Elastic (ESTC) Stock: Value Makes Up For Growth Deceleration

ipopba/iStock via Getty Images

Amid unprecedented market volatility, those with strong stomachs understand this: now is the time to go shopping, particularly in the tech sector. Many high-growth software and internet companies have given up virtually all of their gains since the pandemic began (and some have dropped even below that), which is unfair after two years of stellar fundamental growth.

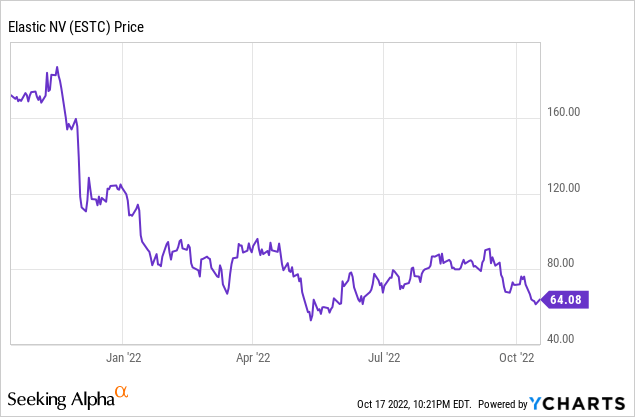

Elastic (NYSE:ESTC), in particular, is one name worth watching. This infrastructure software company, a leader in in-app search technologies, has suffered a ~50% decline in its stock year to date. While it’s true that the business is seeing revenue decelerate (both as a function of a weakening macro outlook as well as natural deceleration that comes with scale), Elastic’s sharp drop in valuations makes it a very worthwhile buy opportunity worth exploring.

I remain bullish on Elastic. I view the company as being weighed down by the same macro headwinds as all other companies – weakened IT purchases from companies tightening their belts and delaying capital projects, as well as sharp FX headwinds from the strengthening dollar. Nothing, in my view, is Elastic-specific.

It’s worth calling out as well that Elastic continues to project confidence in its medium-term outlook of roughly doubling revenue to $2 billion by FY25, or two years from now. It still also expects its Elastic Cloud product to represent more than half of revenue by then, while also delivering “several points” of operating margin expansion each year.

Elastic long-term outlook (Elastic Q1 earnings deck)

As a refresher for investors who are newer to this name, here are the key long-term reasons to be bullish on Elastic:

- Elastic has three powerful tools in its suite, powering enterprise search, security, and APM. Search is Elastic’s bread and butter, and the company is the best-in-breed leader at infrastructure that allows you to essentially perform a Google-like search within the confines of a certain application. Security is a natural extension of Elastic’s data-monitoring ability, with companies using Elastic to protect against fraud and cyber threats. The latter category (APM), meanwhile, is the same space that hotshot Datadog (DDOG) is in, and helps companies maintain their tech stack uptime and monitor performance. The basic point is this: Elastic’s core platform supports a variety of use cases and one that has been adopted by major corporations. It estimates its global TAM at $78 billion, suggesting only ~1% current penetration. This TAM has grown significantly versus $45 billion at the time of Elastic’s IPO in 2018.

- Purely recurring, high-margin software product. 90+% of Elastic’s revenue comes from subscriptions, meaning the company has very high revenue visibility. It has net revenue expansion rates of ~130%, meaning the majority of its customers upsell dramatically (versus ~110% net expansion rates for most other software companies). On top of that, Elastic’s revenue comes in at a high-70s gross margin. The math on this works out like a charm: as more and more Elastic customers renew and expand, Elastic can take advantage of its huge gross margin to scale profitably, given that renewal deals to existing customers cost far less in terms of sales dollars to achieve.

- Very sticky technology base. Elastic is in a category of software considered “infrastructure software,” which means that it sits at the heart of a company’s IT stack. This kind of software is very difficult to rip out (versus a top-end application, like a CRM system, that is relatively easier to stop using and migrate to another solution).

- Strong cloud growth. Elastic’s hosted cloud solutions are seeing much stronger (~60% y/y) growth rates relative to the rest of the company, which serves as an additional upside catalyst for investors to be excited about. It also gives Elastic an easy route to market for customers who are on services like Amazon AWS, where Elastic now features very native integrations.

From a valuation perspective, Elastic has never looked more attractive. At current share prices near $64, Elastic trades at a market cap of $6.09 billion. After netting off the $848.8 million of cash and $566.8 million of debt on the company’s most recent balance sheet, the company’s resulting enterprise value is $5.81 billion.

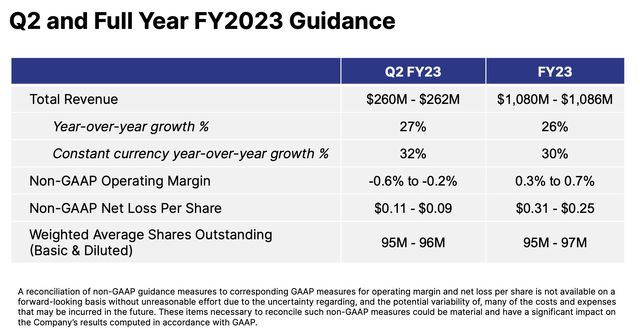

Meanwhile, for the current fiscal year, Elastic has guided to $1.08-$1.086 billion in revenue, representing 26% y/y growth on an as-reported basis (FX-neutral growth would be four points stronger at 30% y/y).

Elastic guidance (Elastic Q1 earnings deck)

Versus this outlook, Elastic trades at just 5.3x EV/FY23 revenue – which is quite a bargain for a company that is still growing in the mid-20s while also hitting an above-breakeven pro forma operating margin.

Stay long here. Elastic’s recent downtrend is a function of heightened paranoia over macro conditions, interest rates, and hesitation to invest in tech stocks in general. Once sentiment rebounds, Elastic will be able to recoup a fair value.

Q1 download

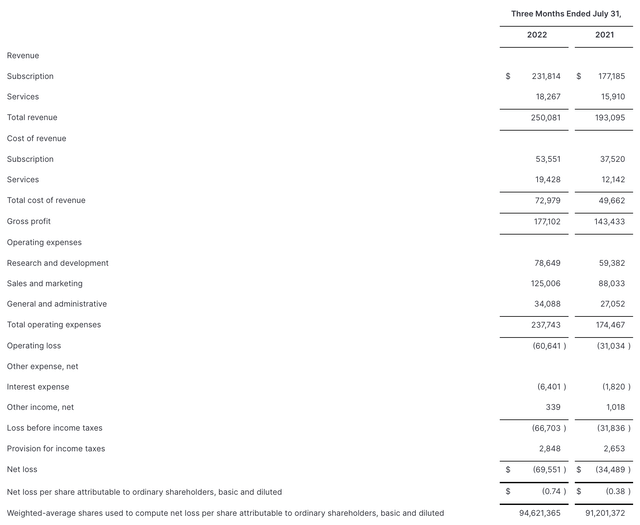

Let’s now review Elastic’s latest quarterly results in greater detail. The fiscal Q1 (July quarter) earnings summary is shown below:

Elastic Q1 results (Elastic Q1 earnings deck)

Elastic grew revenue at a 30% y/y pace to $250.1 million, beating Wall Street’s expectations of $246.4 million (+28% y/y) by a two-point margin. Revenue growth decelerated on an as-reported basis by five points relative to 35% y/y growth in Q4; but on a constant currency basis, Q1 growth of 34% y/y was down by three points relative to 37% y/y FX-neutral growth in Q4.

Cloud revenue saw similar trends as well: down to 59% y/y growth in Q1, versus 71% y/y growth in Q4 – but on a constant currency basis, cloud growth would have been stronger at 62% y/y. Again, while I think the deceleration here is a mix of natural scale-based deceleration, FX and macro trends, I think Elastic’s ~5x forward revenue valuation (typically a valuation assigned to a company growing in the mid-teens, outside of these abnormal, volatile times) more than makes up for that deceleration.

It’s worth noting too that Elastic managed to maintain a net revenue retention rate of “just under 130%” which is consistent to Q4 – signaling that at the very least, Elastic’s installed customer base is continuing to expand their spend at the same rate.

The company noted that in spite of macro headwinds, it was pleased with its sales execution (to the point where it felt confident to raise its full-year guidance, a rare beat and raise in an earnings cycle where many tech companies ended up cutting their guidance).

Here’s some helpful anecdotal commentary from CFO Janesh Moorjani’s prepared remarks on the Q1 earnings call:

We continued our momentum in Elastic Cloud, which represented 39% of total revenue in the quarter, up from 37% in Q4 and 32% a year ago. The resilience of our solutions in the current environment was evident through continued strength in new customer additions and a sustained high net expansion rate. And we did this while demonstrating expense discipline and operating leverage. We once again beat the high-end of both our top line and bottom line guidance for the quarter. We remain confident about the rest of the year and our long-term goals […]

To give you a bit more color on deal flow, we once again saw both strength and balance in deal flow across geographies, segments and industry verticals in the quarter. Adjusted for currency and duration, each geo grew orders in excess of 40% year-over-year growth. Cloud orders also remained strong. As we’ve said before, diversification is the strength of our business model and reflects the breadth and resilience of the solutions supported by our Search platform.

Throughout the quarter, we were also pleased with the strength and linearity as well as new logo wins and net expansions. The tone of customer conversations remain positive as we continue to work with them closely on mission-critical use cases in their businesses. All that said, we are aware that the external environment is dynamic and customers are increasingly agile in responding to changing circumstances. We continue to monitor this closely.”

From a profitability perspective, Elastic’s pro forma gross margins fell 370bps y/y to 73.9%, but we’re not overly concerned here as the company chalked this up to timing of professional services delivery. Pro forma operating margins also fell more than five points to -1.9%, versus 3.7% in the year-ago quarter, hurt by the one-time hit to gross margins as well as opex inflation (again, not an Elastic-specific phenomenon). We remain encouraged, however, by the company’s expectation of hitting above-breakeven margins for the year and its goal of continuing to expand margins by several points per year through FY25.

Key takeaways

We all know the saying that it’s best to buy when others are fearful, and this is very true of Elastic, which has been disproportionately punished by today’s bear market. Stay long here and take advantage of the opportunity to buy a fantastic stock at a great value.