Diamondback Energy: Dividends Are Going Up (NASDAQ:FANG)

Indysystem/iStock via Getty Images

Investment Thesis

Diamondback Energy (NASDAQ:FANG) is yet another oil and gas company that has a strong balance sheet that is determined to return capital to shareholders.

To illustrate my bull thesis, I highlight a comment from FANG’s recent earnings call,

[W]e feel that, it’s time for our equity holders to get their cash back after this company has matured from a high-growth company to a high-returning company.

Yes, there have been a couple of significant acquisitions in the past couple of months, but these are not a distraction from the company’s focus on returning 75% of capital to shareholders.

For investors that like to get their capital back, there’s a lot of nuance here.

A Challenging Environment

In the past couple of months, FANG has signaled to investors that it’s buying up two companies. FANG is deploying somewhere close to $3 billion worth of capital, or very approximately 12% of its market cap being deployed to build inventory.

Both of these recent deals are expected to be accretive on a free cash flow per share basis in 2023 and 2024.

Hence, we are in an interesting state of affairs. There’s bound to be industry consolidation, because after all, even if executives are extremely bullish on oil and gas companies, the fact remains that for now, free cash flow yields remain extraordinarily attractive. Thus, it makes sense to do M&A in the current environment.

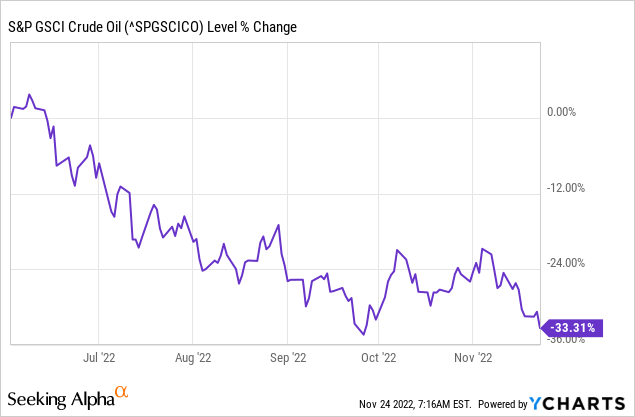

However, before one gets too excited about what’s possible for oil equities in 2023, allow me to put a spotlight on the WTI trend:

What you see right now, is that WTI crude oil has been falling for several months. And there are all kinds of reasons why this is the case.

There’s the belief that China’s lockdown is dampening demand. There’s the possibility being rumored that OPEC may or may not increase supply. There’s the question of the price of Russian oil floated as too high.

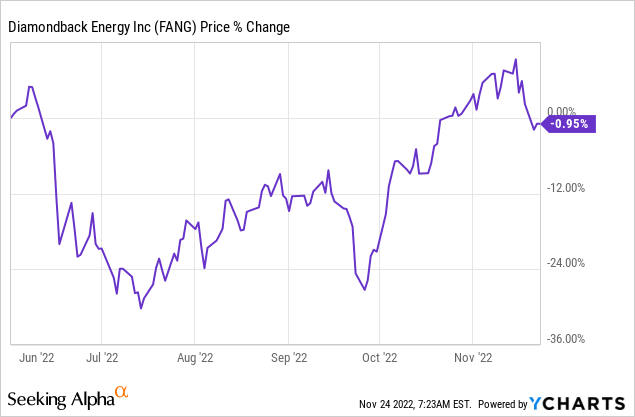

Indeed, there’s a confluence of factors. And yet, for all intents and purposes, despite the weaker underlying commodity, FANG’s stock hasn’t shown any weakness.

So, this leads me to believe that slowly, perhaps equity investors are coming to terms with the fact that oil and gas stocks are undervalued?

With that in mind, let’s now discuss Diamondback Energy’s capital allocation program.

Capital Return Program, Dividends Are Going Up, 6% Annualized

I have made the case for a while that oil and gas companies that investors can ”depend” on to deliver increasing dividends over time are getting nicely rewarded. In fact, getting rewarded significantly better than companies that are favoring buybacks. Why?

Because investors simply don’t trust that the oil boom is here to stay. As an energy bull myself, I know all the arguments for why oil should be going higher right now into next year, but those are not arguments that are translating into higher WTI prices.

Hence, within this context, this is what investors truly care about:

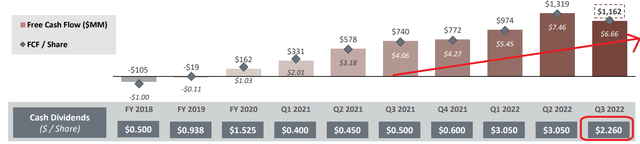

FANG November presentation

FANG’s latest dividend amounts to 6% annualized. This dividend includes a variable component. And this dividend is already going to investors on record, hence it’s for illustration purposes only.

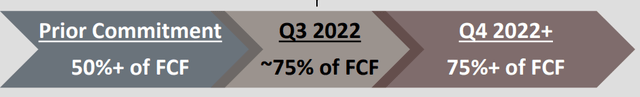

Nevertheless, the point remains that the overall trend for dividends is going higher. And Diamondback Energy remains resolute in sticking to its capital return framework:

FANG November presentation

Along these lines, this was said during the Q3 earnings call,

I think generally, with the 75-25 commitment to equity versus non-equity on cash returns that makes looking at deals even more — put deals under the microscope, right? So in this deal, we’re very focused on not levering up the balance sheet in a meaningful way because we work so hard to get the balance sheet where it is.

That’s exactly what shareholders want to hear. That executives are prioritizing capital returns and not levering up the balance sheet. Those two are crucial elements. And that’s what Diamondback Energy is focused on too.

FANG Stock Valuation – 6x This Year’s Free Cash Flow

Given the $1.2 billion of free cash flow that Diamondback Energy reported this quarter, I believe that it’s very likely that 2022 will end up seeing slightly higher than $4 billion of free cash flow.

This leaves the stock at approximately 6x this year’s free cash flow. On the one hand, we simply have no idea of whether or not WTI will remain strong in 2023.

On the other hand, while investors wait around to find out, FANG is going to be returning +75% of its free cash flow going forward.

Simply put, on an annualized basis, FANG will be returning +$3 billion worth of capital to shareholders through a combination of dividends and buybacks.

The Bottom Line

Diamondback Energy is a cheaply valued oil and gas property, focused on returning capital to investors.

The market right now finds itself in a very interesting point. On the one hand, WTI prices have shown significant weakness in the past few months. On the other hand, equity prices for oil companies have remained strong.

While investors wait around to find out exactly how things unfold in the coming year, FANG is determined to return capital to shareholders. By my estimates, in Q4, FANG’s annualized capital return program will be 11.5% of its market cap.