Datadog Stock: PSG Ratio Shows The Stock Is A Buy Under $100 (NASDAQ:DDOG)

piranka

Introduction

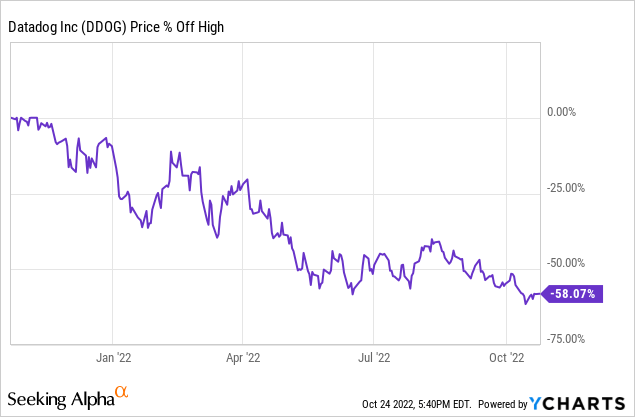

Just like many other growth stocks, Datadog’s (NASDAQ:DDOG) stock price has fallen sharply from its previous high. It’s now down almost 60% from its high about a year ago.

Over the short term, the stock price can remain under pressure. As long as the Fed keeps the pressure on with rising interest rates, growth stocks will probably continue to underperform. While this is understandable for money-losing companies, Datadog is highly profitable. Its growth is internally financed, with its big free cash flow, not by debt or stock issuance. There is also a very specific SaaS metric, the PSG ratio, developed by Robert Smith of Vista Capital, that shows that Datadog is cheap now.

What Datadog does

For the subscribers of my marketplace Potential Multibaggers, I have written a very long and detailed article on what Datadog does exactly, but that would be too elaborate for the scope of this article. I’ll try to summarize what Datadog does here, but if you have questions, feel free to ask them in the comment section.

Datadog was founded in 2010 by Olivier Pomel and Alexis Lê-Quôc, who are still leading the company, Pomel as the CEO, Lê-Quôc as the CTO, Chief Technology Officer. The two Frenchmen are long-time friends and colleagues. They met at the Ecole Centrale in Paris, where they both got a degree in computer science.

Pomel and Lê-Quôc both worked at Wireless Generation, a company that built data systems for K-12 teachers. Wireless Generation was sold to Newscorp in 2010 and that was the sign for the two friends to go and found their own company, Datadog.

The DevOps movement is important to understand Datadog. DevOps tries to solve the problem that many developers and operators worked next to and even against each other, almost acting as enemies. DevOps focuses on how to put them together to make everything more frictionless. Developers often blamed the operational side if there was a problem (for example, the database that was not up-to-date) and operators blamed developers (a mistake in the code). By working together in teams, good communication and even as much integration between the teams as possible, DevOps tried to solve that problem.

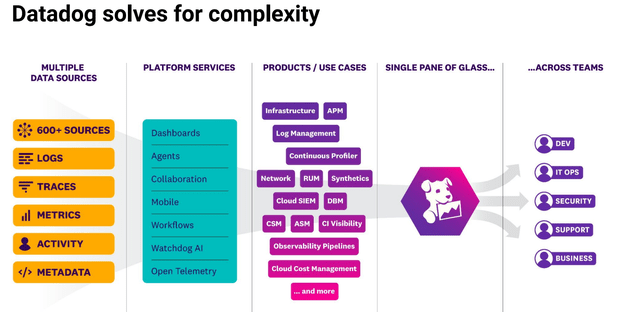

The problem was that no software was available on a unified platform for DevOps and Datadog helped solve that problem. If you wanted to know where the problem was, it was good to have a central observability platform for DevOps and Datadog set it as its task to make that. You will learn much more about what Datadog does exactly in this and the following articles.

As a tech company in New York, the company had a lot of trouble raising money. But once it had secured money, it started building, releasing the first product in 2012, just ten years ago, a cloud infrastructure monitoring service. It had a dashboard, alerting, and visualizations.

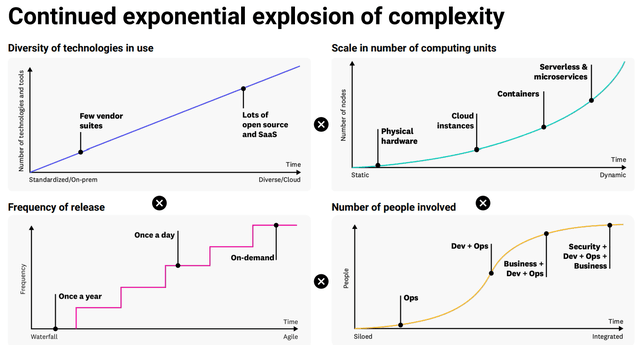

In 2014, Datadog expanded to include AWS, Azure, Google Cloud Platform, Red Hat OpenShift and others. But that was just the start. Over the last few years, the technology stack has become more complex. More software vendors, more SaaS, more multi-cloud usage, more product updates, and more people involved.

Datadog DASH 2022 conference presentation

Datadog tries to be the key solution to tie all monitoring together on one platform and it’s doing that by continuously issuing new products and modules. I argued before that its innovation is a key differentiator. Datadog calls itself the solution for complexity. If you can summarize the very complex products you have in such a simple catchphrase, I think you do a great marketing job.

Datadog DASH conference presentation

In the time that I have followed the company, it has extended the scope of its solutions considerably. It can add modules quite easily. It listens to what its customers want and need, and then Datadog develops that solution or, if it’s more efficient, it does a tuck-in acquisition. It has done many of those smaller acquisitions over the years and most have probably paid themselves back several times over. Good capital allocation is a great feature for long-term stock returns.

How about the recession?

Isn’t the pending recession a huge headwind for Datadog? I would argue much less so than most other companies. The reasons are more automation and reliability. Let me explain.

More automation means that with fewer people, you can do a better job of maintaining an overview of the full technology stack. After all, Datadog can replace three or four other software programs or SaaS subscriptions, which often means three or four different people on the team. It means that Datadog can actually be a source of cost reductions for companies.

Reliability means that Datadog is so fast in detecting problems that it enhances the reliability of the software stack of its customers, which can save them money again. All in all, the value proposition for Datadog is so good that a recession will not hurt it as much as most other, more discretionary, forms of spending.

SMBs (small and medium-sized businesses) are usually hit most during a recession, but they often don’t have a very complex tech stack and therefore are not as likely to be Datadog customers. And if they are, most Datadog products work on volume, which will automatically be lower for SMBs.

All in all, I think the recession risk for Datadog is more limited than for many other companies.

Valuation

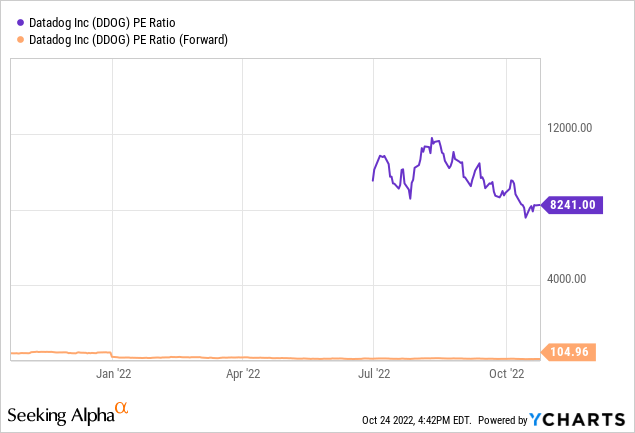

This is the subject that will keep away most investors, especially now. With higher interest rates, they think these “money-losing” growth companies at egregious valuations will do very poorly for years. Allow me to disagree. While there are definitely companies that fit this description, Datadog is not one of them. Of course, when you just look at PE ratios, many will laugh out loud.

With a PE ratio of more than 8200, and even a forward PE ratio of 105, this is not exactly a low PE ratio stock.

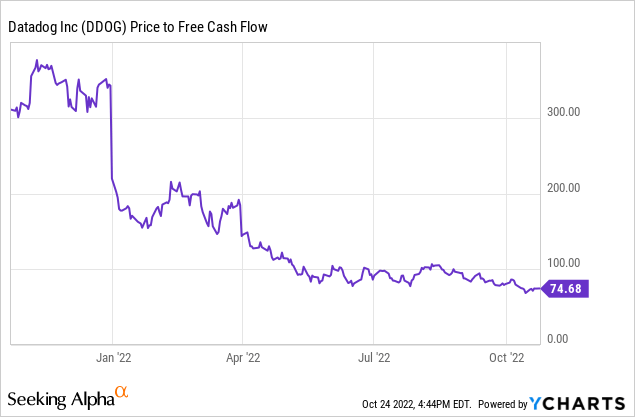

If you look at the price to free cash flow, it’s already a bit lower, but still almost 75.

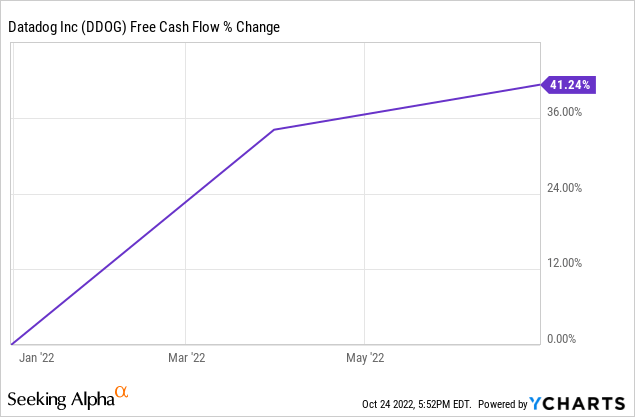

But the fact that the P/FCF has come down from about 350 to 75 in less than a year isn’t just because of the falling stock price. Datadog’s free cash flow has grown substantially over the last year.

If you would look at the last three years, you would see FCF growth of over 44,000%. Of course, this was from a very low starting point. But right now, the company has a trailing-twelve months FCF margin of 26%.

But forget FCF for a while too. This is a growth stock, not a value investment. That means that this free cash flow is very important to fuel the business’s growth, more than a means to value the stock. Datadog doesn’t need outside money to finance that growth and that’s essential.

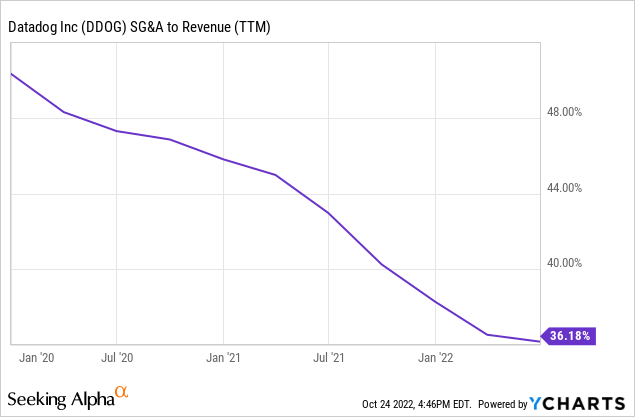

For a growth company, its SG&A (selling, general and administrative) costs are very low and declining fast. It’s just 36% of revenue, while almost all companies in full growth mode have 50%+ and many even 80%+.

If you compare that relatively low sales spending with its growth, it shows Datadog must be doing something right. Its growth is very efficient.

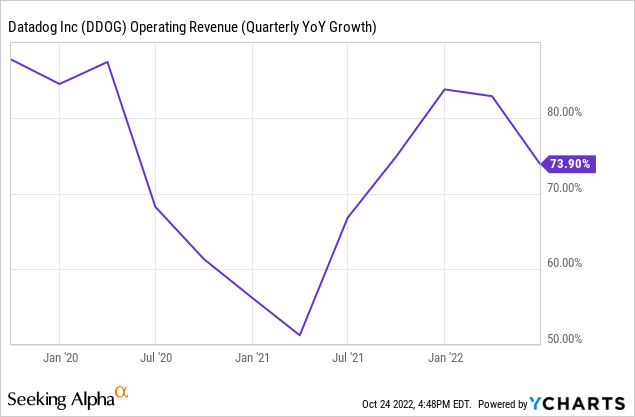

As you can see, revenue has grown at 50% and (much) more in every single quarter, which is impressive if you combine that with the sinking sales costs.

Dollar-based Net Retention

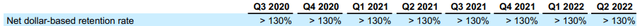

This is a mission-critical SaaS company. What that means is that companies will not stop spending during a recession. With every new use case, and Datadog has created many over the years, the customers will spend more. That is why its dollar-based net retention rate has consistently been above 130%.

Datadog’s Q2 2022 financial statement

I’m not sure if everyone is fully familiar with dollar-based net retention rates and therefore a very short explanation.

Suppose you have a company and it has 100 customers. They each spend $1000 per year. That means you have $100,000 of revenue per year. The next year, five customers leave, but the remaining 95 spend $1,100. That amounts to $104,500 (95x$1,100).

Your dollar-based net retention rate is 4.5% in this case, as $104,500 is 4.5% above $100,000. Can you see how incredibly powerful Datadog’s 130%+ is? Even without one single new customer, your revenue grows by more than 30%.

The PSG Ratio

How do you value a business like that? The answer might be in the PSG ratio. That PSG stands for price, sales and growth. It’s a metric used by Robert Smith, the first big fund manager focussing on business software and therefore, SaaS, Software-as-a-Service. From 1994 to 2000, he worked for Goldman Sachs (GS), specializing in technology mergers and acquisitions.

In 2000, he started his own fund, Vista Equity Partners, which is a private equity and venture capital firm focused on tech. Smith is believed to have generated a CAGR of 30% from the inception to now. The company did over 600 transactions and owns at least 85 tech companies, almost all software-centered. So, I would say he knows a thing or two about how to value a software business.

In a recent podcast interview with Patrick O’Shaughnessy Smith shared that the companies he focuses on, mostly software, historically trade at a fair price when the price divided by revenue divided by growth is at 0.43. In other words, for public companies, the market cap divided by revenue and growth rate has historically been fair at 0.43.

For Smith, it was a reason to split off and bring several of his companies public in the last half year of 2020 and the first of 2021. He saw they were way overvalued.

In contrast, right now, he’s on a buying spree. Vista and several of its branches have been involved in software companies taken private. Citrix early this year for more than $13B, KnowB4 was recently bought for $4.5B, and Avalara for almost $8.5B. The reason? His SaaS valuation method which he has been using since 2000, signals green lights.

Details about the PSG ratio

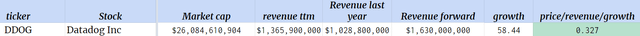

If you talk about growth, which growth is that? It’s revenue growth, that’s for sure, but it’s not 100% clear what Smith exactly means. Do you look forward or not? This is how I approached this. I took last year’s revenue and the projected revenue for this year to determine the revenue growth. I took the trailing twelve months’ revenue for revenue.

I think that’s fair, as trailing twelve months’ revenue is the most certain and not looking back too much. For growth, many companies will grow much less this year (so forward-looking) than last year, both because of the disappearance of the pandemic and because of the macro circumstances. That means I take the most conservative numbers here, which is warranted in this environment.

Datadog’s PSG score

I repeat that for Smith, under 0.43 means fairly valued or even undervalued.

This is the PSG score for Datadog.

Made by the author

As you can see, with just 0.327, Datadog looks undervalued according to Smith’s method.

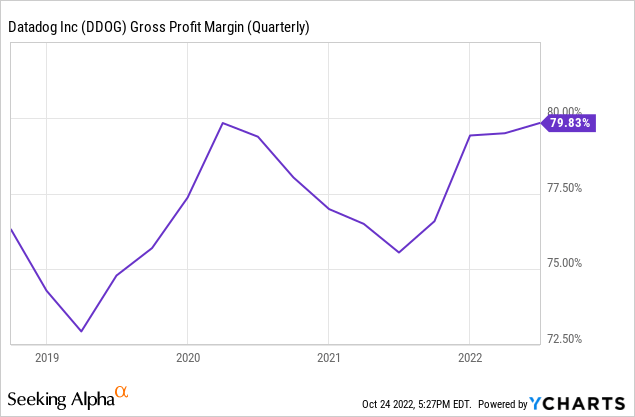

Beware, this valuation method only works for SaaS companies with high margins. Companies with lower margins than software companies will look incredibly cheap. You need gross margins higher than 70% for this method to make sense. For Datadog, that’s no problem at all.

I know many of you may not buy into this valuation method and that’s fine. To each their own. If you know a better valuation method for SaaS stocks, you can always share it in the comment section.

On the short-term price movement

Even though the PSG suggests that Datadog is cheap now, that doesn’t mean there cannot be more short-term pressure on the stock price, of course. When I wrote my previous article about Datadog, the stock traded around a PSG score of 0.43, which would be more or less fair, but it’s still down around 30%. That could happen again from this price point, of course.

My approach is not market timing, though, it’s time in the market. That means that I add to my portfolio every two weeks and I average into positions over long periods, often years.

But I’m adding a bit more aggressively to my Datadog position lately. I’m down about 23% on my average purchase price, but I’m not unhappy about that at all. I can buy the stock of a great company at lower prices and that should bring better returns over the long run.

Conclusion

Datadog is a high-quality business with consistent high growth. While it is being thrown into the bin together with other growth stocks, its high free cash flow combined with its remarkable sales efficiency makes it different from much of the rest of growth stocks.

With the PSG ratio currently at just 0.327, Datadog looks undervalued and that’s why I’m adding a bit more aggressively to my position.

In the meantime, keep growing!