Fevertree Drinks: Headwinds Make For An Uncertain Outlook (OTCPK:FQVTY)

bhofack2/iStock via Getty Images

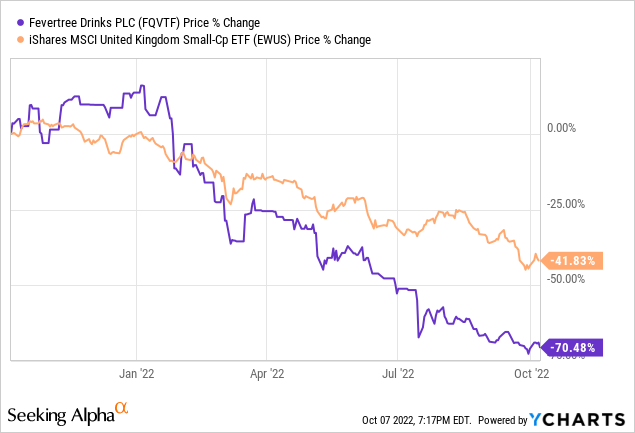

Having once been among the best wealth creators on the London equity markets, 2022 has seen a rapid reversal in fortunes for drinks manufacturer Fevertree (OTCPK:FQVTF)(OTCPK:FQVTY). Shares of the firm are down around 70% so far this year as I type, significantly underperforming the broader iShares MSCI U.K. Small-Cap ETF (EWUS) in the process.

At one point, Fevertree’s progress looked unassailable. The company upended the multi-decade dominance of Schweppes in its domestic British market – pretty much inventing the “premium mixer” category in the process – while it has also branched out into continental Europe, the United States and other international markets. That has seen annual revenue rise roughly tenfold since the firm’s IPO in 2014.

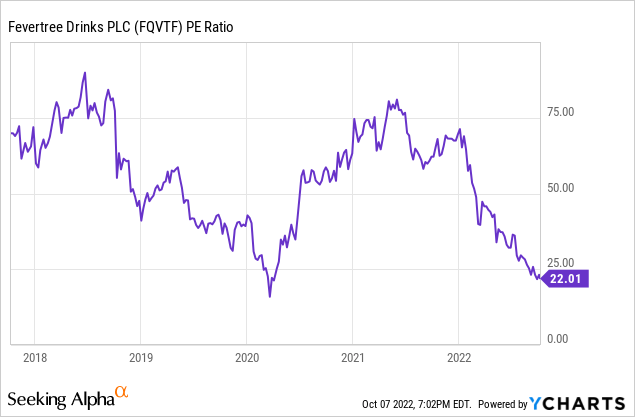

Profit growth had likewise been stellar, helped by an asset light model that resulted in returns on capital in the 40% range. That, in turn, fueled a dizzying valuation for Fevertree’s shares, which at their peak in 2018 were trading for in excess of 70x annual earnings.

The situation looks a whole lot different today. Just as ballooning profits and valuation multiple expansion make for a great combination in good times, collapsing earnings and multiple deflation make for a toxic duo when things turn sour. That has been the case here recently, with the company battling second-order effects from the war in Ukraine and the subsequent markdown of the stock’s earnings multiple.

While that has made for a terrible recent performance on the share price front, the similarly steep fall in profit means that Fevertree stock still doesn’t look particularly cheap. Near-term headwinds facing the company aren’t yet abating either, meaning investors can probably afford to remain on the sidelines until the outlook improves. Hold.

Sales Growing; Profits Falling

On the face of it, Fevertree is hitting its stride again following the blow dealt by COVID containment measures to the global on-trade industry (circa 45% of Fevertree’s pre-COVID revenue). Total sales in H1 2022 were £160.9m, a rise of 14% year-on-year and around 40% higher than the equivalent period immediately prior to the pandemic. Sales in the domestic U.K. market (a third of the company’s total) still look a little soft – clocking in at £53.5m versus over £60m in pre-COVID 1H 2019 – but the US (~25% of sales), Europe (~30%) and the Rest of the World segment (~10%) saw more robust growth, collectively roughly doubling sales versus pre-COVID levels.

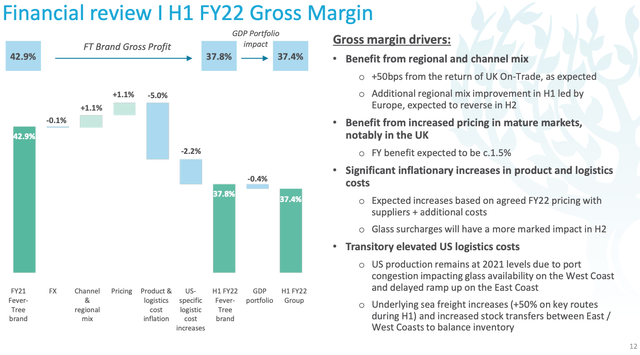

Unfortunately profit has moved in the opposite direction, with the firm’s gross margin falling to 37.4% in H1 2022 from 51.9% before the pandemic. One of the immediate issues is in the United States, where Fevertree’s bottling partner is struggling to ramp up its East Coast plant due to common post-COVID issues like labor shortages. Furthermore, its established West Coast facility has also seen its share of generic post-COVID problems (e.g. port congestion hitting glass availability). The upshot is that US production levels have stalled, meaning the firm has been shipping over product from the U.K. in order to satisfy growing US demand. Given this has occurred in a period of very high freight costs, profit has taken a big hit. Fevertree has also seen more generic input cost inflation eat into its margins.

Source: Fevertree 1H 2022 Results Presentation

Pricing power has also come into question here. The company only saw a 110bps uplift to gross margin from pricing, and is guiding for 150bps for the full year, which looks quite weak to me given the wider inflation rate and the company’s status as a premium player.

Storm Clouds Not Yet Lifting

To be sure, a chunk of this does look transitory – as management have been keen to point out – and eventually US production will align with demand, helping to reduce elevated logistics costs. In the short run, though, this looks set to be a nagging issue, with transatlantic freight costs remaining high despite transpacific costs crashing due to global recession fears.

That doesn’t mean margins will rebound completely, though. For one, the U.S. is now a bigger slice of the firm’s revenue pie, and although Fevertree doesn’t break down profitability by region, its US operations are much less profitable than the U.K., where growth will also be harder to come by as the firm hits market saturation.

Moreover, the domestic macro environment is becoming increasingly bleak. Retail energy costs have skyrocketed despite a recently introduced price-cap, eating into household budgets, while businesses face an even more uncertain outlook given their lower levels of government protection. Wafer thin margins in the hospitality sector look very vulnerable, which could mean bad news for the domestic on-trade industry. Mortgage costs and rent are also increasing alongside general inflation (food, index-linked internet bills, and so on), which is heaping yet more pressure on U.K. consumers. Supermarkets have already been warning that customers are trading down, while discretionary spending is the easiest to cut back on in a downturn. All told, it’s not hard to envisage a tough period ahead for the company.

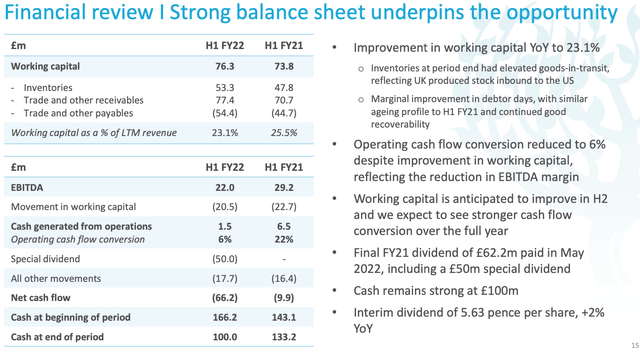

Shares Could Still Be Expensive

So far I’ve painted a pretty bleak picture, at least in the near term, though I should point out that despite its issues Fevertree is still a pretty good business. Taking analyst estimates for 2022 and 2023 earnings (£25m and £30m respectively) at face value still implies a double-digit return on invested capital here. That’s about in line with the average company – maybe a shade higher – and not bad considering we may be about to enter a nasty recession. The balance sheet is also in solid health, with net cash still around the £100m mark.

Source: Fevertree 1H 2022 Results Presentation

The main issue is that expectations were sky high here in the past – fueled by great growth and high quality profits – and may still be so. At around £8.40 in London trading, these shares currently trade for around 40x estimated 2022 earnings and 33x 2023 earnings – numbers that could move even higher if profit disappoints to the downside. Despite the steep share price decline, prospective investors can still afford to wait.