Cincinnati Financial Stock: Dividend King Is Becoming Interesting

CHUNYIP WONG

More than a year ago, I recommended waiting for an approximate 20% correction of Cincinnati Financial (NASDAQ:CINF) before purchasing the stock due to the exceptionally rich valuation of the stock back then. Since my article, the stock has declined 25% but the business landscape has completely changed for the insurer, at least in the short run. Therefore, the big question is whether the stock has finally become a bargain.

Business overview

Cincinnati Financial is a property-and-casualty (P/C) insurance company. It offers insurance products for business, home and vehicles as well as financial products, such as life insurance and annuities.

As an insurer, Cincinnati Financial generates its earnings from two sources. It receives funds thanks to the insurance premiums of the policies it sells to its customers and also generates investment income by investing its revenues in stocks and bonds. Warren Buffett has been particularly interested in the insurance business from the early phases of his investing career thanks to the advantages of the float, which can generate attractive returns through investment in bonds and stocks.

After several years of favorable business conditions, Cincinnati Financial is currently facing a perfect storm due to the surge of inflation to a 40-year high and the aggressive interest rate hikes of the Fed, which are likely to cause an imminent recession. Higher interest rates adversely affect the investment income and the book value of the insurer, as they have a negative impact on the current value of stocks and bonds. Stocks comprise 42% of the investment portfolio of Cincinnati Financial while bonds comprise most of the remaining 58%. In addition, the pronounced economic slowdown of the economy is likely to take its toll on the sales of insurance products in the upcoming quarters.

The deterioration of the business landscape of Cincinnati Financial was clearly reflected in its last earnings report. In the second quarter, the insurer switched from earnings per share of $4.31 in the prior year’s quarter to an excessive loss per share of -$5.06. About 87% of the difference in earnings was caused by a steep decline in the fair value of the stocks and bonds of the investment portfolio of the company. Adjusted earnings per share plunged 64%. As if the plunge of the value of the investment portfolio were not enough, Cincinnati Financial posted a daunting combined ratio of 103.2% in its insurance business due to high catastrophe losses. Overall, it was the second-worst quarter of the company in the last 19 quarters.

However, investors should not be myopic, especially in the highly volatile P/C insurance industry. Instead, they should always focus on the long term. First of all, the P/C insurance is well-known for its volatility, which results from the unpredictable nature of catastrophe losses. The latest quarter was especially adverse for Cincinnati Financial but it is reasonable to expect a reversion to the mean at this front in the upcoming quarters.

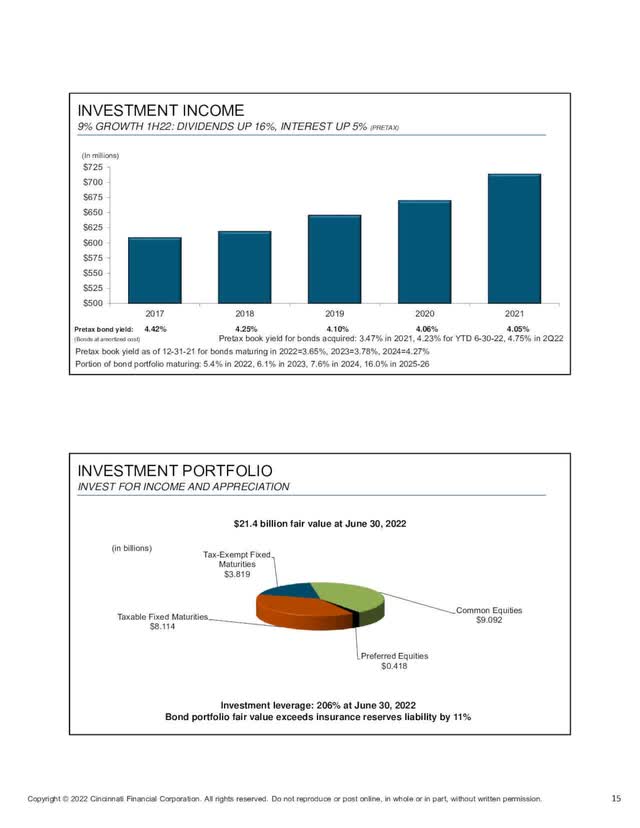

Moreover, the aggressive interest rate hikes of the Fed have caused a slump in the current value of the investment portfolio of Cincinnati Financial but they will soon have a positive effect, as the insurer is now able to invest its available funds at higher interest rates. The increased yields are likely to begin to boost the investment income of the company in the near future, after several years of decreasing yields.

Cincinnati Financial Investment Income (Investor Presentation)

It is also important to note that the recent slump of the mark-to-market value of the investment portfolio of Cincinnati Financial is likely to prove temporary. This is certainly true for the bonds of the investment portfolio, as these securities are held to maturity. It also has good chances of proving true for stocks as well, as long as the Fed restores inflation to normal levels and the economy begins to recover.

To cut a long story short, if the Fed accomplishes its goal of reducing inflation, the mark-to-market value of the investment portfolio of Cincinnati Financial is likely to recover, along with the bond and stock markets, and the insurer will also benefit from the high yields it will lock in its new funds until interest rates fall to lower levels.

Valuation

When I wrote my previous article, Cincinnati Financial was trading at an all-time high and at a nearly 10-year high price-to-earnings ratio of 26.3. That level was much higher than the 10-year average price-to-earnings ratio of 20.9 of the stock.

Since the article, the stock has incurred a 25% correction and thus it is now trading at a price-to-earnings ratio of 20.4, which is nearly equal to the historical average of the stock. Even better, analysts expect the insurer to recover from its current downturn and thus they expect it to grow its earnings per share by 10% next year and by 17% in 2024. Therefore, the stock is currently trading at only 16.1 times its expected earnings in 2024. It thus offers an attractive entry point for patient investors, who can endure stock price volatility and maintain a long-term perspective during the ongoing bear market.

Dividend

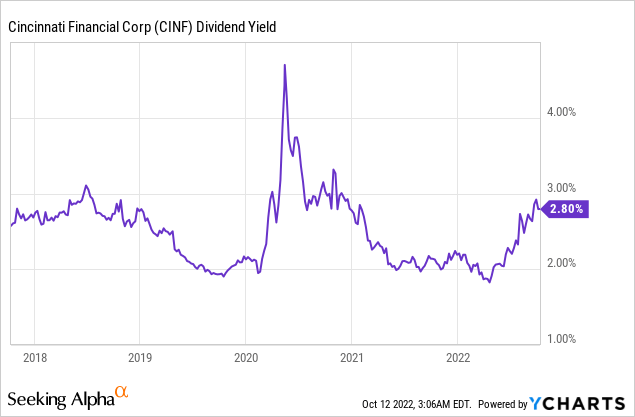

Cincinnati Financial has raised its dividend for 61 consecutive years and thus it is a Dividend King. This is one of the longest dividend growth streaks in the investing universe and hence it is admirable, especially given that the company operates in the highly volatile P/C insurance industry. The exceptional dividend record is a testament to the disciplined underwriting policy of the insurer. Moreover, thanks to its healthy payout ratio of 49% and its promising growth prospects, Cincinnati Financial can easily continue raising its dividend for many more years.

Furthermore, thanks to its correction this year, the stock is currently offering a nearly 4-year high dividend yield (with the exception of the sell-off at the onset of the pandemic) of 2.9%.

While this yield is uninspiring on the surface, it is likely to prove an attractive entry point for long-term investors when combined with the attractive valuation of the stock.

Risk

The current stock price of Cincinnati Financial will probably prove a bargain but only if inflation reverts towards its long-term average of 2% in the next few years. If inflation remains excessive for years, it will continue to exert pressure on the valuation of Cincinnati Financial, as it will keep exerting a drag on the present value of the future cash flows of the company. Therefore, only the investors who are confident that inflation will soon begin to revert towards normal levels should consider purchasing Cincinnati Financial around its current price. Fortunately, the Fed is clearly determined to restore inflation to normal levels, as it has prioritized this goal, even at the expense of short-term economic growth and unemployment. As a result, the adverse scenario of persistent inflation for years is highly unlikely.

Final thoughts

Cincinnati Financial has become interesting thanks to its 25% correction and the resultant improvement in its valuation and dividend yield. However, the company is facing some headwinds in the short run while its stock is in a strong downtrend. Therefore, I advise investors to wait for a further correction of 10% and purchase the stock near its technical support around $85.