Embark Tech: Uncertainties In Push For Autonomous Truck Operations (NASDAQ:EMBK)

Scharfsinn86

A Quick Take On Embark Technology

Embark Technology, Inc. (NASDAQ:EMBK) reported its Q1 2022 financial results in May, continuing the firm’s pre-revenue status while increasing its operating losses significantly.

The company is developing what it calls a “full stack” autonomous truck driving system in the United States.

I see significant uncertainties, including regulatory, technological and economic, so I’m on Hold for Embark for the near term.

Embark Overview

San Francisco-based Embark was founded in 2016 to create autonomous truck driving software and monitoring capabilities for use in the United States.

The firm is headed by co-founder and CEO Alex Rodrigues, who was previously co-founder at Varden Labs and a software engineer at Khan Academy and Nuance Communications.

The company’s primary offerings include:

-

Embark Driver – driving software

-

Universal Interface – OEM integration

-

Guardian – Dispatch and monitoring system

The firm does not yet have paying customers as its system is still in testing and has not been approved for fully commercial operation in California or other U.S. states in which it seeks to operate.

In November 2021, Embark merged with SPAC Northern Genesis Acquisition II in a deal valued at around $5 billion at the time. Currently, Embark’s market capitalization is around $246 million.

Embark’s Market & Competition

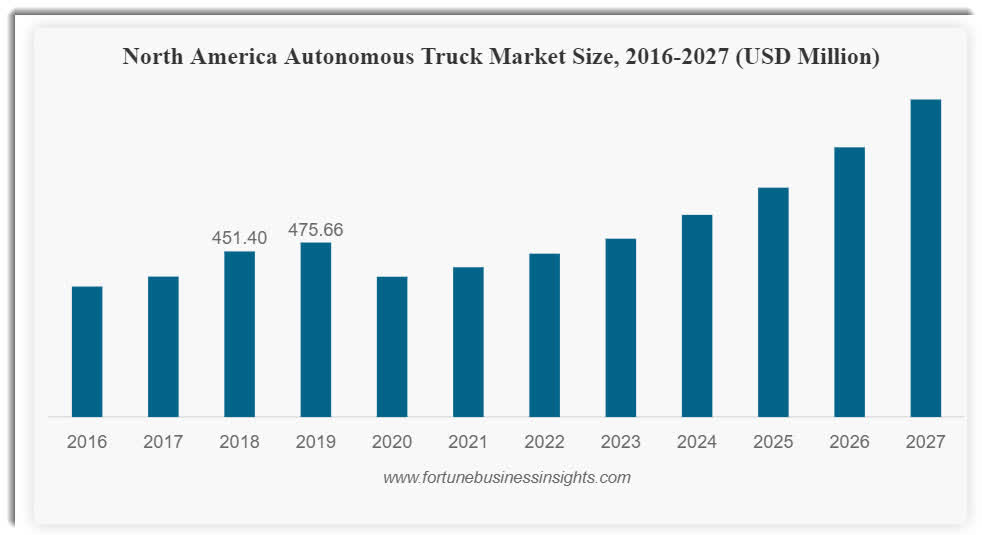

According to a 2020 market research report by Fortune Business Insights, the global market for autonomous trucks and related technologies was $1.1 billion in 2019 and is forecast to reach $2.0 billion by 2027.

This represents a forecast CAGR of 12.6% from 2020 to 2027.

The main drivers for this expected growth are quick progress on sensor technologies and related software processing capabilities as well as improved wireless networks enabling greater truck sector autonomy.

Also, below is a chart showing the historical and projected growth trajectory for autonomous trucking in the U.S.:

N. America Autonomous Truck Market (Fortune Business Insights)

Major competitive or other industry participants include:

-

Google

-

UPS

-

TuSimple

-

Continental

-

AB Volvo

-

Daimler

-

Caterpillar

-

NVIDIA

-

Aptiv

-

Tesla

-

Others

Embark’s Recent Financial Performance & Metrics

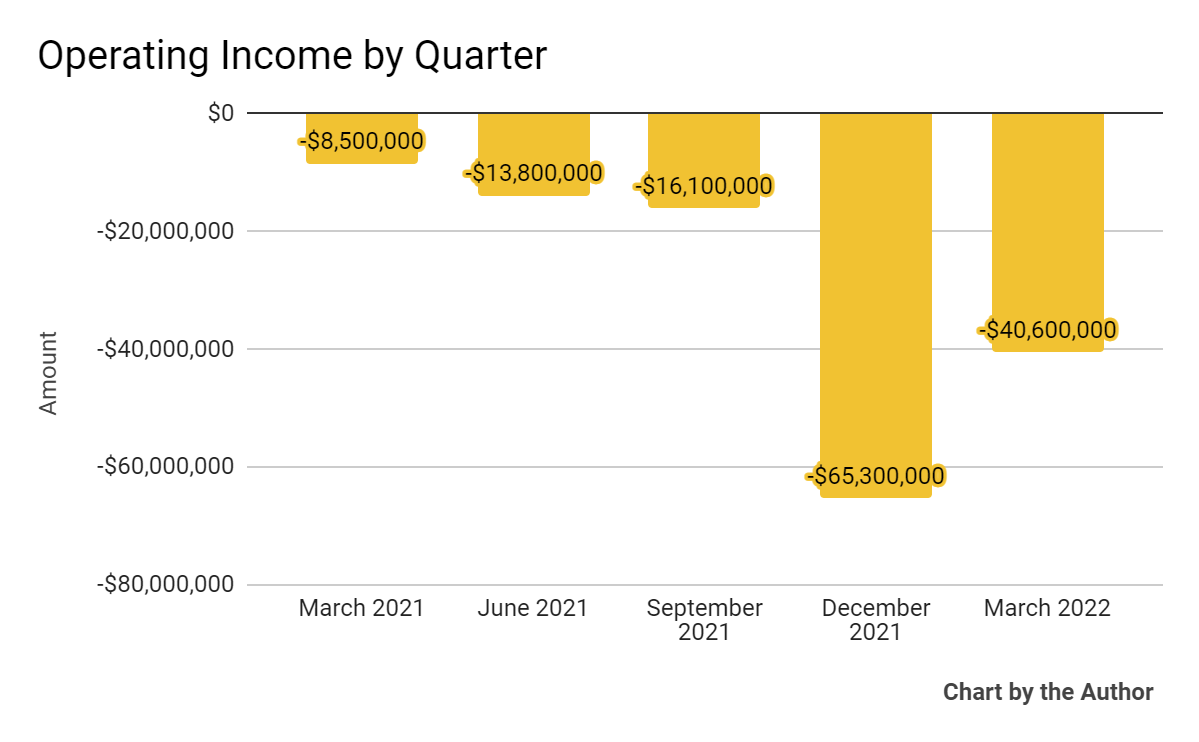

The company has yet to report revenues.

-

Operating losses by quarter have worsened sharply in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

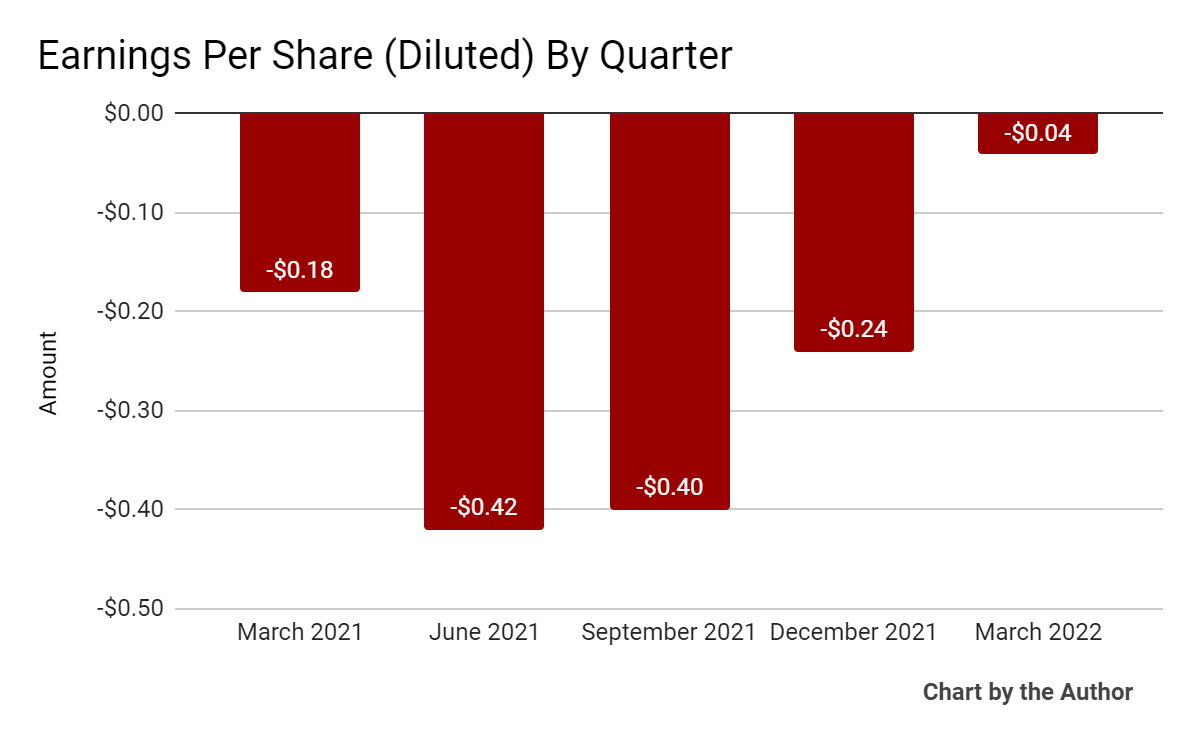

Earnings per share (Diluted) have remained negative:

5 Quarter Earnings Per Share (Seeking Alpha)

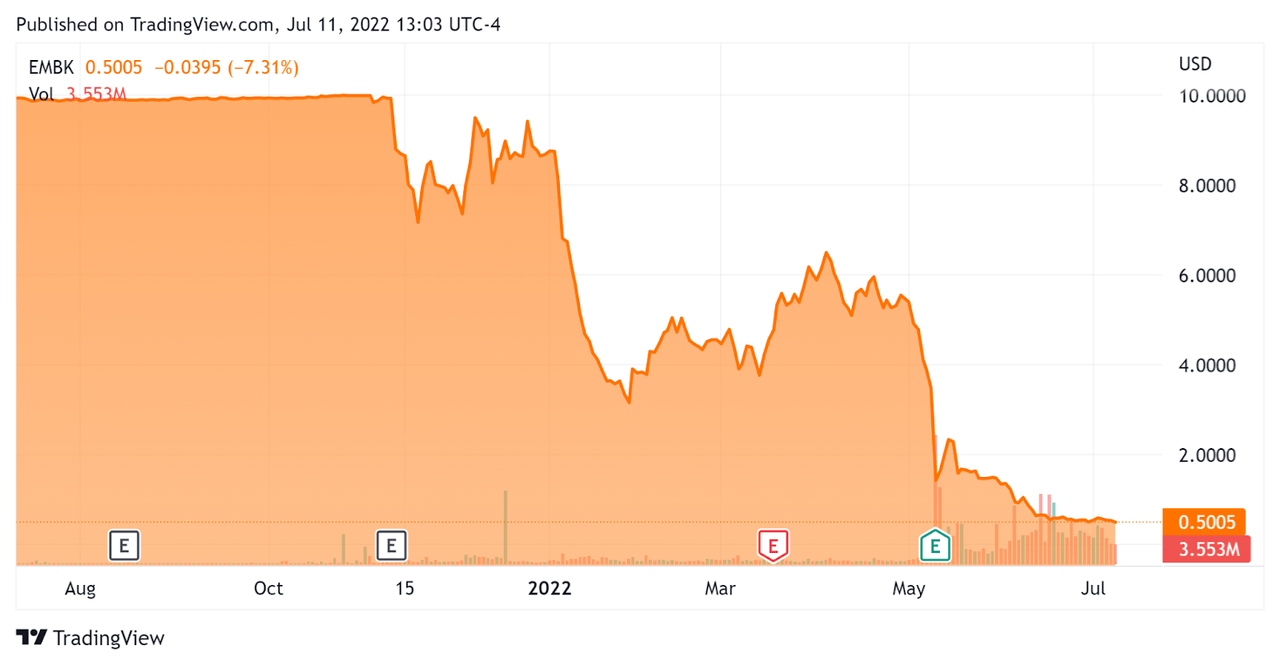

In the past 7 months or so, EMBK’s stock price has fallen 95 percent vs. the U.S. S&P 500 Index’s drop of around 12 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$8,240,000 |

|

Market Capitalization |

$245,920,000 |

|

Enterprise Value / Sales [FWD] |

30.91 |

|

Price / Sales [FWD] |

922.17 |

|

Earnings Per Share (Fully Diluted) |

-$1.10 |

(Source – Seeking Alpha)

Commentary On Embark

In its last conference call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the receipt of its first trucks from Knight-Swift for its Truck Transfer Program, where “carriers own, operate, and maintain an Embark-equipped autonomous truck.”

The firm recently started 24-hour daily testing of its technologies on the I-10 interstate freeway in Texas which will enable it to double the testing capacity as well as include the night time driving environment in its testing functions.

CEO Rodrigues also reiterated the recent inclusion of US Xpress in its partner development program and plans including preparing US Xpress terminals ‘to receive and launch Embark-equipped autonomous trucks.’

Notably, the firm is making progress toward its 2022 goals for launching the backbone of its system across the Sunbelt states.

However, in California, the company, along with numerous other industry participants, has signed a letter to the governor urging the state to lift its ban on autonomous semi trailer trucks on public roads.

As to its financial results, operating losses have worsened in recent quarters as the firm has increased its headcount in a challenging hiring environment.

For the balance sheet, the firm ended the quarter with $245 million in cash and equivalents after spending nearly $20 million in free cash during the quarter.

Extrapolating from the spend run rate, the company would have roughly 19 months before running out of cash.

Regarding valuation, the market has punished the firm severely from its SPAC deal valuation.

The primary risk to the company’s outlook is slow regulatory action in the various sunbelt states in which it is likely to see first business activity.

Additionally, a looming recession in the U.S. may slow customer/pilot partner cycle times resulting in longer time to revenue, even assuming regulatory approvals.

While long-term investors may see value in the stock’s current low nominal price, the firm faces significant competition from well-capitalized companies in the space.

I see significant uncertainties, including regulatory, technological and economic, so I’m on Hold for Embark for the near term.