Clean Harbors: Still A Nice Way To Clean Up Your Portfolio (NYSE:CLH)

Milos Dimic/iStock via Getty Images

As the world has developed, it’s fascinating to look back and see how many new industries have been created. One industry that might have been thought unthinkable over 100 years ago is the industry that’s dedicated to environmental care. But yet today, there are a number of players, some of them with market capitalizations well into the billions of dollars, that are dedicated to making this planet a little less polluted. One example of this that has been performing incredibly well as of late is Clean Harbors (NYSE:CLH). In addition to operating hazardous waste incinerators, landfills, and other related environmental facilities, the company also provides various industrial services to its customers. Compared to the broader market, shares have generated strong performance in recent months. But the big question is whether this performance should continue or if the easy money has already been made.

Great fundamentals

The last time I wrote an article about Clean Harbors was back in early November 2021. Almost a year ago, I lauded the company’s efforts when it came to taking care of hazardous and non-hazardous waste. I acknowledged that the enterprise looked set to continue growing at a nice clip and that it was generating attractive cash flows for its investors. Add on top of this the fact that shares looked cheap at the time, and I could not help but to rate it a “buy,” reflecting my belief at that moment that shares should generate upside that exceeded with the broader market should. In this volatile market, the company definitely delivered. While a 4.9% increase over the course of a year may not seem impressive, it’s when the S&P 500 is down by 15.8% over the same window of time.

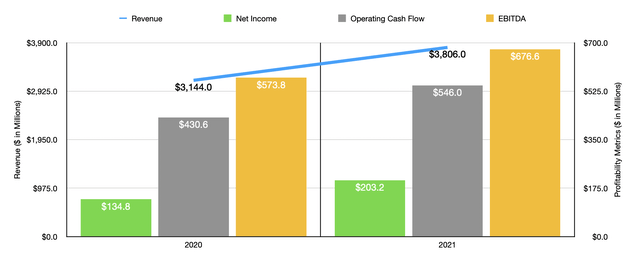

Author – SEC EDGAR Data

To understand why Clean Harbors has outperformed the market so significantly, we should first touch on how it ended its 2021 fiscal year. For that year as a whole, revenue came in at $3.81 billion. That translated to an increase of 21.1% over the $3.14 billion generated in the 2020 fiscal year. A sizable portion of this sales increase, totaling $166.1 million, was associated with the company’s acquisition of HydroChemPSC in October of last year. In addition to that, the company also benefited tremendously from favorable pricing and Him for many of its products sold. For instance, the base and blended oil products the company sells were noteworthy beneficiaries of both price increases and strong demand. Profitability for the company also improved. Net income jumped from $134.8 million to $203.2 million. Operating cash flow went from $430.6 million to $546 million. And EBITDA for the business jumped up from $573.8 million to $676.6 million.

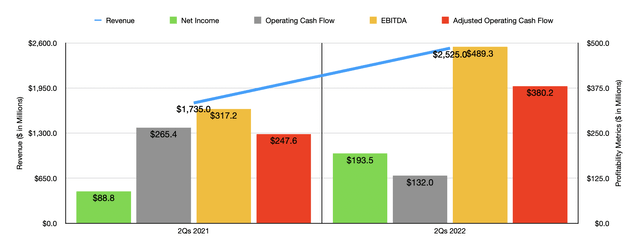

Author – SEC EDGAR Data

Strength for the company has continued well into the 2022 fiscal year. Revenue in the first half of the year, for instance, came in at $2.53 billion. That’s 45.5% higher than the $1.74 billion generated the same time last year. $392 million of this sales increase came from the aforementioned acquisition that the company engaged in. But on top of that, the firm also benefited from higher pricing and higher volume of product sold. This increase in revenue brought with it improved profitability as well. For instance, net income skyrocketed from $88.8 million in the first half of 2021 to $193.5 million the same time this year. Operating cash flow did fall, dropping from $265.4 million down to $132 million. But if we adjust for changes in working capital, it would have risen from $247.6 million to $380.2 million, while EBITDA climbed from $317.2 million to $489.3 million.

Management is expected to report financial results covering the third quarter of the company’s 2022 fiscal year before the market opens on Nov. 2. At present, analysts are anticipating revenue of $1.30 billion. That represents a substantial increase over the $951.5 million in revenue the company generated the same time last year. With this increase in sales also comes an increase in profitability. Earnings per share are currently forecasted at $2.04. By comparison, results from the third quarter of 2021 translated to earnings per share of $1.20. If the company can achieve or even exceed this guidance, there might be a great deal of upside for investors. But given the uncertain market conditions, it also wouldn’t be shocking to miss on guidance.

When it comes to the 2022 fiscal year as a whole, management has some high expectations. For instance, they’re now claiming that EBITDA should be between $975 million and $1.005 billion, with a midpoint of $990 million. That midpoint guidance is now $175 million higher than it was when management last provided guidance for the year. Meanwhile, operating cash flow should be between $630 million and $690 million. The company has not provided any guidance when it comes to net income. But if we annualize results experienced so far for 2022, we would get a reading of $442.8 million.

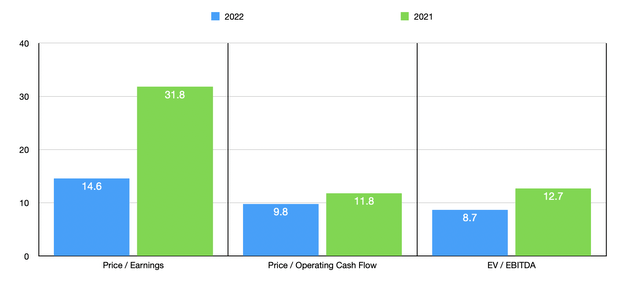

Author – SEC EDGAR Data

Taking these figures, we would get a forward price-to-earnings multiple of 14.6. The forward price to adjusted operating cash flow multiple would be 9.8. And the EV to EBITDA multiple of the company would be 8.7. By comparison, using the data from 2021, these multiples would be 31.8, 11.8, and 12.7, respectively. As part of my analysis, I also compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.5 to a high of 77.5. Using the price to operating cash flow approach, the range was from 7.4 to 49.6. And using the EV to EBITDA approach, the range was from 5.4 to 21.4. In all three cases, only one of the five companies was cheaper than Clean Harbors.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Clean Harbors | 14.6 | 9.8 | 8.7 |

| Quest Resource Holding Corp. (QRHC) | 77.5 | 49.6 | 21.4 |

| Heritage-Crystal Clean (HCCI) | 8.5 | 7.4 | 5.4 |

| SP Plus Corporation (SP) | 17.1 | 12.1 | 10.6 |

| Republic Services (RSG) | 30.6 | 14.8 | 16.0 |

| Tetra Tech (TTEK) | 29.1 | 21.7 | 21.3 |

Takeaway

Thanks to a combination of strong demand and acquisitions, Clean Harbors continues to be an all-star in its space. I also would like to think that the company should be at least somewhat immune from a volatile economy given the nature of the industry it’s in. On top of this, shares look quite cheap on a forward basis. Assuming management can achieve guidance, this implies enough upside potential in my book to warrant the “buy” rating that I have on it still remaining in effect.