Ameren: Wait For A Pullback In This High-Yield Utilities Stock (NYSE:AEE)

SimonSkafar

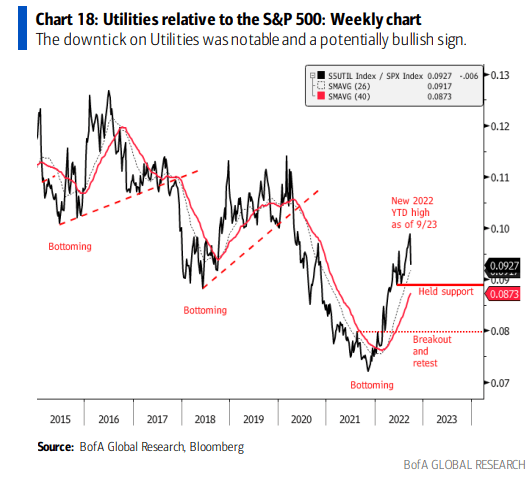

The Utilities sector had a massive relative run versus the S&P 500 from late last year through much of Q3. A big September selloff in the supposedly defensive sector broke many individual stock charts, though. One large-cap player with a big presence in the Midwest is poised to benefit from investments in the region, but shares do not come cheaply.

Utilities Sector Relative to the S&P 500

BofA Global Research

According to Bank of America Global Research and Fidelity Investments, Ameren (NYSE:AEE) is a two-state regulated utility with operations in both Missouri and Illinois, including both Gas and Electric as well as FERC regulated Transmission assets. The firm operates as a public utility holding company in the Midwest. It operates through four segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission. The company engages in rate-regulated electric generation, transmission, and distribution activities; and rate-regulated natural gas distribution and transmission businesses. It primarily generates electricity through coal, nuclear, and natural gas, as well as renewable sources, such as hydroelectric, wind, methane gas, and solar.

The Missouri-based $20.1 billion market cap Multi-Utilities industry company within the Utilities sector trades at a high 19.9 trailing 12-month GAAP price-to-earnings ratio and pays a solid 3.0% dividend yield, according to The Wall Street Journal.

Ameren is well-positioned in the Midcontinent Independent System Operator (MISO) footprint to benefit from transmission buildout initiatives across the Midwest to help improve and move power generation from wind and solar heavy supply areas to demand centers like Chicago and further east toward the PJM market. It can also effectively raise rates in this environment. Downside risks include adverse regulatory changes and unfavorable interest rate moves.

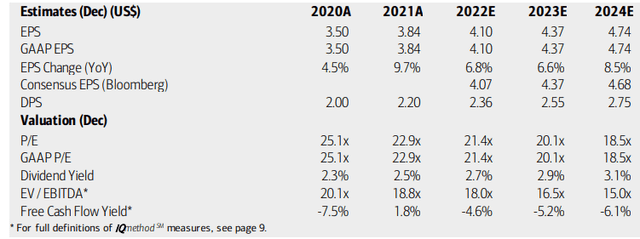

On valuation, BofA analysts see earnings growing at a steady rate through 2024. This kind of EPS stability is hard to find across the sector and market. Bloomberg’s consensus per-share profit growth forecasts are about on par with BofA’s.

AEE’s operating P/E is still high, however. So, that strong and consistent earnings growth comes at a price. Also, other utilities pay higher yields than Ameren’s. Finally, like many of the sector stocks, this utility has negative free cash flow given high capex. Overall, I like the earnings and growth pictures, but the valuation is elevated.

Ameren Earnings, Valuation, And Dividend Forecasts

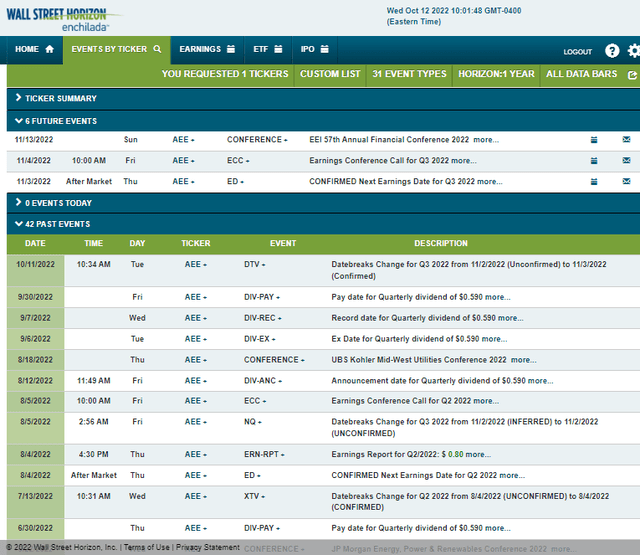

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q3 earnings date of Thursday, Nov. 3 AMC with a conference call immediately after results are released. You can listen live here. Ameren’s management team is also expected to speak at the EEI 57th Annual Financial Conference 2022 on Nov. 13 to 15. Both events could draw excess volatility in AEE’s stock and options.

Corporate Event Calendar

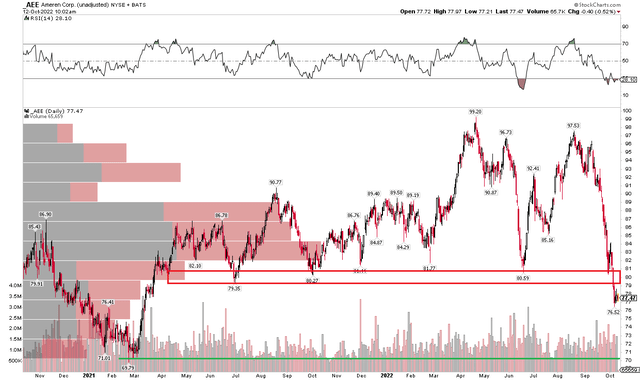

The Technical Take

With a high valuation but decent growth and business positioning, how does the chart look? It’s a bearish scene to me. Notice in the 2-year zoom below that AEE fell below a key support range between $79 and $82. I see further downside to the 2021 low near $70. At that price, the valuation would be a bit more attractive, too.

Shares do have some support from a high volume of stock traded from $70 to near $80, though. So it might take time to punch all the way down to the $72 level, but I think that could be in the cards. Finally, AEE has a bearish ‘oversold’ RSI under 30. While some like to say that a low RSI indicates a potential stock bounce, it is really a signal that the bears are in control.

AEE Shares Fall Below Key Support As Bears Tighten Their Grip

The Bottom Line

Ameren is positioned well to benefit from broad investment trends in the Utilities sector. The stock is not a bargain yet though. I assert that waiting for another 10% downside is warranted to bring the valuation back in check. That’s also where AEE could fall to on the chart.