EVgo: Paving The Way For Electric Vehicle Adoption

Brothers91

Investment Thesis

EVgo, Inc. (NASDAQ:EVGO) is a leading company in the US that owns and operates a fast-charging network for electric vehicles. It generates revenue by installing chargers and strategically expanding its capacity to meet growing demand. EVgo’s network is highly reliable and compatible with all types of EVs in the country, including Teslas, without requiring an adapter. The company has formed valuable partnerships with various stakeholders, such as car manufacturers, ride-sharing companies, and autonomous driving fleets, which has contributed to the company’s growth.

1Q23 Review

In the first quarter, EVgo reported EPS above estimates, thanks to solid network utilization. The company also added a record 220 new charging stalls during the quarter. EVgo reaffirmed its full-year revenue, EBITDA, and stall guidance, with the wide revenue range being largely dependent on achieving eXtend milestones and meeting US-assembled equipment requirements. Despite macro uncertainties, EVgo is well-positioned to benefit from policy support, such as the NEVI (National Environmental Vehicle Infrastructure) and IRA (Investment Tax Credit) programs, both directly and indirectly. Positive trends in utilization and network throughput are encouraging. There are also potential opportunities for margin expansion, including favorable utility rates, advertising revenue through PlugShare, and funding from the NEVI Program, which is expected to have a more significant impact next year.

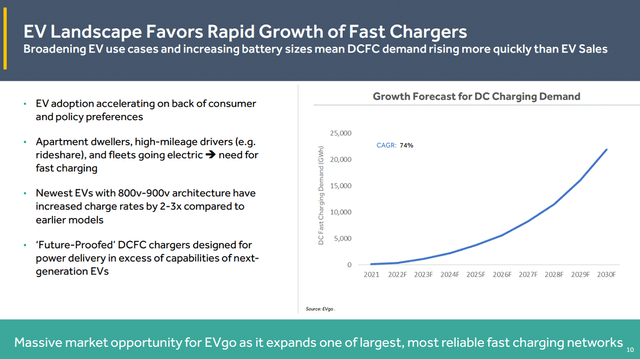

Positioned to Benefit From the Growth of the Market

The $4 billion US EV charging market may expand to $11 billion by 2025, creating plenty of runway for providers. EVgo may earn $100 million over the next five years from the five states with the most DCFC chargers alone, assuming it can maintain its segment shares in those states. At its US-wide share of 8%, the EV charging provider could book as much as $400 million in revenue in that time span. The potential to derive one-quarter of the total opportunity from just 10% of the states — accounting for 48% of US fast chargers — suggests that EVgo’s focus should remain with the DCFC heavyweight states and aggressively pursue state funding in them.

The potential $400 million in revenue is 8x EVgo’s fiscal 2022 revenue, suggesting public investment can turn into a meaningful catalyst, propped up further by adherence to Buy America provisions of manufactured products.

Charger Network Eats Cash

EVgo funnels much of its cash toward capital spending, funding the gradual buildout of charging infrastructure, with each fast-charging station — consisting of four to six stalls — costing $400,000-$700,000. State, local or utility incentives, plus investment offsets from its partners, may reduce the expense by as much as half, yet the buildout still accounted for $65 million of the $95 million in fiscal 2021 cash burn. Capex for EVgo was almost 3x revenue in fiscal 2021 and 2022, and it may decline to parity with sales, while for ChargePoint, by virtue of its asset-light mode, capex hovers around 5% of revenue.

Renewable Energy Credits a Dual Boost to EVgo

EVgo claims the unique distinction of operating an EV charging network 100% powered by renewable energy, accomplished via the purchase of renewable energy credits — a competitive edge that may attract altruistic EV owners. The company then monetizes the sale of electricity on the back end, deriving a portion of revenue from selling regulatory credits by participating in programs such as California’s Low Carbon Fuel Standard. The credits are purchased by carbon emitters — petroleum refiners, importers and wholesalers — that need to stay below carbon-intensity limits set by regulatory bodies. EVgo’s revenue from regulatory credit sales reached a high of $2.1 million in 2Q22, over 23% of the total, falling to just 11% in 3Q, in line with an expected pull-forward from the segment in 1H.

Valuation

While EVgo is an early leader in providing EV charging solutions, there are a handful of early comps for the stock. Investors will likely look to other EV ecosystem, EV charging, clean infrastructure, clean tech, and other high-growth infrastructure companies. A number of clean tech companies trade between 2x and 10x EV/2023E revenue. While shares of EVGO have underperformed the broader market since late last year and early this year (as have many companies that have come to market via SPAC), we have seen volatility around the announcement of the US Infrastructure Bill, earnings, and interest around EV companies newly coming to market.

The stock is currently trading at a 13x forward EV/Sales at a substantial premium to its peers. I believe that there is limited upside in the near-term due to the company’s already premium multiple, which is why I view the stock as a hold for now.

Downside Risks

Slower than expected growth of the EV market

If the growth of the electric vehicle market falls short of expectations, it will result in a lower number of EVs on the roads, leading to decreased demand for charging infrastructure. Additionally, increased competition from other alternative powertrains like fuel cell electric vehicles (FCEVs) and natural gas vehicles could hinder the adoption of EVs and reduce the need for charging stations. In such scenarios, EVgo may end up constructing more charging stations than necessary, resulting in underutilization and potential financial challenges due to lower demand for charging services and network capacity.

Intensifying Competition in the Industry

As the electric vehicle charging industry develops further, it is expected that more companies will enter the market, leading to increased competition in various areas, such as charging networks, hardware, software, and services for retail customers, hosts, and fleets. Moreover, within the owner-operator segment, there may be competition as consumers seek out charging providers that offer greater convenience or competitive pricing. To remain competitive in this evolving landscape, EVgo may need to adjust its technology, expand its network, and refine its customer acquisition strategy to stay relevant and meet changing market demands.

Conclusion

EVgo is a leading EV charging provider in the US and is well-positioned to benefit from the rapid growth of the EV charging market. The company’s network is known for its exceptional reliability and versatility, as it supports all types of EVs in the country without the need for additional adapters. The stock is trading at a premium valuation, and hence I have a hold rating on the stock.