Disney: Despite The Recession, Donald Is Too Feisty (NYSE:DIS)

VCG/Getty Images News

Investment Thesis

These extreme levels of FUD have plummeted Walt Disney Company’s (NYSE:NYSE:DIS) stock price by -48.55% since its peak levels in early 2021. However, it is also interesting to note that the stock had a similar plunge of -50.78% during the previous recession, between September 2008 and March 2009. Given that DIS is already at its previous 7Y support level, it will be interesting to see how Donald steers the ship over the next few weeks. Its performance in the FQ4’22 earnings call will prove to be critical to its recovery as well, assuming a smashing forward guidance.

We are starting to see some spending weaknesses ahead, with the September CPI reporting a sequential reduction in lodging away from by -3.9% and slower growth in recreational services by 0.1%, despite the YoY growth of 3.1% and 4.1%, respectively. Nonetheless, despite all the recessionary fears, we are optimistic about DIS’ eventual recovery by the latest 2024, especially with its accelerated top and bottom lines growth ahead, aided by the eventual success of its streaming segment. Combined with the return of its theme park performance to pre-pandemic levels, the consensus price target in the range of $150s is not overly ambitious.

These Are Temporary Headwinds, Since FY2023 May Boost Its Stock Performance

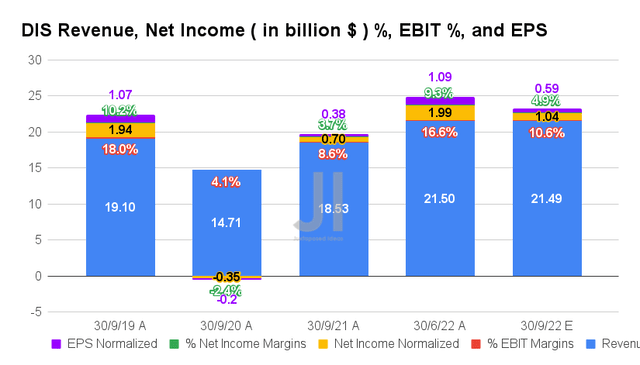

For its upcoming FQ4’22 earnings call, DIS is expected to report revenues of $21.49B, indicating in-line QoQ and an increase of 15.97% YoY. Despite the QoQ decline in its EBIT margins from 16.6% to 10.6%, we must also highlight the improvement YoY from 8.6%, due to the rising inflationary pressures and elevated operating expenses.

In the meantime, DIS is expected to report impacted profitability with net incomes of $1.04B and net income margins of 4.9%, indicating another QoQ decline of -47.73% and -4.4 percentage points, respectively. Otherwise, still a decent increase of 48.57% and 1.2 percentage points YoY, respectively, pointing to the company’s excellent FX hedging thus far.

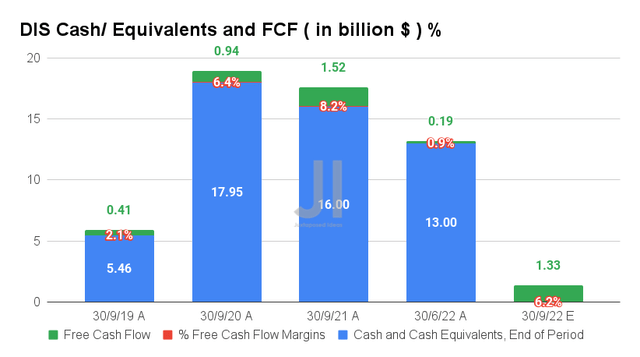

Nonetheless, analysts expect an improved Free Cash Flow (or FCF) generation of $1.33B and an FCF margin of 6.2% in FQ4’22, representing a favorable increase of 700% and 5.3 percentage points QoQ, respectively. This is attributed to its lower planned capital expenditure of $5B for FY2022, indicating a -9.09% revision to $1.22B for the quarter. Otherwise, a moderate YoY decline of -12.5% and 2 percentage points, respectively.

However, with DIS’ robust cash and equivalents of $13B on its balance sheet in FQ3’22, we are not concerned at all about the company’s liquidity moving forward. Especially, combined with the launch and profitability of its ad-supported tier and the priced-up premium tier from December 2022 onwards. We expect its FQ1’23 earnings call to be highly anticipated by market analysts indeed, potentially triggering a meaningful stock recovery, combined with the usual outperformance of its theme parks during the holiday seasons.

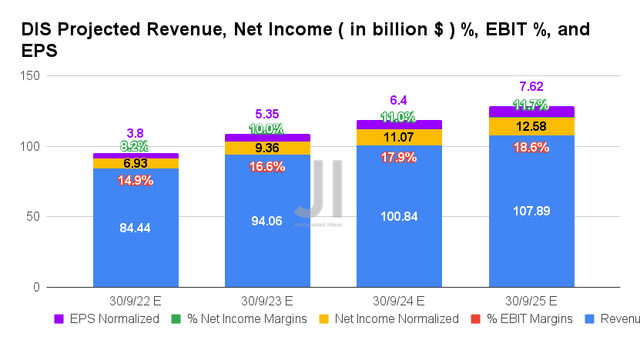

Over the next four years, DIS is expected to report impressive revenue and net income growth at a CAGR of 12.48% and 58.56%, respectively. Otherwise, a normalized CAGR of 10.45% and 2.18% between FY2019 and FY2025, faster than pre-pandemic levels of 7.74% and 0.85%, respectively.

Despite the peak recessionary fears, it is evident that Mr. Market is cautiously optimistic about DIS’ prospects, given the minimal downgrades in its top and bottom line growth by -2.27% and -4.98% since April 2022. This is likely attributed to the strength of its theme park bookings and the profitability of its ad-supported streaming moving forward. Furthermore, with the impressive YoY revenue growth of 11.39% and net incomes of 35.06% in FY2023, we expect a quick rebound in its stock valuation ahead.

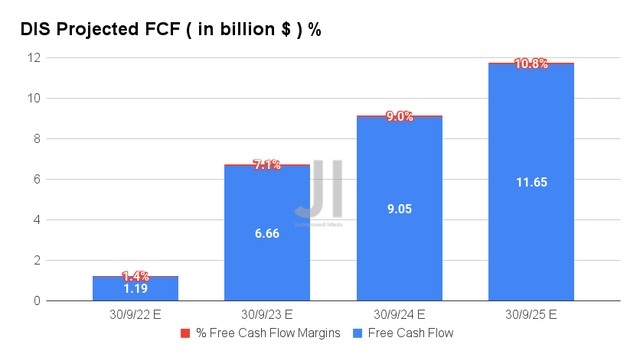

Furthermore, the improvement in DIS’ profitability is excellent too, from adj. net income/ FCF margins of 13.8%/1.6% in FY2019, 6.3%/2.9% in FY2021, and finally to 11.7%/10.8% by FY2024. With its improved FCF generation from FY2023 onwards, we may also see the company reinstate its previously halted dividends. Some analysts are projecting a $0.88 annual dividend payout in FY2023, potentially growing to a stellar $1.82 by FY2025 at a CAGR of 43.81%. Based on current stock prices, we would be looking an excellent dividend yield of 1.84%, compared to FY2019 levels of 1.24%. Interesting.

In the meantime, we encourage you to read our previous article on DIS, which would help you better understand its position and market opportunities.

So, Is DIS Stock A Buy, Sell, Or Hold?

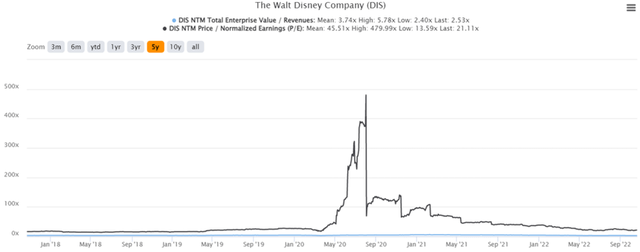

DIS 5Y EV/Revenue and P/E Valuations

DIS is currently trading at an EV/NTM Revenue of 2.53x and NTM P/E of 21.11x, lower than its 5Y mean of 3.74x and 45.51x, respectively. The stock is also trading at $98.59, down -44.99% from its 52 weeks high of $179.25, nearing its 52 weeks low of $90.23. Nonetheless, consensus estimates remain bullish about DIS’s prospects, given their price target of $145.90 and a 47.99% upside from current prices.

DIS 10Y Stock Price

Based on the charts above, DIS has tragically plummeted below its previous pandemic lows and to its previous 7Y support levels. The floor may hold a little longer, assuming the Fed’s 75 basis points hike by early November, as predicted by 93.1% of analysts.

However, we are less optimistic, since the September CPI, PPI, and US labor market remained surprisingly strong, despite the Fed’s hawkish stance thus far. Thereby, indicating the high possibility of raised terminal rates to over 5%, beyond the previous projection of 4.6%. With recessionary chances upgraded to 100%, we expect to see more retracements ahead in the short term to the low $90s, or to the $80s if tightened consumer discretionary spending affects DIS’ top-line growth in FY2023. That is not an overly pessimistic outlook, given the S&P 500 Index’s continued plunge by -23.57% YTD, on top of breaking its previous June lows thrice to Mr. Market’s growing pessimism.

Interestingly, that price target would provide us with an improved margin of safety for long-term investing and portfolio growth, on top of its 2.02% dividend yield by FY2025. Assuming, so we encourage investors with higher risk tolerance to load up, since DIS would naturally rally by the end of 2023 or 2024, once the macroeconomics improves and market fears ease. Do not miss the parade.