Etsy Inc. Might Surprise You In The Post-Pandemic Era (NASDAQ:ETSY)

Editor’s note: Seeking Alpha is proud to welcome Finbuddy Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

grinvalds/iStock via Getty Images

Executive Summary

With the pandemic being over and people returning to officed and starting to spend again a considerable amount of their time outside with family, friends and colleagues, concerns have started raising around the future of Etsy Inc. (NASDAQ:ETSY) as the return to in-person activities is likely to negatively affect the business and slow down online sales growth. Although we think this will hold true in the short term, we believe that in the long term, Etsy, Inc.’s revenues will continue growing as buyers’ demand remains strong post-pandemic and the company’s recent acquisitions of Depop, Elo7 and Reverb will allow it to capitalize on new market opportunities worldwide. In addition, what we absolutely like about Etsy Inc. is the strong expertise that the company has managed to build over the years when it comes to assisting beginner sellers in setting up, running, and scaling personal businesses. We think that this enhanced knowledge is an absolute competitive advantage that will help Etsy Inc. grow fast in the coming years and beat the competition in the new markets where the business is expanding. As such, we give Etsy, Inc. a Buy recommendation.

Company Overview

Etsy, Inc. is an American company founded in 2005 that operates two-sided online marketplaces that connect buyers and sellers; the company offers a full package of services and tools that assist sellers in the sales process to achieve greater volumes while ensuring a positive experience for buyers throughout the purchasing process. The company operates primarily in the US, the UK, Germany, Canada, Australia, France and India. The leading marketplace is Etsy.com which connects local artisans and entrepreneurs with various consumers. In parallel, the business operates 3 other marketplaces which are Reverb (a musical instrument marketplace), Depop (a peer-to-peer social marketplace for fashion) and Elo7 (a Brazilian marketplace for handmade items).

As of December 31, 2021, Etsy, Inc. connected a total of 7.5 million active sellers to 96.3 million active buyers; and had 120 million items for sale.

Investment Thesis

We’ve spent the last 3 weeks analyzing Etsy Inc., evaluating its financial statements and assessing its potential. We usually do this to better understand the business model, uncover hidden insights that people may not notice, and set up realistic growth estimates to determine the current value of the stock.

During our analysis, we’ve identified 3 remarkable trends/insights that we think will contribute to Etsy’s growth in the next 3 years and will accelerate this trend; these factors represent the foundation around which we build our investment thesis.

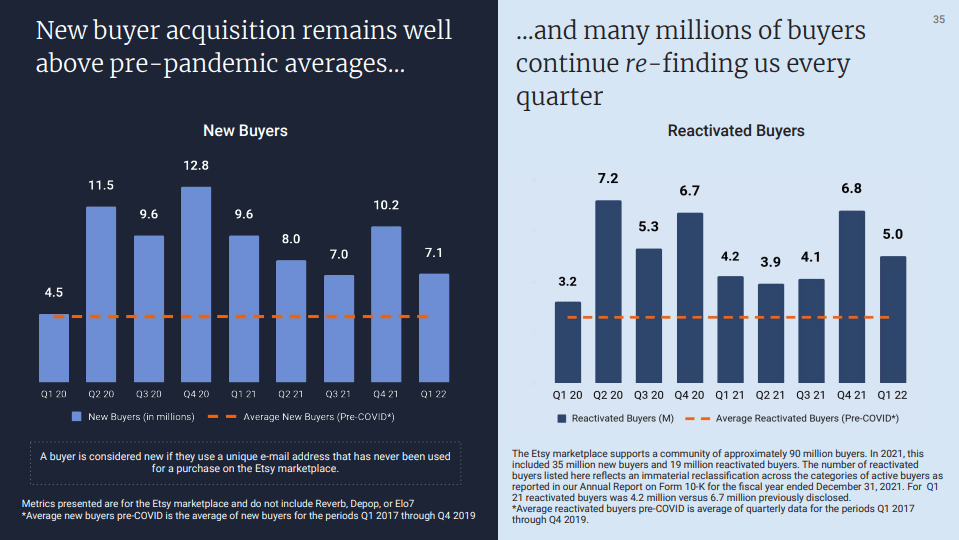

First of all, we’ve noticed that Etsy Inc. has registered high retention of buyers post-pandemic, a data point which we think reveals a growing interest worldwide for more unique items/products, hence a potential market opportunity that we believe has not been fully exploited yet. Here’s what has happened: over the past 2 years, due to Covid-19 and restrictive measures implemented by countries worldwide, we’ve seen the entire e-commerce sector experiencing phenomenal growth with the entire sector jumping as much as 55% at its peak. But now that the pandemic is over, investors’ sentiment has changed as new concerns arise on how the new “in-person” lifestyle could negatively affect e-commerce websites and marketplaces, with online sale volumes going down overall. We think this may be true in the short term, but not necessarily in the long term. Why? Because buyers’ interest in unique/handmade products is not slowing down: as reported in the company’s annual report in fact, the number of new buyers per quarter on Etsy Inc. remains in fact well above the average registered before the pandemic (8.9M post-pandemic vs. 4.5M pre-pandemic) and the number of reactivated buyers also seems not to be going down at all. Because of this, we believe there’s still untapped potential in this sector and we believe Etsy Inc. is well-positioned as a brand to be able to successfully exploit this rising trend.

Etsy Inc. Annual Report

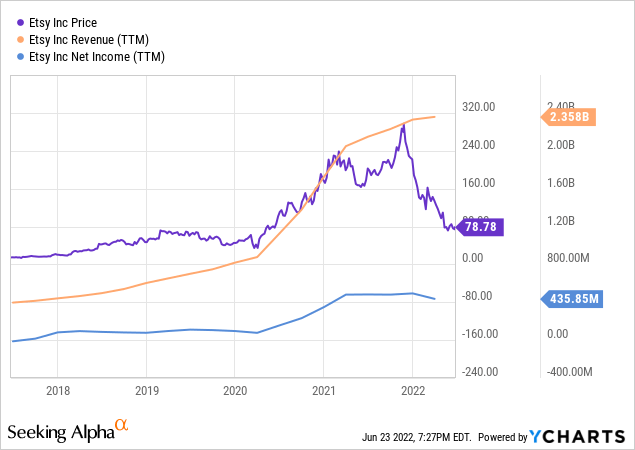

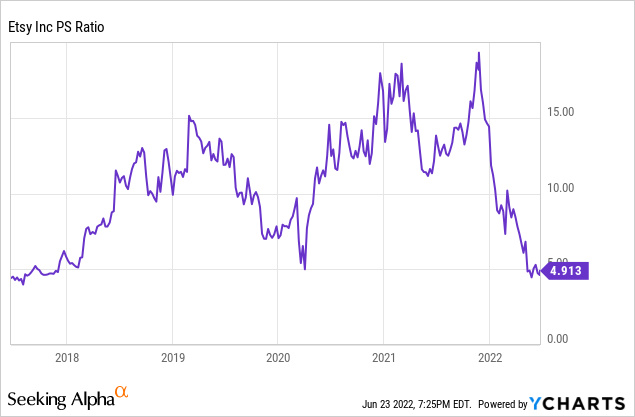

Secondly, following the market crash, we’ve positively observed Etsy Inc.’s stock price coming down and finally reaching accessible entry-price points that make investing in the company attractive again. With the market currently experiencing a downturn in the past few weeks, we all have seen many growth stocks ending up losing a lot of the gains they had accumulated over the past years. For us, this simply means plenty of opportunities to enter new positions at advantageous prices as valuations have been adjusted drastically. Etsy Inc. is currently trading at -74.42% from its peak with a current P/S ratio of only 4.91 vs. 21.39 it reached at its peak in February 2021. The company in the meantime is continuing to showcase strong financial health, register solid profit margins for a growth stock and has increased the fee it charges to sellers from 5% to 6.5% on April 11, 2022; we believe this maneuver especially could be a game changer in this quarter as it could drive new revenues to the business and potentially attract investors’ interest again hence, reverting the current stock downtrend!

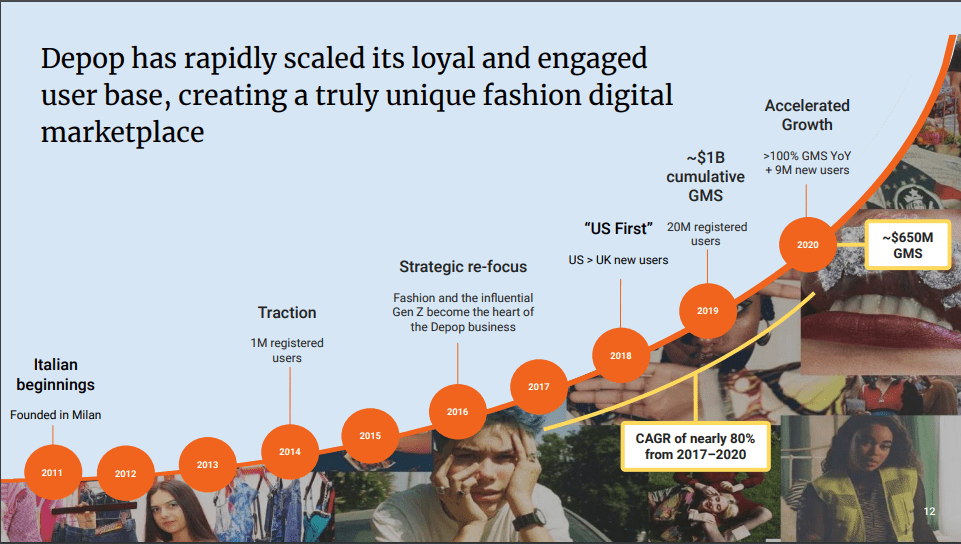

Finally, we believe that Etsy Inc. recent acquisitions will fuel a new wave of fresh growth for the company in new geographies that will ultimately contribute to driving new revenue growth while maintaining solid profit margins across the entire organization. We’re especially bullish on Depop, as the marketplace has experienced massive growth in the last few years (growing at almost 80% CAGR between 2017 and 2020) and presents a strong, loyal Gen Z customer base that is helping the brand become stronger in the fashion industry altogether. While we believe that Depop will play a major role in helping Etsy Inc. create and serve new users across the U.S. and Europe, we also have great expectations for Elo7, better known as the Etsy of Brazil. In fact, we believe Elo7 might be of strategic importance for Etsy Inc. especially in the long term as a gateway for Etsy Inc. to access the South America market, renowned for its cultural tradition when it comes to local markets and individual businesses, given a strong market penetration for e-commerce (in Mexico alone 85% of the population has bought at least one product or service on the Internet in 2021).

Etsy Inc. Annual Report

Risks & Competition

We believe Etsy Inc. is in a strong position to be able to generate promising returns in the next few years. Yet, it is very important to us to also make sure to minimize risks when we enter a new position.

As such, here’s our view on what could go wrong and what competitors you need to be aware of, in order to quickly react if some of the following events occur. Specifically, in our analysis, we’ve identified 2 main potential risks that may negatively affect the future of Etsy Inc.

The first risk relates to the company’s own ability to navigate new markets and geographies as successfully as the business did in the past. We believe the overall expansion strategy Etsy is implementing is the right one: acquiring “local” brands when entering new markets to leverage their own brand, and contextualized expertise to scale faster. We like this strategy because it reduces complexity, it ensures that Etsy’s expertise can be leveraged at the best within the new geography through already existing/established players, and it avoids the business to focus resources on activities that don’t have a direct relationship with sales and growth (if Etsy was to enter a new market without leveraging acquisition in fact, the company would have to spend a lot of resources first of all to create awareness around the Etsy brand and finding a way to penetrate the market successfully). Yet, it’s very important to account for the risk of Etsy not being able to grow acquired brands as successfully as it did with its leading marketplace Etsy.com in the U.S. and Europe. You see, this is a big risk that could have a major impact on the business’ overall profitability margins as well as on the balance sheet if the company would actually need to invest more cash than anticipated to successfully grow its marketplaces around the world.

The second major risk we anticipate is linked to the competition. Marketplaces have become hugely popular, especially thanks to the conditions created during the pandemic (lower barrier to entry, enhanced services to rely on, faster cycles to get started). As such, we’ve seen an aggressive surge of e-commerce websites launched in 2021. What this means is potentially increased competition for Etsy Inc. as more players will try to enter this space in the coming years to gain revenues in this sector (according to Shopify and eMarketer, e-commerces are estimated to generate $6.3 trillion in online sales by 2023). Specifically, we identify 2 typologies of competitors for Etsy Inc.: look-alike competitors like Alibaba (BABA), Amazon (AMZN) and eBay (EBAY) and ideology competitors like Shopify (SHOP), Bonanza, and Wix (WIX). The first group of competitors we believe is the one to worry the most about as these competitors operate a “similar” enough business model that’s easily adjustable and threatens to get into direct competition with Etsy Inc. (all these marketplaces focus mainly on different niches as of today, but fundamentally, all of them can easily “copy-cut” new initiatives to try to gain market share from each other). So far Etsy has managed to successfully compete with these brands by niching down its focus and creating more humanized experiences/relations between buyers and sellers. This has allowed the company to create a strong and well-differentiated brand that buyers and sellers recognize as the go-to place when it comes to unique products; this focus on niches and well-defined product categories that allow buyers to request personalized creation is what we believe really differentiates Etsy from major e-commerce marketplaces like Amazon & eBay. For the future, we see Etsy doubling down on this strategy of tapping into niche markets and leveraging its expertise to create better buyer & seller experiences in specific product categories (the company’s recent acquisitions are proof of this). In regard to the second group of competitors instead, we observe these players focusing more on the ideology of what sellers and buyers want. These competitors, in fact, operate mainly as backend systems on which sellers can create their own e-commerces stack with as much personalization as they want (see Shopify and Wix). We think this conceptual difference is important to consider as it may affect sellers’ preferences in the future, hence bringing more sellers to choose this typology of platforms to sell their goods vs. set-in-stone marketplaces like Etsy.com, Depop etc. Yet, Etsy is putting in place numerous initiatives to make sure that buyers and sellers have a great time when exploring the company’s marketplaces while increasing conversion rates to achieve better financial performance. Of the initiatives we’ve analyzed, the one that we believe has the biggest potential is the new capability launched in 2021 called “XWalk”, a large-scale, real-time graph retrieval engine that expands Etsy’s ability to process data and eventually improve conversion rate, by showing more relevant inventory to buyers. We believe that this attention to the user experience will eventually allow Etsy to increase product stickiness and retain users over platforms like Shopify and Wix for instance.

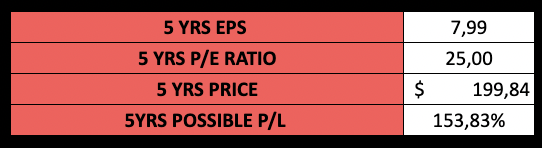

Rating: BUY (+153.83% in 5yrs)

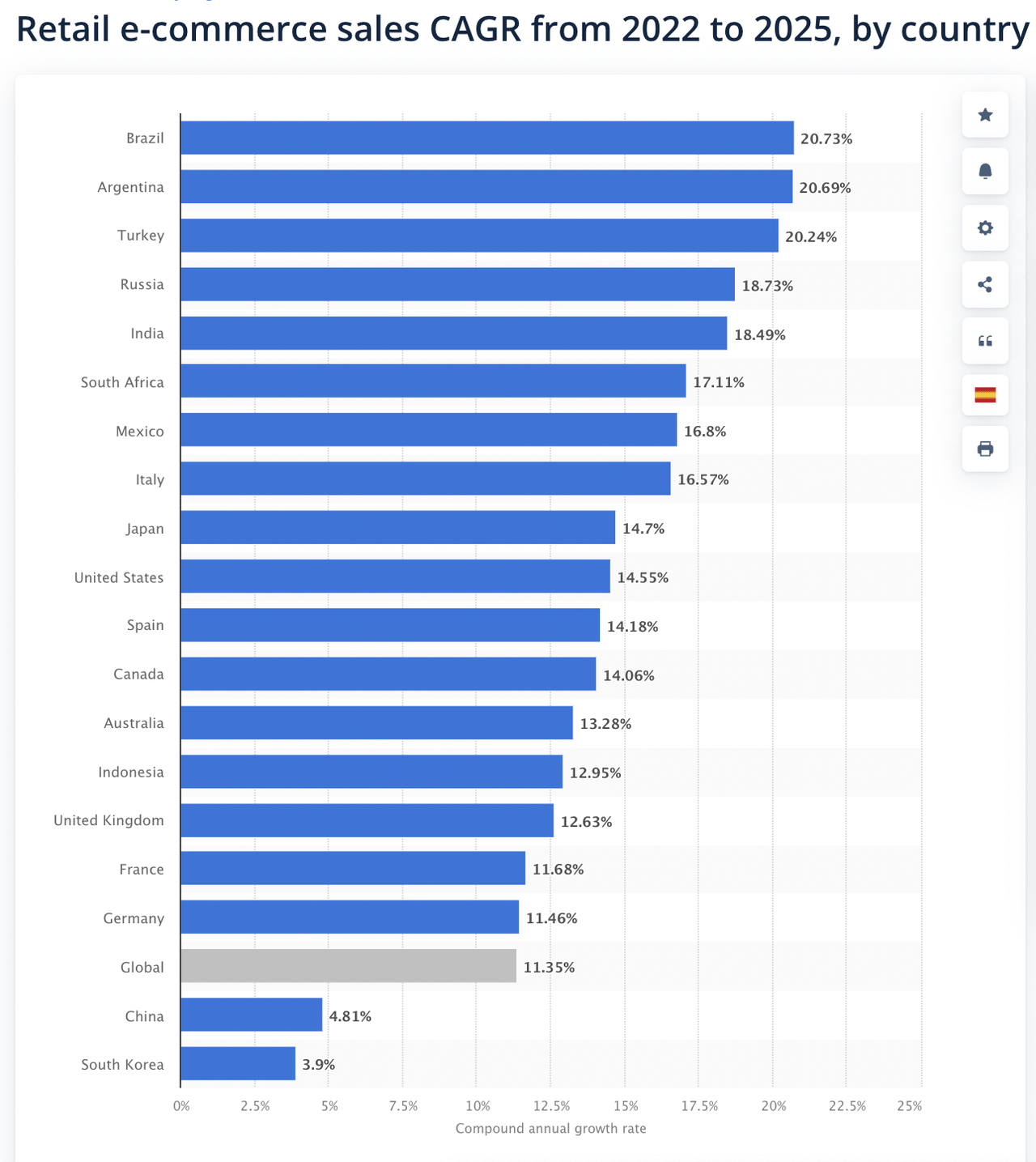

Based on our analysis and our assessment of the company’s financials, we give Etsy Inc. a rating of BUY. In fact, we think Etsy is particularly well-positioned geographically to capitalize on the industry-wide uptrend in the e-commerce sector that will see the demand growing over the next few years (see chart below from Statista).

Retail e-commerce sales CAGR 2022-2025 by country (Statista)

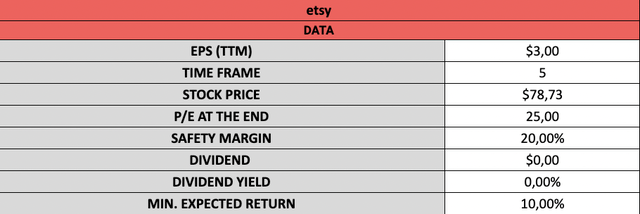

Precisely we expect the stock to grow 153.83% in 5 yrs reaching a price target of $199.84 in 2027 vs. $78.73 current stock price (at the time of writing). We arrive at this conclusion by analyzing first of all the company’s balance sheet to determine Etsy Inc. financial solidity and then focusing on the company’s income statements for the last 3 years to give ourselves a relevant overview of the current growth rates of the business and be able to set up realistic future growth estimates while contextualizing each data point. Below is a summary of the main data category we use in our calculations to arrive at our 5 years target price.

Finbuddy Investments

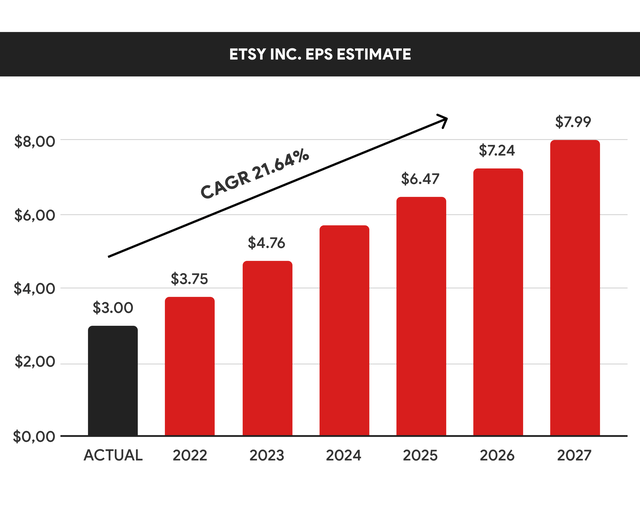

In our analysis we observe that Etsy’s EPS have been growing strongly at a CAGR of 58.77% over the last 3 years; yet, we believe this result is heavily influenced by the pandemic as the Covid-19 contributed to creating a series of scenarios that we believe positively affected Etsy’s overall performance. As such, we anticipate Etsy’s future EPS to continue growing but at a lower CAGR of only 21.64%; we get to this data point by calculating the average between the growth estimate we attribute to Etsy based on our personal experience (20.99%) with 4 other different analyst estimates we take from official sources online (Finviz estimate, Marketwatch estimate, Market Screener estimate and Simply Wall Street estimate – see table below).

Seeking Alpha, Finbuddy Investments

Etsy’s EPS CAGR estimate analysis

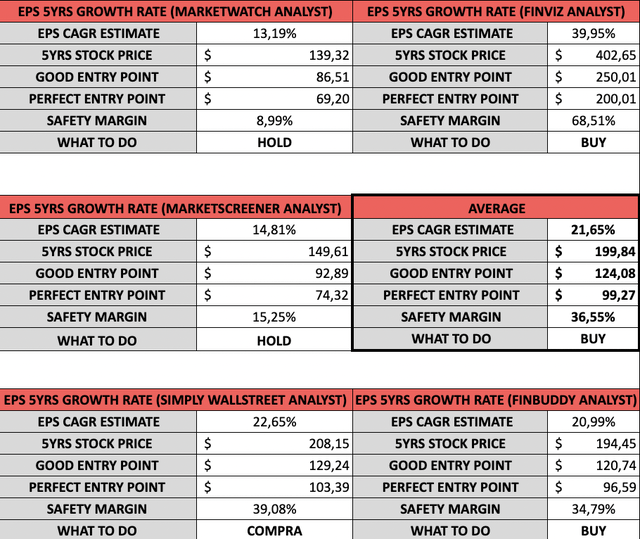

Finbuddy Investments

Legend

| EPS CAGR ESTIMATE | it is the weighted average between our EPS estimate and 4 different official sources |

| 5YRS STOCK PRICE | here’s the formula we use to get to this data:(Current EPS*((1+EPS CAGR estimate)^Time frame)*PE at the end)(3*((1+0.2165)^5)*25 |

| GOOD ENTRY POINT | entry price that would allow us to generate a 10% return on Etsy |

| PERFECT ENTRY POINT | entry price that would allow us to generate a 10% return on Etsy with a 20% safety margin |

| SAFETY MARGIN | the percentage we set as a hedge against potential market mispricing and inaccurate calculations |

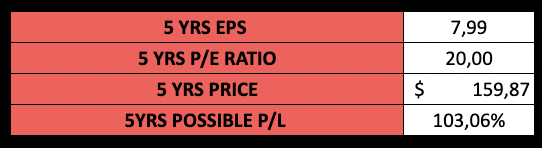

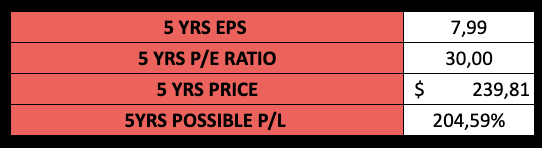

Below we calculate Etsy’s 5-year target price based on 3 different scenarios contemplating different PE ratios. For the moderate scenario, we decide to account for Etsy’s overweight results in the last 2 years due to the pandemic (as mentioned above) by adopting an adjusted PE ratio of 25 to discount Etsy’s earnings for the next 5yrs; based on our personal experience, we believe that a PE ratio of 25 is reasonable in this context as it deducts from our calculations the massive hyper-valuation that the entire e-commerce sector experienced in 2020/2021 due to the pandemic; the PE ratio we use in our analysis is in fact conservatively 66% lower compared to Etsy Inc. average PE ratio of the last 3 years which amounts to 74.85 (Etsy’s PE reached a peak of 220 in August 2020) and it’s rather in line with the 3 years historical PE ratio of the entire e-commerce sector in the U.S., which is equal to 27.9 from Simply Wall St. On top of that, we report below a scenario in which the PE is lower than expected wherein we anticipate the market to under-appreciate Etsy and award the stock a PE ratio of only 20 and a positive scenario in which the market instead over-appreciates Etsy with a PE ratio of 30. As always, anticipating accurately future growth estimates is very difficult, yet, by contemplating different scenarios we try to minimize negative surprises and make informed decisions that take into account all possibilities, hence reducing our risk.

Conclusion

As a conclusion, we believe that Etsy Inc. continues to be an investment with great return potential especially in a long-term perspective. This is because we believe that user demand for e-commerce products remains strong and will likely increase in the coming years. In addition to that, we anticipate Etsy’s recent acquisitions to contribute strongly to the business’ overall performance and growth efforts in the near future and that this expansion efforts will allow Etsy Inc. to tap into new high-growth markets like Brazil for instance and generate higher-than-expected revenues from those markets. Finally, with the market continuing to fall, we believe that the stock has now reached a very attractive entry price.