Exxon Mobil Stock: A Fool And His Money Are Soon Parted (NYSE:XOM)

jetcityimage/iStock Editorial via Getty Images

What happened?

Exxon Mobil (NYSE:XOM) shares broke above $100 for the first time in eight years recently. Nonetheless, the Texas oil titan has fallen 10% in June along with the rest of the energy sector on recession fears.

Exxon Mobil Current Chart (Finviz)

I suspect the sell off is due to many attempting to exit the energy sector prior to the recession hitting. Even so, as a long-time Texan, and former Texas oil man, I believe the sell off has actually provided those looking to start a new position in the stock an excellent buying opportunity. One of my father’s favorite quotes when starting a new position in a stock was:

“The best time to plant a tree was 20 years ago. The second best time is now.”

In the context of this conversation the quote means – if you want success and growth in the future, the best time to act is now. Here’s why.

Buying Opportunity Thesis Overview

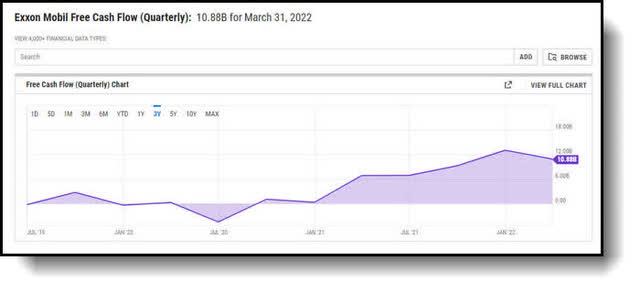

I was born in Omaha, Nebraska. My father was an Air Force intelligence officer who worked at Strategic Air Command and then became a stock broker. So we’re cut from the same cloth as Warren Buffett. We look for companies with strong long-term growth stories, strong organic cash flow, and solid fundamentals. Exxon Mobil fits the bill. Exxon Mobil’s free cash flow has steadily grown over the last three years to a strong $10.9 billion in the last quarter. This is more than adequate to cover the dividend payout and fund future growth via capital expenditures.

Exxon Mobil Quarterly Free Cash Flow (Y Charts)

Plus, I posit those who sold out during June have basically thrown the baby out with the bathwater when it comes to Exxon Mobil, hence the title a fool and his money are soon parted. The reason is, I don’t think oil is going to take that big of a hit this time around, and even if it does, Exxon Mobil has plenty of “gas in the tank,” so to speak. Let me explain.

Recession fears overblown

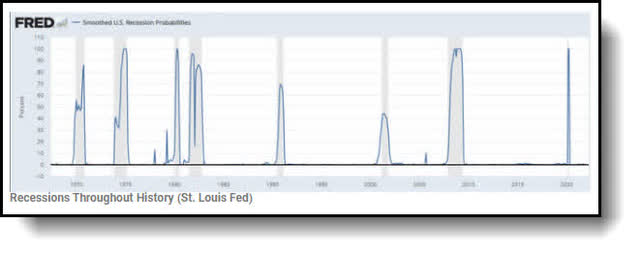

First of all, let me start by saying, after doing my due diligence on past recessionary cycles and the respective effects on the markets in general, I surmise the potential coming recession will be a short and shallow one, even with a hard landing, for several reasons. Firstly, the average drop in the S&P 500 during the past 12 recessions since World War ll was 30%. We’re currently down 20% already, so about two thirds of the recession’s potential downside effect on the market is already priced in by historical standards.

S&PP 500 Current Chart (Seeking Alpha)

Plus, the market always overshoots to the upside and the downside. It’s starting to feel like the fear factor is getting overblown. In fact, the current negative sentiment in the market equals that of the market when it was trading at the very low in March of 2009. The S&P 500 traded at that time for $666, known as the devil’s low or Mark Haines bottom, as it were. The negativity is way out of whack as far as I’m concerned. I feel the recent selloff has created a substantial buying opportunity in Exxon Mobil’s stock. There are three primary reasons I’m positive on the oil giant’s future prospects. They are as follows.

The Supply/Demand Imbalance is going nowhere

The current supply demand imbalance for the global energy market is striking and appears to be worsening with no end in sight. I spent some time back in the day as a FINRA registered securities broker selling partnership units in oil ventures. I still have friends in the oil business as of today. They’re all saying we have at least another five years of strong oil prices, and they are usually on the money.

This is due to the fact that the oil companies are not in a rush to increase production this time around after being burned during the last cycle. The shale assets have the quickest turnaround time, yet require a significant outlay of capital. This is the issue at hand. After the oil companies were burned during the last cycle by prices nosediving just as they maximized production, big oil’s management is in no hurry to shoot themselves in the foot again.

The primary focus now is to return capital to shareholders via increased dividends and share buybacks. It wasn’t so long ago most oil companies were essentially zombies, just making enough money to stay in business, yet going deeper in debt and having zero profits. They aren’t in a hurry to get back into that situation. I can’t blame them with the current administration seemingly out to bring about fossil fuel’s extinction much like the dinosaurs that created it in the first place (good one huh? Ha!). According to the EIA, global oil supply has already fallen by 0.6 mb/d as of April 2022.

EIA Oil Supply Demand Chart (EIA)

Like oil demand, 2022 global oil supply growth has been downgraded by 1.2 thousand barrels per day by major oil organizations since the start of the Ukraine war. The downshift in expectations echoes the risk of a likely EU ban on Russian oil, inadequate global production capacity, and the low probability of Iranian oil returning to international markets in 2022, according to the EIA. What’s more, there’s still limited political will among OPEC countries to raise oil output. Now let’s take a look at Exxon Mobil specifically.

Exxon Mobil’s low break even point and pricing power

It’s a well-known fact that Exxon Mobil’s breakeven point for on a barrel of oil is $41, which makes for a tidy profit. What’s more, the company recently announced its breakeven oil price target should reach an average of $35 per barrel by 2027, down another 15%. On top of this, based on the current economic indicators, the company continues to maintain pricing power. People are definitely complaining about the sharp rise in gas prices and oil distillates writ large, yet the demand hasn’t weakened whatsoever. Moreover, the summer driving season is just now set to start. And with everyone being cooped up for the previous two summers, I expect it to be robust. Now turn our attention to the fundamentals.

Solid valuation and earnings potential

The stock is trading for an 18% discount from its recent 52-week high with 10% of the drop coming in just the last month.

Exxon Mobil 52 Week High Chart (Seeking Alpha)

What’s more, with a PEG ratio of less than 1 at 0.62 and a forward P/E ratio of 9.80, the integrated oil behemoth is trading substantially below the S&P 500 average and at 35% discount to its own historic levels. With the price of oil expected to continue higher and capital allocation remaining low and long cycle, I expect earnings for the oil giant to be revised higher over the coming quarters which should boost the share price and increase the dividend payout.

Exxon Mobil’s assets are second to none

Exxon Mobil’s integrated assets are second to none in the industry. If you have the chance, take the time to watch my CNBC compadre David Faber’s Exxon Mobil documentary, “Exxon Mobil At The Crossroads,” it was an extremely enlightening special that solidified my conviction in the name even further. Exxon Mobil explores for and produces crude oil and natural gas, as well as petrochemicals and other related products.

The downstream segment generates the most revenue, yet the upstream segment generates the most profit. The bottom line is this integrated strategy adds a substantial margin of safety regarding the investment by diversifying the revenue streams. Finally, the Texas oil titan is committed to returning capital to shareholders.

Exxon Mobil is committed to the dividend

The company has stated emphatically they’re committed more than ever to return capital to shareholders. The current dividend payout stands at $3.52 annually for a 4% yield at present. This is probably the most telling sign the oil supply shortage may continue unbated. Under normal circumstances, you’d expect the oil giant to crank up the shale fields, yet this is not the case. To be honest, I can’t blame them with the current political leadership firmly in bed with the alternative energy crowd. Now let’s wrap up this piece and tie a bow on it.

The Wrap Up

Due to the Texas oil titan’s status as an oil industry leader, best-in-class vertically integrated assets, resolute pledge to return capital to shareholders, the stock’s recent pullback, and reasonable valuation, I have chosen Exxon Mobil as the anchor stock for my Winter Warrior SWAN retirement income portfolio. I plan to remain overweight the energy sector stocks for the time being as well. My next pick will be a midstream player.

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into positions over time to reduce risk. I believe the markets have may have further to fall, yet attempting to perfectly time the bottom is a fool’s errand. If you have an extremely low risk tolerance I suggest waiting for a well-defined trend reversal prior to starting as position. I’m in this for the long haul, so I see an opportunity at this level for like-minded investors and retirees. You can count on this stable, growing payout for years to come. If you look at a chart of the past recessions, you will see that they always end, and don’t last nearly as long as expansions. So we will be out the other side before you know it.

As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.” Here’s a picture of my unit loaded into the back of a C141 heading for home after spending a few months in the jungles of Panama in 1989, a vacation I thought would never end.

Those are my thoughts on the matter! I look forward to reading yours! The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think Exxon Mobil is a buy at current levels? Why or why not?