Diamondback Energy Stock: Potential Income From 2020 Acquisitions Realized (NASDAQ:FANG)

peshkov/iStock via Getty Images

(Note: This article appeared in the newsletter May 3, 2022, and has been updated to include current information).

Back in fiscal year 2020, during the shutdown, I made the argument that Diamondback Energy, Inc. (NASDAQ:FANG) was a potential income play for those that were not retiring right away (but soon) as well as those that could withstand some variable income.

This was not going to be a traditional income play that they taught you in business school. Then again, I had a professor that compared options investing to horse racing betting. It points to the wide range of opinions about investing that can be taken to get an investor where they need to go for retirement purposes.

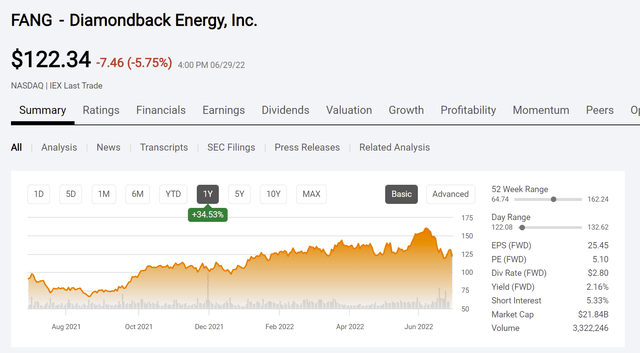

Diamondback Energy Common Stock Price History And Valuation Measures. (Seeking Alpha Website June 29, 2022.)

Back in 2020 when this discussion happened, the stock price headed towards $20 a share and lower. Back then the company declared a second quarter dividend of $.375 per share. The stock price had already more than doubled from its lows to nearly $40 a share, according to the press release.

That base dividend has now doubled to $.75 per quarter, and there are variable extra dividends for more income. The base dividend is likely to be maintained because this company is investment grade. Only another extreme downturn would put the dividend in danger. That base dividend alone would be excellent for a purchase price up through at least $50 per share. That was available for a fairly long period of time.

At the time, there were some comments about how the yield was too low to be considered an income vehicle. But the oil and gas business is often a decent variable income vehicle if you consider the income in the future when the industry is near a cyclical bottom. Fiscal year 2020 was probably as dramatic a bottom as one can get.

Diamondback Energy is a company that has shown relatively fast growth throughout its history. Management had made some acquisitions at the bottom of the market using a combination of stock and debt. Now it is, obvious that management made some great decisions back in fiscal year 2020.

All of a sudden that yield now approaches an annual yield of 10% at the current price. It is even better if the stock was purchased back in fiscal year 2020. Even though a company like this is not thought of as an income vehicle, it is often a very good income vehicle when the stock is purchased at the right time.

The rapid growth through a combination of acquisitions and organic growth will likely continue in some form in the future even if the growth rate slows as the company gets larger. There is a base dividend that is such a small part of cash flow that the base dividend will likely be maintained even in a cyclical downturn. This company has very low debt while maintaining an investment grade rating. Therefore, management has a number of ways to “borrow to pay the dividend” should management choose to do that.

A diversified portfolio with various industry leaders like Diamondback Energy should serve a retired person well. The portfolio can certainly include traditional investments like bonds, and there are good options income strategies as well. It is more a question as to investor tolerance for a non-traditional income investment like Diamondback Energy.

There is also the possibility that a well-run company like Diamondback would be acquired by a major integrated firm in the future. Such an event would definitely firm up the future income stream. But anyone who purchased Diamondback Energy back in fiscal year 2020 will likely have a future income stream that is unlikely to reach the depths of fiscal year 2020 ever again because an extreme year like that fiscal year is unlikely to recur.

In the meantime, the stock offers a lot of investors capital appreciation even from the current price. The company made those acquisitions with the idea that the acquisitions would be accretive in the current cycle. Reasonable projections would look at the previous high, factor in some inflation, and then add a premium for good management decisions like acquisitions.

Diamondback management recently announced the intention to acquire Rattler Midstream (RTLR). Clearly opportunistic growth will continue. Therefore, it is possible to still earn a decent return on this stock from the current price.

Even though there is a war going on, many companies in the industry are far too cheap even for lower oil prices because the market remembers the challenges of the last few years combined with some aborted rallies that really damaged a fair number of speculative profits.

But that means that the “fast buck” money that lent money to the industry to make money using some fantastically unreasonable parameters (because then production quickly went through the roof) is nowhere to be found. That money finally lost enough in the last few cycles to just plain stay away. Instead, the lenders experienced in the industry are still there doing deals that make sense. But no one is borrowing to send production through the roof this time around. As long as that attitude remains, then this recovery should be typical and last longer.

The new “live within our means” attitude means rational decisions will dominate rather than some interesting deals that led to faster pricing crashes. Clearly Mr. Market is expecting a quick recovery as has been the case recently. So, it will take a while for Mr. Market to realize that the new rules will likely stick around for the time being.

In the meantime, a company like this one will show positive comparisons not only because commodity prices rose, but also because management made some decent acquisitions. The recent announcement of more than $5 per share in adjusted net income.

That does not include the “small” acquisition for about $230 million. Those acquisitions, in this case for cash, practically guarantee a production increase per share on top of the benefits of the acquisitions made at the market bottoms a little while back. Management does not have to grow production organically for per share production to rise as long as it continues to make good deals. The very long history of acquisitions practically “guarantees” a decent track record going forward. Also aiding per share growth is the stock repurchase agreement. Despite the sharp runup in price, this stock clearly has a ways to go.

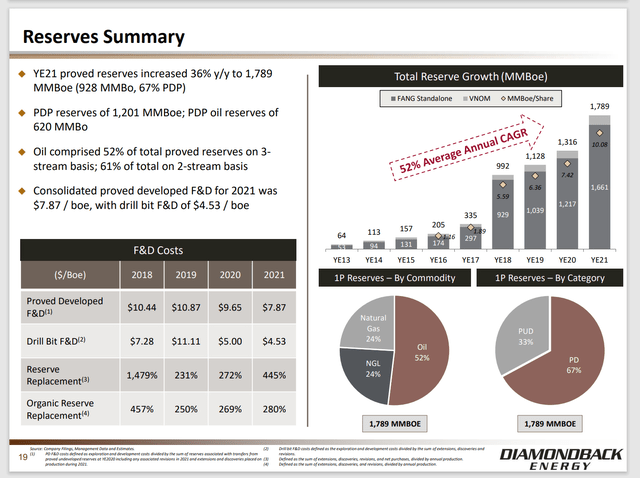

Diamondback Energy Reserve Growth And Cost History (Diamondback Energy May 2022, Corporate Presentation)

The company grows reserves at a pretty good clip. While the market may focus on organic production growth, there is clearly more than one way to grow per share results. Based upon what is shown above, a forward growth rate of at least 15% one way or another should probably be easily achievable.

The company is much larger. Therefore, the big production and reserve gains of the past are very unlikely. But some sort of long-term mix of say 6% organic growth (coming in lumps) combined with another 7% to 10% from acquisitions is very likely. The base dividend growth will be icing on the cake as long as investors realize that the variable dividend will likely be absent at industry cyclical bottoms.

Excellent managements tend to surprise on the upside. Clearly, this is one of the best managements in the industry.