ERTH: Better To Avoid Due To Valuation, Quality Issues, Inflation Risk (NYSEARCA:ERTH)

SW Photography/DigitalVision via Getty Images

As the PPI and CPI reports for September are looming, together with the beginning of the Q3 earnings season, I would like to touch upon the unobvious corner of the market that might suffer a further decline in case U.S. inflation figures surprise to the upside once again.

The Invesco MSCI Sustainable Future ETF (NYSEARCA:ERTH) has an ESG-centered strategy, with a portfolio of names that develop products and solutions essential for the global economy transition towards becoming more sustainable and environmentally responsible. The sub-themes it targets range from EVs to wind power and sustainable agriculture.

The issue with the strategy is that the growth (or the hype, if you please) premia inherent to names involved in renewable energy and adjacent segments pushed their trading multiples to the extremes, thanks to the climate change narrative that bolstered investments, with countries across the globe discussing new ambitious targets (i.e., the EU’s 2030 Climate Target Plan is worth mentioning here), and partly because of risk appetite fueled by the rock-bottom interest rates.

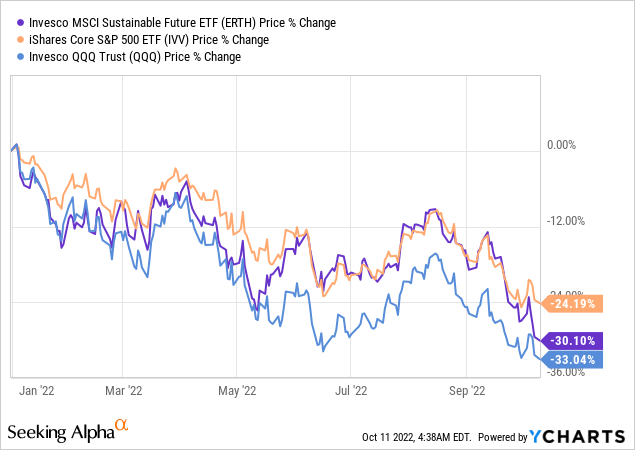

But when the era of capital scarcity arrived, conflating with an energy crisis, intrinsic values the market had forecast became irrelevant. No coincidence that ERTH is down ~30% since the beginning of 2022.

Now, we highlight two major issues that still make the ETF and its peer cleantech-focused funds an exceedingly risky bet in the current environment.

Even though I am moderately skeptical about the prospects of names involved in the green future theme, despite the fact that the energy crisis partly driven by geopolitical issues will most likely slow down the pace of transition towards more sustainable energy generation, ERTH is not a Buy at these levels as there are strong reasons to avoid it. Specifically, the U.S. PPI and CPI data risk overshooting consensus expectations again. As higher inflation means higher interest rates, while burdensome rates might mean a full-scale recession, combined, these factors invite multiple compression for richly valued sustainability plays, resulting in a steep decline in ERTH’s price. Also, it is not to be overlooked that the fund is overweight non-U.S. stocks, and hot inflation data might send most currencies down, the renminbi, yen, and euro being no exception, adding to its difficulties.

The strategy: looking under the hood

ERTH was incepted in 2006, but its strategy underwent changes in 2021, with the underlying index replaced by the MSCI Global Environment Select Index. Previously, it was known as the Invesco Cleantech ETF, with a ticker PZD.

However, even though the differences between the indices exist, it was not a tectonic shift, hence, we would not say that returns the fund had delivered prior to the index change were rendered completely irrelevant.

The starting universe is the MSCI ACWI Investable Market Index. Interestingly, REITs can also compete for a place in the sustainability index (and they are aplenty in the portfolio) in case the provider finds they contribute to the six Environmental Impact Themes, namely “alternative energy, energy efficiency, green building, sustainable water, pollution prevention and control, and sustainable agriculture.” Both emerging and developed world equities (ADRs included) are eligible.

Players that qualified for the final version of the portfolio are free-float-adjusted market-cap-weighted, with a 5% single-stock cap applied and rebalancing implemented quarterly; this simplistic weighting adds to risk as the most generously valued names tend to occupy the leading positions, thus exposing the fund’s portfolio to steeper drawdowns during periods of market anxiety, like the one we have been watching this year.

The current version of the ERTH portfolio contains 164 holdings, with a tilt toward the industrial sector which accounts for around 28.2%. Down the list, we see consumer discretionary stocks with ~17.8%, with Tesla (TSLA) being the key example, and then IT with its ~16.3% share of the net assets.

In terms of country exposure, as I said above, U.S. companies have the lion’s share of the portfolio, with ~44% weight, yet the remaining part is sensitive to the global currencies’ depreciation in case persistent inflation in the U.S. triggers a fresh wave of the USD rally. Chinese companies (close to 16%) are in second place, with NIO Inc. (NIO), a New York, Hong Kong, and Singapore-quoted stock nicely encapsulating the electric vehicles theme, being an example worth mentioning, with a weight of 4.3%.

A few of my readers would likely note here that for NIO, the weaker RMB is a tailwind as it reports in this currency, yet I would be skeptical here as the firm uses both the USD and RMB, so its results will reflect softness in the Chinese currency regardless.

Next, we see a ~7.4% allocation to Japan and Central Japan Railway as the fund’s key Tokyo-quoted holding with a ~3.7% weight. Softness in the yen has been phenomenal this year, and I see little reason for it to remain steady in case U.S. inflation data disappoints. On a side note, the company has qualified for the sustainability index more likely due to its energy-saving efforts.

Delving deeper, there is Denmark, represented by Vestas Wind Systems A/S, a heavyweight name in the wind turbine manufacturing industry, accounting for 4.5%. Let me briefly remind you that the Danish krone is pegged to the euro, and quasi-exposure to this embattled currency, aside from direct exposure via, for instance, EDP Renováveis, a Madrid-quoted utility operating power plants which generate energy from renewable sources, is yet another reason to be cautious on ERTH.

What returns is it capable of delivering?

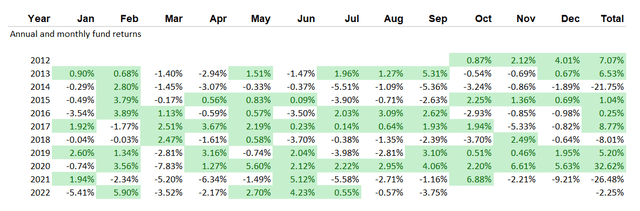

Looking at the ten-year data (during most of the period, it had a legacy ticker and a different index, yet with a strategy mostly similar to the current one), we can conclude the fund delivered fairly solid returns, beating the iShares Core S&P 500 ETF (IVV) every year except for 2014, 2018, 2021, and 2022 YTD. Its 2020 performance is especially remarkable, as the conditions were phenomenally supportive of the cleantech theme: rock-bottom rates, growing climate change concerns, risk appetite, etc.

Created by the author using data from Portfolio Visualizer

But what happened in 2021 as it underperformed IVV by a spectacular 26.5%? It was the capital rotation to value/cyclicals and the removal of the pandemic premium, which continued in 2022.

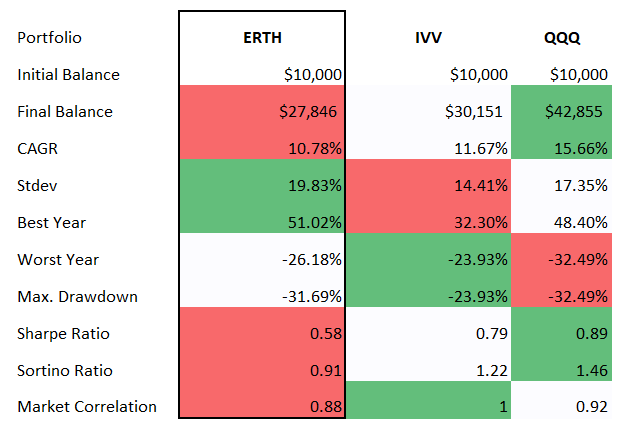

So with 2021 and 2022 factored in, the compound annual growth rate of ERTH over that period looks rather bleak, both compared to IVV and the Invesco QQQ ETF (QQQ).

Created by the author using data from Portfolio Visualizer

ERTH is not a Buy at these levels

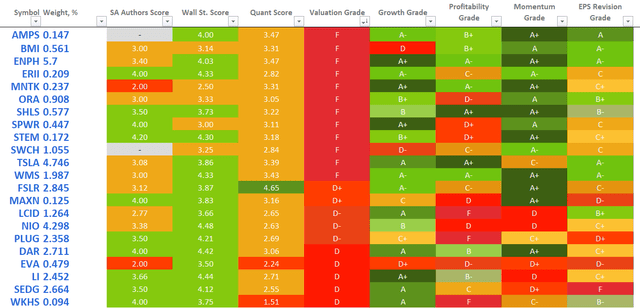

In conclusion, to assess whether valuations have normalized across ERTH’s holdings this year amid the raging bear market, I have taken a sample of 54 U.S. and Canada-quoted stocks as well as American Depositary Receipts; the cohort account for around 54% of the net assets. The findings aren’t very encouraging.

First, the weight of stocks with adequate value characteristics (the Quant Valuation rating of B- or better) is just 6.4% (19 companies), while those priced horribly account for ~36%. These names are summarized in the table below:

Created by the author using data from Seeking Alpha and the fund

Second, 36 stocks (~46% weight) have an EV/Sales ratio north of 2.6x, the median for the traditionally expensive IT sector. This is yet another red flag.

Speaking about quality, the factor of paramount importance, the situation is also far from rosy. 20 companies (~11.5% weight in ERTH) in the cohort are outspending their net operating cash flows, while 15 (13.3%) are EBITDA-negative.

In sum, while paying due attention to the FX risks, I believe ERTH is a suboptimal investment in the current environment.