Exxon Mobil: Russian Blackmail Backfires (NYSE:XOM)

Torsten Asmus

In addition to the European embargo on Russian oil along with a price cap that comes into effect today, Russia is also losing the ability to export its natural gas to Europe, which over time is more than likely to negatively affect its income and undermine its war efforts in Ukraine. While in the past, the natural gas business wasn’t that much attractive due to high competition and low margins, the latest developments in the industry indicate that everything is about to change.

The inability of Russia to supply natural gas to Europe in the same volumes as before along with the inability to significantly redirect the flows to Asia create a once-in-a-generation opportunity for companies such as Exxon Mobil (NYSE:XOM) to expand their market share and increase profits at Russia’s expense. While in the past, I’ve already highlighted how Exxon would be able to benefit from the European embargo on Russian oil along with the price cap on that same oil, this one focuses on the natural gas opportunities, which the business would be able to seize to create additional shareholder value for years to come.

Tight Supplies And High Demand Are Here To Stay

In my latest article on Gazprom (OTCPK:OGZPY), I’ve highlighted how Russia has been using exports of natural gas to Europe as a political weapon to achieve its geopolitical goals. Back in January, I also explained how this weaponization of natural gas negatively affects Gazprom, which lost all of its value on the Western markets after Russia invaded Ukraine in late February. After the invasion, the European Union in particular decided to no longer rely on Russian supplies and has been working with other companies and state actors to fill its natural gas storage ever since.

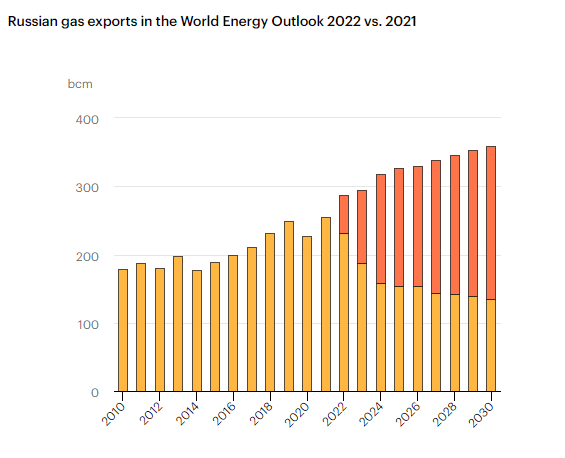

This resulted in Russia slowly losing its dominance in Europe. If in 2021, Gazprom, which has a state monopoly on exports of Russian natural gas via pipelines and is owned mostly by the Russian government, exported a total of ~210 bcm of natural gas out of which ~185 bcm went to Europe, then in 2022, it’s expected to export a total of only ~100bcm to all customers. In addition to that, in the first half of November, the company exported a total of only 2 bcm of natural gas, which indicates that Russian natural gas has trouble reaching other markets mostly due to political issues and logistical constraints both of which won’t be resolved anytime soon. The Russian government has already implemented a windfall tax on Gazprom’s profits in order to avoid the first budget deficit in decades, as its war efforts in Ukraine continue to negatively affect its economy.

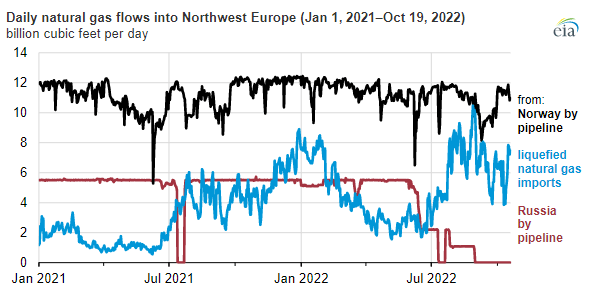

The European Union along with the United Kingdom, on the other hand, managed to fully fill almost all of their storages with natural gas to prepare for the current winter and at the same time are exploring options to reach new deals with additional suppliers. Back in September, EU President Ursula von der Leyen stated that the Russian imports to the union accounted only for 9% of supplies, down from 40% at the beginning of the Russo-Ukrainian war in late February. In large this is due to the increase in LNG imports, improvement of the natural gas infrastructure, and reliance on more stable partners such as Norway, which according to EIA is one of the biggest exporters of natural gas to the EU. At the same time, by the end of 2023, the European Union is expected to increase its LNG import capacity by an additional 50 bcm of natural gas, which would help it to decrease its exposure to Russia even more.

Natural Gas Supplies To Northwest Europe (EIA)

What’s also important to mention is that as Europe is decreasing its reliance on Russian natural gas imports, Russia itself can’t redirect the natural gas flows to Asia or other markets due to logistical constraints. In my latest article on Gazprom, I’ve already explained that last year Russia managed to export a total of only 16.5 bcm of natural gas to China. At the same time, there are questions about whether it would be able to increase its annual export capacity to China to ~100 bcm by the end of the current decade, which is nevertheless less than what it exported to Europe even a year ago.

Considering all of this and the fact that Gazprom’s production of natural gas decreases as well, we could expect a tight natural gas market for the following years, as the IEA in its latest energy outlook expects the Russian natural gas exports to be cut in half by 2030.

Russian Gas Exports in the World Energy Outlook 2022 vs. 2021 (IEA)

Generating Returns At Russia’s Expense

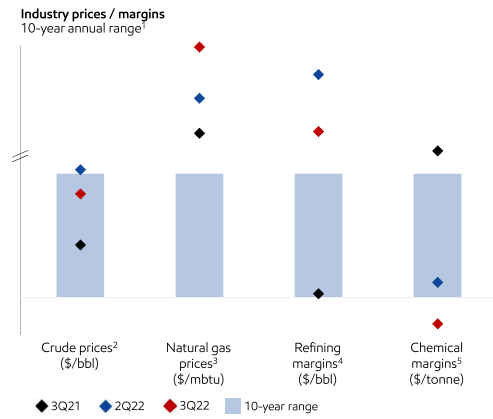

The loss of Russian natural gas creates a once-in-a-generation opportunity for Exxon to benefit from the tight natural gas market at Russia’s expense. If we take a look at the company’s latest earnings presentation, we’ll see that the natural gas prices in Q3 were once again significantly above the average 10-year range, which indicates that a great demand remains despite the high-price environment as a lot of European industries rely on continuing supplies to conduct their own operations. At the same time, Exxon has also reported that its gas realization in Q3 increased by 22% due to Europe’s diversification efforts to fill its storage ahead of winter.

Energy Industry Prices/Margin Ratio (Exxon Mobil)

Here’s what Exxon’s CFO Kathryn Mikells said about the current tight market during the company’s latest conference call in November:

Overall, from a demand perspective, you’re obviously seeing a really tight market. We saw in Europe, the building of inventory and how that has driven prices in Europe, building of inventory ahead of the winter. And so structurally, we would say there’s going to continue to be a tight market until supply and demand comes into equilibrium, right, in that there’s only 2 ways that happen, either more supply or reduced demand and supply, especially supply of LNG does take time to bring online. It isn’t something that is just a spigot that can be turned on overnight.

Another thing that’s worth mentioning is that the high-price environment also makes it possible for Exxon to continue to increase the production of natural gas and invest in new projects without fearing much about potential losses, as tight supplies are more than likely to stay with us for a while. During the same conference call, Exxon’s CEO Darren Woods stated that the start of the production on the Golden Pass LNG alone could increase exports out of the Gulf Coast by 20%. At the same time, Exxon’s offshore investment in Coral South FLNG on the Mozambique coast started producing natural gas last month, creating new profit-generating opportunities for the company.

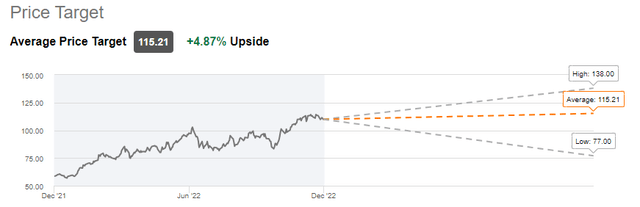

As a result of this, Exxon is more than likely to continue to report record numbers in the following quarters, as the tight natural gas environment along with the European embargo on Russian oil would continue to greatly impact the energy markets. There’s also a case to be made that the street underestimates how big of an upside those events could have on Exxon’s valuation. Let’s not forget that in Q3, Exxon’s revenue of $112.07 billion was above the street estimates by over $9 billion, which prompted the advisory firms to put a higher price target for the company’s shares.

This was the case at least since June when I first started covering the company, as at that time the consensus was that Exxon’s fair value was ~$100 per share. However, as the disruption of oil and natural gas supplies intensified, prices increased and so did Exxon’s profits, which resulted in the street believing that the business’s fair value is now $115.21 per share. As we enter the winter season and the end of the Russo-Ukrainian war is nowhere near in sight, there’s a possibility that the disruptions of the energy markets would outweigh the demand destruction and result in an even greater upside for Exxon’s shares in the following months.

Exxon Mobil’s Consensus Price Target (Seeking Alpha)

The Bottom Line

Now is the perfect time to be in the natural gas business if you’re not from Russia, as supplies are expected to be tight and the buyers are willing to pay high premiums to prevent any further disruptions. Exxon has already greatly benefited from the current high-price environment and was able to create additional shareholder value in recent months. However, the forecasted further decrease of Russian supplies in the years ahead creates additional opportunities to profit from the continuously tight natural gas market at Russia’s expense.