Digital Turbine: The Good And Bad Takes Of The Recent Quarter (NASDAQ:APPS)

Prostock-Studio/iStock via Getty Images

This article is contributed by Jun Hao from our Superstocks Seekers team.

Overview

Digital Turbine, Inc. (“DT”) (NASDAQ:APPS) is a complete Mobile AdTech platform that provides publishers with unique access to the home screen of over 900 million devices and also facilitates end-to-end in-app advertising transactions.

This year hasn’t been a great ride for DT’s shareholders.

Just a year ago, DT was trading at a high of $90 per share. And today, its share price is at a jaw-dropping 75% decline despite making 3 strategic acquisitions. Aside from the possibility of a recession happening and price multiple compression, does DT warrant such drawdown?

In this article, we will be sharing some of our thoughts on the quarters as we walk you through the business updates – both the good and the bad. We do find this to be a mixed quarter, and later on this in this article, you’ll understand our thought process behind why.

Without further ado, let’s get right into it.

Potential Recession: Good and Bad

Multiple headlines about a potential recession have caused a massive selloff in the stock market, especially for companies that have digital advertising-related revenue. And true enough, DT wasn’t spared, along with the likes of Facebook (META) and Snapchat (SNAP).

This was after SNAP’s 1Q22 earnings call:

…as we look forward to Q2, the operating environment remains challenging and forward-looking visibility…is more difficult than probably at any point in recent memory….headwinds that impacted our business in Q1 have persisted into Q2…As a result, we are concerned we could see additional campaign positives or advertiser budget reductions in the future.

And in PubMatic’s (PUBM) 1Q22 earnings call:

…there is potential for further softening of European consumer demand amidst the Ukraine/Russian war and challenging economic conditions rated from high inflation to rising interest rates that may dampen consumer activity and advertiser spending levels.

These have sent the entire stock market into panic mode, as advertisers cutting back on their budgets is usually not a good sign for the economy. This is because, during a recession, consumers will have less demand as they cut back on discretionary spending. Lesser demand leads to brands and advertisers reducing their ad spending.

When that happens, companies facilitating digital ads are likely to suffer a slowdown in revenue growth. So it is understandable why DT wasn’t spared from the selloff.

However, we reckon that this may not be entirely bad for DT.

According to CEO Jeff Green during The Trade Desk (TTD) 1Q22 earnings call:

…when customers become more deliberate with spend and they focus on the most efficient investment opportunities, that’s when The Trade Desk tends to shine…

And from SNAP 1Q22 earnings call:

…is always important for businesses and especially in a volatile macro environment is their return on investment. We saw in the pandemic…brands became much more focused on their return on investment and pulled back on spend that they could measure very clearly…that’s, again, why having a performance advertising platform and focusing on return on investment and making our advertising partners successful is so critically important.

DT now owns an end-to-end mobile ad tech platform, from the demand-side platform (“DSP”) to an ad exchange, to a supply-side platform (“SSP”). Lots of inefficiencies have been taken out of the platform like data that are siloed on different platforms are now consolidated into one. These data could be used to provide more insights to make more effective ad campaigns and even create strong matches between advertisers and publishers. Advertisers on the DT platform will now also have access to more exclusive inventories, and best of all, they get to keep a bigger share of their wallets without all the extra fees to pay the DSP and Ad Exchange.

This makes us strongly believe that DT will be a substantial beneficiary even in a recession as advertisers are careful about where they are allocating their ad dollars.

Impact of the Reporting Changes

Revenue Misses, Or Is It?

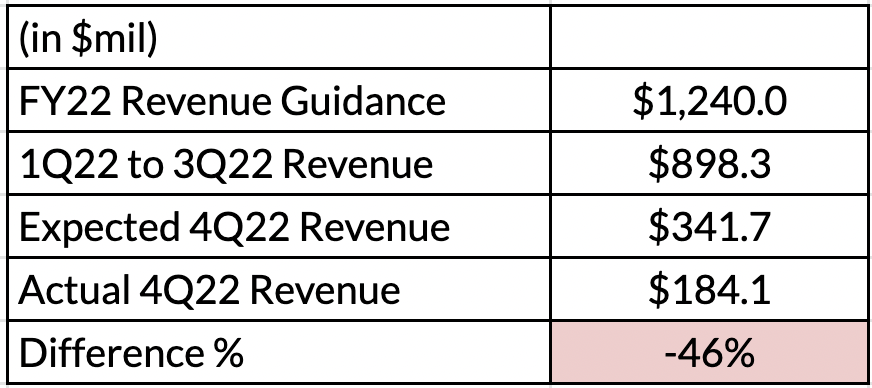

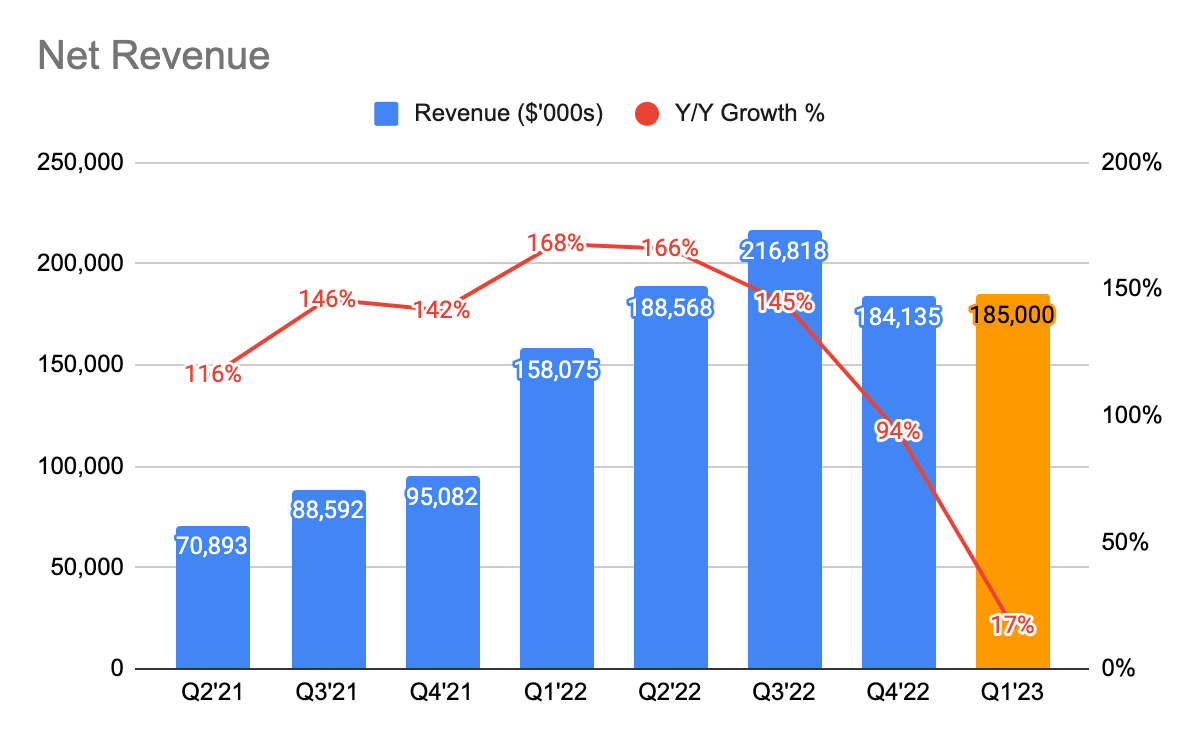

(Source: DT IR)

In DT’s 3Q22 earnings call, the management guided $1,240 million for its FY22 revenue. If we were to do some math, this means that in 4Q22, we should roughly expect $341.7 million of revenue. However, the actual revenue only came in at $184.1 million, a 46% revenue decline.

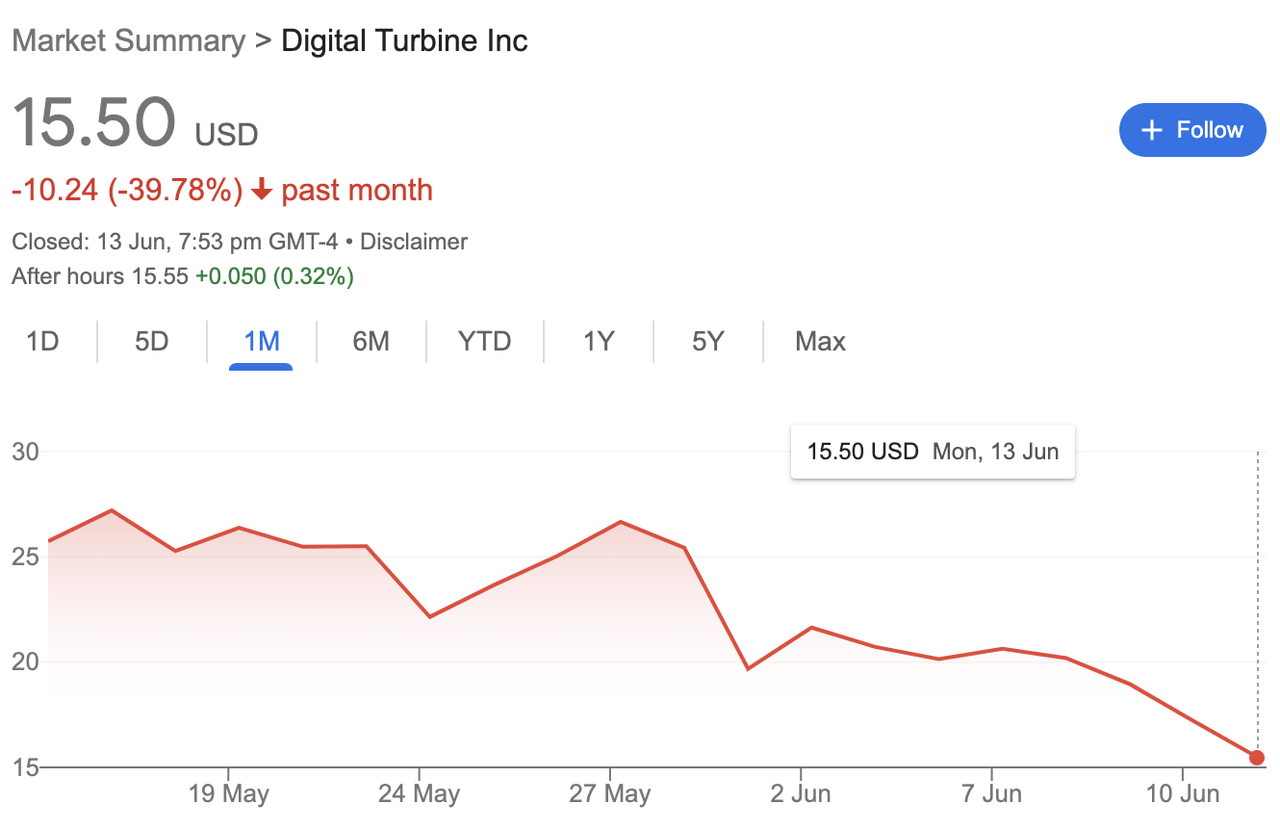

(Source: Google)

This surprise caused DT’s share price to decline 39% after its earnings. However, if investors keep up with the company’s news, they will understand that this is due to reporting changes, rather than revenue misses.

This created the misperception that the company has performed poorly, and might have attributed it to the possibility of advertisers cutting back on ad dollars given the weak economy and the recession looming, which confused many investors, leading to the dumping of the stock.

Comparable Margins Versus Peers

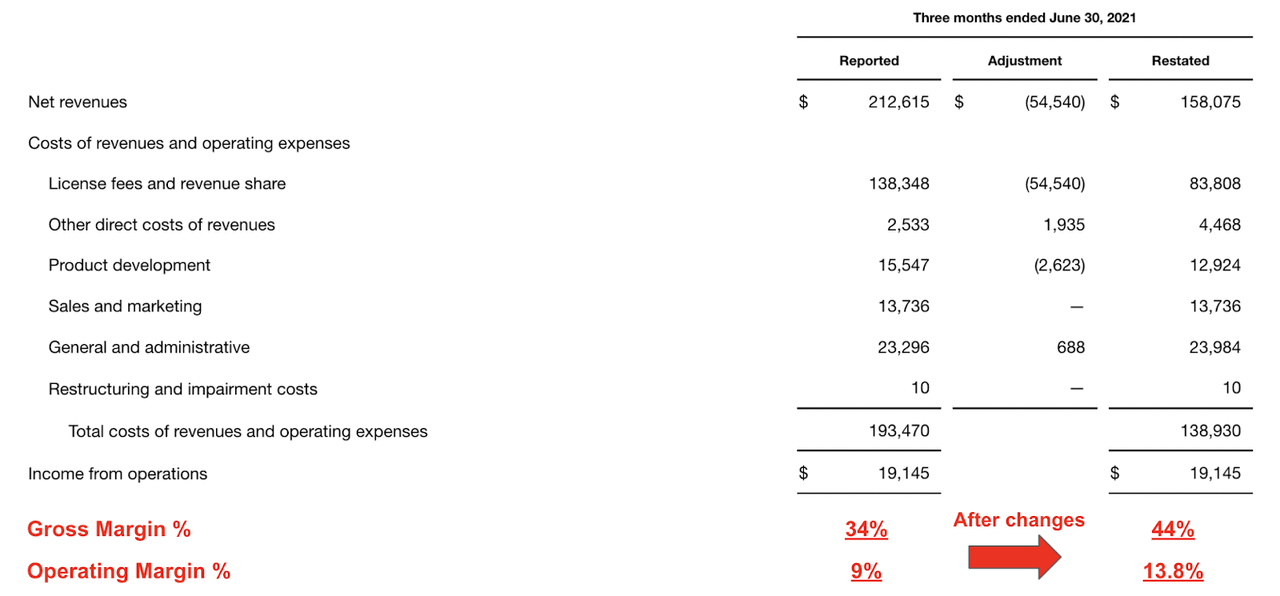

(Source: DT IR & TIKR)

Despite the revenue changes, the management stated that DT now reports a higher gross margin and operating margin, which makes it easier for investors to do a peer comparison.

For illustrative purposes, you can see that its 1Q22 gross margin has increased from 34% to 44%, a 10% difference. Its operating margin has also expanded to 13.8%, a 4.8% difference.

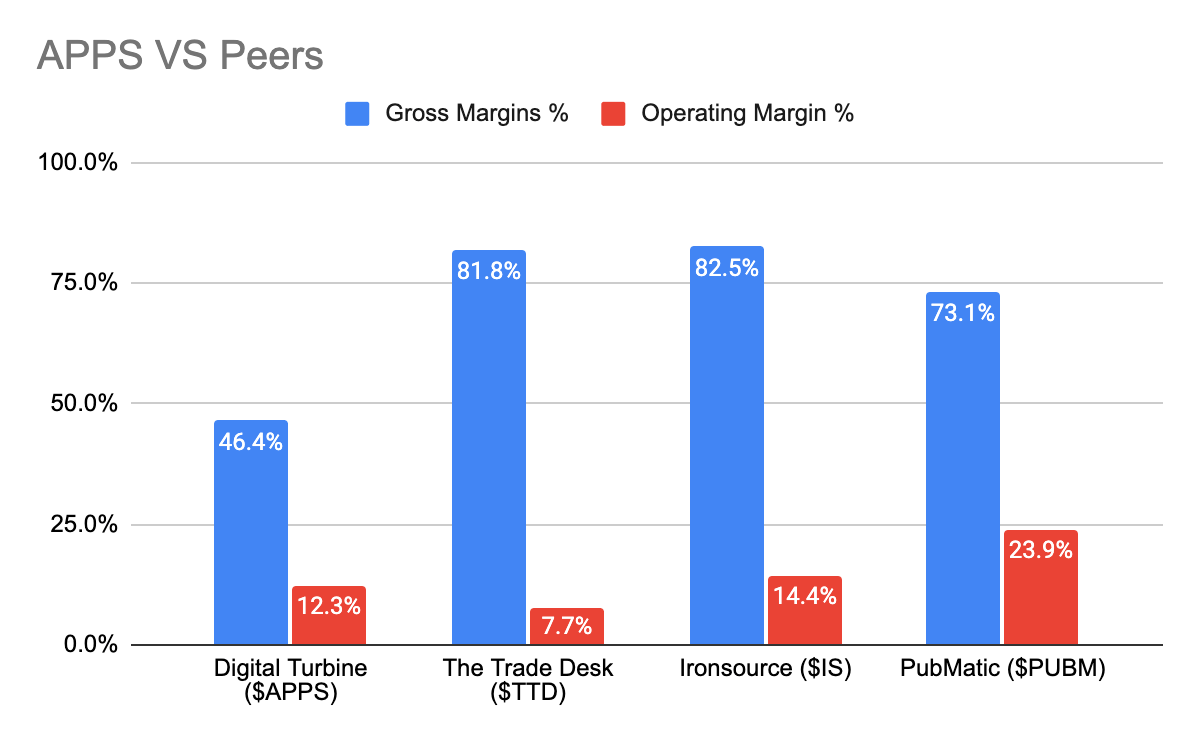

(Source: DT IR)

Let’s take a look at how DT now fares against its peers.

As of FY22, DT has a gross margin of 46.4% and an operating margin of 12.3%. Peers like The Trade Desk and ironSource (IS) have similar margin profiles to DT despite having higher gross margins. This is also the way DT reports its revenue as they are required to report the revenue share of its partners as cost of goods. If not, margins would have been a lot higher.

Regardless of that, this does speak to DT’s highly efficient and profitable business model as they were able to keep operating expenses to the minimum despite making 3 heavy acquisitions.

Lack of Content Media Revenue

(Source: DT IR)

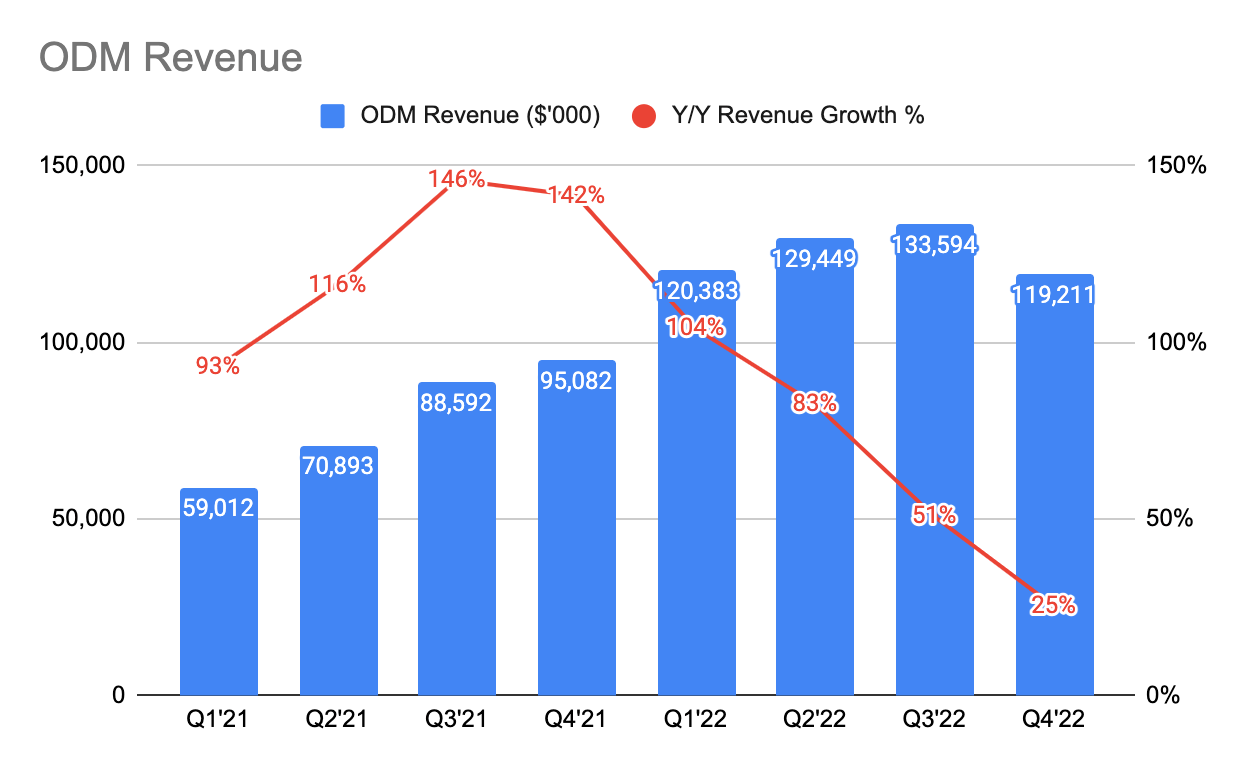

This quarter’s ODM revenue came in only at 25%, a continuous decline from the previous quarters.

This drastic decline was concerning to us, so we have decided to break down its revenue into various segments to understand why it has been declining: (1) App Media & Content Media, and (2) Single-Tap.

Where Is The Content Media Revenue?

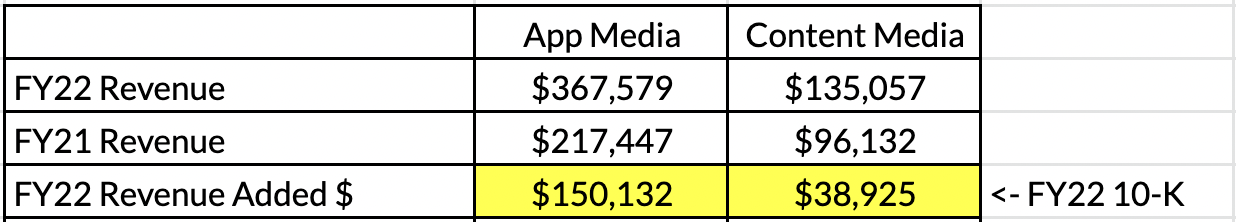

In this portion, we’re attempting to figure out the second half of FY22 (“2H22”) revenue added for each App Media & Content Media, so that we will have better insights as to what’s causing the revenue to drop so quickly.

Let us walk you through how we derived these figures.

(Source: DT IR)

Referencing DT FY22 annual report, we know that the annual revenue added in FY22 was $150,132 and $38,925 for App Media and Content Media, respectively.

(Source: DT IR)

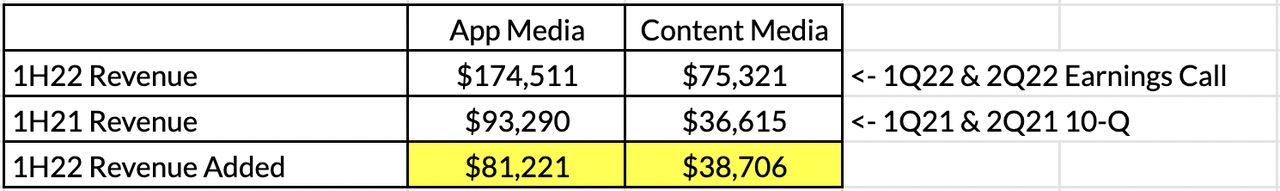

Since DT did not disclose its 3Q22 and 4Q22 revenue for each segment individually, we shall find out the combined revenue added for 2H22 instead. But first, we have to find out the 1H21 revenue.

Quoting from its 1Q21 quarterly report (“10-Q”):

Application media revenue totaled $44,233 (in thousands) in the quarter, while content media revenue totaled $14,779.

And in 2Q21 10-Q:

Application Media revenue totaled $49,057 and $93,290, respectively, for the three and six months ended Sep 30, 2020, while Content Media revenue, primarily related to the Acquisition, totaled $21,836 and $36,615…

Adding these figures will get us combined revenues of about $93 million and $36 million, for each App Media & Content Media, respectively, in 1H21.

Next is to find out the 2H22 revenue.

Referencing its 1Q22 earnings call, CEO Bill Stone mentioned that App Media revenue grew by 81% Y/Y. Since we have already figured earlier on that its 1Q21 revenue was $44 million, this gives us $80 million in 1Q22. And in its 2Q22 earnings call, its Content Media was disclosed to be $35 million.

Adding these figures will give us a combined 1H22 revenue for its App Media & Content Media at $174 million and $75 million, respectively.

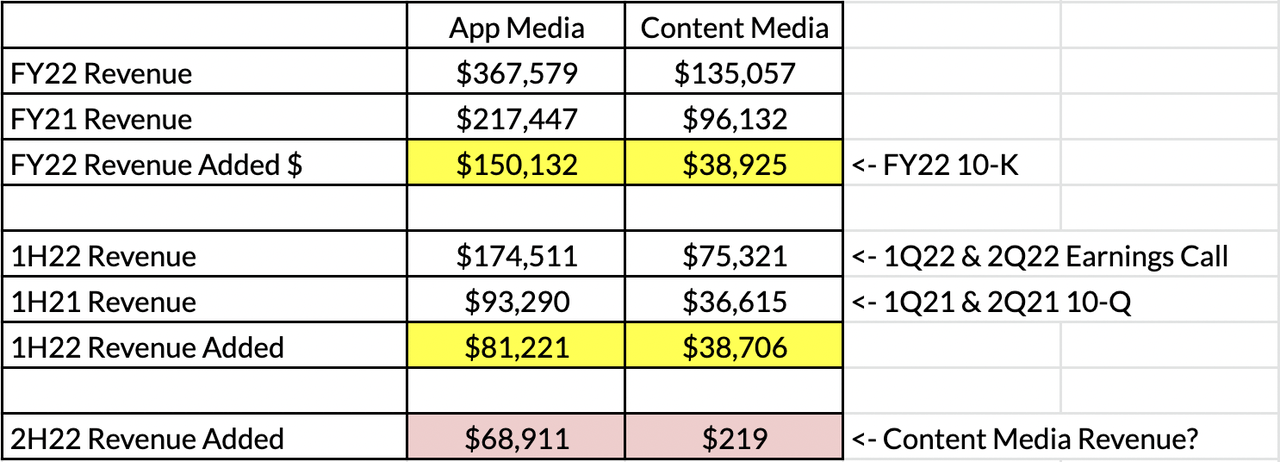

(Source: DT IR)

So to put things into perspective, you can see that DT only brought in $0.219 million in revenue in 2H22. This is a big concern because there is barely any revenue brought in for its Content Media revenue. This was even strange considering that the management did not talk about it during the earnings call.

This does raise concern if there is a lack of adoption for Mobile Posse and a slower rollout for existing customers like AT&T.

Bringing back what CEO Bill Stone said back in the 2Q22 earnings call:

…we just talked about $35 million in quarterly revenue in the Content Media business. The biggest driver of that is our relationship with T-Mobile. And if you think in rough terms that T-Mobile is 1/3 of the market, Verizon is 1/3 of the market and AT&T is 1/3 of the market. That’s how we probably think about the opportunity for us.

Since DT has over 40 OEM and carriers as partners, this indicates the revenue opportunity they’re able to generate in the long term. While this does not break the long-term thesis of the company, this has certainly raised investors’ concerns over the management’s execution.

Single-Tap’s (“ST”) Accelerating Growth

For those who are unclear about what ST does, it provides frictionless app installs for advertisers where users are able to install DT with just a single click without redirecting them into the Google Play Store. This has proven to dramatically increase conversion rates.

During the quarter, ST’s revenue continues to grow at a monstrous rate of 650% Y/Y, as they have already signed contracts and entered live trial phases with their Tier 1 partners. We should also expect a ramp-up soon, and management has also shared that this is a large growth driver and margin enhancer.

In 3Q22, its revenue grew by 800% Y/Y, in 1Q22 it grew by 600% Y/Y, and in 4Q21 its Y/Y growth rate was 1000%. These are strong validation that ST is gaining increasing momentum among its partners.

Growing # of Devices & Revenue Per Device (“RPD”)

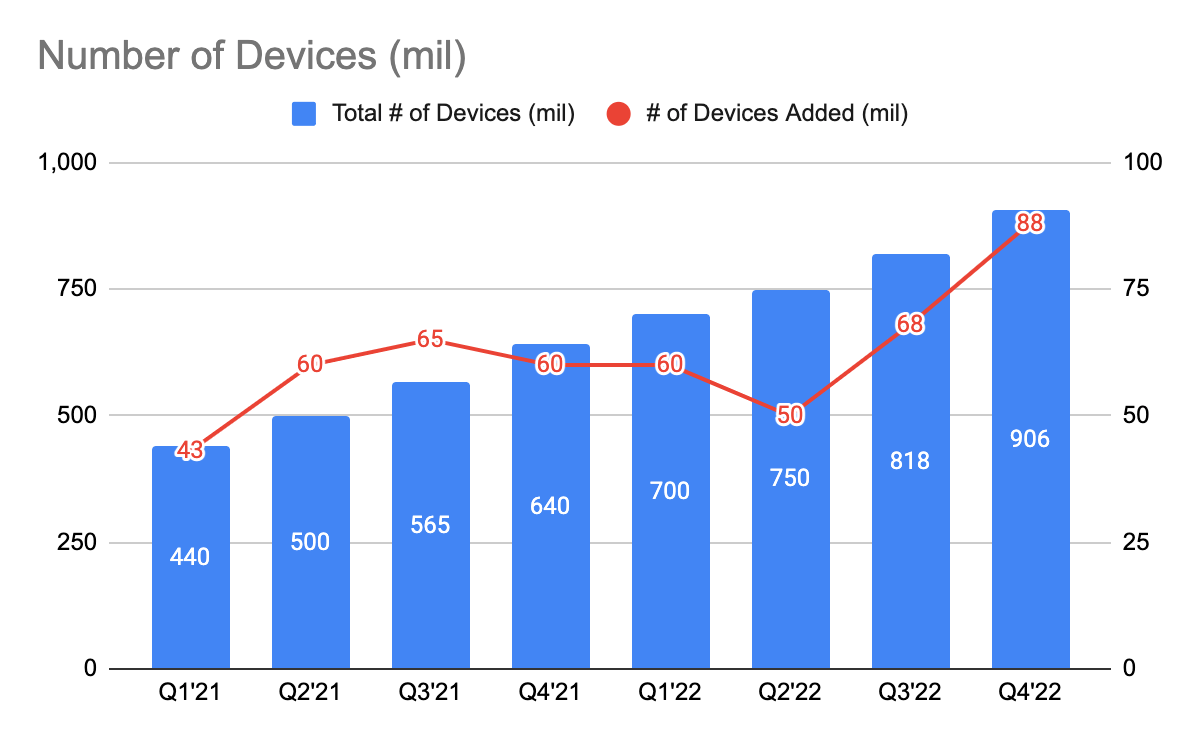

(Source: DT IR)

Despite the slowing revenue, DT’s global distribution footprints continue to expand as they added 88 million devices sequentially in 4Q22, more than the previous quarters. The more devices that are being rollout via DT, this leads to more product adoption and eventually higher recurring revenue.

Not only that, but DT revenue per device (“RPD”) has also been growing at a healthy rate:

In the US, our RPD was $2.10 in FY20, $3.30 (+57%) in FY21, and $4.70 (+42%) for FY22. Internationally, we’re still not where we aspire to be, but we have doubled our RPDs from $0.10 in FY20 to $0.20 (+100%) in FY21 to over $0.40 (+100%) in FY22.

This is important because it tells us that not only are they rolling out more devices, but they are also increasing their spending with DT by taking on more products over time. This speaks to the success of its land-and-expand strategy.

If the number of devices was growing and yet RPD is slowing down, this could be a potential red flag, but this isn’t the case today.

Concern Over the Integrations Between Appreciate, AdColony & Fyber

One thing that stood out during the quarter was the employees’ double lifting to manage the integrations of Appreciate, AdColony, and Fyber. To quote CEO Bill Stone in this quarter’s earnings call:

…while there’s been some double lifting of the teams to support the present and the automation of the future that’s marginally impacted some of the execution, the ability of the team to do both has been impressive.

This doesn’t look good knowing that this could put a toll on its employees’ health, and more importantly, their morale.

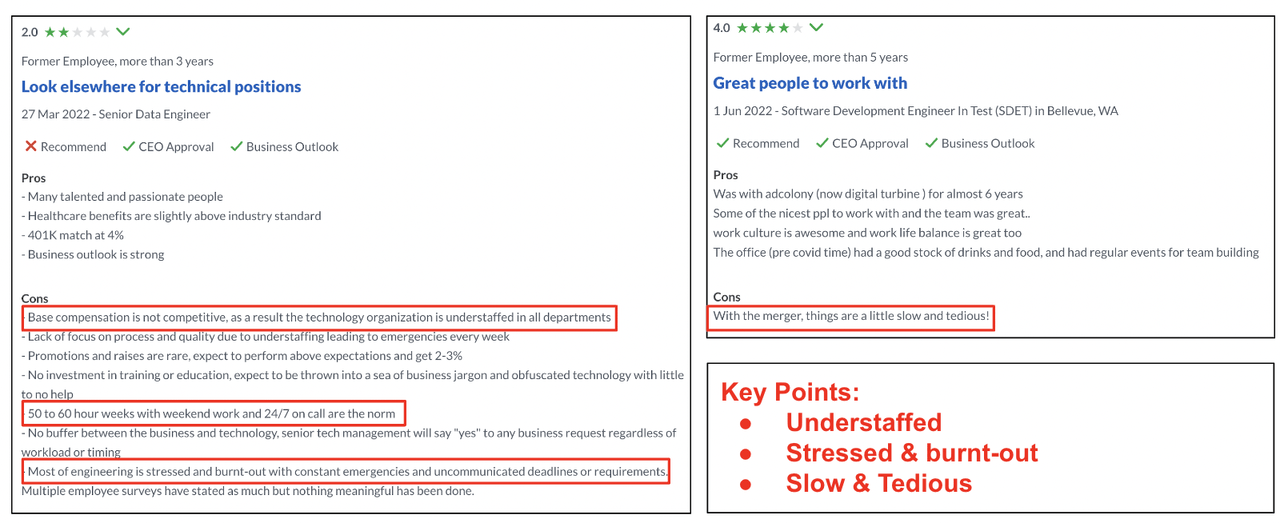

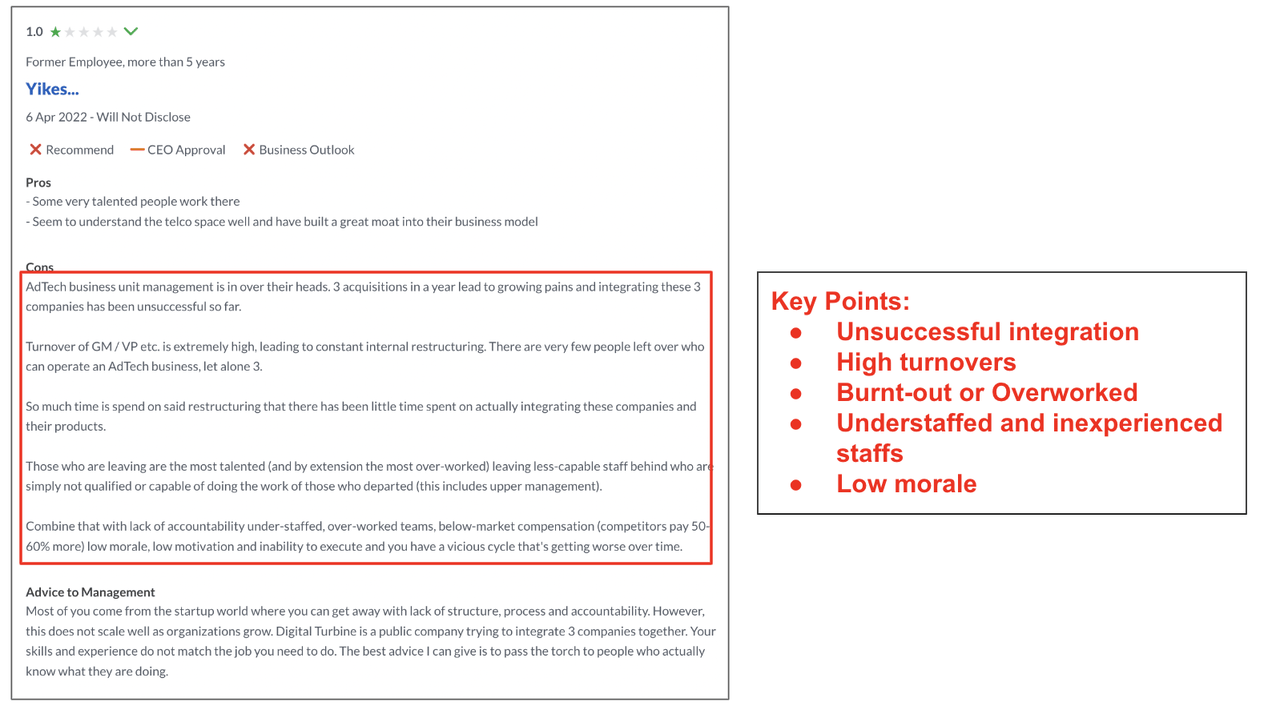

(Source: Glassdoor Reviews)

(Source: Glassdoor Reviews)

On Glassdoor, we have also found negative reviews on how understaffed, stressed, burnt-out or overworked, and low the morale was for their employees.

However, despite the double lifting, CEO Bill Stone sounds confident that these integrations will yield positive results in the coming quarters:

…we’re over 10% of our revenues. We’re planning to launch in the next few months some new initiatives that should help accelerate those revenue synergies and simultaneously help drive more profitable top line growth…a few examples are consolidating our ad tech on the legacy Fyber and AdColony devices into one exchange, where demand and supply platforms such as The Trade Desk can purchase more inventory at scale….this will generate many tens of millions of dollars of incremental revenue this fiscal year and begin next quarter….And secondly, we are integrating our SingleTap capabilities into the Fyber exchange. This capability will make it more attractive for advertisers to bid on Fyber inventory, which in turn should be an overall growth driver for our app growth business.

This is something we’re not comfortable with as integrations like these usually take a long time and this could impact the company’s ability to execute the integrations and product development. This can be unhealthy for employees’ morale in the long run.

Subpar Guidance

(Source: DT IR)

During this quarter’s earnings, the management guided for a 17% Y/Y growth in 1Q23.

Excluding the acquisitions, in 4Q22, ODM revenue grew by 25% Y/Y, and its App Growth’s revenue grew by over 30% Y/Y. This is a slowdown in growth from the previous quarter. However, this could be due to seasonality as advertisers are reallocating their budgets while ramping it up as they approach the holiday seasons in 2H23.

We believe this may have also contributed to the sell-off we have seen in recent weeks.

Concluding Thoughts

We have so far covered the possibility of how the recession will affect DT but at the same time, how they are also likely to benefit from it as they owned the end-to-end ad tech platform.

DT continues to add more devices and increase the spending from partners, although there seems to be a slower rollout of Mobile Posse from existing customers or slower adoption from potential customers. ST’s growth, on the other hand, is accelerating, indicating that they’re seeing massive interest. Once it scales, we believe ST can be a meaningful margin driver for the overall business.

Their most recent acquisitions have also seemed to take a toll on their employee’s morale and health which was something unpleasant and we like to see steps being taken to rectify the well-being of these employees. That can be through ways like hiring more staff to prevent any integration and product development delays.

Last but not least, investors were also concerned over management guidance for 1Q23, which seems to be weaker than expected. However, this is likely due to the seasonality.

This was a rather mixed quarter for us. While we don’t think any of these are real thesis breakers yet, we still prefer to monitor the upcoming quarters for more certainty.

What are your thoughts on the quarter? Do let us know in the comments section below.