Expedia Stock Has Become Remarkably Cheap (NASDAQ:EXPE)

Pgiam/iStock via Getty Images

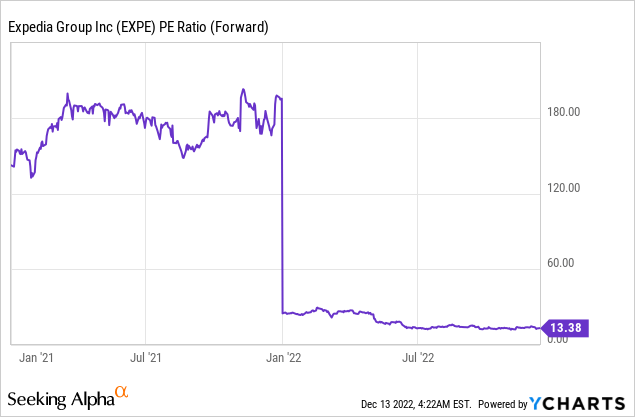

Expedia Group, Inc. (NASDAQ:EXPE) has underperformed the market by a wide margin this year. To be sure, the stock has plunged 48% whereas the S&P 500 has declined only 16%. The vast underperformance has resulted primarily from the negative effect of 40-year high inflation and a global economic slowdown on the business of the company. However, Expedia is on track to post record earnings per share this year and continue growing its bottom line for many more years. As the stock is trading at a nearly 10-year low price-to-earnings ratio of 13.2, it has become remarkably cheap.

Business overview

Expedia operates as an online travel company in the U.S. and internationally. Travel companies are highly sensitive to the underlying global economic growth, as consumers tend to curtail their discretionary spending significantly during recessions or economic slowdowns, like the ongoing one.

In addition, the surge of inflation to a 40-year high has caused numerous consumers to struggle to pay for their living expenses. Consequently, these consumers have drastically reduced their discretionary spending. This development is likely to take its toll on global travel sooner or later.

It is also important to note that the nature of the online business of Expedia has a positive and a negative side. As an online travel company, Expedia has much lower operating costs than brick-and-mortar travel agencies. On the other hand, due to its nature, this business has low barriers to entry, as it is not extremely hard for competitors to try to imitate most features of the business model of Expedia. As a result, competition has heated in this business in recent years.

However, Expedia has been doing its best to differentiate from its competitors and has succeeded in its efforts, partly thanks to its immense scale. In the third quarter, despite the global economic slowdown, the company achieved all-time high revenue and adjusted EBITDA, with the latter exceeding $1 billion for the first time in the history of the company.

Adjusted EBITDA grew 18% over the third quarter of 2019, with EBITDA margin expanding from 25.8% to nearly 30.0%. In addition, while Expedia is a leader in flights, it has escalated its growth efforts on lodging lately, with great success, as it achieved all-time high lodging bookings in the third quarter. As a side note, the company compares its results to 2019, as its earnings were much lower than normal in 2020-2021 due to the pandemic.

Thanks to its strong business performance, Expedia grew its earnings per share 15% over the prior year’s quarter, from $3.53 to an all-time high of $4.05. With only one quarter left for 2022, the company is on track to achieve earnings per share of $7.15 in the full year, a record level.

Even better, Expedia does not rest on its laurels. It is using product innovation and membership benefits in order to increase the engagement of its customers and thus retain high-value customers for the long run. Its efforts seem to be bearing fruit, as it achieved a nearly 50% increase in loyalty members vs. the third quarter of 2019. It is also worth noting that Expedia is in the process of formulating a unified loyalty program across all its platforms. This program is likely to prove a significant catalyst for sustained membership growth.

Moreover, the active app users grew nearly 40% vs. the third quarter of 2019, with almost two-thirds of bookings coming from direct traffic. Furthermore, Expedia has introduced some new features, namely price tracking and smart shopping, which have differentiated the company from other travel providers. Price tracking is a significant engagement tool while smart shopping helps travelers compare different rooms of a given hotel. Overall, Expedia is doing its best to diversify from other online travel companies and thus create a meaningful business moat.

Thanks to its sustained focus on differentiating from competitors and the ample room for growth in its business, Expedia has exhibited an exceptional performance record. Since 2004, it has grown its gross bookings every single year, with the exception of 2020-2021 due to the pandemic, from $13 billion in 2004 to $108 billion in 2019. It is also on track to post new all-time high revenues and earnings this year.

Moreover, thanks to its excessive free cash flows, Expedia is in the process of reducing its debt. As its interest expense currently consumes only 21% of its operating income, its debt is certainly manageable. Management also recently stated that it has resumed share repurchases. It repurchased about 1% of its share count in October and has a remaining authorization for repurchasing about 21 million shares. This authorization is sufficient to reduce the share count of Expedia by 13%.

Even better, analysts are confident in the growth efforts of the company and thus they expect it to grow its earnings per share by 32% next year, by 19% in 2023 and by 21% in 2024. In other words, analysts expect Expedia to nearly double its earnings per share over the next three years, from $7.15 in 2022 to $13.63 in 2025.

Valuation

Due to its plunge this year, the stock of Expedia is currently trading at a nearly 10-year low price-to-earnings ratio of 13.2.

This is an extremely cheap valuation level for a high-growth stock. The depressed valuation has resulted primarily from the concerns of the market over the impact of high inflation and the global economic slowdown on global travel.

However, the Fed has made it clear that it will exhaust its means to drive inflation back to its long-term target of about 2%. Thanks to its drastic interest rate hikes, the central bank will almost certainly achieve its goal sooner or later. When inflation begins to subside, the market will probably reward the stock with a more reasonable earnings multiple. It is remarkable that the stock is trading at only 7.0 times its expected earnings in 2025.

Moreover, thanks to the cheap valuation of the stock, the share repurchases are more efficient. At its current price-to-earnings ratio of 13.2, Expedia can reduce its share count by about 8% per year (=1/13.2) without the use of any debt. As a result, the share repurchases of Expedia greatly enhance shareholder value right now.

Risks

As mentioned above, the online travel business is characterized by somewhat intense competition, as there are low barriers to entry. This is a significant risk factor, which should not be underestimated by investors. On the other hand, Expedia has always maintained a meaningful business moat thanks to its immense scale and its sustained efforts to differentiate from its competitors. Given also the aforementioned differentiating strategies of the company, this risk factor hardly applies to Expedia, at least in the short run.

The other potential risk is the adverse scenario of a prolonged global recession. Due to the interest rate hikes implemented by most central banks in response to high inflation, the risk of an upcoming recession has increased. However, central banks are much more reactive nowadays than they were in the distant past. Therefore, if a recession shows up, central banks will do their best to keep it mild and make sure that a decent economic recovery follows. Even the Great Recession, the worst financial crisis of the last 90 years, lasted for only about a year, with a decrease of global GDP of only -1.3%. Whenever the economy rebounds from its latest slowdown, the market is likely to greatly appreciate the promising growth prospects of Expedia.

Final thoughts

The market sentiment is exceptionally negative for travel companies right now, mostly due to the impact of excessive inflation on consumer discretionary spending. This is the primary reason behind the exceptionally cheap valuation of Expedia. However, such tumultuous periods present rare opportunities to purchase high-growth companies, with solid long-term fundamentals, at a deep discount. This is certainly the case for Expedia. Whenever inflation subsides, the market is likely to shift its focus on the reliable growth trajectory of Expedia Group, Inc. and thus it will probably reward the stock with a more reasonable price-to-earnings ratio. In such a case, investors will enjoy a double reward; higher earnings and a higher price-to-earnings ratio.