First United (FUNC): Cheap Regional Bank With Rising Dividend

Oscar Gutierrez Zozulia

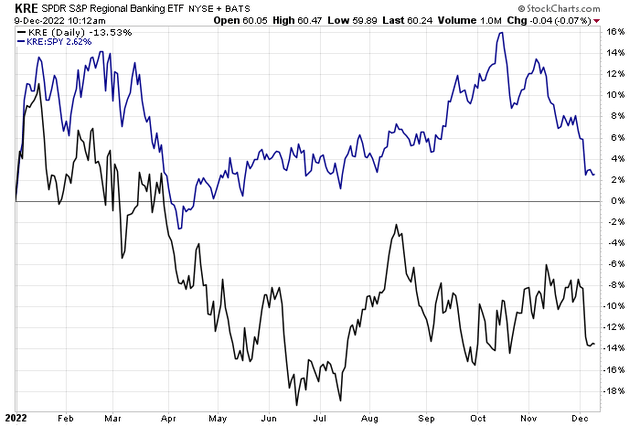

Inflation risks and higher interest rate trending are shifting to recession worries. With a yield curve that’s nearly 80 basis points inverted and the risk of lower domestic small business loan demand, regional banks have come under pressure after a big relative rise earlier this year. One small bank sports top-line growth, but are macro headwinds too much to overcome? Let’s check in on First United (NASDAQ:FUNC).

Regional Banks Suddenly Struggling vs SPX

According to CFRA Research, First United Corporation operates as the bank holding company for First United Bank & Trust that provides various retail and commercial banking services to businesses and individuals. The company offers various deposit products.

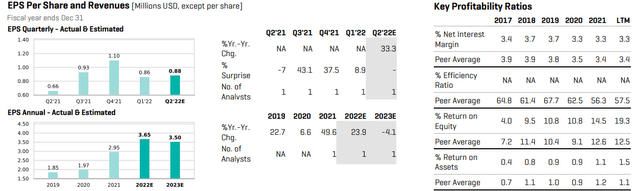

The Maryland-based $132 million market cap Regional Banks industry company within the Financials sector trades at a low 5.2 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.6% dividend yield, according to The Wall Street Journal. Back in early October, the bank hiked its quarterly dividend by a whopping 20% to $0.18 per share as rising interest rates generally benefit the depository institution. First United also issued quarterly non-GAAP earnings of $1.04 on revenue of $19.75 million, an 8.8% increase from the same period a year ago. The bottom-line number also beat forecasts of just $0.96, according to Fidelity Investments.

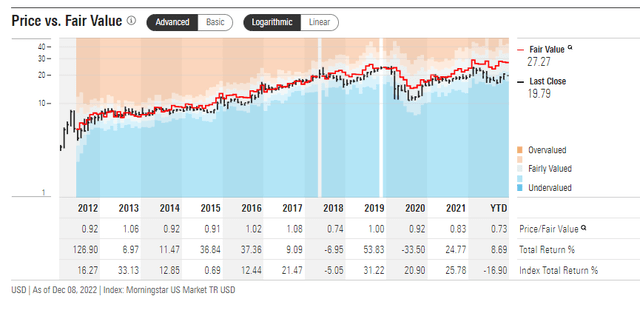

On valuation, FUNC trades at an earnings multiple of roughly half that of the industry, despite having decent sales growth in the past 12 months. Moreover, Morningstar placed a quantitative fair value stock price of $27.27 vs. a $19.85 closing price last Thursday on this small-cap value stock. With an earnings yield near 20% and trading at just 1.0 times book, I see the stock has a solid value here.

FUNC: Stock Price vs Fair Value

CFRA Research estimates show that per-share profits are seen as rising from $2.95 in 2021 to $3.65 this year. Next year, though, earnings are expected to retreat modestly. Still, even with a below-market 10x P/E on $3.5 of earnings, you get a much higher stock price than where FUNC trades today. Meanwhile, margins are positive, and its ROE is much better than the industry average, per CFRA. Overall, I like the earnings and valuation story here.

Higher Profits in 2022, Small EPS Drop Expected Next Year

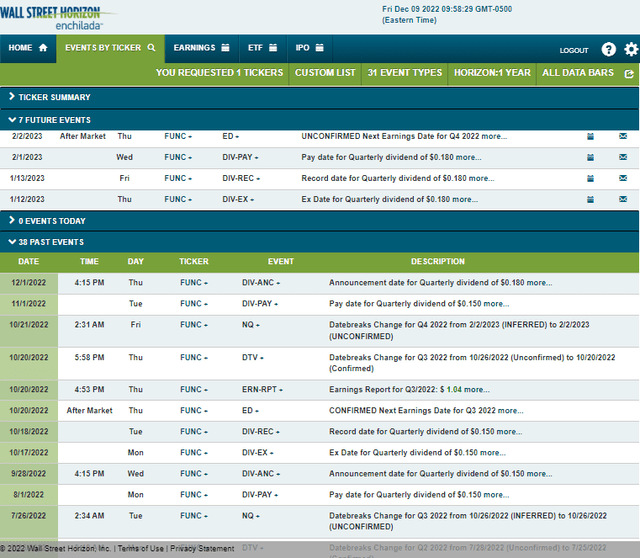

Looking ahead, corporate event data from Wall Street Horizon show a Q4 2022 earnings date of Thursday, Feb. 2 AMC. Before that, the stock trades ex-div on Thursday, Jan. 12.

Corporate Event Calendar

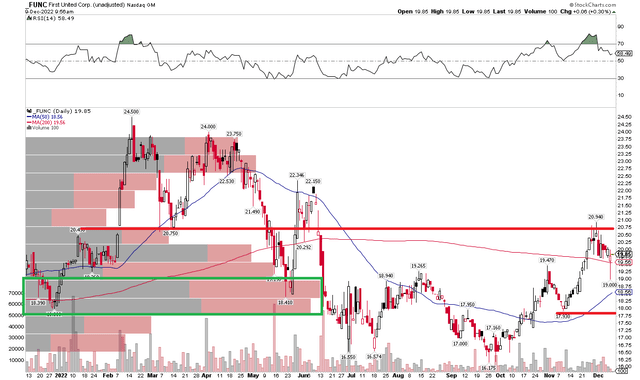

The Technical Take

With a good-looking valuation and respectable yield, how does the chart look? I see shares as in a trading range, so buying the dip or playing for a bullish breakout can make sense. Notice in the chart below that the stock has low volume and is coming off of overbought levels. A further pullback to the $18 to $19 range looks in play to me – that would be a buying spot, with a sell stop under the November low of $17.93. I see resistance in the $22 to $23 zone.

FUNC: Buy On A Retreat to Support

The Bottom Line

Regional banks face a scary time ahead with a steeply inverted yield curve and domestic recession risks possibly impacting loan growth. Further weaknesses in small business growth and with the consumer are headwinds, but with a low valuation, FUNC appears to be a good value.