AT&T Stock: Be Fearful When Others Are Fearful (NYSE:T)

Justin Sullivan

What Happened?

AT&T (NYSE:T) has just gotten shellacked recently by a plethora of Seeking Alpha authors. See all the articles here.

On top of this, I wrote a bullish article stating I saw the stock as a “blood in the streets” contrarian buying opportunity and received an enormous number of negative comments stating I was out of my mind to be advocating buying AT&T at current levels.

The two major complaints championed by those preaching gloom and doom ahead for AT&T are:

- The company is burdened with too much debt and the current rising rate environment will cause AT&T to self destruct.

- The company has zero growth and therefore will die a slow death as its competitors take market share.

Well let’s just take a closer look at these two issues and see if the “Nattering nabobs of negativism are correct, shall we?”

Nattering nabobs of negativism are out in force

Just for those who are unfamiliar, the phrase “nattering nabobs of negativism” was famously used by Vice President Spiro Agnew to refer to the members of the media with whom he had a very acrimonious relationship.

While speaking to the California Republican state convention on Sept. 11, 1970, Agnew stated:

“In the United States today, we have more than our share of the nattering nabobs of negativism. They have formed their own 4-H Club — the ‘hopeless, hysterical hypochondriacs of history.’”

While the phrase is generally attributed to Agnew, it was actually written by White House speechwriter William Safire. I love this alliteration! So, I choose to share it now and again for those unaware. Now back to business!

Regarding the substantial cohort of negative analysts and bloggers who don’t have faith in AT&T’s ability to grow or manage their debt, there have been several statements made. We will address the debt question first as I see that as the largest looming issue brought forth by Seeking Alpha members and negative nabobs alike.

The thrust of their arguments are that the debt is too large and in a rising interest rate environment where debt refinancing will undoubtedly become more costly this will be the downfall of the stock, which will lead to the dividend being cut and subsequently the stock price cratering.

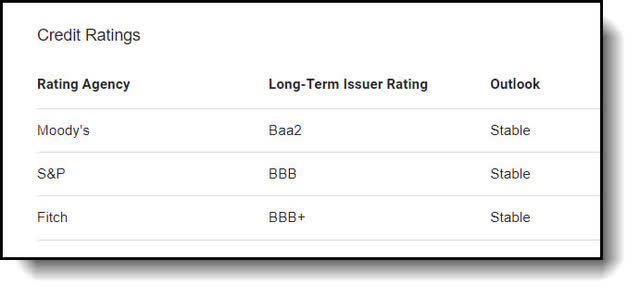

Here’s the problem. It seems as though the negative nabobs do a lot of nattering, yet very little due diligence. The fact of the matter is when taking a look at the latest ratings agency reports, the only people who seem to be concerned about the debt are the nabobs. All three agencies rate AT&T debt as Stable.

AT&T

A “Stable” outlook indicates a low likelihood of rating change in the near to medium term. AT&T’s Baa2 senior unsecured rating from Moody’s “reflects materially improved credit metrics following a year of focused debt reduction in 2019 following the acquisition of Warner Media.”

Digging deeper into the debt

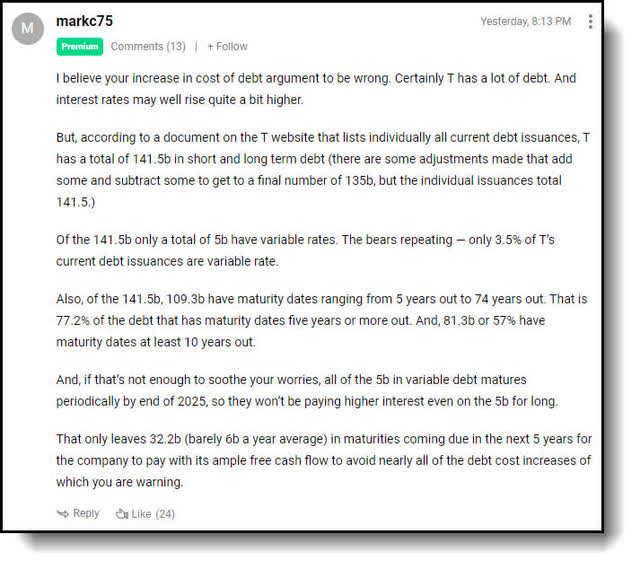

And as a very prescient Seeking Alpha member Markc75 pointed out in a comment on a recent article, the worries of AT&T having to refinance their debt at higher rates are wholly unfounded.

If the negative nabobs would have just done a little bit of research prior to making their drastically overdramatic claims, they would have found that there was no reason to worry, hence the stable rating by the three agencies.

Markc75 stated:

“But, according to a document on the T website that lists individually all current debt issuances, T has a total of 141.5b in short- and long-term debt (there are some adjustments made that add some and subtract some to get to a final number of 135b, but the individual issuances total 141.5.)

Of the 141.5b only a total of 5b have variable rates. The bears repeating — only 3.5% of T’s current debt issuances are variable rate.

Also, of the 141.5b, 109.3b have maturity dates ranging from 5 years out to 74 years out. That is 77.2% of the debt that has maturity dates five years or more out. And, 81.3b or 57% have maturity dates at least 10 years out.

And, if that’s not enough to soothe your worries, all of the 5b in variable debt matures periodically by end of 2025, so they won’t be paying higher interest even on the 5b for long.

That only leaves 32.2b (barely 6b a year average) in maturities coming due in the next 5 years for the company to pay with its ample free cash flow to avoid nearly all of the debt cost increases of which you are warning.”

So now that we have put the debt concerns to bed let’s take a stab at the “AT&T’s not a growth stock in any way, shape, or form” argument.

AT&T has anemic growth argument

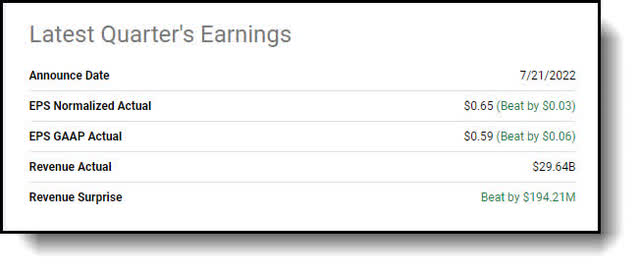

Regarding this untruth, I really don’t understand how anyone could come to this conclusion. All you had to do was read the latest earnings report to see they are growing and taking market share by leaps and bounds. In fact, they beat on the top and bottom lines actually last quarter.

Seeking Alpha

What’s more, the company actually posted record levels of revenue growth during the first half of 2022 while also taking share from their primary competitor Verizon (VZ) who actually lost 200,000 subs.

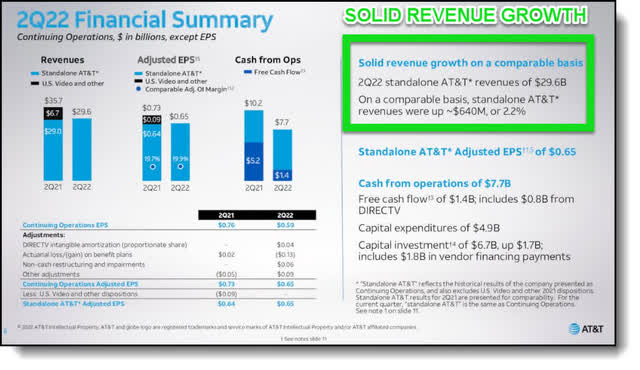

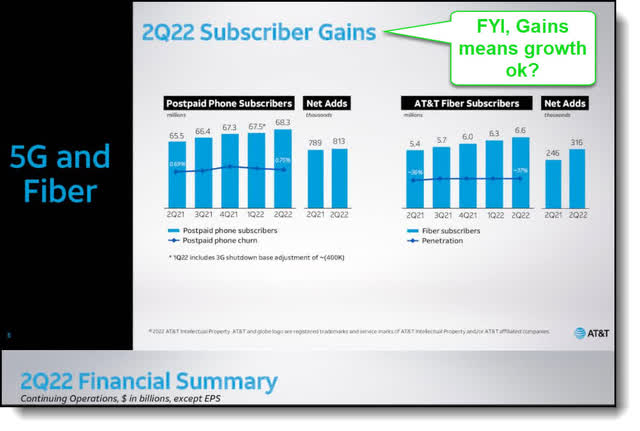

AT&T

AT&T CEO John Stankey stated on the latest conference call:

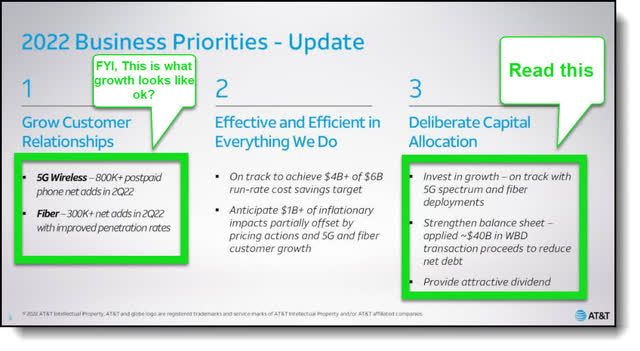

“Thank you for joining us today. Last quarter, I shared that AT&T had entered a new era with the right asset base capabilities and financial structure to become America’s best broadband provider. I’m happy to share this morning that we’re continuing our progress, improving our infrastructure and expanding our customer base across our twin engines of growth, 5G and Fiber. We saw historic levels of second quarter net additions, thanks to our discipline and consistent go-to-market strategy and solid execution, building fiber and deploying our mid-band 5G spectrum assets.

Industry growth in the first half of 2022 has been stronger than the expectations I shared with you late last year. In our view, this strong performance reinforces that our success is not solely promotion-led, but instead reflective of our improved value proposition in the market. Even though better-than-anticipated customer growth metrics resulted in some higher-than-expected success-based investment, ARPU and profitability in 2Q improved and we expect that trend line to accelerate in the second half of the year. As Pascal will discuss shortly, we’re, in fact, increasing our service revenue growth guidance for 2022.”

AT&T

Record Growth Highlights from earnings

In Mobility, AT&T brought in the most second quarter postpaid phone net adds in more than a decade.

In Fiber, AT&T continued to invest in building out a premium network, drive a great build velocity and delivered on their stated expectations for accelerated customer growth through improved penetration rates. This is evidenced by AT&T’s more than 300,000 second quarter AT&T Fiber net adds, marking the 10th straight quarter with more than 200,000 Fiber net adds.

The strength and value of the AT&T Fiber experience is enabling AT&T to increase share in its Fiber footprint and convert more IP broadband Internet subscribers to Fiber subscribers. Ultimately, the Fiber strategy is a sustainable and long-term technology play that will support key macro trends. AT&T expects to see a continuation of favorable ARPU trends, as they expand the availability of what AT&T believes is a best-in-class network with a multi-decade lifespan.

Over the last eight quarters, AT&T achieved an industry-best 6 million postpaid phone net adds, while adding nearly 2.3 million AT&T Fiber customers, increasing the Fiber subscriber base by more than 50%.

AT&T has rapidly expanded its 5G and fiber footprint as well. AT&T has achieved their target of covering 70 million mid-band POPs, two quarters ahead of the year-end target, and are now on track to approach 100 million mid-band POPs by the end of this year. Furthermore, the expanded Consumer Wireline fiber footprint now gives AT&T the ability to serve 18 million customer locations. This is an increase of nearly 2 million from the start of the year.

So, it seems as though the death of AT&T’s growth has been greatly exaggerated. So why is AT&T down? Let me address that question next prior to putting this baby to bed.

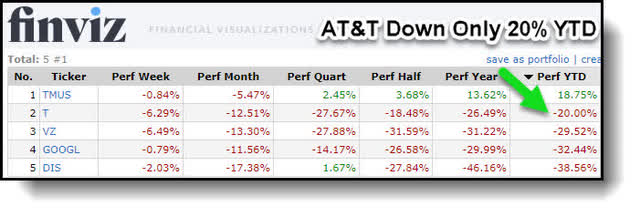

Why is AT&T stock down 20% for the year-to-date

The short answer is we are in a bear market macro selloff at present and everything is getting sold. In fact, AT&T is actually outperforming the broader market at present.

CNBC

AT&T is down 20% year-to-date while the S&P 500 is down over 24%. What’s more, when compared to its peer group, only T-Mobile (TMUS) is outperforming AT&T in regard to year-to-date performance.

Finviz

The thing is, T-Mobile doesn’t pay a dividend so it’s a moot point.

The selloff in AT&T actually began in earnest after last quarter’s earnings announcement. AT&T beat on the top and bottom line, yet lowered free cash flow guidance going forward by $2 billion. The lowering of free cash flow guidance was definitely the culprit for the recent selloff.

Given the combination of elevated success-based investment, the potential for further extension of payments by customers, inflation and the more challenging environment facing the company’s Business Wireline unit, AT&T’s management made the prudent decision. They took a more conservative stance on free cash flow for the remainder of the year by lowering the estimated free cash flow guidance from $16 billion to $14 billion. So, AT&T is in the same boat as everyone else and taking a hit due to the current macro state of affairs, nothing more, nothing less. What’s more, it created an epic income investor buying opportunity with the stock sporting an over 7% yield at present.

Fantastic dividend income buying opportunity

The fact of the matter is, AT&T is actually growing at present.

AT&T

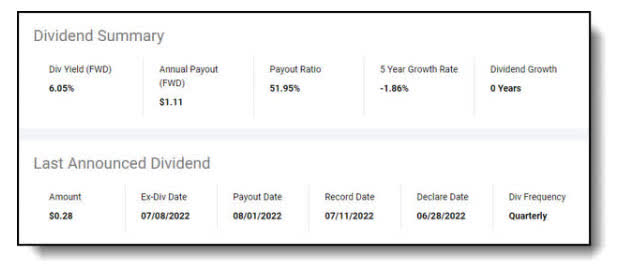

Furthermore, with a 7% yield to boot, the stock presents a fantastic buying opportunity for prospective dividend and income investors looking to lock in a superior and safe yield.

Seeking Alpha

The current quarterly dividend per share is $0.2775. The quarterly free cash flow required to cover dividend is approximately $2 billion. Come hell or high water, AT&T will pay the dividend, as we say in Texas. The current payout ratio is 66%.

AT&T is a mature high-yield income play with the potential for substantial capital appreciation. It you’re looking for dividend growth, this stock isn’t for you. This is a stock for those looking to boost their current income levels.

Think of AT&T as a giant mature oak tree that has been growing for years. It has grown into a majestic tree with a large canopy (7% dividend yield) that creates substantial shade (income) for you to enjoy during your golden years.

The wrap up

It seems a lot of people are getting scared out of their positions with the 20% selloff in AT&T presently. Many people often quote Warren Buffett’s famous line “Be greedy when others are fearful.” It seems to me that those advocating selling out now are doing the exact opposite, “Being fearful when others are fearful.” Ha!

Let me add one additional gen from Buffett I feel is quite apropos for the fearful investors in the market as we approach All Hallows Eve, Warren Buffett also famously said:

“Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market.”

So maybe those who are getting frightened out of their positions based on the current selloff should sell out and not invest in the stocks. Or maybe you have too much money in the market for your level of risk tolerance. If you can’t sleep well at night or are constantly worried during times of market duress, I would say you need to reduce your level of invested capital to where you can relax. Then you can make the proper decisions. Because, investing in the market is not for the faith of heart. It’s completely counterintuitive. You have to buy when everyone else is selling and selling when everyone else is buying. That’s the hardest of all things to do. My saying is “bad news and buying opportunities come hand in hand.” That’s my two cents for today! I look forward to reading yours!