Eaton Vance EFR Fund: 8% Yield Via This Leveraged Loan CEF

AerialPerspective Works

Thesis

Eaton Vance Senior Floating-Rate Trust (NYSE:EFR) is a closed end fund from the Eaton Vance family. The vehicle focuses on leveraged loans, and has a classic granular composition. The fund runs a bit on the aggressive side via its leverage, which is currently clocking in at 38%.

As per its literature:

The Fund’s investment objective is to provide a high level of current income. The Fund may, as a secondary objective, also seek preservation of capital to the extent consistent with its primary goal of high current income.

The CEF is currently fully covering its distribution from the cash flows received on the underlying loans, although earlier in the year it did use some ROC for distributions. Its long-term performance is very robust, with the fund falling in the middle of the return cohort when benchmarked against other leading loan CEFs.

The fund has a classic build through its granularity and collateral composition, both with mimic the wider market to a large extent:

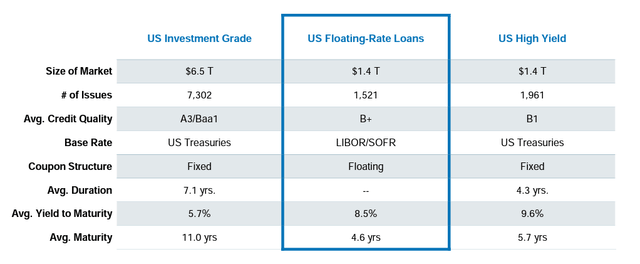

Leverage Loan Market (Eaton Vance)

We can see from the above table that leveraged loans have substantially grown in size, with the overall market now matching the fixed rate bond one. The average issuer has a single “B” rating and an average yield to maturity of 8.5%.

Holdings

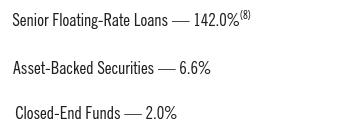

As extracted from its annual report, the fund is overweight floating rate loans:

Holding (Annual Report)

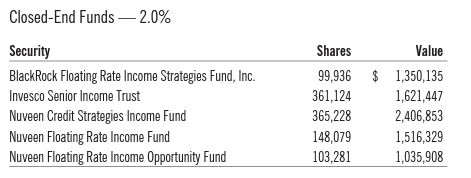

The above percentages add up to over 100% because the fund is including its leverage in the calculations. It is interesting to note the vehicle contains shares in other CEFs. When digging in, we noticed the shares held are in other leveraged loan funds:

CEF Holdings (Annual Report)

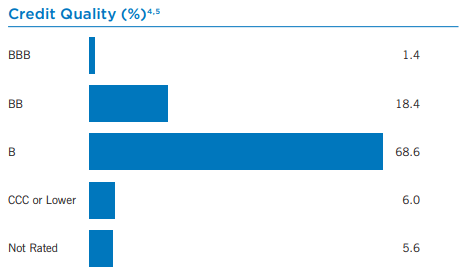

The fund runs a portfolio which has a high concentration in “B” names:

Ratings Distribution (Fund Fact Sheet)

We can notice from the above table that the vast majority of the collateral falls in the single-“B” rating band. Given the “CCC” bucket is extremely low, we cannot call the fund aggressive here, but usually we see “BB” credits accounting for more than 20% of a fund.

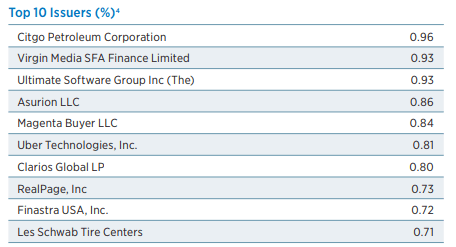

The collateral composition is fairly granular:

Top Issuers (Fund Fact Sheet)

We can notice from the above table that all issuers fall under a 1% threshold. That is an extremely granular approach, and we surmise this is made possible by the Eaton Vance platform. Usually, large asset managers have centralized credit platforms where issuer data is stored and the fund’s credit appetite vectors and limits are set up.

Performance

The fund is down -17% year to date:

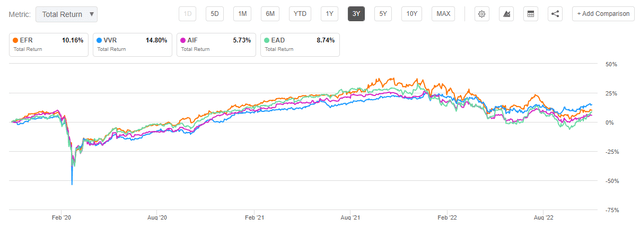

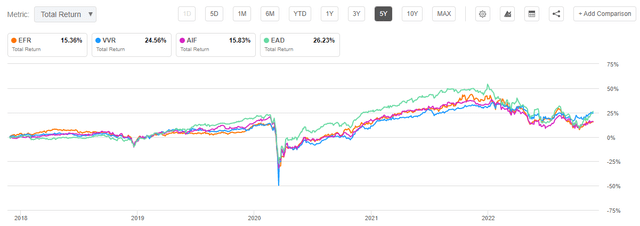

We can see that EFR’s performance is in line with the other robust leveraged loan CEFs covered so far.

On a 3-year time frame, we can observe the same distribution of total returns:

When extending the time horizon to 5 years, the cohort CEFs exhibit similar results:

EFR is a robust fund that has managed to outperform the index and is in the middle of the pack when compared with some other robust leveraged loans CEFs.

Premium/Discount to NAV

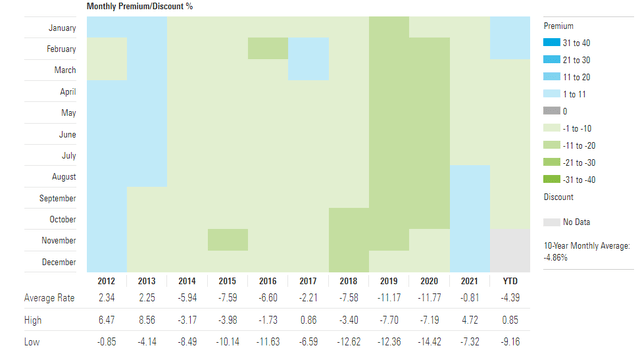

Outside the 2021 period, the fund has traded at a slight discount to net asset value:

Premium/Discount to NAV (Morningstar)

We can see that historically the CEF traded at a -6% discount to NAV. During the zero rates environment experienced in 2021, the vehicle moved to a premium for a short period of time.

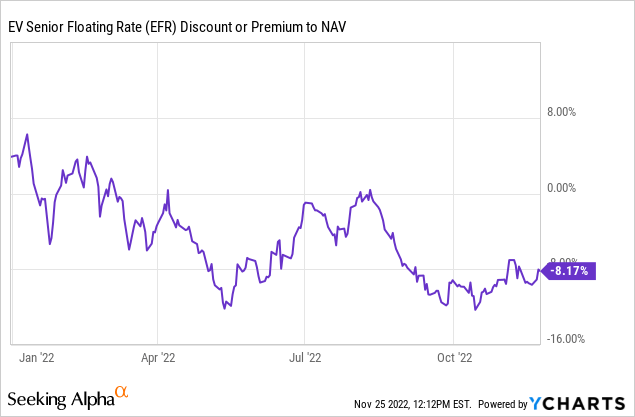

This year, the fund’s discount has exhibited a high correlation to the market risk-on / risk-off environment:

We can see how the CEF moved to a large discount during the June market sell-off, only to be flat to NAV during the rally in July/August. The story is similar for the current market rally, only that the fund is not “believing” the current risk-on move, given its discount is still on the wide side. The investor community is telling us there is another leg down to develop shortly.

Distributions

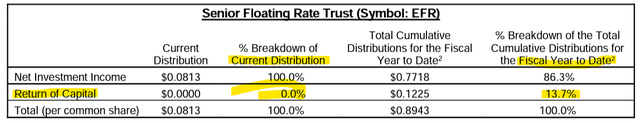

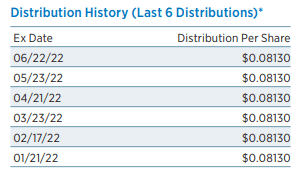

The fund has a monthly distribution of $0.0813 per share:

Distributions (Fund Fact Sheet)

While floating rates have risen, the fund only now fully covers what it disburses to shareholders:

We can see that for the latest distribution date the “Return of Capital” is 0%, but for the current Fiscal-Year-to-Date the percentage is not zero.

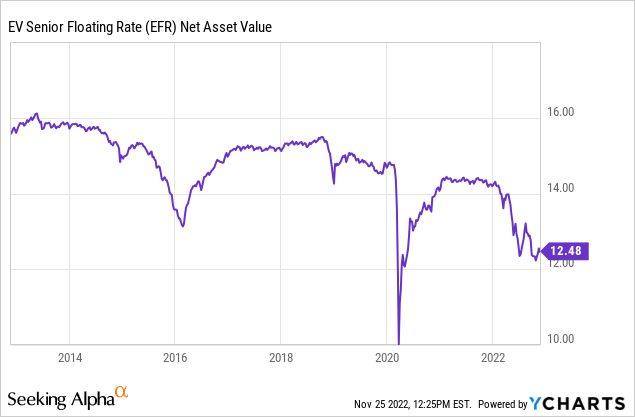

When looking at the historic NAV performance for the fund, we can notice that outside the market induced fall of 2022, the fund is exhibiting a fairly stable NAV:

This indicates that while the CEF might use ROC from time to time, it does not abuse this structural feature.

Conclusion

EFR is a closed end fund focused on leveraged loans. The vehicle comes from the Eaton Vance family and exhibits a classic granular build, although the leverage is on the high side at 38%. The vehicle focuses on single “B” loans, the market average, and has managed to deliver robust long-term results that benchmark favorably with other premier floating rate loan CEFs. The fund currently offers an 8% yield, which is fully covered by the interest income produced by the underlying loans. The vehicle is currently trading at an -8.4% discount to NAV. Expect this discount to move to a flat level when the market recovers in 2023. EFR is a robust buy-and-hold CEF, and while 2022 has been rough on all risk assets, do expect a bright performance from this fund next year, driven by credit spread narrowing and discount to NAV compression.