BlueLinx: Repurchased ~9% Of Stock In Q2, Priced At 2X EPS (NYSE:BXC)

Juanmonino/E+ via Getty Images

Investment Thesis

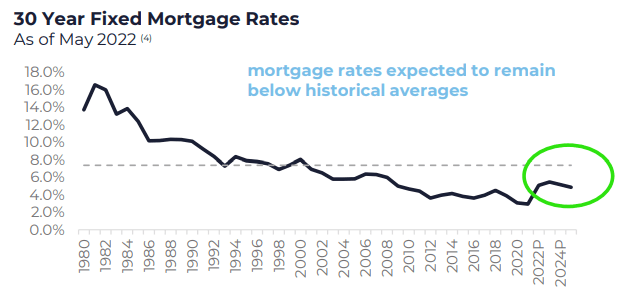

BlueLinx (NYSE:BXC) is priced at 2x this year’s EPS as investors believe that a higher interest rate environment will lead to the housing market cooling down.

Consequently, with less appetite for taking out new mortgages, demand for housing and renovations will retrace lower. Hence, investors have absolutely no interest in buying housing stocks.

That being said, what if this higher interest rate environment has less impact on housing demand than investors originally believed? What if demand for housing isn’t materially impacted?

After all, keep in mind, that interest rates are still below historical averages.

Even while recognizing some of the risk factors facing BlueLinx and the sector in general, I believe that paying 2x this year’s EPS already factors in a lot of negative considerations.

Hence why I rate this stock a buy.

BlueLinx’s Revenue Growth Rates Ticking Along

Author’s calculations

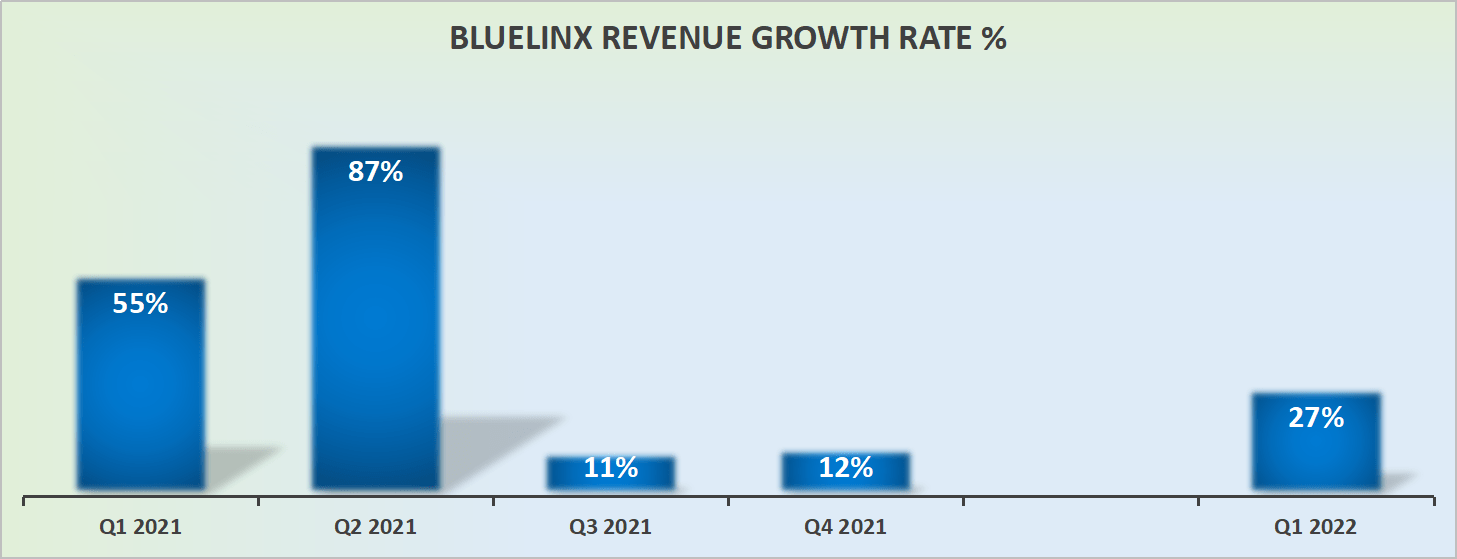

BlueLinx’s Q1 2022 revenue growth rates positively surprised many investors. Investors are now looking ahead and trying to get some insight into whether or not the US is going into a recession, and if it is, how deep will this recession be?

Needless to say that Q2 2022 is going to be a very tough comparison against the same period a year ago. However, after Q2, H2 should be a fairly easy period for BlueLinx to compare against.

That being said, there are some further considerations to keep in mind.

BlueLinx’s Near-Term Prospects

BlueLinx is a wholesale distributor of building and industrial products. That means that its risks and opportunities are nearly fully aligned with the housing market.

If the US housing market cools down on the back of the higher interest rate environment, this would lead housing stocks to report poor levels of profitability.

And so far, that’s what investors appear to be pricing in, as BlueLinx’s multiple has meaningfully compressed.

BXC Investor Day, June

Meanwhile, as you can see above, even with the slight jump in interest rates, we are still very much below historical averages. Consequently, if there was high demand for housing in a higher interest rate environment, it’s fair to assume that there will continue to be housing demand going forward.

What’s more, BlueLinx’s new management obviously recognizes all these dynamics, as well as that BlueLinx stock’s multiple is compressed. This has led to BlueLinx’s drive to support its share price via a shareholder-friendly capital allocation policy.

Capital Allocation Policy, 9.0% Capital Return Program Completed

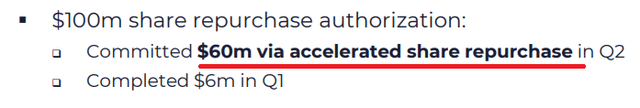

BlueLinx has a $100 million share repurchase program authorized. Many companies have open-ended share repurchase programs, but few actually complete their programs.

However, as you can see above, BlueLinx has sought to repurchase $60 million worth of stock in Q2. That means that BlueLinx has now returned 9.0% worth of capital to shareholders over a 90-day period!

That means that when BlueLinx reports its Q2 results, its EPS figures will probably be closer to $7.65 EPS, rather than the $7.05 that analysts expect.

BXC Stock Valuation – 2x EPS

Presently, together with its Q2 buybacks, it appears that BlueLinx is about to report approximately $20.85 of EPS for H1 2022 results.

Even if we simply take analysts’ EPS expectations for the remainder of 2022, this would put BlueLinx on a path to report $31.51. This would put the stock priced at approximately 2x this year’s EPS.

Then, you are still left with roughly $40 million on the repurchase program, a further 6.0% worth of buybacks to be repurchased over the coming months.

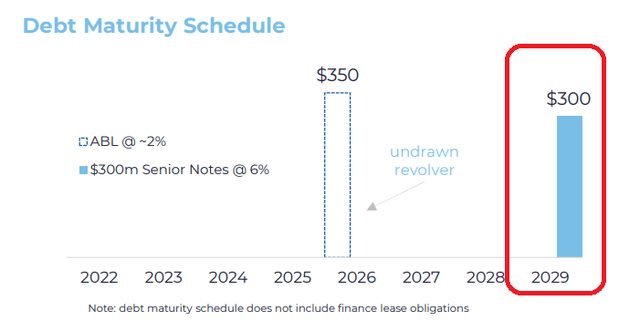

In practical terms, investors are paying 2x EPS for a business that has no debt maturity until 2029. A business that is oozing free cash flows and returning capital to shareholders.

Altogether, this strikes me as a compelling investment.

The Bottom Line

Many investors have come to believe that BlueLinx requires very high lumber prices to be able to generate strong free cash flows. However, as you can see above, BlueLinx’s recent Investor Day based its financial decisions and capital allocation strategy off of $450 lumber prices.

Lumber prices, today, are nearly 40% higher than these key assumptions. There’s a large margin of safety when investors are asked to pay just 2x this year’s EPS for a stock.