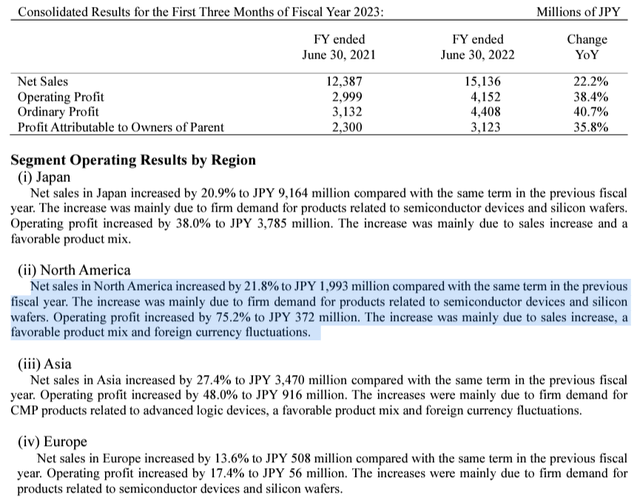

In its latest financial results for the first quarter of 2023 ending June 2022, the Japanese company made JPY15.387 billion (table below) in net sales, or a 22.2% increase over the same period in 2021, but at the same time, its operating profit soared by over 38%. This was due to increased sales, a favorable product mix, and forex tailwinds.

Consolidated Results (www.ircms.jp)

For this purpose, with a USD/JPY ratio of over 140 for the most part of 2022 and North American sales surging by 21.8% the company also saw operating profits up by a whopping 75%.

Looking at geographical diversification, most of its revenues (about 60%) come from Japan where it grew by 20.9% with some exposure to the rest of Asia (22%) and Europe (3%).

I now come to Siltronic which belongs to the semiconductor equipment industry and operates within the IT sector.

Siltronic with a presence on American soil

The company manufactures wafers made of “hyperpure silicon”, which forms the basis for miniaturization by enabling nanotechnology. As such, it has been a partner to major foundry operators like Intel for decades. The Munich-based company has production facilities in Asia, Europe, and the USA.

It has an advanced edge production site in Oregon, in addition to Europe and Asia used by Intel for its leading-edge nodes. Additionally, its largest manufacturing capacity is in Singapore, namely for more matured (lagging) process nodes like 200mm and 300mm wafers.

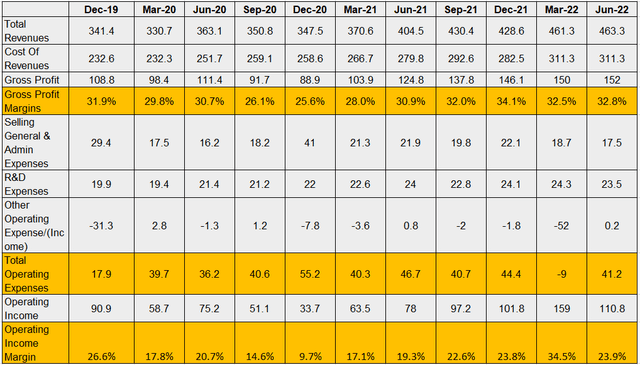

Looking at finances, in the same way as its Japanese counterpart, the German company saw its margins increase in the June 2022 quarter (Q2) as a result of higher sales due to high demand and currency tailwinds.

Besides sales, another key metric to observe here and especially during supply disruption times and periods of higher cost-push inflation due to high energy prices impacting Europe is the gross margins. This has been relatively stable for the past four quarters, with the higher value for Q2 as shown in the table below (relative to last year) due to higher sales. As a result, there was a progression in operating margins too.

Quarterly Income Statement (seekingalpha.com)

However, the picture becomes tainted when looking into the rest of 2022.

Uncertainty due to demand and geopolitics

Going forward, there has been a weakness in PC sales by both DRAM and NAND memory producer Micron (MU). Intel has also announced that it is likely to slash hiring due to concerns about demand. There are also rising geopolitical tensions between the U.S. and China culminating in the Department of Commerce imposing severe restrictions on the export of advanced microprocessors to that country due to fears that these may be used for manufacturing sophisticated weapons. Analysts had previously issued warnings on Apple’s iPhone sales in 2023. As a result, the VanEck Semiconductor ETF (NASDAQ:SMH) has fallen by more than 40% since the start of this year and there appears to be no end in sight to pains.

During its earnings call back on July 29, Siltronic’s CEO acknowledged that there was some weakness ahead. However, he also mentioned that there was no indication of weakening demand for his company’s products. On the contrary, they expected to sell more as a result of their customer’s inventories still being low, while at the same being confident about being able to increase product prices and benefit from favorable exchange rates.

However, the real risks for Siltronic pertain to gas supply as Germany’s industrial base depended on Russian gas for decades. As of the end of July, the management planned to reduce gas consumption and replace it with fuel oil at its Freiberg site within 6 months.

Hence, in view of the complete cutoff of Russian gas, it is important to check whether the wafer manufacturer has been able to switch energy sources and kept production running at its plants. More details may be obtained during the Q3 earnings call scheduled for the end of this month.

Therefore, the German company faces energy-related pains in addition to potential demand-related uncertainty.

Valuations and financial metrics

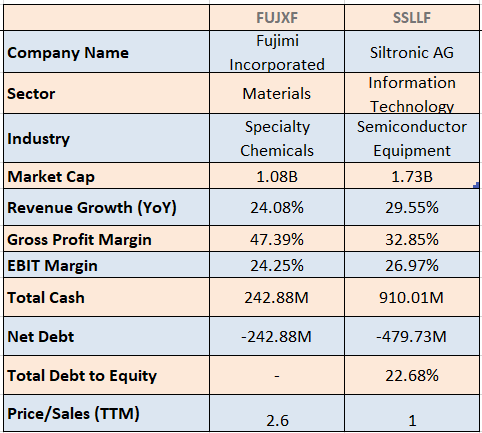

As for Fujimi, it is less exposed to higher energy costs as it does not manufacture wafers, which is the reason for its gross margins being higher than Siltronic as shown in the table below.

Comparison of Metrics (www.seekingalpha.com)

On the other hand, its sales for hard disk-related products increased by 32.8% in Q2, implying that it is also dependent on the PC sector. Also, both companies are exposed to China, which was a large consumer (more than 50%) of the world’s chips in 2021. Consequently, the country’s semiconductor stocks have been very volatile after the U.S. imposed the latest sanctions, which may go to the extent of further restricting chip equipment plays to sell to China.

Still, looking at other sectors of the economy, the two companies make products that are used by the industrial and automotive sectors, where there has been no news of a demand slump. These are industries where supply remains below demand. As a result, they may have some backlogs or unmet customer demand. Moreover, forex tailwinds constituted by a falling euro and yen for Siltronic and Fujimi respectively could offset, albeit partially, lower sales volumes.

Furthermore, as seen in the above table, these two companies have good cash flow and debt metrics as a result of selling to major semiconductor companies which are well established and signify that their balance sheets are flexible enough to take in some short-term stress.

As for valuations, as shown in the table above, Fujimi has a trailing price-to-sales ratio of 2.6x, which is overvalued relative to the median of the Materials sector by over 150%, which means that even after its 20% one-year downside, it remains significantly overvalued. On the other hand, compared to the IT sector’s median, Siltronic’s P/S is undervalued by over 50%, which is due to the market having priced in risks associated with the Ukrainian conflict.

Therefore, it is better to avoid taking a position in the current market environment where global recession risks are higher. Balancing out, I consider these companies to be “holds”.

Conclusion

Thinking strategically, they play a role in wafers used to conceive chips, which are the basis of all electronic applications – from computers, and smartphones to electric cars, F-35 jet fighters, and wind turbines. More important, in light of the U.S. onshoring its semiconductor supply chains, Fujimi’s and Siltronic’s U.S. operations confer to them a competitive advantage over peers which have no presence on American soil. Thus, they should be on investors’ watchlists.

Finally, no one can predict the future and Intel may bring changes to its supplier base in view of new market conditions, but the fact that these two companies have already won quality awards certainly favors them.