Battalion Oil: A Look At Potential 2023 Scenarios (NYSE:BATL)

limpido

Battalion Oil’s (NYSE:BATL) adjusted EBITDA should improve significantly in 2023 due to smaller hedging losses and reduced gathering and other costs after its acid gas treating facility enters service. Battalion may have ended 2022 with around $80 million in adjusted EBITDA for the year, while it looks capable of generating around $145 million to $170 million in adjusted EBITDA in 2023 depending on how much it spends on capex (to grow oil production or not).

Battalion does look capable of reducing its leverage to near its target level of 1.0x by the end of 2023, but will have some decisions to make about its 2023 development plans. It could aim to grow oil production modestly from Q4 2022 levels, which would give it a small amount of positive cash flow for the year. It could also reduce its capex budget and aim for a more significant level of debt paydown in exchange for some modest oil production declines from Q4 2022 levels.

Natural gas prices have fallen considerably since I last looked at Battalion, but it is roughly 70% hedged on natural gas for both Henry Hub prices and Waha basis differentials. Thus, I still believe that Battalion can be worth in the mid-teens per share in a long-term (after 2023) $70 WTI oil and $4 Henry Hub gas scenario. Battalion’s term loan debt will need to be carefully managed though.

Notes On Hedges

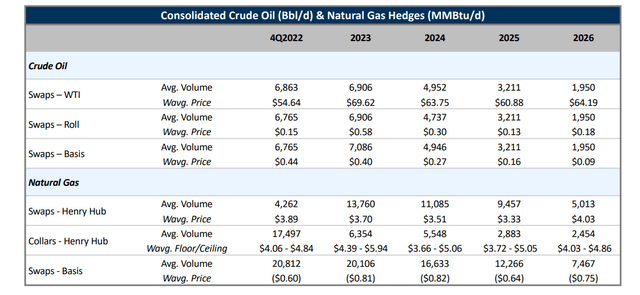

Battalion’s large amount of hedges means that it doesn’t benefit much from increases in commodity prices and also doesn’t suffer much when commodity prices go down. I estimate that Battalion is approximately 70% hedged on natural gas in 2023, both for Henry Hub prices and Waha basis differentials.

This means that a $1 decrease in Waha natural gas prices in 2023 reduces Battalion’s estimated free cash flow by approximately $3 million.

Battalion’s Hedges (battalionoil.com)

Around 73% of Battalion’s oil production (by my estimates) is also covered by hedges. A $5 change in oil prices changes Battalion’s estimated cash flow by $7 million net of hedges. This includes the impact of changes in the prices of NGLs, which are often correlated with oil prices.

Updated 2023 Outlook

I’ve updated my 2023 model for Battalion with current strip prices. This includes high-$70s WTI oil and approximately $3.10 NYMEX gas. Due to the impact of wide Waha differentials on top of that, Battalion may realize very little for its natural gas before hedges.

Battalion does have hedges covering 70% of its estimated natural gas production for 2023. The Henry Hub hedges have an average floor/swap price of $3.92. The Waha basis hedges are at negative $0.81, so 70% of Battalion’s natural gas production is effectively hedged at a Waha price of $3.11, which is quite favorable at the moment.

After hedges, Battalion is now projected to generate $318 million in revenues at current strip prices.

|

Type |

Barrels/Mcf |

$ Per Barrel/Mcf |

$ Million |

|

Oil |

3,467,500 |

$78.00 |

$270 |

|

NGLs |

1,543,950 |

$30.50 |

$47 |

|

Gas |

10,446,300 |

$1.00 |

$10 |

|

Hedge Value |

$-9 |

||

|

Total |

$318 |

This leads to a projection of $16 million in positive cash flow for Battalion in 2023 in this scenario where it has $130 million in capital expenditures and grows its 2023 oil production by mid-single digits from Q4 2022 levels.

Battalion would then end 2023 with net debt of approximately $185 million to $190 million, along with leverage of 1.1x. This level of leverage is slightly above Battalion’s 1.0x target.

Rising interest costs are a minor issue for Battalion, with its SOFR-based term loan carrying an interest rate of 11.8% currently. Each 1% increase in interest rates increases its annual interest costs by around $2 million, which has around the same impact on Battalion’s 2023 cash flow (after factoring in its hedges) as a $1.50 decrease in oil prices.

|

$ Million |

|

|

Lease Operating and Workover |

$62 |

|

Production Taxes |

$18 |

|

Cash G&A |

$17 |

|

Gathering and Other |

$52 |

|

Cash Interest |

$23 |

|

Capital Expenditures |

$130 |

|

Total |

$302 |

Alternative 2023 Scenario

The above scenario looks at what happens if Battalion spends to grow 2023 oil production by mid-single digits from Q4 2022 levels. I’ve also modeled an alternative scenario here where Battalion reduces its capex budget to $70 million and ends up with 2023 oil production down by mid-single digits from Q4 2022 levels instead.

At high-$70s WTI oil and $3.10 NYMEX gas, Battalion would now generate $290 million in revenues after hedges.

|

Type |

Barrels/Mcf |

$ Per Barrel/Mcf |

$ Million |

|

Oil |

3,117,500 |

$78.00 |

$243 |

|

NGLs |

1,508,950 |

$30.50 |

$46 |

|

Gas |

10,206,300 |

$1.00 |

$10 |

|

Hedge Value |

$-9 |

||

|

Total |

$290 |

With its reduced capex budget of $70 million, Battalion would now be projected to generate around $54 million in positive cash flow in 2023. This would reduce its net debt to approximately $150 million by the end of 2023, while its year-end 2023 leverage would be in-line with its 1.0x target.

|

$ Million |

|

|

Lease Operating and Workover |

$61 |

|

Production Taxes |

$17 |

|

Cash G&A |

$17 |

|

Gathering and Other |

$50 |

|

Cash Interest |

$21 |

|

Capital Expenditures |

$70 |

|

Total |

$236 |

This alternative scenario where Battalion reduced its capex budget to $70 million would give it lower net debt and slightly lower leverage. However, it would also leave Battalion with around 10% lower oil production in 2023 compared to the $130 million capex scenario.

Conclusion

Battalion looks capable of reducing its leverage to around its target level of 1.0x by the end of 2023 at current strip prices. Battalion’s high level of hedges also means that its projected results don’t change all that much as commodity prices move.

Battalion will need to decide on what sort of development program it wants to do in 2023. It will need to balance debt paydown with oil production growth (or at least maintaining oil production levels). We should find out more about Battalion’s 2023 plans in a few weeks, and I am maintaining Battalion’s estimated value at mid-teens per share in a long-term $70 WTI oil environment.