CRISPR Therapeutics: The Pick Of The Gene Therapy Bunch (NASDAQ:CRSP)

vchal

Investment Overview

Gene therapy is one of the most exciting and innovative fields of drug development research, although for biotech investors it’s also one of the most risky places to park your money.

Consider Bluebird Bio (BLUE) for example, a company that won not one, but two approvals for gene therapies – Skysona, approved for the rare disease cerebral adrenoleukodystrophy (“CALD”), and Zynteglo, for the blood disorder beta thalassemia. Despite these breakthrough successes, Bluebird’s share price has sunk in value by >90% across the past five years.

The reason gene therapy is such an exciting field of research is that it offers the possibility of “functional cures” i.e. a “one and done therapy,” that after being administered a single time, cures the patient for life. That is also why approved gene therapies tend to be the most expensive on the market.

Novartis’ (NVS) Zolgensma, for example, which is indicated to treat Spinal Muscular Atrophy (“SMA”) in infants, comes with a >$2m price tag. Compared to Biogen’s (BIIB) Spinraza, also indicated for SMA, however, Zolgensma can be considered cheap. Spinraza, administered four times per year, every year (since it is not a “functional cure”) costs $750k for the first year of treatment and $350k per annum after that. Within five years, the drug becomes more expensive than Zolgensma.

Developing gene therapies is fraught with complex and difficult challenges, however, and most listed companies that have attempted to do so have ended up burning through investors cash in the clinic, without producing a drug that works. Sio Gene Therapies (SIOX) stock is down 82% in the past 12 months, Generation Bio (GBIO) is down 69%, and Voyager Therapeutics (VYGR) stock is down 63% across the past five years.

There’s one field of gene therapy research that has rewarded investors handsomely over the past five years, however, and that’s CRISPR gene editing. CRISPR stands for Clustered, Regularly Interspaced Short Palindromic Repeats, and its discovery earned the scientists Jenifer Doudna and Emannualle Charpentier the Nobel Prize for Chemistry in 2020.

In nature, CRISPR is used by bacteria to identify genetic sequences belonging to harmful viruses and cleave them using specialised enzymes, such as CAS-9, and Doudna and Charpentier were able to show that this system could be adapted to target and edit, remove, or destroy harmful genetic sequences in humans.

This discovery spawned several biotech companies – Doudna became a scientific co-founder of Intellia Therapeutics (NTLA) whilst Charpentier co-founded CRISPR Therapeutics (NASDAQ:CRSP) – the subject of this post. These 2 companies share prices are respectively up 146%, and 210% over the past 5 years, versus the S&P 500’s 53% gain over the same period.

Some other CRISPR focused companies have admittedly not fared so well. Editas Medicine (EDIT), founded by scientists at the Broad Institute, Harvard, who have patent disputes ongoing with Doudna and Charpentier, and the University of California at Berkeley and the University of Vienna (collectively known as CVC) over who adapted the technology to treat human disease first – has seen its share price fall by 55% over the past five years.

Caribou Biosciences (CRBU) – another CVC vehicle – has seen its stock fall by 44% since its July 2021 IPO raised ~$304m, while the Broad Institute’s next generation CRISPR / base editing vehicle Beam Therapeutics (BEAM) has been a success, up 47% since its Feb 2020 IPO raised $180m.

The reality is that with it being more than two years since Doudna and Charpentier’s Nobel Prize, and 10 years before scientists began investigating CRISPR, these companies stock prices can no longer trade on hype and the possibility of breakthrough, “one and done” therapies, and need to start showing they can win approvals for drugs that genuinely work.

At this time there’s only one company close to achieving this market validation and that’s Crispr Therapeutics. In the rest of this post I will discuss what those opportunities are, the potential market opportunity, and why I suspect that investors are better off buying into this $4.5bn market cap company than any other publicly traded CRISPR-focused company at the present time.

The beauty of buying CRISPR at the present time is that it’s trading at a 30% discount to recent highs. The stock is typically volatile and strongly catalyst driven, and with a first ever approval of a CRISPR drug in the offing in 2023, the chances of a spike in the share price are clear and present.

Crispr Therapeutics Is About To Make The First Ever Regulatory Filing For A CRISPR Drug

In its Q322 earnings presentation, released on Nov. 4, Crispr Therapeutics states that it is “in position” for a first Biologics License Application (“BLA”) submission to the Food and Drug Agency (‘FDA”), and first Marketing Authorization Approval (“MAA”) to the European Medicines Agency (“EMA”) for its lead drug candidate exaglamglogene autotemcel, or “Exa-Cel”, in beta thalassemia and Sickle Cell Disease (“SCD”).

The application is based on data from a study of 75 patients – 44 with transfusion dependent thalassemia (“TDT”) and 31 with sickle cell disease. Both are debilitating, life-long diseases that presently require patients to regularly undergo blood transfusions to ease pain and suffering. In the study, 42 of 44 TDT patients were able to stop blood transfusions altogether, and all 31 patients with SCD were free vaso-occlusive (“VOC”) episodes (where tissues become deprived of oxygen and intravenous hydration often required) after a duration of 2 – 32 months.

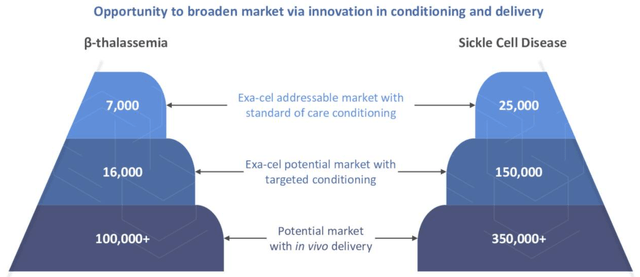

The data is widely regarded as sufficient for an approval for Exa-Cel, and the market opportunity is expected to be initially 7k TDT patients and 25k SCD patients. Exa-Cel is an “ex-vivo” therapy which means a patient’s cells are harvested, taken to a lab where they are re-engineered using CRISPR/Cas9 techniques to express high levels of fetal hemoglobin – which helps them to prevent VOCs – and then re-infused back into the patients’ bloodstream.

It’s a complex procedure that presents numerous safety issues, the most notable being graft vs host disease (“GvHD”), when the immune system rejects the engineered cells, which can be fatal. CRISPR has established a strong safety profile across 5 separate Phase 3 studies in various patients subsets, however, with only 4 Serious Adverse Events – all resolved – encountered in the TDT patients that were related to Exa-Cel, and none in the SCD arm.

Vertex Partnership and Market Opportunity

Crispr has a significant partner for Exa-Cel in the form of the $80bn market cap, ~$8bn per annum revenue Cystic Fibrosis giant Vertex (VRTX). To gain an understanding of the value of Exa-Cel as a therapy, Vertex paid Crispr Therapeutics ~$1bn in 2021 to increase its share of global net sales from 50%, to 60%, implying Vertex values Exa-Cel sales potential at least $10bn.

Naturally that means that Crispr only earns 40% of net sales of the drug, and there are some doubts about the size of the market for an ex-vivo therapy. The costs of such a drug may be prohibitive, and patients must undergo a harsh pre-conditioning regime before their cells can be harvested – many SCD / TDT sufferers may conclude that Exa-Cel is not for them.

The pharma giant Pfizer (PFE) recently spent $5.4bn acquiring Global Blood Therapeutics and its oral SCD therapy Oxbryta, plus its potential replacement inclacumab, currently in Phase 3 trials. Pfizer management stated it believed it could extract $3bn per annum peak sales from this acquisition, suggesting the Pharma is confident patients will opt against gene therapies.

Furthermore, Exa-Cel isn’t even the only gene therapy chasing near-term approval in SCD / beta thalassemia. Bluebird Bio expects to file its BLA for lovotibeglogene autotemcel, or “Lovo-Cel” in Q123, which prevented VOC’s in 25/25 patients in its pivotal study.

Nevertheless, analysts believe Exa-Cel could become a “blockbuster” (sales >$1bn per annum) drug, meaning that CRISPR could be a commercial stage pharmaceutical company with revenues ~$400m per annum in a few years’ time. Although a forward price to sales ratio of ~10x may seem high, the peak sales opportunity may end up much higher than this, as I discuss below, and CRISPR has some very exciting opportunities outside of SCD.

Conditioning, In Vivo, and Diabetes

Exa-Cel – full market opportunity (CRISPR earnings presentation)

The above slide provides a good illustration not just of how Crispr’s SCD revenues could grow exponentially, but of how the company can develop other assets in a similar fashion.

“Targeted conditioning” is essentially making the pre-conditioning regime more palatable for patients, using, for example, antibody drug conjugates, and Crispr is preparing to submit an Investigational New Drug application (“IND”) seeking permission to enter the clinic with such a therapy. If successful, the higher potency next-generation candidate, with less off-target toxicity, ought to drastically increase the addressable patient population, as shown above, by >5x in management’s estimation.

If we assume that first generation Exa-Cel is a $1bn per annum selling drug, this enhancement could therefore turn it into a $5bn per annum selling drug, which suddenly makes Crispr’s market cap valuation of ~$4.5bn look a lot lower.

Plus, there’s an even bigger step forward that Crispr Therapeutics can take. So far we have only discussed ex-vivo, but what if these therapies could be developed to access patients cells in-vivo? Then there would be no need for pre-conditioning at all.

To date, Intellia Therapeutics is the class leader in this regard – its lead candidate, NTLA-2001 successfully reduced TTR Serum levels in six patients with the disease Transthyretin (ATTR) Amyloidosis using an intravenous injection – the first ever proof of concept for an in-vivo gene therapy.

The technology that’s making in-vivo editing possible is not necessarily exclusive to Intellia, however. Lipid nano particles (“LNPs”), for example, have been developed that can transport RNA (used by CRISPR technology) and MRNA to target cells without damaging them. LNP’s were crucial to the development of Pfizer and Moderna’s (MRNA) COVID vaccines, they are not patent protected, and one day soon they may be able to perform a similar role for next-generation Exa-Cel or other CRISPR medicines as they do for the COVID vaccines.

Crispr’s in-vivo pipeline currently consists of a single asset in IND-enabling studies, and six projects still at the discovery stage, but there ought to be real hope that in the next five years CRISPR drugs can do their work in vivo as opposed to ex vivo, which ought to be faster, more effective, and cheaper. As shown above, the peak sales opportunity in SCD / beta thalassemia could increase to >$10bn per annum should Crispr Therapeutics’ in-vivo work with exa-cel come to fruition, and Crispr owns this next-generation technology, not Vertex.

Make no mistake, CRISPR will play a significant role in the in-vivo gene therapy development race and the targets are mouthwatering – hemophilia is one, and ANGPTL3 – a protein involved in diseases such as nonalcoholic steatohepatitis, for which there are no approved drugs and an estimated $40bn+ market opportunity in waiting – is another.

Finally, in February Crispr announced that a first patient had been dosed in a Phase 1 clinical trial of candidate VCTX210, indicated for treatment of type 1 diabetes. The biotech Via-Cyte is a partner on this particular product, which is an “allogeneic, gene-edited, stem cell-derived product.” Viacyte was recently acquired by Vertex (VRTX), meaning CRISPR is working with its favoured Pharma partner on diabetes as well as SCD.

This is another ex-vivo therapy, and it has to be said that the strides being made in diabetes treatment by the likes of Eli Lilly (LLY) with Mounjaro and Novo Nordisk (NOV) with Ozempic – two oral therapies that are both approved and have peak sales expectations >$10bn – currently put VCTX210 in the shade. But, it mustn’t be forgotten that VCTX210 is a potential “one and done” therapy, which could eliminate the need for patients to take Ozempic or Mounjaro altogether. That is what makes CRISPR such an exciting prospect – and Crispr Therapeutics an exciting investment opportunity for the long as well as the short term.

Conclusion – Crispr Is The “Fantasy” Stock To Hold In Your Portfolio – With Genuine Near-Term Revenue Potential

In this post, I have not even covered Crispr Therapeutics’ oncology pipeline, which many might argue is the beating heart of the company. Again, this pipeline is largely based around ex-vivo projects but the Pharma industry has witnessed the approval of several new such autologous cell therapy drugs in the past year or so. Bristol Myers Squibb’s (BMY) Abecma and Breyanzi, Legend Biotech’s (LEGN) Carvykit, and Gilead Sciences (GILD) Tecartus.

All of these drugs target hematological cancers and stand a good chance of achieving blockbuster sales – some of the data being produced in late stage clinical trials is highly encouraging – Carvykti achieved a >70% Complete Response rate in Multiple Myeloma (“MM”), for example. The next goal is to develop allogeneic therapies (the engineered cells come from donors, not the patients themselves), and make the process work in solid tumor as well a blood related cancers.

Crispr has eight cell therapy projects with two in clinical development, and I would be surprised if at least one or two don’t make it to market, given the company’s body of work to date, and one day – perhaps before the end of the decade – add ~$1 – $2bn to CRISPR’s top line revenues.

In this article I have focused on the near term SCD / Beta thalassemia opportunity mainly, since it underlines the fact that Crispr Therapeutics is very likely going to make it to market with a CRISPR therapy before anybody else. For anybody who believes that process is straightforward, witness the recent failure of Editas Medicine’s attempts to develop a drug for blindness, or Beam Therapeutics decision not to file an IND for its own SCD drug candidate.

The challenge of developing gene therapies is not one to be taken lightly, which is why – amid all the hype – Crispr Therapeutics can be singled out as the best managed company, with the most advanced pipeline, science that’s proven to work in a hard to treat disease such as SCD with a huge market opportunity, and mouthwatering near, medium and long term opportunities to develop next generation, “one and done” therapies for a range of different diseases.

For good measure, Crispr reported >$1.9bn of cash as of Q322. Net loss in the 9m to September 30th is high, at $557m, but the ends ought to begin to justify the means with a first ever approval lined up for 2023, and that’s something that presently, of all the CRISPR companies, only Crispr Therapeutics can say with any confidence.