Dividend Challengers Review: Allegion (NYSE:ALLE)

AirfilmDrone/iStock via Getty Images

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long-term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided by other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of Allegion plc (NYSE:ALLE).

Allegion is a manufacturer and seller of mechanical and electronic security products and solutions throughout the world. The company was incorporated in 2013 and is headquartered in Dublin, Ireland.

Dividend

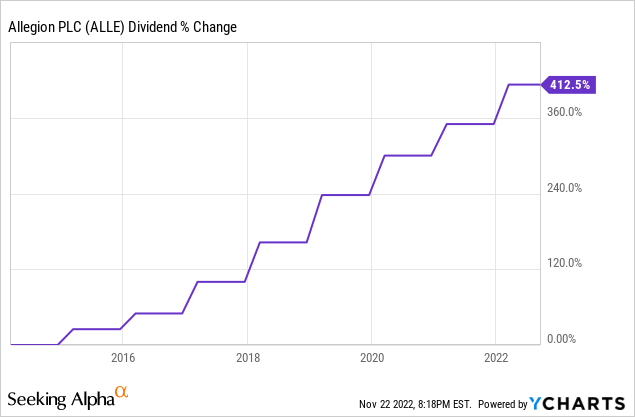

Allegion is on the verge of moving up to the Dividend Contenders list with 9 years of consecutive dividend increases. Looking at the chart below you can see that Allegion has seen impressive dividend growth during this time period.

Allegion’s latest dividend payment had an ex-div date of 9/15/2022 and was $0.41 per share, up from 2021’s $0.36 quarterly dividend rate.

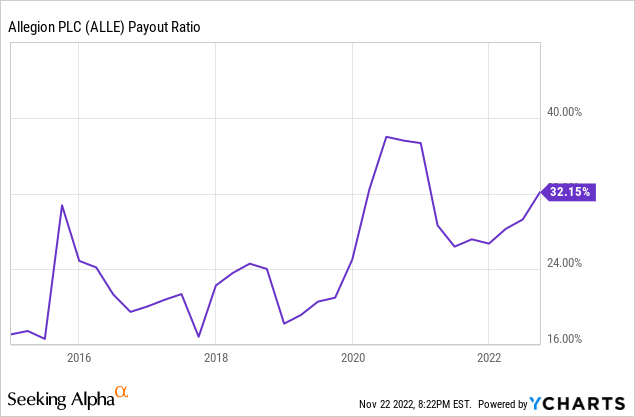

Looking at the chart below, you can see that Allegion’s payout ratio remains relatively low, meaning that it should be able to continue its low dividend growth moving forward.

Allegion currently maintains a dividend yield of 1.46%.

Financials

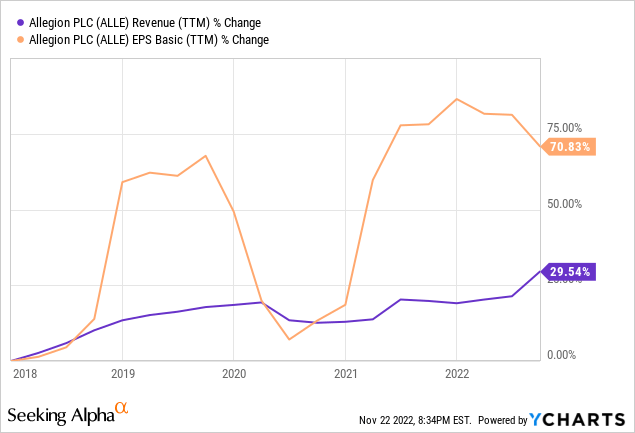

Allegion has seen ups and downs in terms of its revenue and earnings growth over the past several years. Looking at the chart below you can see that both revenue and earnings have seen overall positive growth during this period with Allegion’s earnings being more variable compared to Allegion’s more consistent revenue growth.

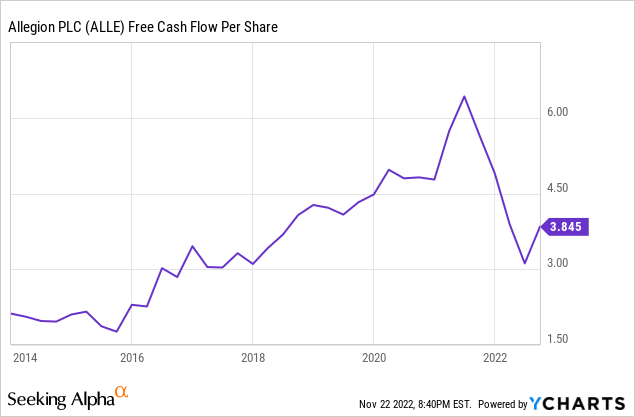

When looking at cash, you can see that Allegion’s free cash flow per share remains at a respectable level that should not affect its payout ratio or future dividend growth.

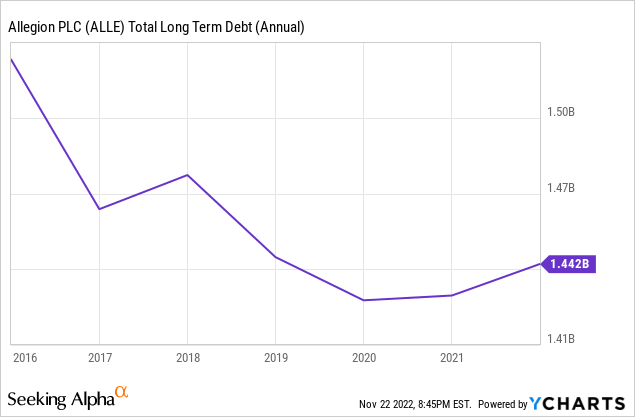

Allegion’s long-term debt also remains at the low end of its recent average.

Allegion had strong recent quarterly results in Q3 beating both revenue and earnings estimates. EPS beat by $0.16 per share and revenue beat by $40.12M.

Valuation and Performance

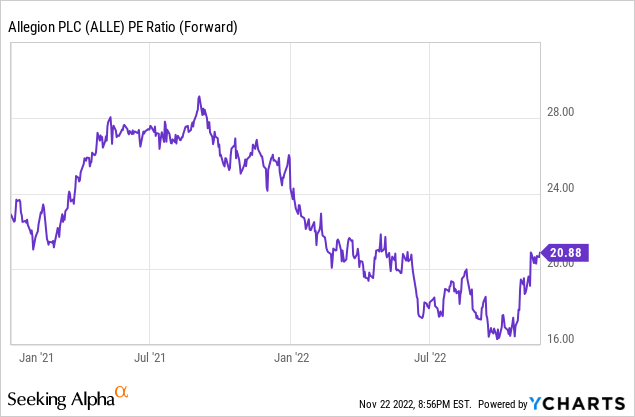

Allegion currently has a forward PE ratio of 20.88. Looking at the chart below, you can see that this remains low compared to its recent historical average.

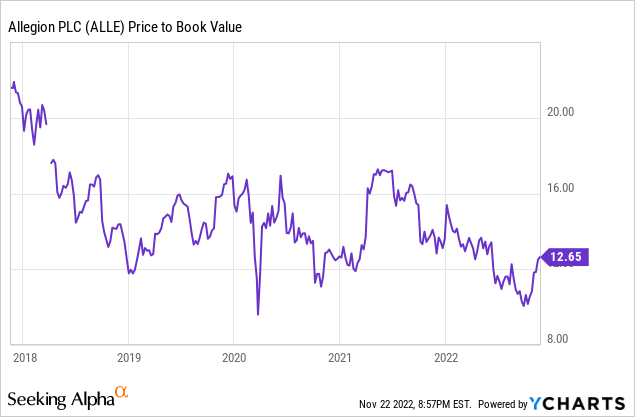

A similar trend can be seen when looking at Allegion’s price-to-book value.

At first glance, this seems like a positive and appears to make Allegion an attractively valued stock; however, this does not take into consideration Allegion’s price performance during this time period.

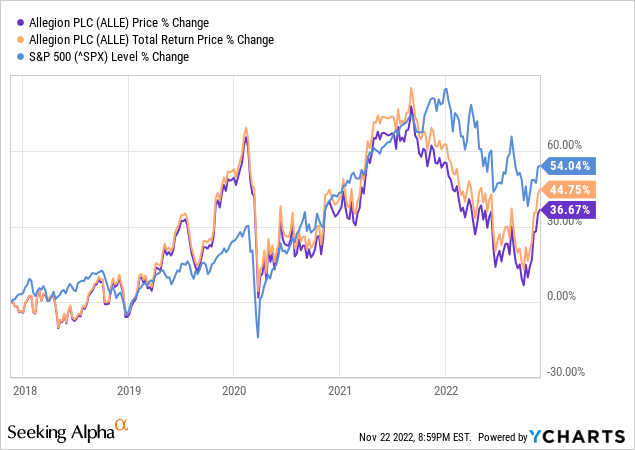

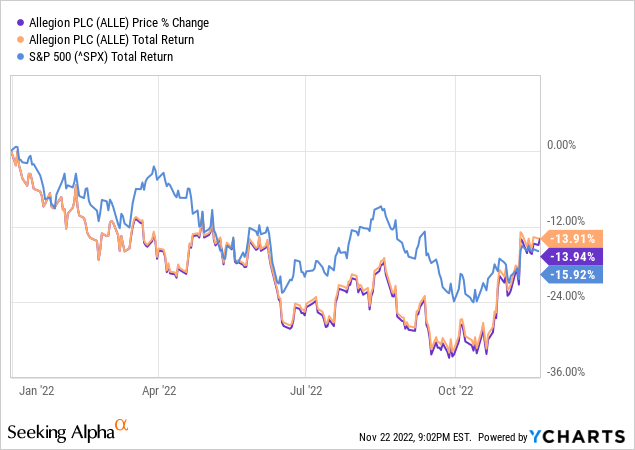

Looking at the chart below, you can see that Allegion’s performance has been closely aligned with the returns of the S&P 500 even though it has underperformed the index over the past five years.

However, looking at more recent performance, Allegion has slightly outperformed the S&P 500 year to date.

Peer Comparison

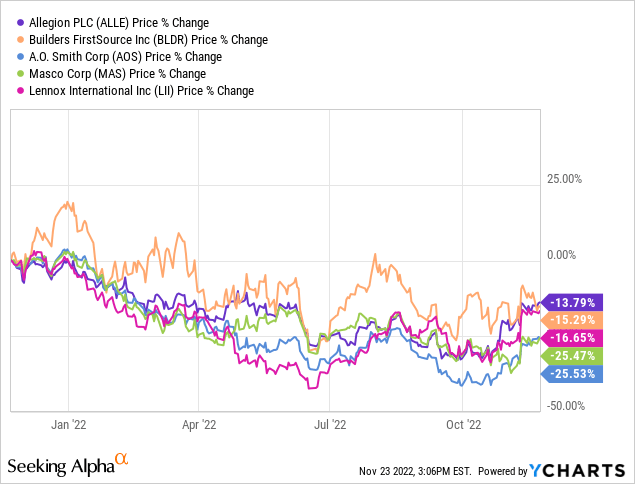

A few stocks within the same industry as Allegion include Lennox International (LII), Builders FirstSource (BLDR), A.O. Smith (AOS), and Masco (MAS).

In terms of stock price, you can see that the past year has been difficult for stocks within the building products industry. Each of the five stocks has seen declines in price over the past year; however, Allegion has seen the lowest drop in stock price out of this group of stocks.

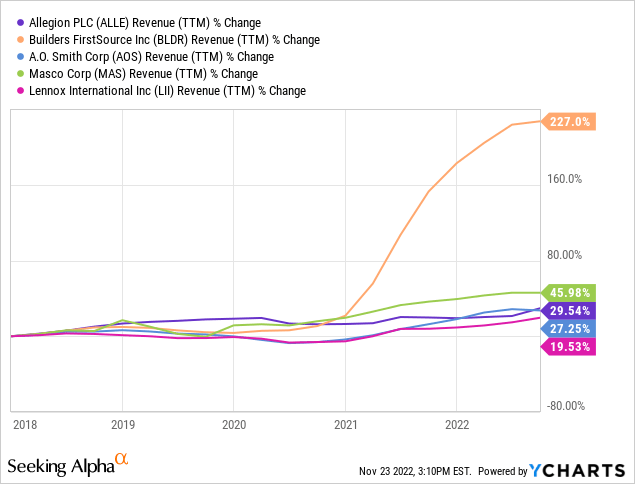

When looking at revenue growth you can see that with the exception of Builders FirstSource, which has seen tremendous revenue growth since 2021, Allegion compares favorably with the other stocks in this group.

Recent News

As stated above, Allegion had strong 3rd quarter results beating both revenue and earnings estimates. Some highlights from that report include:

- Adjusted net earnings up 5.1% compared to prior year

- Net revenues up 27.4% compared to prior year

- Organic net revenue up 18.6% compared to prior year

The company’s Americas business segment saw revenue increase by 42.5% while its International segment saw a decline in revenue of 13.6% due to softening markets in the region and the negative impact of currency movements.

It was recently announced that Allegion has agreed to acquire workforce management solution firm plano (the deal is expected to close in the first quarter of 2023).

Conclusion

I feel that Allegion is a great option for dividend growth investors. The company has continued to see revenue and earnings growth even during a difficult environment. There are definite environmental pressures, such as inflation, rising interest rates, and labor shortages that can negatively affect Allegion’s results moving forward but I feel that the company has enough diversification to weather any short-term storms it will encounter (which we have seen as its International business segment continues to struggle with revenue growth).

It’s dividend history has been very impressive. It raised its dividend by 13.9% this year, 12.5% last year, 18.5% in 2020, and 28.6% in 2019. With consistent double digit growth in its yearly dividend that is likely to continue, this stock is definitely a good one to consider especially as its valuation remains attractive compared to its recent historical averages.

I believe that Allegion compares favorably to the competitors list above even with Builders FirstSource’s impressive recent revenue growth. While the revenue growth is nice a good portion of that has come from several recent acquisitions. When taking into consideration that Builders FirstSource doesn’t offer a dividend and is currently in a transition phase as its CEO recently stepped down, I feel that Allegion is the safer bet. As always, I suggest individual investors perform their own research before making any investment decisions.