Comcast: 15% Buyback Yield, Favorable Valuation Should Drive Share Price Up (NASDAQ:CMCSA)

Justin Sullivan

Introduction

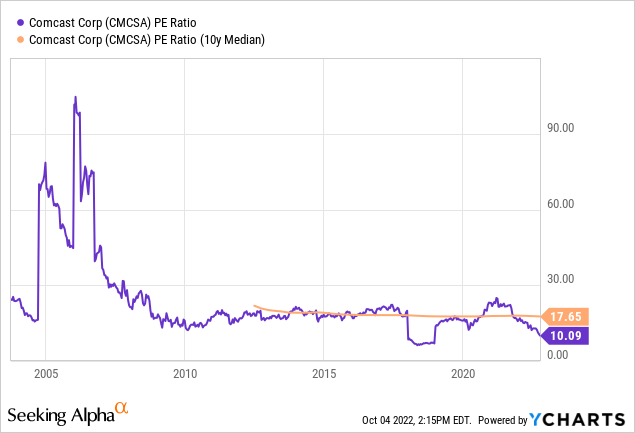

Comcast Corporation (NASDAQ:CMCSA) is one of many stocks that have fallen sharply. The stock has been heavily penalized, peaking at $60 in September 2021, after which the share price fell to $30 now. The stock has a P/E ratio of 8.5 and management is very shareholder friendly, which makes it interesting to analyze the stock in more detail. Investors are shocked by the stock because of the strong rise of streaming and the possible consequences for cable television.

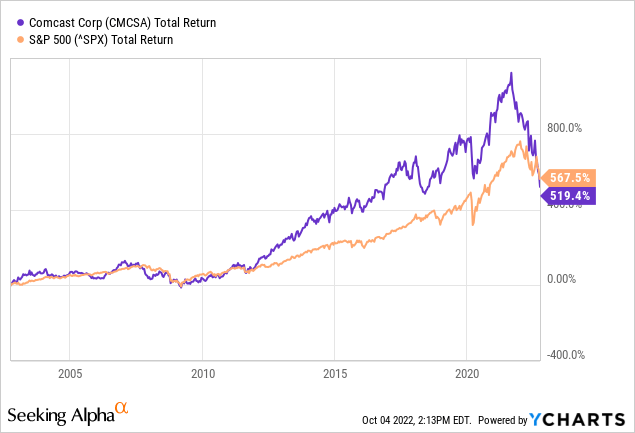

I take the stock price chart to 2002, so that the price evolution around the financial recession of 2008 is clearly visible. Comcast has risen sharply, especially after the financial crisis, outperforming the S&P500. From September 2021, the share fell sharply.

Investors fear the worst for Comcast, but I think investors have punished the stock too hard. Their Cable Communications division provides stable cash flow and investors believe the emergence of steaming will have a major impact on the future. I think this is overrated. I believe Comcast is a strong buy because of their high free cash flow margin, generous share buyback program, low stock valuation and positive earnings per share outlook.

Comcast Has Grown Strongly In Recent Years

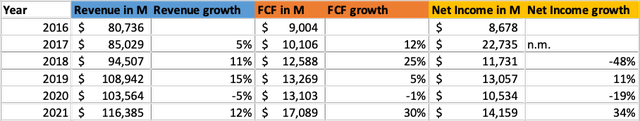

Comcast’s revenue grew strongly over the past 5 years at an average annual rate of 8%. Free cash flow also grew strongly in the same period by an average of 14%. Comcast has its costs well under control. The free cash flow margin is very high at 15%, a strong improvement compared to the free cash flow margin of 2016 (11%).

Comcast’ Financials (SEC and Author’s Own Calculation)

2020 was a year in which Comcast generated less revenue due to lower revenue in their theme parks due to the mandatory closure to contain the corona pandemic. In 2021, Comcast recovered and generated a 12% increase in revenue.

Comcast’ Financial Results (SEC and Author’s Own Graphical Representation)

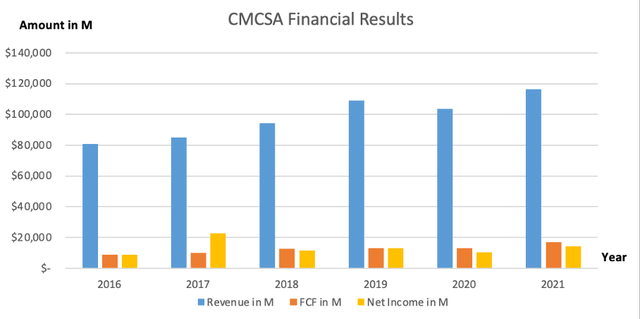

Non-GAAP EPS grew strongly over the past 4 years at an average annualized rate of 12%. This growth is partly due to the large number of shares that Comcast has repurchased over the years.

Comcast’ EPS (SA CMCSA Ticker Page)

For 2024, 19 analysts expect EPS to grow 11% from 2023. Expectations are mixed: 18 analysts have revised their EPS forecast upwards and 12 have revised their EPS forecast downwards.

The roll-out of 10G symmetric speed full network, among other things, will contribute to higher revenue and earnings in the coming years. The company recently announced that their network test is successful.

$20B Share Repurchase Program Should Drive The Share Price Up

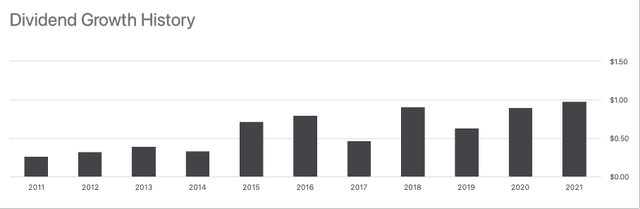

Comcast pays a solid dividend of $1.08, which equates to a dividend yield of 3.53%. On average, the dividend has grown rapidly over the past 10 years by an average of 14% per year.

Comcast’ Dividend Growth History (SA CMCSA Ticker Page)

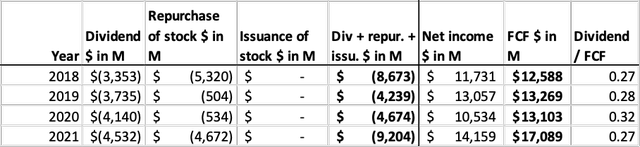

Due to the high free cash flows, Comcast can easily pay the dividend, the dividend to FCF (free cash flow) ratio is 0.27 for 2021. In addition to paying a high dividend, Comcast repurchases shares, which not only ensures growth in dividend per share but also the earnings per share will increase.

Comcast barely repurchased shares in 2019 and 2020, but in 2021 Comcast bought back $4.7 billion worth of its own shares. At the time, this represented a buyback yield of 2.1%.

Comcast’ Cash Flow Highlights (SEC and Author’s Own Calculations)

Despite buying back $9 billion in its own stock this year, Comcast’s stock fell sharply in 2022. Comcast recently announced a large share repurchase program of no less than $20 billion. The end time is unknown, but the buyback yield is calculated at 15%. This is a lot and can push the stock up sharply.

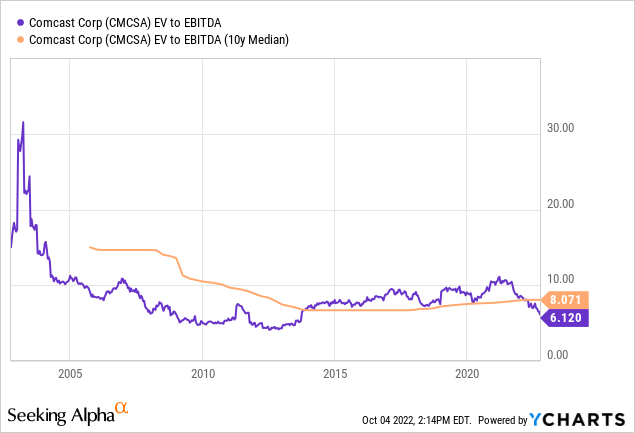

Valuation Metrics Look Favorable

The recent fall in share price gives the stock an attractive valuation. Comcast is repurchasing its own shares and paying dividends in an amount greater than the free cash flow generated this year. Therefore, Comcast will use their cash for funding. This makes the EV to EBITDA ratio and the P/E ratio suitable choices for mapping valuation metrics.

What we see on the EV to EBITDA chart is an attractive valuation that is below the 10-year average and close to historic lows. An EV/EBITDA ratio of 6.1 is generally very low and suggests an attractive buying opportunity.

The P/E ratio also shows a similar picture. The P/E ratio is historically low, and because earnings per share increase when Comcast repurchases its own shares, the ratio will be even lower if the stock price remains at current price level.

Investors fear the decline of cable television due to the strong rise of streaming providers. Still, I think investors are pricing in the worst for Comcast. Comcast is performing strongly, and I expect it to continue to be so for years to come.

Conclusion

Comcast has fallen more than 50% since its peak in September 2021. Investors are shocked because of the strong rise of streaming and the possible negative consequences for cable television. Over the past 5 years, revenue has grown by an average of 8% per year and free cash flow has grown by an average of 14% over the same period. Dividends and a strong share buyback program are financed by their free cash flows.

Currently, the dividend yield stands at 3.53% and is increasing every year because of higher earnings and the share repurchases. The dividend has increased by an average of 14% per year over the past 10 years. In September of this year, Comcast announced a significant $20 billion share repurchase program. This corresponds to a share buyback return of no less than 15%. I think Comcast stock is a strong buy because analysts expect earnings per share growth in the coming years, the generous share buyback program could drive the share price higher, and the stock valuation is very favorable.