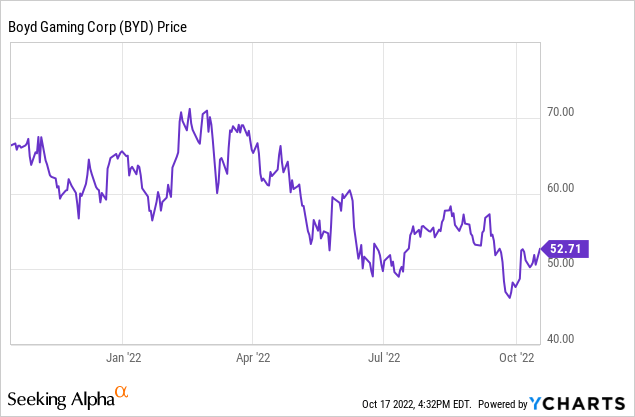

Boyd Gaming: At Midpoint Of 52-Week Range, Buy Signal Is Lit Before Earnings (NYSE:BYD)

David Becker/Getty Images Entertainment

Consensus PT for Boyd Gaming Corporation (NYSE:BYD): $65. Our PT: $71 by end of 1Q23 due to what we see as a late-stage pandemic easing cast against a looming recession.

What’s not entirely baked into the current price

The Las Vegas locals market early-retiree slot customer segment is less likely to be daunted by recession, as both their fixed-pension feed and expected rise in Social Security Cola buffers macro headwinds to a greater extent than believed. Population growth stirred by escape from high-tax and lifestyle challenges in many states are sustaining population growth in Clark County, Nevada.

Between 2020 and 2022, Clark county population grew by 2.2%, well above the national average, which is flat. Demographers expect the trend to continue. Long-term growth of the area is forecasted to reach 30% between now and 2040. The demographic prolife of new residents represents a match for the most valuable potential players in the years ahead.

The economic health of the Las Vegas macro economy will endure recession better than most. Though the spurt of pent-up demand may be waning a bit, we see a sharp rise of convention and meeting business fueling employment, translating to strong local returns.

And the attraction of its state policies in taxation represents a plus going in, to add to the discretionary income potential of existing and new residents.

- Boyd’s regional properties are holding their own, as the consumer discretionary dollar begins to tighten.

- The company owns 5% of the equity of Fan Duel unit of global online gaming leader Flutter Entertainment plc (PDYPF, PDYPY), which eventually will spin off Fan Duel now valued most recently at $11.2b, putting BYD’s equity in theory worth ~$660m. This is essentially free to holders of BYD, as its earnings are calculated on the performance of it 28 casino properties.

- Its current ratio of 0.78 is telling us that its ability to manage its $3.77b in long-term debt meets the test of solid liquidity going forward.

- It has $250m in cash (mrq) and has resumed modest dividend payouts. Prudent moves with free cash flows is a signal skill of management.

- Its operating cash flow cash flow is $967m (ttm) with a leveraged free cash flow (“FCF”) of $487m.

- BYD has no exposure to the Asian gaming markets still under pressure from China’s zero covid toleration policy.

The company’s transactional mentality in driving growth is expected to continue. Its timing in buying 50% of the AC Borgata in the early 2000’s and selling its equity to partner MGM in 2016 and using part of their $900m in proceeds to fund acquisitions in the Vegas locals market has paid off. We expect management to continue moving ahead with expansion deals by acquisitions.

TTM: Revenue hit $3.48b throwing off $1.21b in EBITDA. Given the gyrations of lockdowns, re-openings, and long re-ramps since 2020, we see this as an outstanding performance in the U.S. regional gaming space.

- BYD has no exposure to the Las Vegas strip. Clearly, many investors see this as limiting BYD prospects given the strong, propulsive drive of demand both in tourism and meetings that has moved Strip revenue recovery to new highs.

- However, it likewise relieves a burden for BYD in a marketplace, though showing great vitality, that will continue to experience new supply with the arrival of the massive Resorts World property already open and the Fontainebleau property expected to debut in the fourth quarter of this year.

- BYD’s trailing P/E put it at 10.20, among the better valuations currently in the sector. MGM Resorts International (MGM) trades at a P/E of 4.62, which is clearly a buy. But MGM still has exposure to the covid dead-pooled Macau market. We think BYD’s multiple could stand a much larger valuation given its prospects going forward for this fiscal year as well as even more improved possibilities for 2023.

EV/EBITDA: 7.77 by any measure, very healthy. As we have often noted, among all metrics, this one is the gold standard for casino operators.

Discounted cash flow value according to Alpha Spread: $67.84. On the basis of the current price, the stock is undervalued 23%.

Institutional support

At writing, BYD is 71% institutionally owned. Analysts posting 12 month targets on the stock over the last three months ranged from a low of $64 to a high of $80. Our PT leans on the more bullish side because we see the stock as a value story at its current price as well as its going-forward position.

Fan Duel spinoff potential

While there has been no tangible change in Flutter’s public statements that a spinoff IPO of Fan Duel was either imminent, being developed, or even under serious consideration, we continue to believe it will happen. Fan Duel is the market share leader of sports betting with an overall ~51% of the U.S. market according to their calculations.

BYD is involved with the company now, as they are a provider of that vertical to BYD casinos. Fan Duel is forecasting ~$3b in U.S. revenue for 2022. What’s more important is that by this last September, it was the first operator in the space to record a profit. It made $22m, and Flutter has said it expects the site to be entirely profitable for the whole 2023 year. Meanwhile, it is staying mum on a spinoff for several reasons, though assumed by savvy industry observers.

The first reason is tied into its complex arbitration process with Fox Sports, an early investor. The ongoing dispute is overvaluing the Fox equity. FLTR says it is based on what Fox paid for its 18% of its stock when it bought in, and Fox claims the value is what its market cap is today.

The other reasons, according to our sources, involve a disinclination of FLTR to move now when the company has just peeked into profit. “They’d probably want to wait until they get a full year of most of it under their belt to show the massive profits thus valuing any spinoff much higher than now,” reportedly said one executive of a competing platform.

No matter what the final resolution, it appears that, once again, BYD management had made a very smart investment at the right time in the right place. Investors will benefit from this longer term, but they are still buying BYD at a price essentially based on their casino business alone. “These guys know how to move their money a lot better than many peers in the space,” reportedly said one investment banker who had worked on prior BYD deals.

Our final take: BYD belongs in any balanced gaming portfolio now: Strong buy and Overweight due to what we believe will be a steady re-ramp of revenue and EBITDA.