Biblical Mean Reversion In Motion

domoskanonos

Subprime loan delinquency rates are higher than the 2008 recession levels today, with unemployment still near all-time lows and the layoff cycle just beginning…

But the Fed won’t rescue the housing market.

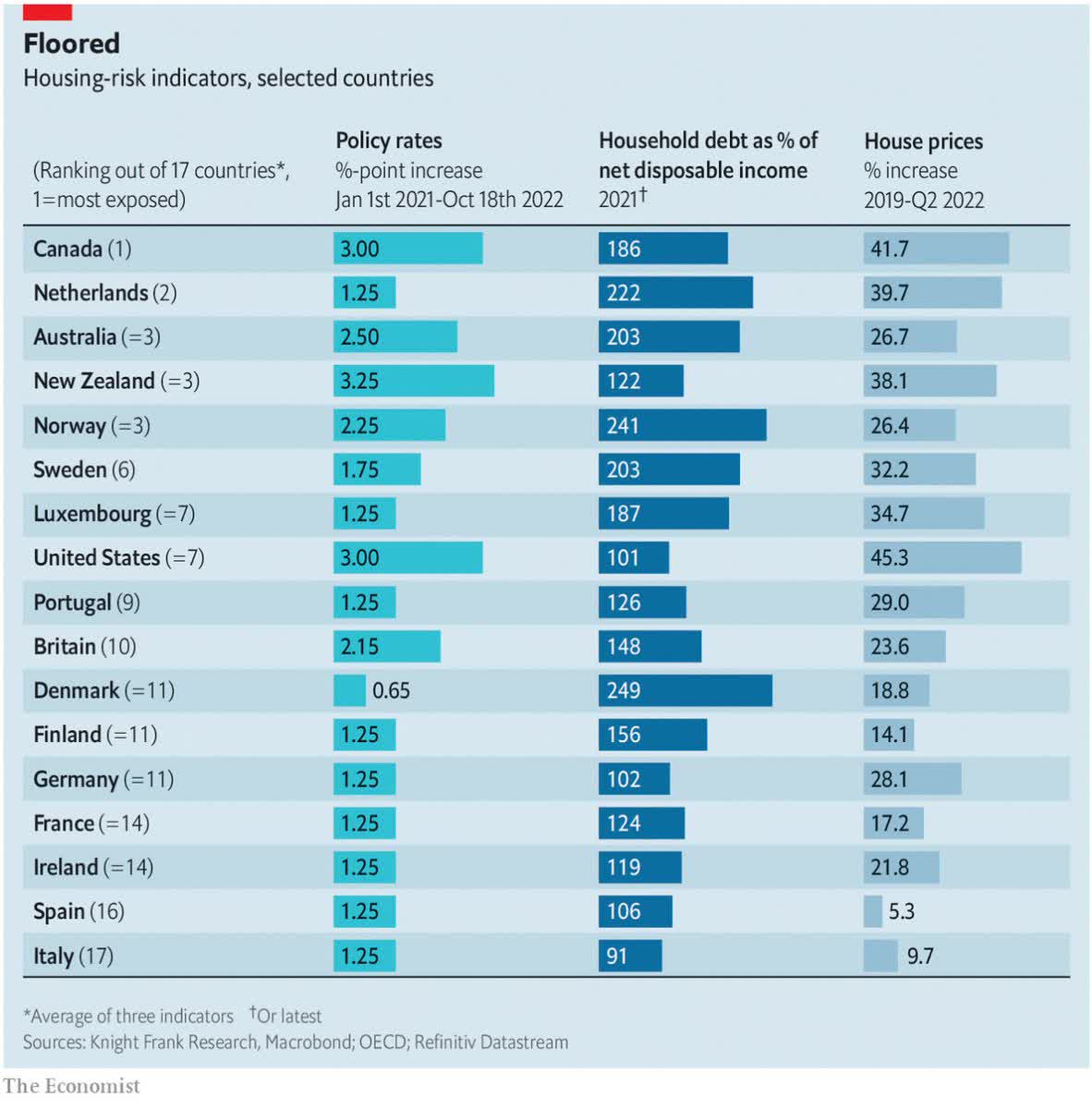

As shown below, Canada is top of housing risk downside globally.

Housing Risk Indicators

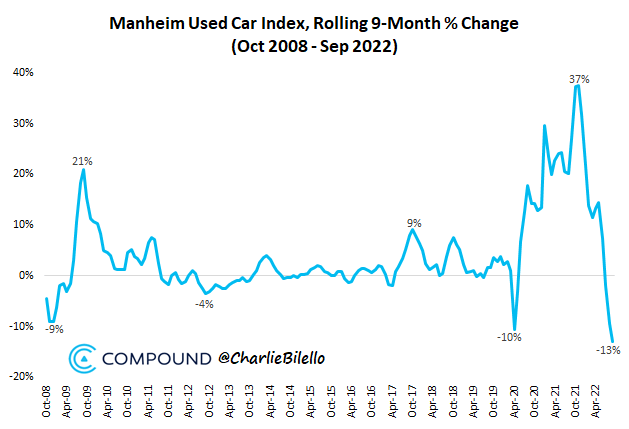

What goes up above average comes down more than average (mean reversion folks!) Below we have used car prices since October 2008.

Manheim Used Car Index, Rolling 9M % Change

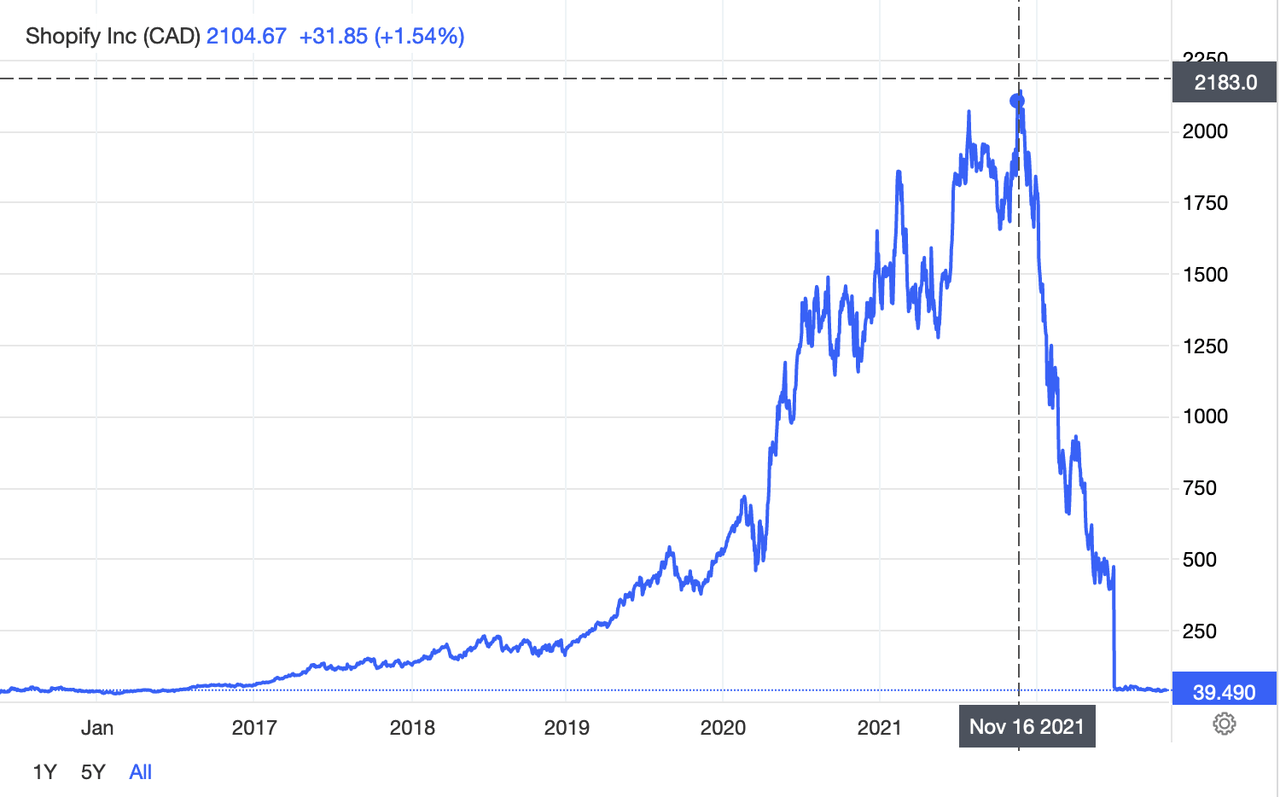

And here’s Canada tech star Shopify (SHOP) from the most expensive company in the TSX index last November to -98% since.

SHOP (CAD)

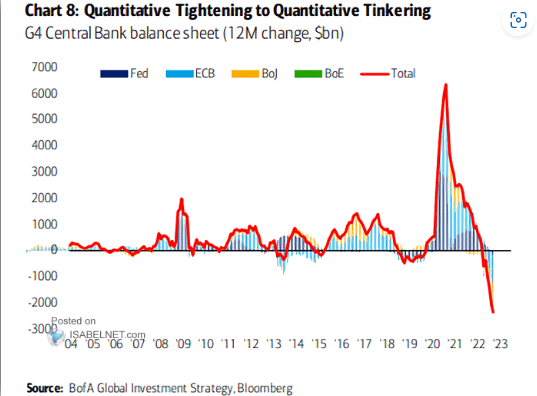

While central banks have vowed relentless rate hikes (caveat: until something big breaks) as shown below, they have just barely started quantitative tightening (QT) in 2022. For public optics sake, central banks may well pause QT before they stop hiking rates. Risk markets are likely to rally on news of slower monetary tightening (less QT/smaller rate hikes), but historically, market bottoms do not come until 70% through recessions when the next rate cutting cycle is nearing an end.

Disclosure: No positions.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.